i'm never doing this narrow range again, too much stress... next time: wider range, wider spread, smaller contracts, and checking 'best' delta for the shorts instead of focusing on SP.My +p580/-p590/-c650/+c660 Iron Condor is in danger of going ITM (premarket 589), is not in danger, is in danger, is not in danger, ... Of course, this is all my fault: 550-650 was the original range before i got greedy.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

FYIYes. Options take one day to settle, while normal stocks take 3 days. So if you sell an option, and then buy anything else with the proceeds you can't sell the new position until the next day without violating the good faith rule. (Unless you are in a margin enabled account.)

Normal stocks in the US now settle in 2 days instead of 3 and I heard some chatter that they are thinking of moving that to 1 day in 2022...

juanmedina

Active Member

I did close those covered calls out last night for $.10 to give myself another shot at re-selling on an expected pop today. So today I tried to day-trade some covered calls on a slightly more aggressive scale to scalp some more "safe" premium (or at least what I thought to be safe!). I had targeted $605s before open, thinking (1) we'd get a morning pop carrying over from pre-market and (2) the call wall at $600 would provide support.

My plan worked great initially, but it was soon apparent I acted too quickly. I sold 45x $605s for $.72 when the stock was around $585 (around 9:45 am or so), but if I had held out for 30 more minutes (the time I expected a MMD), the same calls went for over $3 as the SP approached $595, so more than 4x what I sold them for.

It was not a leisurely Friday afternoon experience, but I felt pretty comfortable that the $600 call wall would hold - and it did. But it was a lot more nerve wracking than it could have been if I had been able to 4x my premium. I wound up closing out for $.02 a few minutes before close. However, it turned a so-so week into a better week. I made 45x $1.13 premiums for the week ($.43 and $.70) on two day trades.

Hopefully we carry this new-found momentum into next week. I did not open any positions for next week, but will watch and see how things unfold.

I did something similar on Friday but I sold $652.5 for 6/11 in batches $2, 2.3, 2.6, 2.7 and closed them all by 12:30 at $1.85 to play with my kids and I didn't wanted to hold any open CC's for next week. I made $1.27 per contract for the week. I have been thinking about my strategy and I think I will shoot for $2 per contract per week because I usually end up screwing up the week when I get greedy or have a way too stressful week. Obviously selling calls is dynamic but I want to be able to get consistent results and more than $2 is welcome

I have also been able to get "margin" on my Fidelity IRA account(s). The purpose of this "margin" is to enable trading of unsettled funds. From Fidelity's site:Yes. Options take one day to settle, while normal stocks take 3 days. So if you sell an option, and then buy anything else with the proceeds you can't sell the new position until the next day without violating the good faith rule. (Unless you are in a margin enabled account.)

Limited Margin

Limited margin, a restricted version of margin, allows customers with retirement accounts to trade on unsettled funds without triggering trading restrictions. Customers can day trade stocks and options, provided the required options agreement is in place, in an IRA. There are specific criteria that need to be met in order to be eligible for limited

I expect this is available at other brokerages as well. Quite handy I find

I sure to like it when I get paid to learn things! Sometimes that learning involves losing money as wellIt's all about learning, and when you watch the SP and the options chart so closely, you really see how values plummet in that last hour or two.

Time value decay that last hour always seems tricky to me. In some ways I'm regularly surprised at just how much time value remains even an hour or two before expiration, even up to 30 minutes before expiration.

AND as you say just a little bit more OTM just crushes option value towards the end. I have intentionally taken a small position that was very close ATM into the final 5 or 10 minutes to expiration just to see how that worked out. It was surprising to me how long the option retained value, and is something I avoid doing now as a result

I am a BIG fan of intentionally created small positions designed to learn stuff with skin in the game. At least for me I learn a lot better when I have a few $ on the line, even if it's like $1000.

