Out of all the things he's done, just in this thread alone, the house renovation intrigues you?Wait, you are renovating a house? First I've heard of it.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

AquaY

Member

I’m curious as to how he intends on decorating.Out of all the things he's done, just in this thread alone, the house renovation intrigues you?

Earth tones, or perhaps Triadic colors. These are important options

R

ReddyLeaf

Guest

I appreciate everything that you have added to this thread. However, this statement has me completely flummoxed. Just give me a price and date. Thanks.A lot of my friends are buying into the notion that we're entering a deep market correction. I don't, but I do entertain the idea. The brick wall, dubbed by James Stephenson on Twitter, or simply put, the upward trendline set since March 2020, has been supporting TSLA through the worst of it: 2020 September tech crash and the March 2021 correction. That trendline is only $40-50 below where we are today and it doesn't take much for TSLA to break below that. With its beta, the QQQ only needs to correct 5% for TSLA to do so. With its fundamentals stronger than ever, I wonder if TSLA is gonna be held up by the invisible hands through a correction. Worst case scenario, I see us briefly dip below for a day or two before bouncing off the upward sloping 200 DMA @ 620.

Criscmt

Member

max pain is below James Stephenson's bullish trend line.Regarding the 1450 call, I'm just seeing if small very high calls can have an impact on max pain. I doubt it and I think you or someone wrote up on how the market makers have to cover, based on some model of risk, based on odds of hitting the strike. Undoubtedly just $5.00 wasted, but I'm disappointed max pain is somehow staying below 700. If anyone wants to join me though, maybe a few hundred 1450 calls will push max pain up.

On the BPS, I like the $10 spread, I think I get the most profit opportunity, but it is higher risk than a 20 or 50 point spread and doing fewer contracts. I generally stay far enough OTM to avoid having to roll, with the week before last being an exception. So a little higher risk, but I can make more selling 10 650-640 BPS, versus 5 650-630 BPS. I've set aside more money for margin lately, so maybe I'll try to 20 or 50 point spread coming up, if I think the odds of a decline increase. The profit is very small on the 600-550, but I need more cash to move up to the next 100 share increment, when I can sell more covered calls.

Of note, tomorrow the golden cross and the max pain is below James Stephenson's bullish trend line. If we maintain both, we should have a breakout next week.

Are you sure it (690) is below the trend line? Am I reading this graph incorrectly?

jschwefel

Tesla fan/TSLA, Model Y and Cybertruck owner.

InTheShadows

Active Member

Does anyone know of software to do back testing on? (Does TOS do it?) I want to backtest 2000-2002 on spy what some of us are doing on tsla now to see how it turns out. And by that I mean ~50% shares, 50% DITM LEAP calls, selling weekly calls against all of those and selling put spreads with 20-40% of the margin.

I chose this time frame because I figure that is about as bad as it could get.

I chose this time frame because I figure that is about as bad as it could get.

jeewee3000

Active Member

@dl003 , in reference to your post in the main investor thread regarding 1% gain on your capital per week.

I've read this figure here and there in this thread, but when looking at my personal returns, they are much less than that.

I'f I'm really conservative / safe selling cc's (aka shitcalls), I get 0,1% - 0,15% gain on capital weekly.

Recent weeks I'm more agressive with some cc's, but leaving others non-agressive to allow me to take profits on the non-agressive cc's and have the opportunity to roll the agressive cc's to multiple contracts (should the stock shoot up). This nets me around 0,3%-0,4% gain on capital.

If I were to gain 1% on my capital, I'd have to be crazy agressive on almost all my positions and then be lucky/skillfull enough not to have to roll (since that cancels out the gain of that week and moves it to the week after that, IF the stock corrects. Worst case I'm chasing that 1% gain for weeks till I catch up to the SP with my rolls.)

I have read most of this thread and am up to speed on the various tactics (BPS/ BCS / IC's / cc's / lcc's / ccp's / lcp's / ...) but could you elaborate if you're truly getting 1% gain each week? And if so, what is the general strategy?

Currently I'm only selling cc's since my cash is tied up mostly as margin for longer term sold puts (march 2022 and JUN2023). The premiums received from those puts largely went into LEAPS, leaving me to have to "rebuild" a cash balance with selling cc's.

