Am I still entitled for a tax credit of $3750 for a Model 3 purchased on June 8, 2019? The proposed IRS form 8936 available on line now for 2019 limits the total tax credit to $2500...of which I would now get 50% ($1250). The same site said that the official 2019 form 8936 displayed was not final. Since the "Growing Renewable Energy and Efficiency Now Act of 2019" failed to pass does that mean the tax credits are again based on the original $7500...depending on all EV manufacturers' total units sold? Anyone have any comments.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Please....some clarification of the Federal tax credit for a Tesla purchased in 2019

- Thread starter voucher2002

- Start date

raptor5244

Active Member

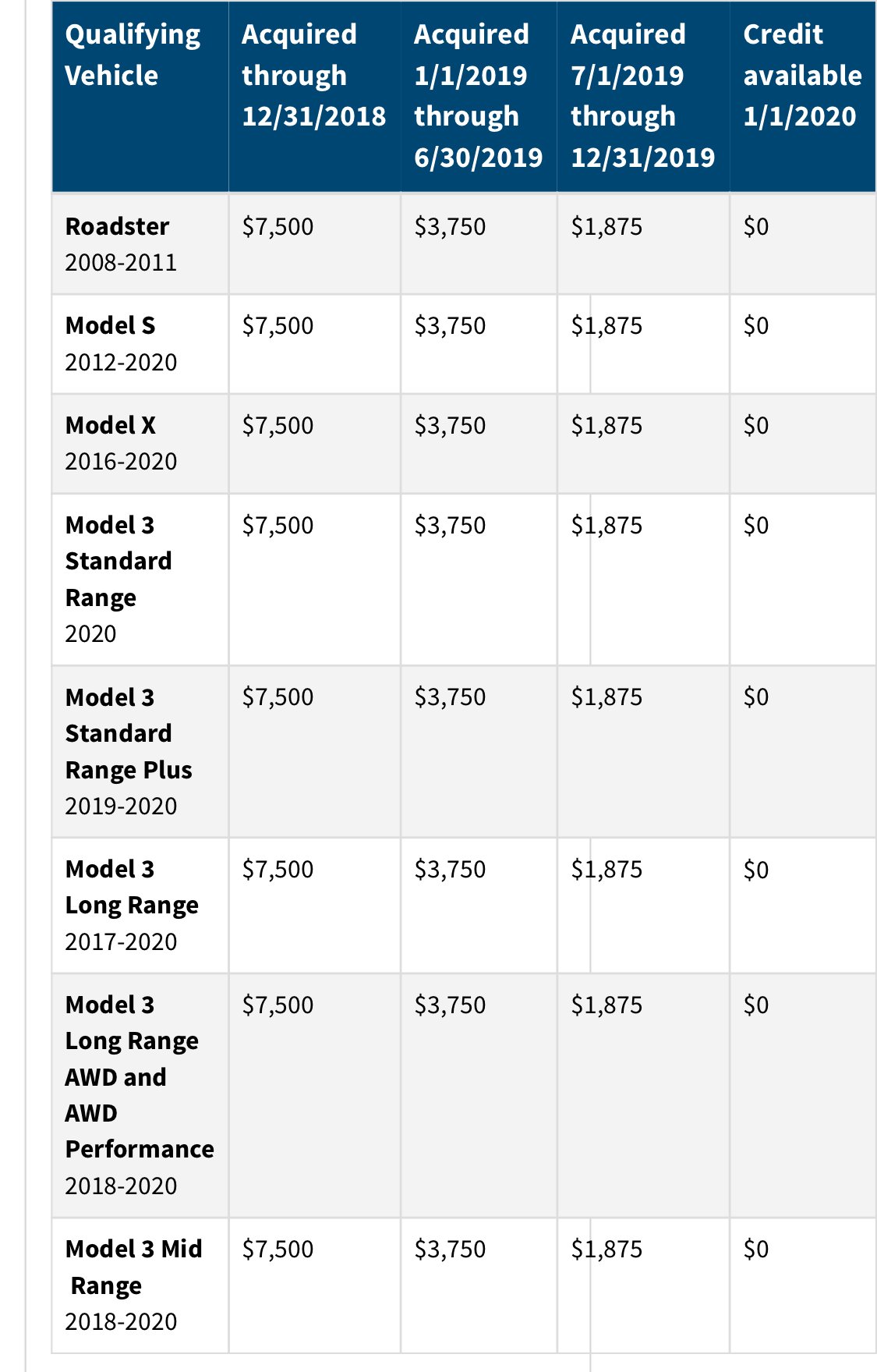

$3750 if you TOOK DELIVERY before 7/1/19. Not the date you ordered, but the date you put the car into service.

