Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

R

ReddyLeaf

Guest

Suggestion: Buy two of the puts back, effectively locking in your loss but releasing the cash. Then buy 200 shares and sell two 605c 5/28 covered call, and keep the extra cash available for options trading contingency. Then, on Fri 5/28, roll the calls and put forward one week at strikes about $50 above and below the stock price, respectively. You should be able to get about $2-$10/shr on each contract. Keep this 2:1 CC/CSP ratio and continue rolling each week, saving the accumulated cash to buy stock in 2-5 share increments at $5-$10 lower prices. Having both CCs and CSPs means that one will always “win.” If you’re lucky, the SP will finish between the two strikes and both will expire worthless. Always keep enough cash available to buyback and roll forward which will allow you to adjust weekly.Newbie here in selling puts, would be great if you could provide some advices from all experts here.

Early last week I sold 3 cash secured puts of $645 (around $19 per contract) and wish it would expired worthless on that week. However, SP suddenly dropped a lot and thus I decided to roll (last thursday) to around $640 with expiry date of May 28. With the current price movement, I am a bit afraid it would continue dropping and may not be able to get back to the right level in the new few months and really want to get rid of this trouble asap. What suggestions would you recommend?

1) Should I continue to roll every week and hope it will get back to the right level soon?

2) I read the comments from bxr140 & adiggs and talking about selling covered call with the same ITM amount, but I am afraid I would not be able to catch the timing right and will eventually make another wrong attempt.

In fact, I am keen to pick up 300 more shares with the price around 500-560, but now the 3 selling puts are now actually holding my cash (with the 3 selling puts at the moment, it would only allow me to buy 10 more shares at max unless I start using margin/buying power)

Appreciate it.

tradenewbie

Member

Thanks for valuable suggestions here.

Just to clarify, my current remaining cash remaining balance is enough to buy 300 shares for SP around 500-560 (as long as I won't let those 3 X 640 secured puts to get exercised). If I just go ahead to buy 300 shares at these 500s price levels first, and in the meanwhile, just keep rolling the 3 secured puts every week and won't let these puts to get exercised, do I still need to worry about the margin stuff in the future?

Sorry if this is a newbie question about margin/buying power.

Just to clarify, my current remaining cash remaining balance is enough to buy 300 shares for SP around 500-560 (as long as I won't let those 3 X 640 secured puts to get exercised). If I just go ahead to buy 300 shares at these 500s price levels first, and in the meanwhile, just keep rolling the 3 secured puts every week and won't let these puts to get exercised, do I still need to worry about the margin stuff in the future?

Sorry if this is a newbie question about margin/buying power.

With the current price movement, I am a bit afraid it would continue dropping and may not be able to get back to the right level in the new few months and really want to get rid of this trouble asap. What suggestions would you recommend?

I strongly recommend not taking on more risk in an attempt to recover. While doing so is a viable course of action (as described upthread), it can also seriously nuke your account balance. I also strongly recommend that you not enter any other positions until this one is in a safe place. You are a real $15k+ in the hole on a position that capped potential profit at $5700. You'll hear folks try to brush that kind of place off as a paper loss. Make no mistake, it is real; it is no joke.

IMHO, your two courses of action are:

1. Play the roll-out-and-down game until price comes back to your position.

2. Close the position, take the loss, and learn the lesson.

Xepa777

Banned

Did this just happen? Hahaha

If Tesla does get to 400 next week I think it's time to sell 2023 margin-secured puts and buy some LEAPs LOL.

If Tesla does get to 400 next week I think it's time to sell 2023 margin-secured puts and buy some LEAPs LOL.

alterac000

Member

Venting and sharing. Price action continues to disappoint. For this week I have setup the following:

sold 580cc

sold IC +510p|-515|-605c|+610c

I would almost feel better if I ended up needing to roll any of the calls...

sold 580cc

sold IC +510p|-515|-605c|+610c

I would almost feel better if I ended up needing to roll any of the calls...

i am thinking of the same IC range, or maybe 540-610Venting and sharing. Price action continues to disappoint. For this week I have setup the following:

sold 580cc

sold IC +510p|-515|-605c|+610c

I would almost feel better if I ended up needing to roll any of the calls...

What tools do you use to evaluate different options? I found optionsprofitcalculator website good but it not easy to compare different strikes and dates.My brokers’ tools are just confusing.

Would appreciate any tips on tools.

Also, planning to buy some LEAP calls soon. What strikes and dates do you find interesting now?

Would appreciate any tips on tools.

Also, planning to buy some LEAP calls soon. What strikes and dates do you find interesting now?