I've been thinking of letting some shares get assigned after selling agressive cc's (@Lycanthrope style) and then using that money to sell puts against. After all, I hear puts is the backbone and cc's are the gravy/beer money. But in case of a 2020 climb I can't imagine ever catching up to the SP.

Would love to hear people's input on:

- what's your weekly % gain ? (in relation to TSLA holding or account balance - no detailed numbers required)

- what's your weekly % gain goal? How often do you hit or miss it?

- what's the strat you generally use (of course most will do X when stock is high, Y when stock is low, etc. A mix is indeed the most fitting IMO).

EDIT: went over the numbers. To get a 1% return on TSLA stock by selling cc's you'd have to go for premiums of $7. Which is crazy agressive.

I've read this figure here and there in this thread, but when looking at my personal returns, they are much less than that.

I'f I'm really conservative / safe selling cc's (aka shitcalls), I get 0,1% - 0,15% gain on capital weekly.

Recent weeks I'm more agressive with some cc's, but leaving others non-agressive to allow me to take profits on the non-agressive cc's and have the opportunity to roll the agressive cc's to multiple contracts (should the stock shoot up). This nets me around 0,3%-0,4% gain on capital.

If I were to gain 1% on my capital, I'd have to be crazy agressive on almost all my positions and then be lucky/skillfull enough not to have to roll (since that cancels out the gain of that week and moves it to the week after that, IF the stock corrects. Worst case I'm chasing that 1% gain for weeks till I catch up to the SP with my rolls.)

I have read most of this thread and am up to speed on the various tactics (BPS/ BCS / IC's / cc's / lcc's / ccp's / lcp's / ...) but could you elaborate if you're truly getting 1% gain each week? And if so, what is the general strategy?

Currently I'm only selling cc's since my cash is tied up mostly as margin for longer term sold puts (march 2022 and JUN2023). The premiums received from those puts largely went into LEAPS, leaving me to have to "rebuild" a cash balance with selling cc's.

I've been thinking of letting some shares get assigned after selling agressive cc's (@Lycanthrope style) and then using that money to sell puts against. After all, I hear puts is the backbone and cc's are the gravy/beer money. But in case of a 2020 climb I can't imagine ever catching up to the SP.

Would love to hear people's input on:

- what's your weekly % gain ? (in relation to TSLA holding or account balance - no detailed numbers required)

- what's your weekly % gain goal? How often do you hit or miss it?

- what's the strat you generally use (of course most will do X when stock is high, Y when stock is low, etc. A mix is indeed the most fitting IMO).

EDIT: went over the numbers. To get a 1% return on TSLA stock by selling cc's you'd have to go for premiums of $7. Which is crazy agressive.

Last edited:

