Good question. I don't see anything about an exercise on the order/execution details, just buy to close. Would there be any indication? I'll call them after the close where I imagine i'll be complaining that these would have expired worthlessWas it fidelity or did someone exercise early?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

If they are due to expire today they were closed by fidelity. All brokers do this if the liability from the exercise will exceed your buying power, though I'm pretty sure the timing varies from broker to broker.Good question. I don't see anything about an exercise on the order/execution details, just buy to close. Would there be any indication? I'll call them after the close where I imagine i'll be complaining that these would have expired worthless

bkp_duke

Well-Known Member

If they are due to expire today they were closed by fidelity. All brokers do this if the liability from the exercise will exceed your buying power, though I'm pretty sure the timing varies from broker to broker.

I've heard the exact same thing. One more reason not to hold these positions to the afternoon of expiration.

The indication would be if you have less tsla shares than before OR if you had no tsla shares before, that you are now short 100 shares per contractGood question. I don't see anything about an exercise on the order/execution details, just buy to close. Would there be any indication? I'll call them after the close where I imagine i'll be complaining that these would have expired worthless

BrownOuttaSpec

Active Member

Stock price took off like a rocket in the last 10 minutes, they could have expired worthlessWas planning to roll my -1030/+930s or have them expire worthless but obviously waited too long because Fidelity just liquidated the short leg on my behalf. Wtf.

FS_FRA

Member

When we go back down, “legging out” of that 970 might be a nice double play.. I think the 770 is solid.

With the way the share price is going right now, I’ll take another 2 days of theta until Monday. Right now legging out of the -970 only returns 84% profit. I think there is more to be had.

Never wait until expiration day. Brokerages have the right to liquidate the position if there is any “perceived” risk of being ITM.Was planning to roll my -1030/+930s or have them expire worthless but obviously waited too long because Fidelity just liquidated the short leg on my behalf. Wtf.

My brokerage gives me until 2PM on expiration day, at which point they can decide to liquidate at their discretion.

corduroy

Active Member

I closed out all my 1/14 spreads for pennies. I ended up not rolling anything this week, but opened new positions yesterday for next week. I hit 75% of my weekly income goal.

I'm carrying only about 15% of my available margin over the weekend with some 1/21 BPS positions at 790/-890, 780/-880, and 740/-840. That's about as much risk as I want with macro environment. My main goal right now is not make any big mistakes and survive this market until conditions are more clear.

I'm carrying only about 15% of my available margin over the weekend with some 1/21 BPS positions at 790/-890, 780/-880, and 740/-840. That's about as much risk as I want with macro environment. My main goal right now is not make any big mistakes and survive this market until conditions are more clear.

FS_FRA

Member

Crazy!Seem like the bastards* are targeting that 1050 call wall today...?

My Jan21 1000/900bps which I got yesterday just before close did the job. I expect a monday morning dip and then up again, so I'm holding them for now and think to close once sentiment goes down again, probably around Wednesday.

The Jan28 1000/930bps are legacy, holding on for now since they are still slightly red. Hopefully they go green on monday, and once we go down again I'll probably skip the descend and hook up again once we go up again.

The Jan28 1000/930bps are legacy, holding on for now since they are still slightly red. Hopefully they go green on monday, and once we go down again I'll probably skip the descend and hook up again once we go up again.

@wooter, market is closed on Monday in observation of Martin Luther King Jr. Day. Short trading week.My Jan21 1000/900bps which I got yesterday just before close did the job. I expect a monday morning dip and then up again, so I'm holding them for now and think to close once sentiment goes down again, probably around Wednesday.

The Jan28 1000/930bps are legacy, holding on for now since they are still slightly red. Hopefully they go green on monday, and once we go down again I'll probably skip the descend and hook up again once we go up again.

InTheShadows

Active Member

Was planning to roll my -1030/+930s or have them expire worthless but obviously waited too long because Fidelity just liquidated the short leg on my behalf. Wtf.

Could you let us know what time of day they did that?

I rolled some 880/-1040s to next week 860/-1040s with Fidelity today at 1:25 eastern. And some 900/-1060s to 840/-1060s at 1:15 in another fidelity account. I would have thought these would have gotten called away before yours if fidelity was actively managing spreads. Got killer premiums on those.

Yeah it was about 1:20pm which seems early for this type of stuff. They dipped in the money for a period but yeah, they would have ended up $20 out of the money and expired worthless. So Fidelity essentially lost me $50k without even sending a message or any type of explanation. Lesson learned but not happy about it.Could you let us know what time of day they did that?

I rolled some 880/-1040s to next week 860/-1040s with Fidelity today at 1:25 eastern. And some 900/-1060s to 840/-1060s at 1:15 in another fidelity account. I would have thought these would have gotten called away before yours if fidelity was actively managing spreads. Got killer premiums on those.

PSA: If anybody is interested in TA I'd like to mention "TheDailyTraderPierre" on youtube. I know TA is not precise but I have been watching this guy's daily videos and I think he is really good in calling the trend. His charts are great.