Tslynk67

Well-Known Member

I have no analysis tools other than the stock chart and Max Pain, I'm trading based on gut feeling, which seems to be as successful as most other methods I've observedWhat tools do you use to evaluate different options? I found optionsprofitcalculator website good but it not easy to compare different strikes and dates.My brokers’ tools are just confusing.

Would appreciate any tips on tools.

Also, planning to buy some LEAP calls soon. What strikes and dates do you find interesting now?

My personal preference for LEAPS is to buy near-ATM calls, so if I were in the market for sone now it would be July 23 $700's, something like that

Then you get the benefit of some early leverage as they move ITM followed by a certain security once they are ITM, then DITM - plus you can sell covered calls against them, so the lower strike is interesting for that too

I sold some $605 covered calls for Friday, expecting to have to BTC. Easily financing a Covid breakout trip to SF.

I'm trying out my first Iron Condors this week. Yesterday I bought 10 x May21 560/575 690/705 for a bit over $6 each. They're much heavier on the put side but I may roll the call side down with the way the price action is going. I'm liking these IC's so far, light with the margin and easy to adjust if needed.

Make sure to double-check that you sold, not bought. Accidentally made that mistake before and received debit instead of credit.I'm trying out my first Iron Condors this week. Yesterday I bought 10 x May21 560/575 690/705 for a bit over $6 each. They're much heavier on the put side but I may roll the call side down with the way the price action is going. I'm liking these IC's so far, light with the margin and easy to adjust if needed.

I am waiting for the SP reaction to the Biden speech this afternoon. If no change, my IC range will probably be 550-650.

550 is due to

- yesterday's 561 low

- today's premarket 566 low

- this morning's 563 low

That's 3 failed attempts to reach 560.

650 is due to the 640 max pain and 650 call wall.

Hope it works!

I double and triple checked and even then had to redo one order. I also placed an order but had existing sold Puts at the same strikes as the bought puts. This resulted in the IC being unravelled so I had to close out and replace the order while avoiding any existing strikes.Make sure to double-check that you sold, not bought. Accidentally made that mistake before and received debit instead of credit.

Your strikes look good. I'll likely move to these safer strikes on the put side in future and sell more contracts.

Thanks! Where do you find the max pain?I have no analysis tools other than the stock chart and Max Pain, I'm trading based on gut feeling, which seems to be as successful as most other methods I've observed

My personal preference for LEAPS is to buy near-ATM calls, so if I were in the market for sone now it would be July 23 $700's, something like that

Also helpful to hear about your LEAPS strategy. I was inclined to go a bit more OTM that far out, but seems useful to be able to sell calls when you are DITM. (This is my first real options buy, I have just used warrants before.)

Tslynk67

Well-Known Member

Here you go: Stock Option Max PainThanks! Where do you find the max pain?

Also helpful to hear about your LEAPS strategy. I was inclined to go a bit more OTM that far out, but seems useful to be able to sell calls when you are DITM. (This is my first real options buy, I have just used warrants before.)

Yeah, these "warrants" are a thing in Scandinavia I hear and options far harder to trade up there?

Whatever, be careful you can get poor real quick

tradenewbie

Member

Thanks for advices from experts here. I was struggling to buy back with significant lose and worried about rolling it forever which made me super nervous. With the little bounce of SP today, I decided to close two puts ( 1 put still live though) and sell cover callNewbie here in selling puts, would be great if you could provide some advices from all experts here.

Early last week I sold 3 cash secured puts of $645 (around $19 per contract) and wish it would expired worthless on that week. However, SP suddenly dropped a lot and thus I decided to roll (last thursday) to around $640 with expiry date of May 28. With the current price movement, I am a bit afraid it would continue dropping and may not be able to get back to the right level in the new few months and really want to get rid of this trouble asap. What suggestions would you recommend?

1) Should I continue to roll every week and hope it will get back to the right level soon?

2) I read the comments from bxr140 & adiggs and talking about selling covered call with the same ITM amount, but I am afraid I would not be able to catch the timing right and will eventually make another wrong attempt.

In fact, I am keen to pick up 300 more shares with the price around 500-560, but now the 3 selling puts are now actually holding my cash (with the 3 selling puts at the moment, it would only allow me to buy 10 more shares at max unless I start using margin/buying power)

Appreciate it.