PastorDave

Member

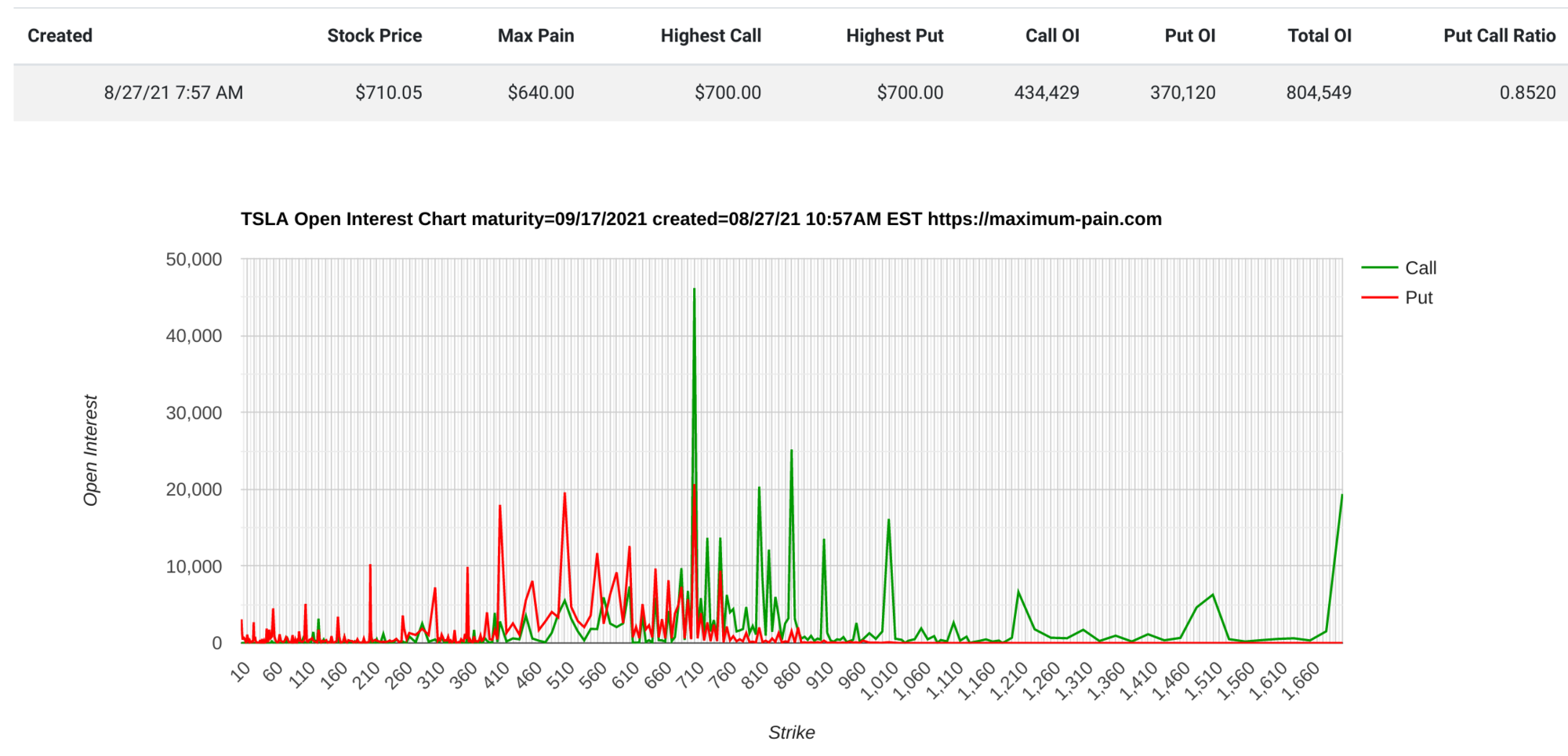

A few thoughts on Max Pain for the upcoming weeks.

9/3 - 675

9/10 - 700

9/17 - 640

9/24 - 700

I know these are subject to change closer to the date, but next week's MP has decreased since yesterday, and I'm not thrilled about it. The monthly expiration date makes sense to me being lower, but next week going down instead of up strikes me as odd. Jitters from yesterday's decline?

Also, here's my Max Pain call/put spread for today. Looks like 700-702 is actually the most advantageous for the MMs this week (calls left, puts right, rightmost column is OI calls - OI puts):

9/3 - 675

9/10 - 700

9/17 - 640

9/24 - 700

I know these are subject to change closer to the date, but next week's MP has decreased since yesterday, and I'm not thrilled about it. The monthly expiration date makes sense to me being lower, but next week going down instead of up strikes me as odd. Jitters from yesterday's decline?

Also, here's my Max Pain call/put spread for today. Looks like 700-702 is actually the most advantageous for the MMs this week (calls left, puts right, rightmost column is OI calls - OI puts):

| 31.5 | 0 | - | 9,308 | 2,592 | 670 | 0.67 | 0 | - | 10,135 | 9,576 | -6,984 | |

| 25.45 | 0 | - | 753 | 1852 | 675 | 0.74 | 0 | - | 8,123 | 6,645 | -4,793 | |

| 21.9 | 0 | - | 15,634 | 7,624 | 680 | 0.91 | 0 | - | 15,406 | 12,577 | -4,953 | |

