Looks like Tesla's announcement of most processes in Fremont and Gigafactory1 demonstrated Model 3 production capabilities at a 7K/week rate was just the ticket to balance any worries about the Dec.1 deadline for a position on the March bonds coming due, and TSLA headed upwards today with the help of favorable macros. Shorty was busy trying to crash the party and was tagged with 58% of the selling on Friday. By no means does the news suggest Tesla will be cranking out 7K Model 3s a week in early December, but it is huge news because it shows that a lot of previous bottlenecks (such as in paint shop and battery modules) have been eliminated and the company should be ready to realize meaningful volume increases now.

Here's a TMC post from @avoigt that reproduces the content of the email sent by Elon to employees.

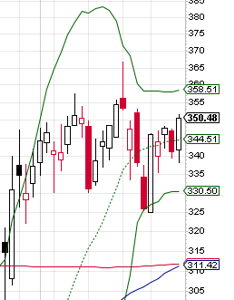

Looking at the TSLA chart above, you can see a pathetic mandatory morning dip, which turned into a substantial climb once defeated. More than 150,000 shares traded in the final minute of market trading, suggesting lots of shorts reloading at end of day to take advantage of no upward bump to the stock price during that minute.

The NASDAQ rose 0.79% today, setting the stage for a nice TSLA rally as well. A NASDAQ dip into the red a bit after 1pm did not depress TSLA significantly, suggesting TSLA strength. TSLA followed the two peaks in the morning but with much more climb, hardly dipped at the 1:20pm NASDAQ dip, and then roughly followed the NASDAQ in the afternoon but in a much more restrained way, which I think was partly due to manipulations by shorts (they had to deploy the real portion of that 58% selling somewhere).

Elon stated the Model 3 bottleneck right now is in body in white, which was not the bottleneck before. Paint shop and battery module production now appear to be up to the task of producing 7K/week. I suspect Tesla will start getting suppliers to up their parts so as to at least match the capabilities of the slowest part of the production process.

The second significant part of that email was that at the moment, Tesla believes it would cost $38,000 to produce the basic Model 3. In reality, not many short range Model 3s will be absolutely barebone models because people want colors other than black, some want autopilot, some pup, etc. The takeaway should be that the barebones Model 3 will not be a significant part of Model 3 production until costs come down. The good news is that there is a waiting supply of buyers for the lower-cost versions of the car so that if there ever developed a demand issue with more heavily equipped M3s, Tesla could keep the production lines rolling at full speed by simply requiring PUP or autopilot in an order until costs come down further.

The broader picture is that the market is waking to the realities that Tesla was right all along and other companies are going to have to scramble to catch up in vehicles and energy.This realization is part of what drove us higher on Friday, I believe. Consider:

* The enormous battery in South Australia using Tesla Powerpacks turned one year old this week and produced not only substantial profits for the owners but also $90 million is savings for customers. It has been such a roaring success that other similar projects are inevitable.

* GM recently announced factory closing of non-BEV vehicles, including the Chevy Volt. GM says it is preparing for a future with autonomous driving and electric vehicles and needs to take these steps. Takeaway: confirmation that Tesla was on the right path years ago.

* Troy and other VIN watchers agree on more than 60K M3s and 85K total Tesla vehicles being both produced and delivered in Q4, and most observers including Troy himself see these numbers as conservative. Decreases in costs per vehicle should be deeper than relatively small decreases in ASP ($2K/vehicle?). The net result is we have evidence that Q4 will indeed be sufficient to bring profits and substantial positive cash flow yet again.

* At the Los Angeles Car Show the buzz was on EVs, with both Bugatti and Mazda officials pointing out how Tesla has a head start on the industry

The bottom line of these news stories is that we're seeing confirmation that Tesla has indeed changed the course of human terrestrial transport and energy creation/storage and has a substantial head start in implementing the new transportation vision. Add in the growing list of countries and provinces that are requiring the end of ICE new vehicle sales in future years, and it is apparent that Tesla has a brilliant future ahead unless some odd event trips them up. Combine Tesla being at the head of these disruptive changes with the Q4 results, add the catalyst of additional short covering, and you have a recipe for some very nice stock price appreciation ahead.

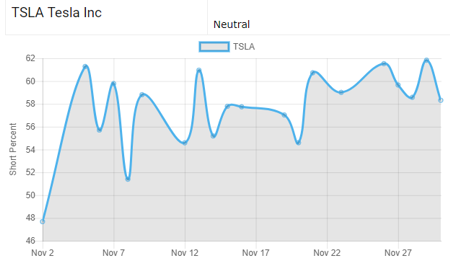

Shorts were tagged with 58.32% of TSLA selling on Friday, a very high number on a day when the stock price ran high and stayed high all day. This was the third day this week in which shorts doing the manipulations came away with sizable losses for their efforts. The fact that even with this substantial high percentage of selling by shorts this week TSLA managed to rise more than 20 suggests shorts are losing their grip on the stock.

Looking at the tech chart, you can see the golden cross of the 50 day moving average (blue) and the 200 DMA (red) as imminent. Looks like it'll happen on Monday, which is a positive development. Notice that TSLA is now on leg 4 of climbing after the rally turned to slow-climb. Provided that last Friday's dip didn't invalidate the patterns, TSLA should now climb into the 360s and retake the prices explored (but not held) on the last leg. No guarantees. We're just curiously watching to see if the pattern repeats after a break on the downside last Friday. The upper bollinger band will likely have to move higher in order to enable a creep into the 360s.

There's much to say about the short sellers now, and I will do so in a separate post.

For the week, TSLA closed at 350.48, up 24.65 from last Friday's 325.83 and recovering all but 3.83 of last week's dip. It's been a good week, please enjoy your weekend.

Conditions:

* Dow up 200 (0.79%)

* NASDAQ up 57 (0.79%)

* TSLA 350.48, up 9.31 (2.73%)

* TSLA volume 5.6M shares

* Oil 50.93, down 0.52 (1.01%)

* Percent of TSLA selling by shorts: 58.32%