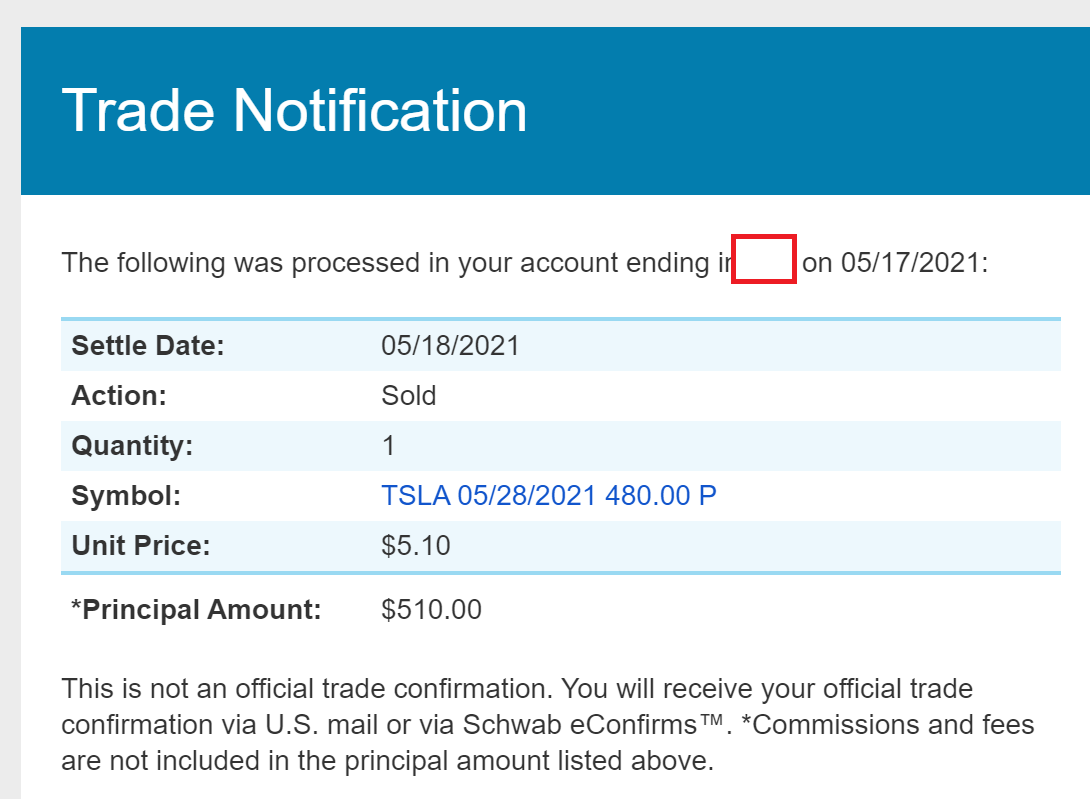

last week:

STO 640 sp: +$88 premium totally

this morning

BTC 640 sp - $60 X 2 = -$120

STO 605 sc - 8.6 X 6 (Currently I have 6 contracts) = +$51.6

Although I still have 1 more sp alive and 605 sc is risky, at least at the moment it gives me a bit relief...

I've been buying 300 strike Jun '23 calls for the DITM / call selling capability. As well as share replacement. I found that for the same cost as 100 shares (actually around 110 shares) I get 2 contracts and a 1.8x delta. So I get upside (and downside) leverage as well as coverage for covered call sales.I have no analysis tools other than the stock chart and Max Pain, I'm trading based on gut feeling, which seems to be as successful as most other methods I've observed

My personal preference for LEAPS is to buy near-ATM calls, so if I were in the market for sone now it would be July 23 $700's, something like that

Then you get the benefit of some early leverage as they move ITM followed by a certain security once they are ITM, then DITM - plus you can sell covered calls against them, so the lower strike is interesting for that too

OR I don't lever up and instead free up cash (relative to owning shares outright) for selling puts. I'm really doing more on this side as most of my accounts are share rich and cash poor relative to my target.

Make sure to double-check that you sold, not bought. Accidentally made that mistake before and received debit instead of credit.

I am waiting for the SP reaction to the Biden speech this afternoon. If no change, my IC range will probably be 550-650.

550 is due to

- yesterday's 561 low

- today's premarket 566 low

- this morning's 563 low

That's 3 failed attempts to reach 560.

650 is due to the 640 max pain and 650 call wall.

Hope it works!

Thanks for the update (and to others providing similar condor plans). I particularly like that you've gone through your logic for how you arrived at this choice. This provides me with an incremental bit of information as I evaluate my own condor plans for the week. Not waiting for Thursday this week, eh?

Same here, STO 3x 5/21 cc600 @ 10. GTC BTC order for 80% profit also entered.

When you say ”80% profit”, that means you will BTC at $2? If not, what is the formula?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K