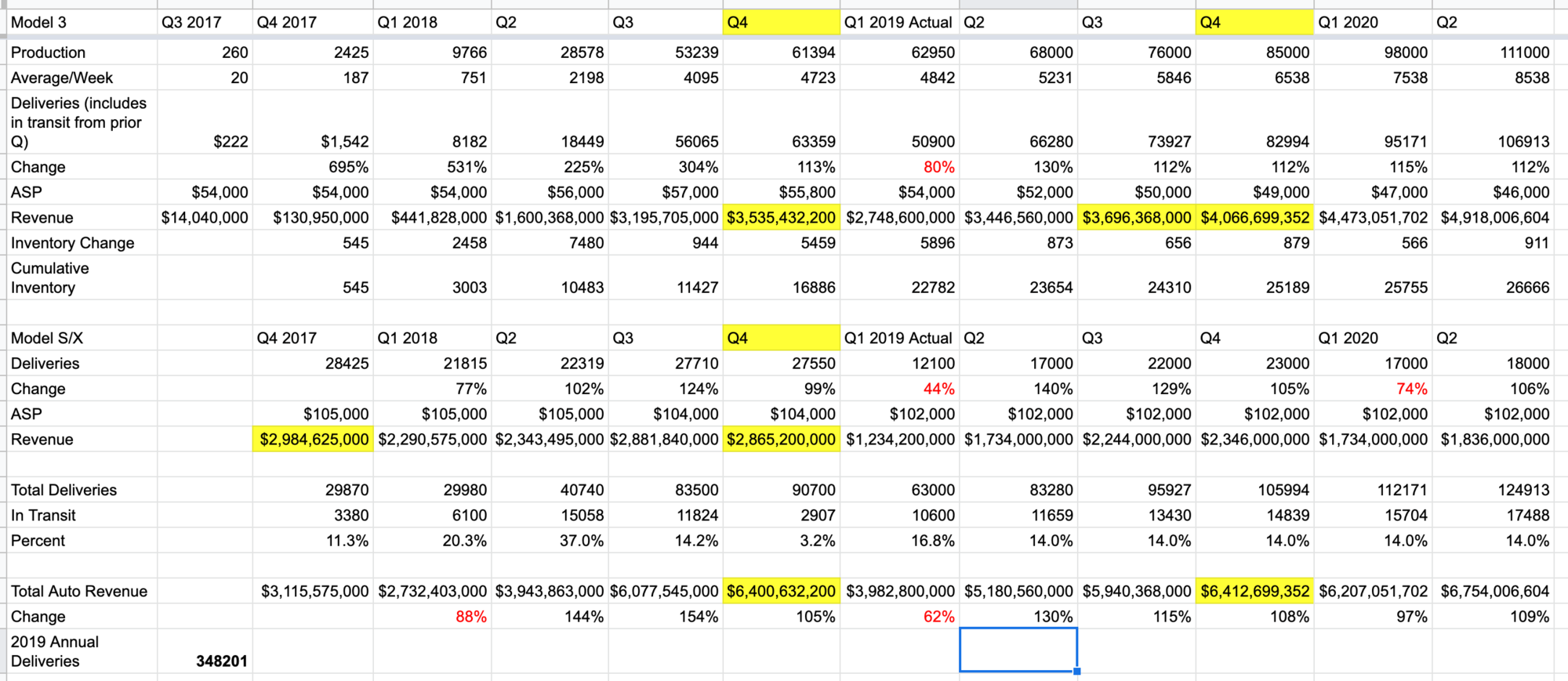

I wanted to generate some discussion about expectations of quarterly auto production, delivery, and revenue over the next year or so. Here is my current forecast. I am personally trying to set reasonable production and delivery expectations based upon current execution. With this model, I am seeing model 3 inventory increase mildly to about 26,000 from the current 22,000. That may not be the plan at all. In fact, I could see Tesla decrease inventory a bit, but I don't know what they plan to do. Given over 20,000 current model 3 inventory, it may be preferable to sell off some inventory rather than maximize production, particularly given the fairly tight cash situation. With the new markets Tesla is selling model 3 into, it would make sense that inventory would increase. I'm interested in opinions about all of this. I am not modeling substantial input from Shanghai until Q1 2020. I think it is optimistic to expect earlier production there. Obviously, this forecast requires speculation about production, deliveries, and ASP. Thanks for any input.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

Quarterly Auto Production, Delivery, & Revenue Forecast

- Thread starter bdy0627

- Start date