| 17.25 | 0 | - | 433 | 2,891 | 685 | 1.24 | 0 | - | 8,545 | 3,461 | -570 | |

| 12.86 | 0 | - | 4,146 | 3604 | 690 | 1.7 | 0 | - | 18,749 | 5,203 | -1,599 | |

| 8.95 | 0 | - | 2,109 | 2,519 | 695 | 2.7 | 0 | - | 8,448 | 4,975 | -2,456 | |

| 7.25 | 0 | - | 2,906 | 1,897 | 697.5 | 3.45 | 0 | - | 6,123 | 1,939 | -42 | |

| 5.6 | 0 | - | 29,194 | 12,878 | 700 | 4.4 | 0 | - | 54,947 | 13,280 | -402 | |

| 4.25 | 0 | - | 9,531 | 3,197 | 702.5 | 5.45 | 0 | - | 7,764 | 1,477 | 1,720 | |

| 3.22 | 0 | - | 27,851 | 4138 | 705 | 7.01 | 0 | - | 28,896 | 2,376 | 1,762 | |

| 2.38 | 0 | - | 14,472 | 3,883 | 707.5 | 8.55 | 0 | - | 6,499 | 965 | 2,918 | |

| 1.74 | 0 | - | 54,460 | 13326 | 710 | 10.5 | 0 | - | 30,876 | 5,157 | 8,169 | |

| 1.27 | 0 | - | 13,841 | 2926 | 712.5 | 12.6 | 0 | - | 5,123 | 1,272 | 1,654 | |

| 0.9 | 0 | - | 34,393 | 7281 | 715 | 14.8 | 0 | - | 4,372 | 1,507 | 5,774 | |

| 0.62 | 0 | - | 5,159 | 2,338 | 717.5 | 17.75 | 0 | - | 1,127 | 656 | 1,682 | |

| 0.49 | 0 | - | 45,507 | 12115 | 720 | 19.3 | 0 | - | 2,158 | 4,637 | 7,478 | |

| 0.29 | 0 | - | 20,472 | 9101 | 725 | 24.22 | 0 | - | 819 | 426 | 8,675 | |

| 0.2 | 0 | - | 29,954 | 13612 | 730 | 29.28 | 0 | - | 786 | 1,140 | 12,472 |

tos allows backtesting, but maybe only up to 2009:Does anyone know of software to do back testing on? (Does TOS do it?) I want to backtest 2000-2002 on spy what some of us are doing on tsla now to see how it turns out. And by that I mean ~50% shares, 50% DITM LEAP calls, selling weekly calls against all of those and selling put spreads with 20-40% of the margin.

I chose this time frame because I figure that is about as bad as it could get.

Backtesting with thinkOnDemand to Help Optimize Your Trading - Ticker Tape

Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk.

juanmedina

Active Member

@dl003 , in reference to your post in the main investor thread regarding 1% gain on your capital per week.

I've read this figure here and there in this thread, but when looking at my personal returns, they are much less than that.

I'f I'm really conservative / safe selling cc's (aka shitcalls), I get 0,1% - 0,15% gain on capital weekly.

Recent weeks I'm more agressive with some cc's, but leaving others non-agressive to allow me to take profits on the non-agressive cc's and have the opportunity to roll the agressive cc's to multiple contracts (should the stock shoot up). This nets me around 0,3%-0,4% gain on capital.

If I were to gain 1% on my capital, I'd have to be crazy agressive on almost all my positions and then be lucky/skillfull enough not to have to roll (since that cancels out the gain of that week and moves it to the week after that, IF the stock corrects. Worst case I'm chasing that 1% gain for weeks till I catch up to the SP with my rolls.)

I have read most of this thread and am up to speed on the various tactics (BPS/ BCS / IC's / cc's / lcc's / ccp's / lcp's / ...) but could you elaborate if you're truly getting 1% gain each week? And if so, what is the general strategy?

Currently I'm only selling cc's since my cash is tied up mostly as margin for longer term sold puts (march 2022 and JUN2023). The premiums received from those puts largely went into LEAPS, leaving me to have to "rebuild" a cash balance with selling cc's.

I've been thinking of letting some shares get assigned after selling agressive cc's (@Lycanthrope style) and then using that money to sell puts against. After all, I hear puts is the backbone and cc's are the gravy/beer money. But in case of a 2020 climb I can't imagine ever catching up to the SP.

