Weird thing was "5000 in transit" to end Q3. However, Oct / Nov sales numbers in Europe and estimates in the USA didn't really back that up. So, we don't know for sure really how many were in transit and if so, how many were simply inventory/marketing or actual Customer units.

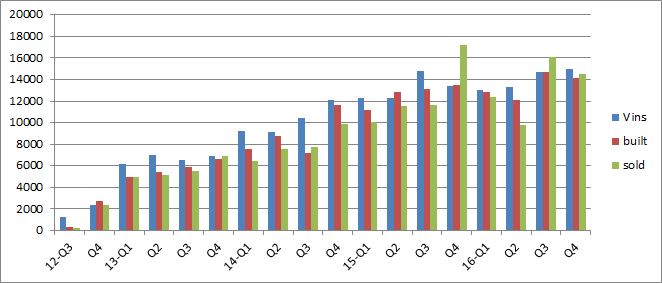

Regarding Model S itself, this is the data but includes my estimates for Q4. All prior quarters are factual from the ER releases. Then add in the Model X activity and you can estimate the Q4 numbers. I adjust the Q4 data once we hear more about the sales and then after the Q4 ER comes out in February with production numbers and actual sales numbers adjusted. Actually - I do hope that the sales are better than I think they are for everyone's sake. But the actual data isn't "yelling" blow out quarter just yet.

Regarding Model S itself, this is the data but includes my estimates for Q4. All prior quarters are factual from the ER releases. Then add in the Model X activity and you can estimate the Q4 numbers. I adjust the Q4 data once we hear more about the sales and then after the Q4 ER comes out in February with production numbers and actual sales numbers adjusted. Actually - I do hope that the sales are better than I think they are for everyone's sake. But the actual data isn't "yelling" blow out quarter just yet.

Last edited: