Well macro just fell off a cliff, so I think 273 now looking unlikely tooMaybe I heard wrong and he said 273. Sorry.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

R

ReddyLeaf

Guest

FWIW, I gave everyone “loves”, because that’s what we all need after the past year’s portfolio decimations. Sorry, just isn’t enough, after having read about everyone’s situation. From my non-margin, IRAs, all-in TESLA (and only CSP/CC options), I’m down 37% yoy vs 52% for TSLA stock. Certainly would have been better off in an S&P mutual fund (-18%), but not as much fun and learning, so I consider it a “win”. Also, FWIW, I missed buying at the MMD today because I was reading everyone’s story, which I consider a much greater benefit than the handful of shares I might have bought. Your insights are beyond solid gold or even TSLA stock. Thanks to all.

It sure seems like this is the capitulation and SP that the hedgies were targeting. We almost tagged the 2-yr intraday low 3/5/21 $179.83, so maybe there’s another day push down, but we’re pretty close. Last time we got this low, I was over zealous in selling puts, didn’t roll them down and out fast enough, and was put shares at $266.67. Learned a bit there, but not enough because was caught again with the Hertz run up (losing CC shares) and the Elon selling plummet (getting put shares again). What’s my point here? Even with getting caught out several times in 2-yrs, I’m still ahead by selling options, and getting smarter every week (hopefully).

I cannot predict the future (macros, geopolitical, SP, IV, delta, gamma, or rho) and my rudimentary understanding of technical analysis has usually failed me as well. The only thing that I know with absolute certainty is that time, and theta decay will progress. When selling an ATM straddle with maximum time value, I know with absolute certainty that at least one side will win and that money is realized profit. There’s also a very slim chance that both sides will decay to essentially zero, so better than 50% chance of winning. As long as one stays “near” ATM, this is a viable strategy. Personally, I tried weekly ATM and it’s great for theta, but have since rolled out closer to monthly and SP+10%. Less theta, but less heartburn and easier sleeping. Straddles are not without risk or management, and do require a lot of cash/share backing, but have helped me sell CCs at levels I would have never thought possible. GLTA.

It sure seems like this is the capitulation and SP that the hedgies were targeting. We almost tagged the 2-yr intraday low 3/5/21 $179.83, so maybe there’s another day push down, but we’re pretty close. Last time we got this low, I was over zealous in selling puts, didn’t roll them down and out fast enough, and was put shares at $266.67. Learned a bit there, but not enough because was caught again with the Hertz run up (losing CC shares) and the Elon selling plummet (getting put shares again). What’s my point here? Even with getting caught out several times in 2-yrs, I’m still ahead by selling options, and getting smarter every week (hopefully).

I cannot predict the future (macros, geopolitical, SP, IV, delta, gamma, or rho) and my rudimentary understanding of technical analysis has usually failed me as well. The only thing that I know with absolute certainty is that time, and theta decay will progress. When selling an ATM straddle with maximum time value, I know with absolute certainty that at least one side will win and that money is realized profit. There’s also a very slim chance that both sides will decay to essentially zero, so better than 50% chance of winning. As long as one stays “near” ATM, this is a viable strategy. Personally, I tried weekly ATM and it’s great for theta, but have since rolled out closer to monthly and SP+10%. Less theta, but less heartburn and easier sleeping. Straddles are not without risk or management, and do require a lot of cash/share backing, but have helped me sell CCs at levels I would have never thought possible. GLTA.

FWIW, I gave everyone “loves”, because that’s what we all need after the past year’s portfolio decimations. Sorry, just isn’t enough, after having read about everyone’s situation. From my non-margin, IRAs, all-in TESLA (and only CSP/CC options), I’m down 37% yoy vs 52% for TSLA stock. Certainly would have been better off in an S&P mutual fund (-18%), but not as much fun and learning, so I consider it a “win”. Also, FWIW, I missed buying at the MMD today because I was reading everyone’s story, which I consider a much greater benefit than the handful of shares I might have bought. Your insights are beyond solid gold or even TSLA stock. Thanks to all.