Would love to hear people's input on:

- what's your weekly % gain ? (in relation to TSLA holding or account balance - no detailed numbers required)

- what's your weekly % gain goal? How often do you hit or miss it?

- what's the strat you generally use (of course most will do X when stock is high, Y when stock is low, etc. A mix is indeed the most fitting IMO).

EDIT: went over the numbers. To get a 1% return on TSLA stock by selling cc's you'd have to go for premiums of $7. Which is crazy agressive.

I usually shoot for $200 per contract with CC's but then I add a few with more aggressive strikes, some BPS and naked puts that can bring the average up to $400 per contract.

I have done 3-4% before in a week usually around earnings.

Sigh. Sure you want to see what's inside the circus? Ok, here we go. A picture is worth a thousand words and what not.@dl003 , in reference to your post in the main investor thread regarding 1% gain on your capital per week.

I've read this figure here and there in this thread, but when looking at my personal returns, they are much less than that.

I'f I'm really conservative / safe selling cc's (aka shitcalls), I get 0,1% - 0,15% gain on capital weekly.

Recent weeks I'm more agressive with some cc's, but leaving others non-agressive to allow me to take profits on the non-agressive cc's and have the opportunity to roll the agressive cc's to multiple contracts (should the stock shoot up). This nets me around 0,3%-0,4% gain on capital.

If I were to gain 1% on my capital, I'd have to be crazy agressive on almost all my positions and then be lucky/skillfull enough not to have to roll (since that cancels out the gain of that week and moves it to the week after that, IF the stock corrects. Worst case I'm chasing that 1% gain for weeks till I catch up to the SP with my rolls.)

I have read most of this thread and am up to speed on the various tactics (BPS/ BCS / IC's / cc's / lcc's / ccp's / lcp's / ...) but could you elaborate if you're truly getting 1% gain each week? And if so, what is the general strategy?

Currently I'm only selling cc's since my cash is tied up mostly as margin for longer term sold puts (march 2022 and JUN2023). The premiums received from those puts largely went into LEAPS, leaving me to have to "rebuild" a cash balance with selling cc's.

I've been thinking of letting some shares get assigned after selling agressive cc's (@Lycanthrope style) and then using that money to sell puts against. After all, I hear puts is the backbone and cc's are the gravy/beer money. But in case of a 2020 climb I can't imagine ever catching up to the SP.

Would love to hear people's input on:

- what's your weekly % gain ? (in relation to TSLA holding or account balance - no detailed numbers required)

- what's your weekly % gain goal? How often do you hit or miss it?

- what's the strat you generally use (of course most will do X when stock is high, Y when stock is low, etc. A mix is indeed the most fitting IMO).

EDIT: went over the numbers. To get a 1% return on TSLA stock by selling cc's you'd have to go for premiums of $7. Which is crazy agressive.

My strategy consists of:

20% short FOTM TSLA LEAP calls - these were rolled down from 1700s and the original premium was much higher than today. These are naked.

10% non-TSLA trades. These includes: (1) shorting FOTM puts on stable growth with strong cash flow (2) shorting FOTM calls on overextended big Tech stocks and (3) shorting FOTM calls on meme stocks that have exhausted their run. These are all naked shorts. UPST, GME, and AMC have treated me quite well the last couple of weeks.

20% naked shorting TSLA weekly puts. Here you see a 2023 -1000p that I just put on. Haven't made anything off of it and I may just close it today.

50% shorting TSLA weekly calls.

Out of these, only the weekly short calls have seen some evolution in my strategy this year. I started the year shorting naked weekly calls (think 8-10 calls for each 100 shares). I would start with what you call shitcalls and then take it up 5-10 strikes. Then, as the week progresses, I either added more or rolled them down for more premium. I made good money on them, but there was this nagging insecurity: if the stock rallied hard, however unlikely that might be judging by the current action and option OI, I would be screwed as I had no safety net. I often had to roll them up prematurely to maintain tons and tons of (unnecessary) margin of safety.

Lately, I cleaned that up and started following @Lycanthrope's lead. What I've noticed is: while the money is roughly the same, I'm much less stressed out now because although my strikes are a lot closer to the stock price than before, I've got my safety net back. I can just roll them out forever if they get ITM.