Xepa777

Banned

So Tesla IV is back to the lows it was at pre-S&P inclusion, looks like the opportune moment for 2023 LEAPs, especially considering the option price collapse this year. Thoughts?

I think I'm gonna go in this week.

I think I'm gonna go in this week.

Criscmt

Member

Thank you, as always very helpful.Seems like this is going to work out for you anyway, but a few thoughts for next time, in no particular order:

1. Consider a wider spread. One strike apart often doesn't maximize return on margin (at least from study I did a few years ago, ~2-3 strikes apart is the sweet spot for that) and the tighter the spread, the more binary the position. I typically do 20-30$ spreads on TSLA at this price range and sometimes up to 50. A practical side benefit is you end up with fewer total contracts, which is useful if you have a hard time stomaching the kick-in-the-head commission from rolling or closing early. Its all relative (bigger position typically is bigger return), but still, it sucks to close 100x ICs or whatever at ~50 cents a contract.

2. "Timing" the market is a gamble. (I can't give advice on gambling) Instead, develop entry and exit points before you open a position....then timing becomes a non-issue. The follow on to that: if for whatever reason you make a real time decision that you need out of a bad position--including rolling to avoid ITM execution, and including superseding your entry and exit points--do it ASAP.

3. IMHO it is not worth taking a loss until you can't practically recover. The major issue here is that the casino odds of selling options means that if you always just take the loss, you will lose money. Beyond that, as no doubt opined upthread at some point, that's my own personal rule and its definitely capital inefficient, but it also provide structure to next actions in what can otherwise be a frustrating/emotional scenario. THE WORST thing a trader can do after a bad beat is to try and recover the loss on the next cycle, and by forcing myself to recover from the current bad position I pretty much box myself out of turning around that capital and doing something stupid with it. The only thing worse than losing $25k on a bad spread is turning that capital right around into another $25k loss. BTDT.

4. Broken record here on price analysis, but consider more defensible strikes. ~$550 is clearly a support price right now; that would have been a stronger anchor leg than 575.

5. Read through your IBKR terms. They're not doing anything they haven't already told you they would do.

6. NEVER let buying power get anywhere close to 0. Always have buying power in reserve for things like roll-splits and, if you're selling naked options, margin hikes. A good rule of thumb is having ~double the margin you need for the sum of the positions you're opening. If you're opening really diversified set of positions (like, ICs for 5 different tickers) you might be able to reduce that under the statistical probability that not all 5 ICs are going to go into the *sugar*.

7. Criteria for selecting future contracts is pretty well laid out upthread. I'm a strong proponent of never-for-debit. If you're going to take a debit, you close out completely. Rolling at a debit is a pretty JV play as it reduces profit (since that debit is explicitly reducing the initial credit) while maintaining the same amount of risk in what has already proven to be a bad trade.

You answered partly a question I was going to. How to pick the right strategy at any point of time, for example, right now the IV is on the lower side, perhaps Strangle is better compared to Straddle?

Is IC a good choice, if yes, I how to identify the strikes on either side? What strikes will be manageable when one side goes against us? Are strikes with low probability of going against us with low return better than strikes with high probability of going against us with higher returns better?

Are there tools? I found ETrade strategy optimizer.

Last edited:

Criscmt

Member

Mind explaining more, especially the part “checking 'best' delta for the shorts instead of focusing on SP”i'm never doing this narrow range again, too much stress... next time: wider range, wider spread, smaller contracts, and checking 'best' delta for the shorts instead of focusing on SP.

I meant finding the lowest -P/-C deltas that i can tolerate (because prems will also be lower).Mind explaining more, especially the part “checking 'best' delta for the shorts instead of focusing on SP”

For example: I used to just guestimate the range. Yesterday's 590-650 IC was a win, but I could/should have added some more technical analysis before opening the trade. 590 was gambling that won, but I might not be so lucky next time.

In my IC future (i am looking at the 6/11 chain):

- if i want 90% chance of success (per side) on 6/11, i need to look for 0.10 delta on both sides. The result is 540-650 range. 80% chance of success overall.

