So early this week I sold some 1/7 900/1000 BPSs for pocket lint. ($0.46) I wasn't sure what was going to happen and I wanted to tie up my purchasing power to get me "in the market" and prevent me from doing something too risky... My plan was just to let them expire. But they "made" me roll them to next week for a $12.69 credit. (Yeah, I should have rolled closer to the bottom, but this was good enough.) They are up ~33% already.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Another tactical question: how do you all go about rolling BPSs? Does your trading platform allow you to roll both ends on the same trade? I use Schwab and I don't see an ability to do this. If I am rolling each side separately, which do you do first? I want to use limits so would prefer to do all at the same time.

I use schwab and if you are doing any frequency of trades - you need to use their Street Smart Edge program.Another tactical question: how do you all go about rolling BPSs? Does your trading platform allow you to roll both ends on the same trade? I use Schwab and I don't see an ability to do this. If I am rolling each side separately, which do you do first? I want to use limits so would prefer to do all at the same time.

There is a ticket already in there for Rollout Spread and a ton of other useful info.

BrownOuttaSpec

Active Member

I don't know about Schwab since I don't use their platform but I made a tutorial for ETrade, maybe it is similar: LinkAnother tactical question: how do you all go about rolling BPSs? Does your trading platform allow you to roll both ends on the same trade? I use Schwab and I don't see an ability to do this. If I am rolling each side separately, which do you do first? I want to use limits so would prefer to do all at the same time.

Thanks @UltradoomY! I saw this as I was rummaging around and got it set up. And I see the rollout spread option. Will need to spend some time looking around here; looks like a great tool.I use schwab and if you are doing any frequency of trades - you need to use their Street Smart Edge program.

There is a ticket already in there for Rollout Spread and a ton of other useful info.

Knightshade

Well-Known Member

Another tactical question: how do you all go about rolling BPSs? Does your trading platform allow you to roll both ends on the same trade? I use Schwab and I don't see an ability to do this. If I am rolling each side separately, which do you do first? I want to use limits so would prefer to do all at the same time.

Fidelity lets me create a roll ticket for either the short or the long side, and then add 2 legs to include the other side on the same ticket.

ML is garbage and does not support this-a roll ticket only lets you roll one side of the spread- so for margin reasons I have to roll the long side first (otherwise it would show me as having a BUNCH of naked puts)....my current workaround is to open two tabs each with a roll ticket and fill in everything for both sides, then submit the long side, soon as it says executed submit the short side. My long term workaround will be moving my $ out of ML but I'm waiting for a lull in volatility and catalysts to avoid being unable to trade for a week (which is about how long moving my IRA account out of ML to Fidelity took late last year) so probably at least post-ER.

I use schwab, and I roll the long leg first to maintain the spread.Another tactical question: how do you all go about rolling BPSs? Does your trading platform allow you to roll both ends on the same trade? I use Schwab and I don't see an ability to do this. If I am rolling each side separately, which do you do first? I want to use limits so would prefer to do all at the same time.

Once I made the mistake of rolling the short-leg first, and the schwab algorithm immediately put me into a margin call position (even after "fixing" it by rolling the long leg). Couldn't trade for 2 days while the option trades "settled".

Another tactical question: how do you all go about rolling BPSs? Does your trading platform allow you to roll both ends on the same trade? I use Schwab and I don't see an ability to do this. If I am rolling each side separately, which do you do first? I want to use limits so would prefer to do all at the same time.

There is an "All-in-One" trade ticket on the Schwab website where you can add as many legs as you need.

Anyone figure out how to do this in IB? I know you can do it in the IB workstation but the bulk of my trades are through the IB app and I don't see a way to roll a spread that way.Another tactical question: how do you all go about rolling BPSs? Does your trading platform allow you to roll both ends on the same trade? I use Schwab and I don't see an ability to do this. If I am rolling each side separately, which do you do first? I want to use limits so would prefer to do all at the same time.