It sure seems like this is the capitulation and SP that the hedgies were targeting. We almost tagged the 2-yr intraday low 3/5/21 $179.83, so maybe there’s another day push down, but we’re pretty close. Last time we got this low, I was over zealous in selling puts, didn’t roll them down and out fast enough, and was put shares at $266.67. Learned a bit there, but not enough because was caught again with the Hertz run up (losing CC shares) and the Elon selling plummet (getting put shares again). What’s my point here? Even with getting caught out several times in 2-yrs, I’m still ahead by selling options, and getting smarter every week (hopefully).

I cannot predict the future (macros, geopolitical, SP, IV, delta, gamma, or rho) and my rudimentary understanding of technical analysis has usually failed me as well. The only thing that I know with absolute certainty is that time, and theta decay will progress. When selling an ATM straddle with maximum time value, I know with absolute certainty that at least one side will win and that money is realized profit. There’s also a very slim chance that both sides will decay to essentially zero, so better than 50% chance of winning. As long as one stays “near” ATM, this is a viable strategy. Personally, I tried weekly ATM and it’s great for theta, but have since rolled out closer to monthly and SP+10%. Less theta, but less heartburn and easier sleeping. Straddles are not without risk or management, and do require a lot of cash/share backing, but have helped me sell CCs at levels I would have never thought possible. GLTA.

Capitulation juste before midterms and then end of the year rally with good CPI report.

That is what I wish to everyone!