- if i want 85% chance of success (per side) on 6/11, i need to look for 0.15 delta on both sides. The result is 555-640 range. 70% chance of success overall.

What does this mean to me?

- lower profits because range is wider, but i can widen the spread to make up. Commissions will be lower. Contracts opened will be fewer. Margin used may be bigger.

- less guesswork on what the range is.

- i don't have to wait for Wednesdays to open an IC. In theory, i can start on Monday but I need to learn the other greeks (ie vega) first before i change my opening day.

- maybe less babysitting. Since i am trading on deltas, i can just create alerts if my 0.10 increased to 0.20.

That's just my general rookie not-advice guideline for normal weeks. Because of a pending 6/10(?) announcement, all bets are off and I need to be extra careful next week. I might just skip IC and do BPS.

Here's a tutorial : if i understood it, everybody can.

R

ReddyLeaf

Guest

Way to go! Looking at buying some +c630s for 6/11, hoping for some similar action on Tuesday. Anybody else nervous about selling calls this week? Reading about the S&P rebalancing and Plaid S delivery event has me expecting a significant SP bump. +$50, +$100, +$150? It would be really crazy if my -p800s for 6/18 actually expire worthless. I have a dream……Yay! More than doubled my money on those 40x calls…. If I had known what I was doing I would have tripled my money. But 4K isn’t bad for a lotto ticket gamble. Good times. I’m never doing that again..

Somehow made it out of this week alive… will pick up next week with my 19 puts in place at 597.50! Time to drink heavily … what a week!

Cheers!

I can see maybe not selling until Friday. Or selling and then closing on Wednesday or Thursday. For the S&P rebalancing, that might actually result in selling, right? I think Gary Black mentioned TSLA's performance is 496 in the S&P 500 in 2021. And we know it entered at $695. So there might be some selling pressure, although hopefully that is more than offset by the MS Plaid event. Macros look flatish, slightly negative right now.Anybody else nervous about selling calls this week? Reading about the S&P rebalancing and Plaid S delivery event has me expecting a significant SP bump. +$50, +$100, +$150? It would be really crazy if my -p800s for 6/18 actually expire worthless. I have a dream……

I'm very intrigued for a different reason. I've been experimenting with synthetics this past month, somewhat awkwardly but I've been lucky to make money on them and not be punished too severely for my mis-steps.bto 10x June 2023 c1400 @$58.41

Consider the following:

The biggest downside to the synthetic is when you are wrong you will want to roll the puts.... therefore you need to rebuy calls again each time you are wrong. This is why some more knowledgable folks explained to me that they that they utilize longer duration calls is the best way to play a synthetic.

Many people here love DITM LEAPS, so if I truly wanted to have a rollable synthetic each week, why not use LEAPS for this purpose?

Consider this: Schwab requires only 10% initial and maintenance margin to establish a reverse conversion position (sold OTM put and buy OTM call)... meaning you simply have to have 10% of the executable contract sitting in your account for each synthetic.

The leverage is astounding, so I wonder what I'm missing.

10% of your cash allocated to the synthetic.

You are selling high premium rollable puts each week and are still protected on upside.

If you do this with LEAPS as the call component... you can sell calls too!

So you are basically doing sold strangles for far less capital.

This seems to be a loophole to buying short duration long calls.

That's not how it works. Changes in the the company's IWF and share count shift the totals around and cause rebalancing. However, if a constituent's stock price drops, both its weight and the value of shares in the index drop also, so there is no action to take.I can see maybe not selling until Friday. Or selling and then closing on Wednesday or Thursday. For the S&P rebalancing, that might actually result in selling, right? I think Gary Black mentioned TSLA's performance is 496 in the S&P 500 in 2021. And we know it entered at $695. So there might be some selling pressure, although hopefully that is more than offset by the MS Plaid event. Macros look flatish, slightly negative right now.