per this page: IRC 30D New Qualified Plug-In Electric Drive Motor Vehicle Credit | Internal Revenue Service

per this page: IRC 30D New Qualified Plug-In Electric Drive Motor Vehicle Credit | Internal Revenue Service

The 2500 is the minimum. The form sucks. You need to enter the kWh to get the max and the date to get the proper amount as on the above table.

ItsNotAboutTheMoney

Well-Known Member

No. The amount is based on the date you _purchased_ the car, which is probably taken to be the point at which the car is legally yours. The word purchased is used explicitly for Tesla in the instructions for the form.$3750 if you TOOK DELIVERY before 7/1/19. Not the date you ordered, but the date you put the car into service.

The _tax year_ is based on date put into service.

No. The amount is based on the date you _purchased_ the car, which is probably taken to be the point at which the car is legally yours. The word purchased is used explicitly for Tesla in the instructions for the form.

The _tax year_ is based on date put into service.

You are correct, but as @OCR1 mentions, they are one and the same.

Many people consider their order date as date of purchase, which is incorrect.

ItsNotAboutTheMoney

Well-Known Member

You are correct, but as @OCR1 mentions, they are one and the same.

Many people consider their order date as date of purchase, which is incorrect.

No.

If you're having the car delivered, you've paid for it and legal title is transferred out of state before the car is delivered.

OP is in Texas and would have fully paid for the car in advance.

The key word is _purchased_.

Last edited:

No.

If you're having the car delivered, you've paid for it and legal title is transferred out of state before the car is delivered.

OP is in Texas and would have fully paid for the car in advance.

The key word is _purchased_.

From the minute you sign the papers, you have put the vehicle in service. It is yours, whether the delivery has been completed or not. They really are one and the same - in service isn’t delivery; it’s upon purchase.

What ‘warranty starts on the first in-service date’ means for certified-used cars – The Mercury News

(We’re basically saying the same thing ...)

ItsNotAboutTheMoney

Well-Known Member

From the minute you sign the papers, you have put the vehicle in service. It is yours, whether the delivery has been completed or not. They really are one and the same - in service isn’t delivery; it’s upon purchase.

What ‘warranty starts on the first in-service date’ means for certified-used cars – The Mercury News

(We’re basically saying the same thing ...)

Hmm. I think "Put into service" is normally used in accounting (for amortization) to refer to it being available for use, not just purchased, or even delivered.

In the OP's state, Texas, I believe it's delivered with a temporary tag so it can be driven immediately so it would be put in service at delivery.

But in Maine (and probably other states where the car is prepped and delivered from Massachusetts), you don't get a temporary tag, so you have to wait for paperwork from Tesla, so that you can register it, and drive it to get it inspected, so you can drive it. So it might not be considered in service at delivery.

But "put into service" only matters for deciding the tax year, not the amount.

Last edited:

Am I still entitled for a tax credit of $3750 for a Model 3 purchased on June 8, 2019? The proposed IRS form 8936 available on line now for 2019 limits the total tax credit to $2500...of which I would now get 50% ($1250). The same site said that the official 2019 form 8936 displayed was not final. Since the "Growing Renewable Energy and Efficiency Now Act of 2019" failed to pass does that mean the tax credits are again based on the original $7500...depending on all EV manufacturers' total units sold? Anyone have any comments.

The $2,500 limit is in Part II (the credit for business/investment or a credit from a partnership or S corporation). Individual owners fill out Parts I and III, but skip Part II. No $2,500 limit for individual owners.

Instructions for Part II: Next: If you did NOT use your vehicle for business or investment purposes and did not have a credit from a partnership or S corporation, skip Part II and go to Part III. All others, go to Part II.

Part II Credit for Business/Investment Use Part of Vehicle ...

Similar threads

- Replies

- 20

- Views

- 3K

- Replies

- 803

- Views

- 82K

- Replies

- 80

- Views

- 12K