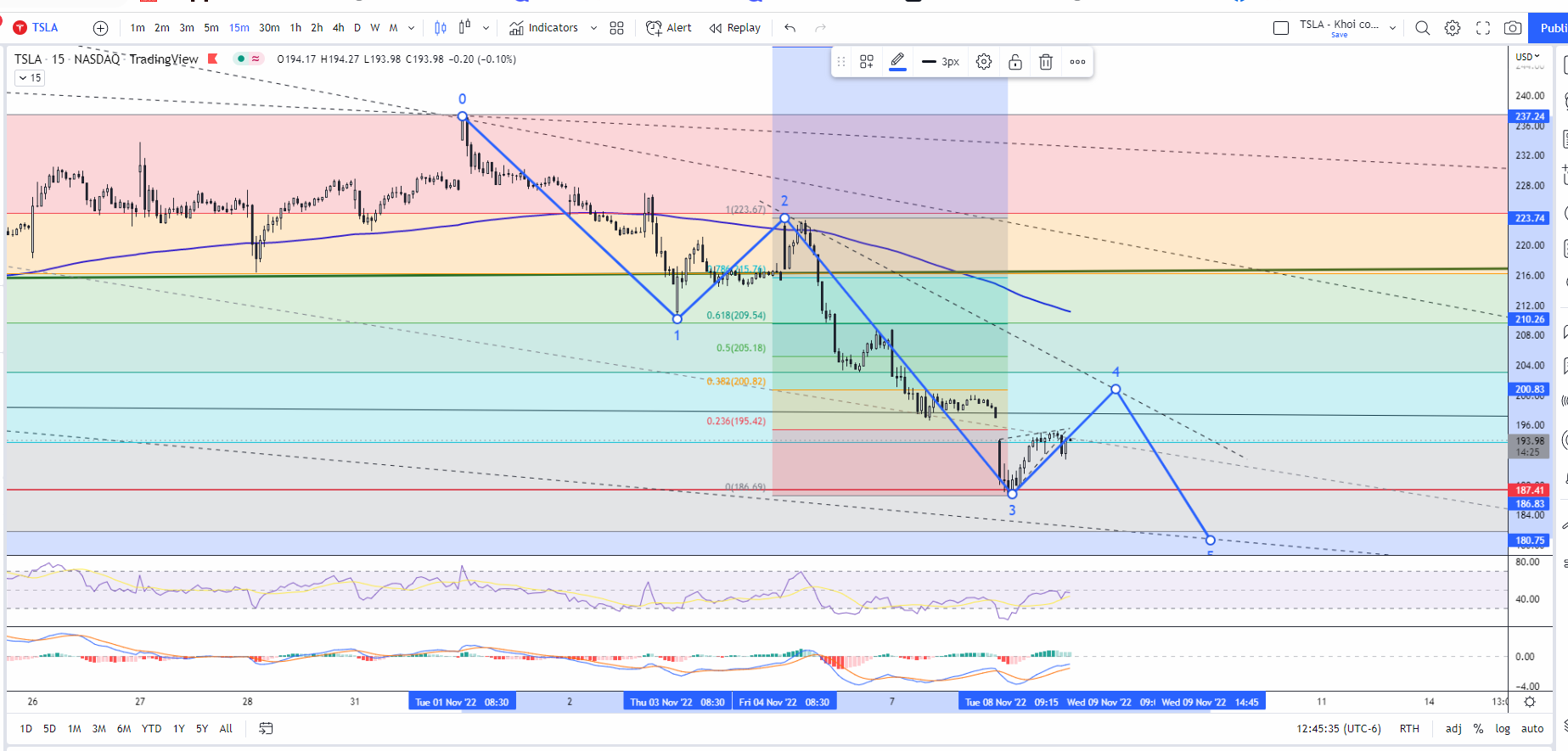

I'm seeing things more clearly now. I wouldn't be surprised if shorts get cold feet tomorrow and push TSLA up to $200 but then we'll go back down to find a real bottom. The reason I'm thinking it is because I haven't seen exhausted selling pressure on a higher timeframe yet. Need more late bears to pile on after this bounce.

SpeedyEddy

Active Member

I called upon Elon, while doing things for humanity not to forget the long time HODL-ers like myself, that would have liked a high once in a while, in my case necessary to be able to buy the ordered new Model 3. So talk to the board and start the buyback. No taxes involved. Tesla gets a good price and we get some relief.Anyone rage tweeting about the shitty stock price? I rolled 10 240CC's down to 220, rolled 3 240 CC's in another account to 215 and sold a couple of additional 215's in my primary account. If we rally, fine, if not, I'm still making some minor money.

Until earnings or deliveries overtake the Elon news cycle, seems like we're stuck down here. If China closures get worse, they are going to have a worse recession than the US. Good news and danger abounds, so hopefully selling time value will continue to help us all, until the TSLA can get back some value.

NO ANSWER received LOL

(E's remark being "Politics is war and truth is the first casualty"

Last edited:

When you say straddles at +10% of SP, you mean the puts too, right, same strike (just to be sure)? So you're selling ITM puts and OTM calls at, say 11/18 215 strike, would that be right?FWIW, I gave everyone “loves”, because that’s what we all need after the past year’s portfolio decimations. Sorry, just isn’t enough, after having read about everyone’s situation. From my non-margin, IRAs, all-in TESLA (and only CSP/CC options), I’m down 37% yoy vs 52% for TSLA stock. Certainly would have been better off in an S&P mutual fund (-18%), but not as much fun and learning, so I consider it a “win”. Also, FWIW, I missed buying at the MMD today because I was reading everyone’s story, which I consider a much greater benefit than the handful of shares I might have bought. Your insights are beyond solid gold or even TSLA stock. Thanks to all.

It sure seems like this is the capitulation and SP that the hedgies were targeting. We almost tagged the 2-yr intraday low 3/5/21 $179.83, so maybe there’s another day push down, but we’re pretty close. Last time we got this low, I was over zealous in selling puts, didn’t roll them down and out fast enough, and was put shares at $266.67. Learned a bit there, but not enough because was caught again with the Hertz run up (losing CC shares) and the Elon selling plummet (getting put shares again). What’s my point here? Even with getting caught out several times in 2-yrs, I’m still ahead by selling options, and getting smarter every week (hopefully).