Thank you all for the replies!

As @UltradoomY mentioned, for those of you on Schwab or those of you looking to make a change (e.g., @Knightshade), Schwab offers a 'traders' platform called StreetSmart Edge. It's free and offers much more in-depth tools than their standard platform.

As @UltradoomY mentioned, for those of you on Schwab or those of you looking to make a change (e.g., @Knightshade), Schwab offers a 'traders' platform called StreetSmart Edge. It's free and offers much more in-depth tools than their standard platform.

Thanks Mike. I see that now. There is even an option for Rollout Spread. That is what I was looking for initially before I found the StreetSmart Edge option. Looks good if you don't want to download the SSE app.There is an "All-in-One" trade ticket on the Schwab website where you can add as many legs as you need.

As far as I know it is not possible in the app, it breaks your spread into individual legs. As you know, TWS does allow it. Very frustrating for me as well. If someone knows a way to roll spreads in the app I would love to know as well.Anyone figure out how to do this in IB? I know you can do it in the IB workstation but the bulk of my trades are through the IB app and I don't see a way to roll a spread that way.

Spreads coupled with MMs and margin calls are what will screw you. This morning was not funI want to know more. "Spreads are what screw you..." I know this has been discussed, but reminders are oh so helpful...

Anyone figure out how to do this in IB? I know you can do it in the IB workstation but the bulk of my trades are through the IB app and I don't see a way to roll a spread that way.

As far as I know it is not possible in the app, it breaks your spread into individual legs. As you know, TWS does allow it. Very frustrating for me as well. If someone knows a way to roll spreads in the app I would love to know as well.

You cannot roll spreads on the app but perhaps there is a workaround. I have not tried this yet but you might be able to use the strategy builder with multiple legs but it is a manual process. For example if you want to roll -1050/+1000 Jan 7th BPS to -1025/+975 Jan 14 BPS you can create an order using the following legs.

Buy 1050 Jan 7th Put

Sell 1000 Jan 7th Put

Sell 1025 Jan 14th Put

Buy 975 Jan 14th Put

One of the difficulties in trading a stock like this is knowing how to deal with your conviction in your positions.

My conviction in holding TSLA stock over the years has paid me back, in some cases, a hundred fold.

If you held short term positions with conviction the past four days you have been at the very least stressed out if you opened far OTM conservative strikes, or obliterated with aggressive positions if you did not scramble to contain the damage.

Very different mindsets required.

Trading can be very hard indeed.

My conviction in holding TSLA stock over the years has paid me back, in some cases, a hundred fold.

If you held short term positions with conviction the past four days you have been at the very least stressed out if you opened far OTM conservative strikes, or obliterated with aggressive positions if you did not scramble to contain the damage.

Very different mindsets required.

Trading can be very hard indeed.

Interesting. As long as it buys and sells the puts in your portfolio (as opposed to the market) for Jan 7th in your example, that would work. Might have to try that with 1 position if/when it comes time to roll.You cannot roll spreads on the app but perhaps there is a workaround. I have not tried this yet but you might be able to use the strategy builder with multiple legs but it is a manual process. For example if you want to roll -1050/+1000 Jan 7th BPS to -1025/+975 Jan 14 BPS you can create an order using the following legs.

Buy 1050 Jan 7th Put

Sell 1000 Jan 7th Put

Sell 1025 Jan 14th Put

Buy 975 Jan 14th Put

jeewee3000

Active Member

That's why the most popular New Year resolution on this thread was:One of the difficulties in trading a stock like this is knowing how to deal with your conviction in your positions.

My conviction in holding TSLA stock over the years has paid me back, in some cases, a hundred fold.

If you held short term positions with conviction the past four days you have been at the very least stressed out if you opened far OTM conservative strikes, or obliterated with aggressive positions if you did not scramble to contain the damage.

Very different mindsets required.

Trading can be very hard indeed.

