Let's be more specific

@FrankSG . I know you're a detail guy...

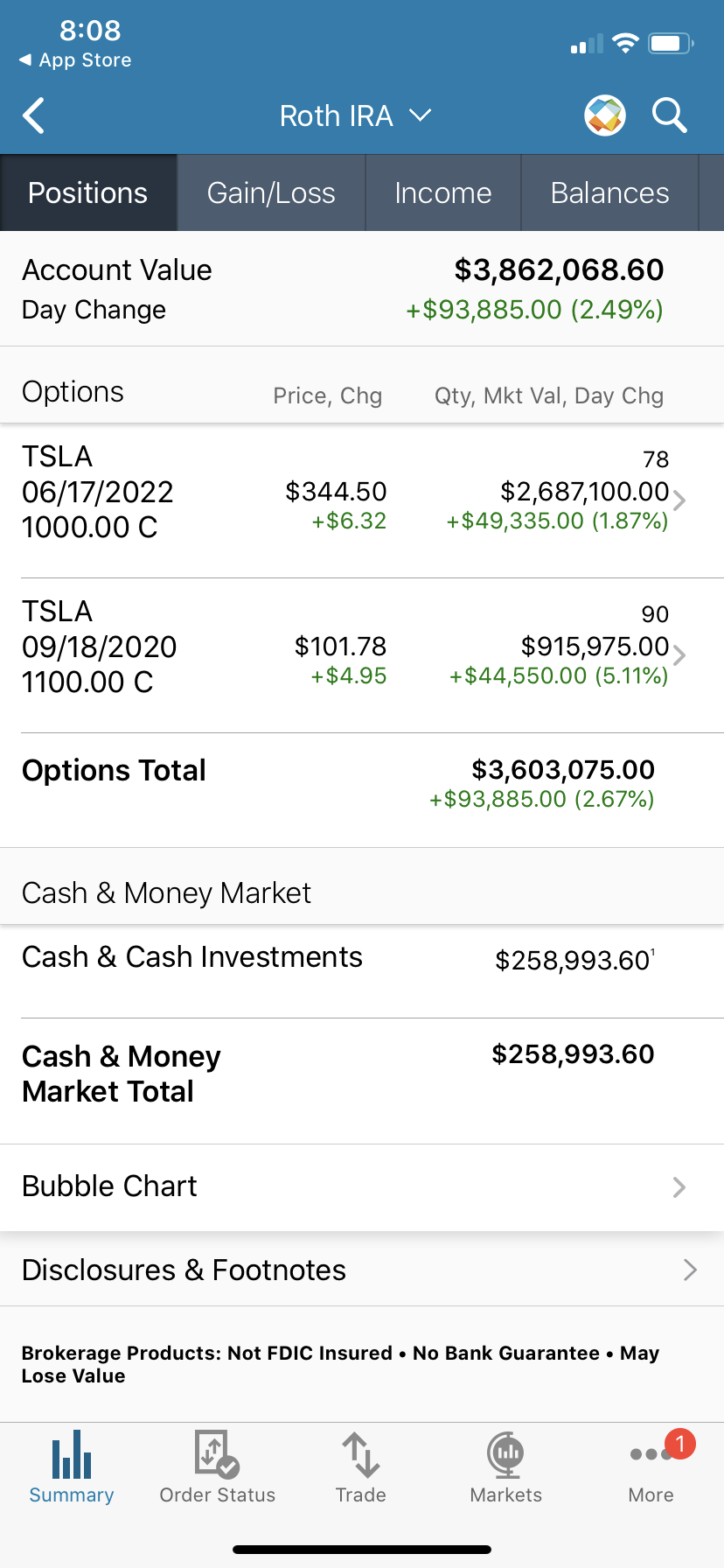

With TSLA at 1,009.89,

Jun 2022 1000C (which my friend owns) are 342.05

At expiration, breakeven between the two is $1,515

Jun 2022 1200C, breakeven between the two is $1,662

The truth of it though is that the owner of the Leaps isn't going to hold to expiration. But this DOES illustrate the risk of not getting an outsized move in the stock early during your holding period in the option.

My friend realized they got very lucky by getting outsized bullish moves in the stock very early in the holding period. This is precisely why they moved to June 2022 for the majority of their holdings.

Also, while admittedly what is about to be shared is voodoo math, Tesla is growing units by 50% while WS projects 25% unit growth at least 5 years out. Conservatively, wouldn't the stock grow by 50% per year while this persists? Ironically on it's 10 year anniversary of its IPO and of WS chronically underestimating them for 10 years, Tesla stock has compounded at 50% per year (or 50.7% or whatever).

DOUBLE EXPONENTIAL

Exponential growing is mind boggling by itself. Parts of Tesla's technology are benefiting from double exponential growth.

If Tesla stock continues to grow at 50% per year (exponential growth), then options positions will grow double exponential. This is potentially life changing, if you are poised to take advantage. But you still need to be risk controlled, you still need discipline. But let's look at 50% per year from here for June 2022...

stock: +125%

June 2022 1000C: +272%

June 2022 1200C: +289% (not much difference but breakeven much higher)

June 2022 1800C: +169% (just for giggles to see)

Let's look at an early move... Let's say TSLA goes to 1,500 by the begin of Sept 2020 b/c of inclusion...

(using

Long call calculator: Purchase call options)

Stock: +50%

June 2022 1000C +102%

June 2022 1200C +109%

June 2022 1800C +123%

The inclusion play...

Sept 2020 1100C +300% (but risk is way, way, way higher)