You can see the 10x 780 9/3 calls I have open. I can't help but keep some naked shitcalls. I started out this week with 8/27 780s. Instead of rolling them down with my CCs, I rolled them out because 780 is the lowest I want for my shitcalls. Did I mention something about a circus? Yeah...

This is not a sell and forget strategy. As you can see, there're a lot of naked stuff going around but my number one rule is keep the delta low and minimize dealing with the unicorns in the market. So far it's worked out alright.

There's one caveat to the 1% weekly return: it depends on whether you're planning to live off it or reinvest it into more shares of TSLA. I started out with a 50% annual return goal. Then, if you're living off it, simply divide it by 52 weeks to arrive at roughly 1% per week. However, if you're reinvesting the proceed into more share in order to sell more calls and have more margin to work with, you only need 0.7% (1.07^52 = 1.5).

I can't say that this is not stressful at times. What I have working for me is a knack for consuming market information all day everyday and so this feels more like a hobby than a job and the risks feel manageable. When and if I quit my job to trade fulltime, I plan to (1) cut back on my naked positions and (2) buy more options instead of selling them (if I can get good at it of course).

So far this year, my cash return is 57%. With the stock flat for the year, this has allowed me to increase my stake in TSLA by 45% and pay last year capital gain taxes. That's 57% over 40 weeks so a little more than 1%. I don't expect to be able to repeat it. Heck, I don't know what to expect for the future. I live one day at a time. TSLA is both a hobby and a study for me. One can only try to do their best everyday and hope for the best.

Last edited:

jeewee3000

Active Member

@dl003 , thanks for sharing in such detail. Gives me plenty to think about.

Naked shorting to the extent you are doing is just impossible with my broker, so I don't even have to open that can of worms mentally. It does however prevent me from larger gains. Oh well, it means I do have a safety net, which is fine since I am more risk averse than you (apparently, no judgement).

So basically I'll be happy to try and get 0,3-0,5% per week, which is still huge compared to the bank. And keep a bigger cash reserve to sell puts against.

Next step in my re-evaluation of my weekly shorts is: why sell put spreads instead of just selling puts and letting them assign/rolling them ? It seems to me the bought put is wasted $$ most of the time.

Naked shorting to the extent you are doing is just impossible with my broker, so I don't even have to open that can of worms mentally. It does however prevent me from larger gains. Oh well, it means I do have a safety net, which is fine since I am more risk averse than you (apparently, no judgement).

So basically I'll be happy to try and get 0,3-0,5% per week, which is still huge compared to the bank. And keep a bigger cash reserve to sell puts against.

Next step in my re-evaluation of my weekly shorts is: why sell put spreads instead of just selling puts and letting them assign/rolling them ? It seems to me the bought put is wasted $$ most of the time.

ChefBoyardee

Member

I've tried a few things, but my main strat now is stock, leaps spreads, and weekly put credit spreads. I use way too much buying power for my credit spreads so I wouldn't recommend that, but I'm averaging 3% ish return per week (10% return on the trades). For the weeks I need to roll, I sell more spreads near ATM at the new expiration date which is why you see the big up ticks after rollingWould love to hear people's input on:

- what's your weekly % gain ? (in relation to TSLA holding or account balance - no detailed numbers required)

- what's your weekly % gain goal? How often do you hit or miss it?

- what's the strat you generally use (of course most will do X when stock is high, Y when stock is low, etc. A mix is indeed the most fitting IMO).

When the stock is high I sell less spreads and go further OTM. When the stock is low I sell more and closer to ATM

AquaY

Member

I want the the bought put to be a waste of money. Just like i want my car insurance to be a waste pf money.@dl003 , thanks for sharing in such detail. Gives me plenty to think about.

Naked shorting to the extent you are doing is just impossible with my broker, so I don't even have to open that can of worms mentally. It does however prevent me from larger gains. Oh well, it means I do have a safety net, which is fine since I am more risk averse than you (apparently, no judgement).

So basically I'll be happy to try and get 0,3-0,5% per week, which is still huge compared to the bank. And keep a bigger cash reserve to sell puts against.