I cannot predict the future (macros, geopolitical, SP, IV, delta, gamma, or rho) and my rudimentary understanding of technical analysis has usually failed me as well. The only thing that I know with absolute certainty is that time, and theta decay will progress. When selling an ATM straddle with maximum time value, I know with absolute certainty that at least one side will win and that money is realized profit. There’s also a very slim chance that both sides will decay to essentially zero, so better than 50% chance of winning. As long as one stays “near” ATM, this is a viable strategy. Personally, I tried weekly ATM and it’s great for theta, but have since rolled out closer to monthly and SP+10%. Less theta, but less heartburn and easier sleeping. Straddles are not without risk or management, and do require a lot of cash/share backing, but have helped me sell CCs at levels I would have never thought possible. GLTA.

I called upon Elon, while doing things for humanity not to forget the long time HODL-ers like myself, that would have liked a high once in a while, in my case necessary to be able to buy the ordered new Model 3. So talk to the board and start the buyback. No taxes involved. Tesla gets a good price and we get some relief.

NO ANSWER received LOL

My plan was to buy a 4 motor Cybertruck and a roadster with my TSLA profits. Now with that reasoning I would have to sell my Model Y to cover my losses.

I can’t decide when to sell CCs again. Every time I sell CCs the stock rockets +5% the day after. I don’t know if I sell at the end of the day so we gap up tomorrow. Or if I wait for a bounce tomorrow because we are beyond crazy oversold.

Sharing from my notes from a coaching session with a pro re selling CCs, in case it’s helpful:I can’t decide when to sell CCs again. Every time I sell CCs the stock rockets +5% the day after. I don’t know if I sell at the end of the day so we gap up tomorrow. Or if I wait for a bounce tomorrow because we are beyond crazy oversold.

Optimal time to sell covered calls is just after a rise completes and the stock is in a congestion zone (choppy). Once the stock begins showing signs of breakdown and it loses Stochastic over 60 on the 1hr for more than one bar and is confirmed trending down, sell a strike ABOVE resistance for 90 days out. Since the stock is trending down, the CC strike will likely not hit and you get to keep premium.

Bonus:

Optimal time to sell Cash Secured Puts is just after a drop completes/plateaus (perhaps around these days…) and the stock is in a congestion zone. Once the stock begins showing signs of breakout over resistance and gains Stochastic over 60 on the 1hr for more than one bar, sell a CSP strike below support for 90 days out. Since the stock is trending up, the CSP strike will likely not hit and you get to keep premium.

I’m not a pro, so let me know if these make sense.

Any particular reason they are targeting 90 days out?Sharing from my notes from a coaching session with a pro re selling CCs, in case it’s helpful:

Optimal time to sell covered calls is just after a rise completes and the stock is in a congestion zone (choppy). Once the stock begins showing signs of breakdown and it loses Stochastic over 60 on the 1hr for more than one bar and is confirmed trending down, sell a strike ABOVE resistance for 90 days out. Since the stock is trending down, the CC strike will likely not hit and you get to keep premium.

Bonus:

Optimal time to sell Cash Secured Puts is just after a drop completes/plateaus (perhaps around these days…) and the stock is in a congestion zone. Once the stock begins showing signs of breakout over resistance and gains Stochastic over 60 on the 1hr for more than one bar, sell a CSP strike below support for 90 days out. Since the stock is trending up, the CSP strike will likely not hit and you get to keep premium.

I’m not a pro, so let me know if these make sense.

CPI tomorrow and possible election outcome moves makes me very hesitant to do anything today outside of being defensive. I closed a few sold puts to provide some overhead in the event of a high CPI number tomorrow.

SebastienBonny

Member

Surely not before CPI and at current levels (but we can always go lower...)My plan was to buy a 4 motor Cybertruck and a roadster with my TSLA profits. Now with that reasoning I would have to sell my Model Y to cover my losses.

