alterac000

Member

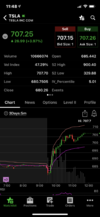

sto 50% 8/27 cc710@9

sto 50% 8/27 [email protected]

Have 700/740 call vertical from last week's 690/730 roll which I'll close or roll later this week. Same with 680/640 bps.

sto 50% 8/27 [email protected]

Have 700/740 call vertical from last week's 690/730 roll which I'll close or roll later this week. Same with 680/640 bps.