Next step in my re-evaluation of my weekly shorts is: why sell put spreads instead of just selling puts and letting them assign/rolling them ? It seems to me the bought put is wasted $$ most of the time.

and that is one thing the bought put or long leg is. Insurance.

But it's more than that too.

Basically a Vertical put spread is 2 things:

1) It is insurance. You are limiting your loses to the spread between the bought and sold puts.

2) Naked puts are more capital intensive. Whether cash or margin. You need to commit more for a naked put.

My current weekly gain is around 3-5% against total account capital/liquidity but was less before I got things properly worked out. I have achieved 7% but that was pushing it or just a crazy week to trade. My target is 5% and I see this being achievable unless I hit a bad week and then need a recovery week. I could achieve more if I didn't have mostly shares in the accounts as only about 1/3 of the share value gets released as excess liquidity that I can actually trade against.Would love to hear people's input on:

- what's your weekly % gain ? (in relation to TSLA holding or account balance - no detailed numbers required)

- what's your weekly % gain goal? How often do you hit or miss it?

- what's the strat you generally use (of course most will do X when stock is high, Y when stock is low, etc. A mix is indeed the most fitting IMO).

EDIT: went over the numbers. To get a 1% return on TSLA stock by selling cc's you'd have to go for premiums of $7. Which is crazy agressive.

I've recently started an experiment with a couple of my sons, one through my account (shadow accounting) and one through his own new account. Taking one for example, he started with around $5k excess liquidity, and is using half that amount as the margin limit to sell options against each week. So far this is yielding weekly option premiums of $4.25-$6, so say around 10%. At first this only allows for one contract per week but will build into additional contracts as the capital compounds. If we can keep this up for a year, then I won't have my kids coming to me asking for money.

Edit: Added graph for the last month for my main account:

Last edited:

I'm at play this week with open calls and puts, but I'm also looking ahead and I see this huge call wall for 9/17 expiry.

This is the biggest wall I've seen in a while and am wondering what others think this means (if anything).

It is interesting that it is at $700 and could have been opened at anytime, but that it remains is something amazing to me as it is so high.

Both 9/10 and 9/23 are very small relatively and seem normal.

This is the biggest wall I've seen in a while and am wondering what others think this means (if anything).

It is interesting that it is at $700 and could have been opened at anytime, but that it remains is something amazing to me as it is so high.

Both 9/10 and 9/23 are very small relatively and seem normal.

I'm at play this week with open calls and puts, but I'm also looking ahead and I see this huge call wall for 9/17 expiry.

This is the biggest wall I've seen in a while and am wondering what others think this means (if anything).

It is interesting that it is at $700 and could have been opened at anytime, but that it remains is something amazing to me as it is so high.

Both 9/10 and 9/23 are very small relatively and seem normal.

View attachment 702073

9/17 is a monthly expiration date - contracts have been available for much longer. The OI interest in weeklies doesn't really pick up until that week.

EDIT: Actually, I think 9/17 is a LEAP expiration date, which would explain it much better than just a monthly. (For instance, 9/16/22s are available right now, etc.)

Last edited:

jeewee3000

Active Member

You think 46.000 calls @$700 expiring 09/17/2021 is a lot?I'm at play this week with open calls and puts, but I'm also looking ahead and I see this huge call wall for 9/17 expiry.

This is the biggest wall I've seen in a while and am wondering what others think this means (if anything).

It is interesting that it is at $700 and could have been opened at anytime, but that it remains is something amazing to me as it is so high.

Both 9/10 and 9/23 are very small relatively and seem normal.

View attachment 702073

Check the 77.000 puts @$0 expiring 01/21/2022

AquaY

Member

BTC 8/27 CC 725 @.08. No fees on Etrade.

Figured for $40 I'd not worry about a possible run up this afternoon

Figured for $40 I'd not worry about a possible run up this afternoon

FS_FRA

Member

BTC my 08/27 cc735 for $0.05

STO 09/03 cc730 for $4.47 (@Lycanthrope - you timed it better I see, congrats)

STO 09/03 cc730 for $4.47 (@Lycanthrope - you timed it better I see, congrats)

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K