I can’t decide when to sell CCs again. Every time I sell CCs the stock rockets +5% the day after. I don’t know if I sell at the end of the day so we gap up tomorrow. Or if I wait for a bounce tomorrow because we are beyond crazy oversold.

Any particular reason they are targeting 90 days out?

CPI tomorrow and possible election outcome moves makes me very hesitant to do anything today outside of being defensive. I closed a few sold puts to provide some overhead in the event of a high CPI number tomorrow.

The 90 days is just an example during “normal” times. Yes, may need to adjust to fit the current climate. The intention is to allow time to manage position if it goes in the wrong direction.

Sharing from my notes from a coaching session with a pro re selling CCs, in case it’s helpful:

Optimal time to sell covered calls is just after a rise completes and the stock is in a congestion zone (choppy). Once the stock begins showing signs of breakdown and it loses Stochastic over 60 on the 1hr for more than one bar and is confirmed trending down, sell a strike ABOVE resistance for 90 days out. Since the stock is trending down, the CC strike will likely not hit and you get to keep premium.

Bonus:

Optimal time to sell Cash Secured Puts is just after a drop completes/plateaus (perhaps around these days…) and the stock is in a congestion zone. Once the stock begins showing signs of breakout over resistance and gains Stochastic over 60 on the 1hr for more than one bar, sell a CSP strike below support for 90 days out. Since the stock is trending up, the CSP strike will likely not hit and you get to keep premium.

I’m not a pro, so let me know if these make sense.

Selling CCs during a free fall when everybody is trying to catch a falling knife might be good to. I just can’t decide if the knife will keep falling or we are about to bounce.

If anything, price action today proves that this is a technical sell off in TSLA. Stock exhibited extreme weakness until it hits 200 weekly EMA @187. Since then it's been pretty stable despite the choppy action in SPX. My bet is traders were taking advantage of:

1. An unclear topping pattern in TSLA in August - September which made it very difficult to tell where TSLA was in the correction.

2. Negative press on Elon & politics

3. Sell off in beneficiaries of the IRA, in anticipation of Reps taking both houses.

Things are more clear now and 180 is starting to look more and more like a better bottom than 198.5 was.

1. An unclear topping pattern in TSLA in August - September which made it very difficult to tell where TSLA was in the correction.

2. Negative press on Elon & politics

3. Sell off in beneficiaries of the IRA, in anticipation of Reps taking both houses.

Things are more clear now and 180 is starting to look more and more like a better bottom than 198.5 was.

SpeedyEddy

Active Member

IF closing around 194 AND opening tomorrow (+ stays) above 197, this looks an island reversal on the hourly...

Dunno. I’m often afraid of losing control of CCs so I’m more conservative. A bounce can come anytime. Whereas selling CCs after a plateau has formed and above resistance greatly reduces that risk.Selling CCs during a free fall when everybody is trying to catch a falling knife might be good to. I just can’t decide if the knife will keep falling or we are about to bounce.

I wish my problem over the past year was losing control of CCs LOL.Dunno. I’m often afraid of losing control of CCs so I’m more conservative. A bounce can come anytime. Whereas selling CCs after a plateau has formed and above resistance greatly reduces that risk.

The volume is HUGE. We are going to see at least 2X normal volume and over 120M shares by EOD. Technicals 101 says needed for plateau either way. Today it would be for some sort of bottom. Anyone with me here, or am I whistling past the graveyard? No shortage of buyers it seems or we would be much lower.

john tanglewoo

2012 Roadster Owner

Any particular reason they are targeting 90 days out?

CPI tomorrow and possible election outcome moves makes me very hesitant to do anything today outside of being defensive. I closed a few sold puts to provide some overhead in the event of a high CPI number tomorrow.

- I don't ever sell CCs less than 30 days out, and usually aim for 30-45 depending on volatility and how juicy the premiums are.