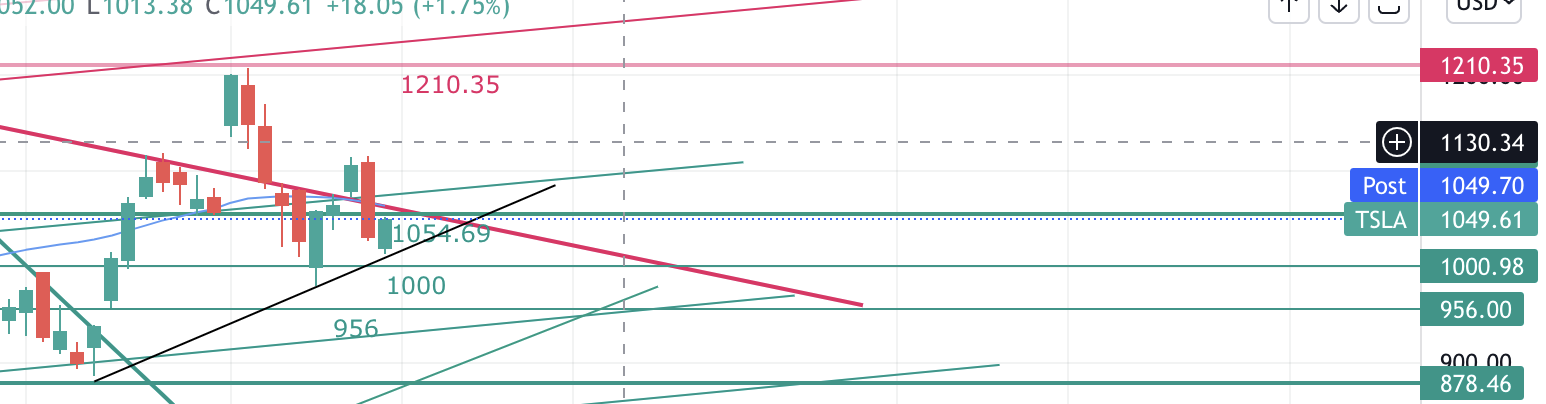

He also has a membership option for 5$ a month and the big benefit is he goes into details of TSLA charts every Sunday looking at monthly, weekly, daily and hourly charts, it helps you prepare for the next week. You also get to learn some TA. He also provides access to his tradingview.com chart which shows key support and resistance zones in addition to things like Stoch, RSI, DMI etc. For example the screenshot below is for the daily chart and look at the low for the day(pretty much on the dot when you look at the wedge). I think as per him we are still in that bullish trend as long as we stay within the wedge.

Definitely look him up on youtube, he reviews TSLA daily and those videos are free.

He also has a membership option for 5$ a month and the big benefit is he goes into details of TSLA charts every Sunday looking at monthly, weekly, daily and hourly charts, it helps you prepare for the next week. You also get to learn some TA. He also provides access to his tradingview.com chart which shows key support and resistance zones in addition to things like Stoch, RSI, DMI etc. For example the screenshot below is for the daily chart and look at the low for the day(pretty much on the dot when you look at the wedge). I think as per him we are still in that bullish trend as long as we stay within the wedge.

Definitely look him up on youtube, he reviews TSLA daily and those videos are free.

I follow his videos. While a lot of TA works best in retrospect I find his resistance levels fairly reliable. His charts and resistance lines are part of what I use to select strikes when doing more aggressive positions.PSA: If anybody is interested in TA I'd like to mention "TheDailyTraderPierre" on youtube. I know TA is not precise but I have been watching this guy's daily videos and I think he is really good in calling the trend. His charts are great.

He also has a membership option for 5$ a month and the big benefit is he goes into details of TSLA charts every Sunday looking at monthly, weekly, daily and hourly charts, it helps you prepare for the next week. You also get to learn some TA. He also provides access to his tradingview.com chart which shows key support and resistance zones in addition to things like Stoch, RSI, DMI etc. For example the screenshot below is for the daily chart and look at the low for the day(pretty much on the dot when you look at the wedge). I think as per him we are still in that bullish trend as long as we stay within the wedge.

Definitely look him up on youtube, he reviews TSLA daily and those videos are free.

View attachment 755756

corduroy

Active Member

I'll check him out, thanks!PSA: If anybody is interested in TA I'd like to mention "TheDailyTraderPierre" on youtube. I know TA is not precise but I have been watching this guy's daily videos and I think he is really good in calling the trend. His charts are great.

He also has a membership option for 5$ a month and the big benefit is he goes into details of TSLA charts every Sunday looking at monthly, weekly, daily and hourly charts, it helps you prepare for the next week. You also get to learn some TA. He also provides access to his tradingview.com chart which shows key support and resistance zones in addition to things like Stoch, RSI, DMI etc. For example the screenshot below is for the daily chart and look at the low for the day(pretty much on the dot when you look at the wedge). I think as per him we are still in that bullish trend as long as we stay within the wedge.

Definitely look him up on youtube, he reviews TSLA daily and those videos are free.

View attachment 755756

Just to add to this, a helpful tool that you mentioned tradingview.com. I started using this a couple months ago and now subscribe to the paid version. This is an great tool and now is my go to daily chart to for all my trade decisions. It has so many features and really fast real time updates. I have my tradingview TSLA chart chromecasted to a 50" monitor on my wall all day as I work.

I follow his videos. While a lot of TA works best in retrospect I find his resistance levels fairly reliable. His charts and resistance lines are part of what I use to select strikes when doing more aggressive positions.

Agreed, if you are looking to learn more TA I will say the 5$ per month is definitely worth it especially since you get access to his charts on trading view. He reviews the TSLA chart on Sat/Sun for like 20 minutes.

Yep tradingview is great imo. I use the paid version too and also have this on my second monitor all the time.They usually run some promotions every now and then in case someone is interested.I'll check him out, thanks!

Just to add to this, a helpful tool that you mentioned tradingview.com. I started using this a couple months ago and now subscribe to the paid version. This is an great tool and now is my go to daily chart to for all my trade decisions. It has so many features and really fast real time updates. I have my tradingview TSLA chart chromecasted to a 50" monitor on my wall all day as I work.

Just to clarify I'm not affiliated with Pierre or trading view, just thought I will pass on the information to folks who want a healthy dose of TA to go along with their Tesla fundamental knowledge.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K