"In 2022 I'll choose safer/wider/further OTM strikes". If you have $300 wide strikes, today's action means very little.

Knightshade

Well-Known Member

One of the difficulties in trading a stock like this is knowing how to deal with your conviction in your positions.

My conviction in holding TSLA stock over the years has paid me back, in some cases, a hundred fold.

If you held short term positions with conviction the past four days you have been at the very least stressed out if you opened far OTM conservative strikes, or obliterated with aggressive positions if you did not scramble to contain the damage.

To me far OTM is 20% or more.

That would've been a -950 even opening near the very very top on Monday.

I wouldn't have been especially stressed at all holding those even with the 1020-1030 dip today.

If you're a "10% OTM is conservative" thinker YMMV of course.

jeewee3000

Active Member

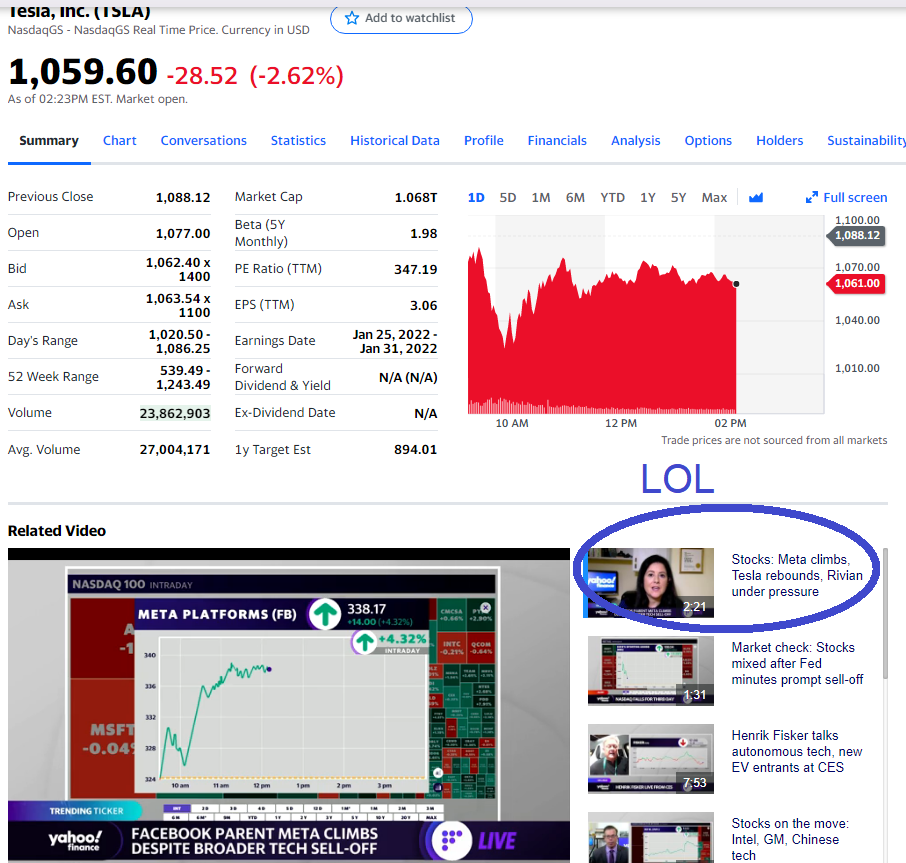

BTW, Tesla is rebounding today, haven't you been following the news?

Flehmenlips

Member

Honestly, trading is hard on my self esteem!One of the difficulties in trading a stock like this is knowing how to deal with your conviction in your positions.

My conviction in holding TSLA stock over the years has paid me back, in some cases, a hundred fold.

If you held short term positions with conviction the past four days you have been at the very least stressed out if you opened far OTM conservative strikes, or obliterated with aggressive positions if you did not scramble to contain the damage.

Very different mindsets required.

Trading can be very hard indeed.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K