- I also never sell CCs unless the stock price is trending up, and has been for at least a couple days. I can give more specific numbers, but in general this strategy has worked for me every single time.

- I always target SP about 20% out (or based on the historical moving average of the stock over a similar time period), and I don't get greedy - always closing when I've hit at least 60% profit. But i'm always watching the premiums on the other side that let me know if I'm in any trouble or not.

Everyone has their own methods so it's important to see which one makes you the most comfortable. At the end of the day, sometimes no trade is the best trade you can make!

But to your point that I quoted - I am actually waiting for the CPI / election news this week to solidify whether I want to sell puts or calls....and that's only because in this environment, Tesla is being affected by every little thing so you have to pay attention.

AquaY

Member

You have to watch extrinsic value with ITM and especially DITM short puts regardless of expiration.Ugh - the short leg of my Jan'23 326.67/276.67 was just assigned for my parents account. Better to try to have them call and exercise the long leg, or just sell the shares that were assigned? How are you all handling early options assignment on BPS?

I note the extrinsic of all my ITM short puts in a notebook every Monday and mark it up during the week.

Whenever the stock takes a hit I note them again.

There is no hard rule when to roll but IMO you are certainly at huge risk of assignment when the extrinsic drops to under .30

The more volatile the market the higher I want that number. Same goes for the Deeper ITM the put is i want uit higher.

DITM puts can lose extrinsic value fast and sometimes you need to roll them out far to get a cushion if you don't want to close them or risk assignment.

I had a small position of 3x 366.67 short puts for January 23 which I rolled out to March weeks ago. I rolled it out to June 2 weeks ago and rolled it out and down a little to 363.33 for June 24. yesterday when extrinsic had dropped to .09.

This works with naked puts. Its improbable it would work with a BPS.

ETA. I do this for credit only. Ideally I'll roll out and down but only if I can still do it for a credit

Last edited:

I’m on the sidelines until at least Thursday after the election dust mostly settles, other than HODLing shares and LEAPs. Made a small move today to reduce covered calls in case of a post-election bump (removing some political uncertainty):

Overall, bummed out about a lot of things — portfolio, fracturing of the country, potential for violence, stupid Twitter overhang……….looking forward to maybe a few good surprises tonight, and the holidays.

- btc 6 x 121622-c$250 at $1.57 (+87% from 10/26)

- btc 6 x 012023-c$250 at $4.50 (+75% from 10/26)

- sto 6 x 122322-c$220 at $7.00

- net credit is pocket change, but took 6 of last 12 CC off the board

Overall, bummed out about a lot of things — portfolio, fracturing of the country, potential for violence, stupid Twitter overhang……….looking forward to maybe a few good surprises tonight, and the holidays.

Last edited:

I wish my problem over the past year was losing control of CCs LOL.

The volume is HUGE. We are going to see at least 2X normal volume and over 120M shares by EOD. Technicals 101 says needed for plateau either way. Today it would be for some sort of bottom. Anyone with me here, or am I whistling past the graveyard? No shortage of buyers it seems or we would be much lower.

Indeed, technically now(ish) may be a good time to sell CSPs with a strike below 170 and hope the SP claws its way back over $200 and further from here, then BTC for nice gains. Not advice.

I didn’t follow my own advice and my CSP’s got away from me to where it’s too costly to BTC.

When TSLA was at $300 I sold 19x CSP for 12/16 266.66 for $45k. I didn’t stop out properly and am stuck with them now (cost $98k to BTC on top of giving back the $45k). The $500k+ TD is holding against the CSPs is tying up almost all my margin cushion (have 3,900 long TSLA at $341 avg which is being used as collateral) and I can only weather TSLA down to $185-ish before being in a maintenance call.

It seems I have no choice but to let it expire and I'll probably be assigned 1,900 shares at $266.66 ($244 after accounting for the premium I got).

I need to find out how to manage this once assigned on 12/16 or sooner since it’ll be eating up $500k+ of margin at 5.75% (TD Ameritrade).

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K