Two stocks with the same market cap (add a k or mm) and float adjusted share count to start with:

A: $50, 10 shares, $500 total

B: $50, 10 shares

50% each, $1,000 total

A drops in half

A: $25, 10, $250

B: $50, 10, $500

Total: $750, A's weight should now be 33%, A's value is now 33%

juanmedina

Active Member

Way to go! Looking at buying some +c630s for 6/11, hoping for some similar action on Tuesday. Anybody else nervous about selling calls this week? Reading about the S&P rebalancing and Plaid S delivery event has me expecting a significant SP bump. +$50, +$100, +$150? It would be really crazy if my -p800s for 6/18 actually expire worthless. I have a dream……

Gary feel the same way but for deferent reasons:

I am going to sell some calls anyway if the opportunity presents.

corduroy

Active Member

Me too, I just don't see any large run ups in this environment, even with good news.I am going to sell some calls anyway if the opportunity presents.

Xepa777

Banned

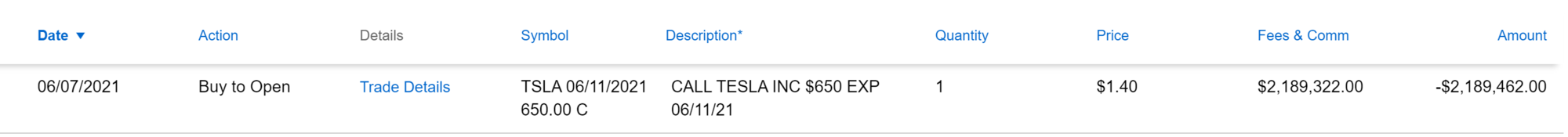

So Charles Schwab is experiencing a technical glitch today which resulted in this commission fee when I tried to place a trade.

I was literally on the phone with them when I read this about another glitch showing available margin. ($20M, should definitely not be that much)So Charles Schwab is experiencing a technical glitch today which resulted in this commission fee when I tried to place a trade.

View attachment 670525

Xepa777

Banned

You shoulda just taken advantage and wrote everything against weekly $450 puts for some free money LOL.I was literally on the phone with them when I read this about another glitch showing available margin. ($20M, should definitely not be that much)

Are there tools? I found ETrade strategy optimizer.

Every platform worth its salt has tools to analyze profit/loss. Etrade's web interface (power etrade) is actually pretty good. Their desktop platform is of course more powerful, but its Windows 95 era UI and my access to other platforms' tools mean I don't use at all. I uninstalled it after 3 days.

why didn't you buy for example:

bto 5x June 2023 c900 @$~115.0

You have a delta of 46 vs 28 and a vega of 3.40 vs 2.85.

IV is about the same.

So shouldn't the c900 increase in price faster than c1400?

The important thing is to multiply the number of contracts by The Greeks.

10 contracts at .28 ∆ is a position ∆ of $2.8, while 5 contracts at .46 ∆ is a position ∆ of $2.3. This is in line with the general trend that the farther OTM the strike, the better the ∆/$ when you buy-in. Similarly position Vega is $28.5 vs $17.

I wonder what I'm missing.

In no particular order:

1. A conversion requires you to own shares (so you need that capital tied up in shares and you very much have to be willing to let the shares be called away)

2. A reverse conversion requires you to short shares (so you'll need capital/margin tied up in the short shares)

3. The options legs of a conversion/RC form nearly the opposite P/L curve as the underlying shares/shorts, so the end profit for the whole position is just the small difference between the price of the put vs its equivalent call, as that is the thing that makes up the difference between "nearly" and "exactly".

4. If you're looking to modify the P/L of the options combo via different strikes/expirys you a) will require more margin and/or more initial capital, and b) the less the P/L of the options will move like shares (so you'll be exposed to P/L from underlying movement)

In general, I'd recommend not trying to find a unicorn.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K