Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I sold an 800c for $1.91 this morning and bought to close for $4.11 five minutes before the market closed. Could have been a lot worse if we didn't pull back from the session highs, so I was okay taking the loss. Didn't want to chase the underlying if the rally continues tomorrow. Good luck!So yeah, I got run over today with my 800ccs.

But I haven't closed or rolled them (yet). Odds are decent we finish the trading week tomorrow below 800.

As I DCA'd the writing of the cc's, I'm not in terrible shape. Just slightly terrible. Curious about tomorrows price action, that's for sure.

jeewee3000

Active Member

Don't tell anyone I leaked it to save my 800cc's.Interesting new “email leak” comes out on Friday morning. I’m sure it’s all just a coincidence.

juanmedina

Active Member

Wow this stock is really hard to trade right now. I sold 880cc for next week way to early yesterday and was over 100% down and I was worried lol. I am sad that this rally that seemed to had legs was killed like other recent rallies by some strange decisions.

Last edited:

Before you do anything with your positions make sure you check out the nightly videos/tweets from Cory, Wifey and all the TA expertsWow this stock is really hard to trade right now. I sold 880cc for next week way to early yesterday and was over 100% down and I was worried lol. Thanks Elon..?.

Elon is definitely one of us. He just got a bit too aggressive with his CC this week…

jeewee3000

Active Member

Yeah I can't imagine this stock dropping below 700 on a week like this, on news as flimsy as this. End of day could push 800 again easily.Might be a good day to buy some lottos. Elon will chime in at some point on Twitter unless he wants to keep the employees guessing.

Might be a good day to buy some lottos. Elon will chime in at some point on Twitter unless he wants to keep the employees guessing.

Sell the rumour buy the news kind of day? ;P

thurs 7am OI

so my takeaway lesson is this: don't assume the wall will be "stronger" the next day just because there is huge Vol spike. Even tall walls can't be trusted. Stick to the original OTM% plan and don't adjust strikes.

- c800 18k

- c750 15k

- p750 3k

- p700 12k

- c800 120k

- c750 20k

- p750 50k

- p700 80k

- c800 13k

- c750 14k

- p750 4k

- p700 13k

so my takeaway lesson is this: don't assume the wall will be "stronger" the next day just because there is huge Vol spike. Even tall walls can't be trusted. Stick to the original OTM% plan and don't adjust strikes.

Last edited:

corduroy

Active Member

I haven't done much all week, but I'll be looking to sell some 0 DTE puts on open. The question is, do we recover right away or is this going to be a slow bleed all the way until close on the hiring email leak.

TheTalkingMule

Distributed Energy Enthusiast

Again, can we not clutter this already cluttered options thread with Twitter posts? These kinds of posts are barely on topic in the main thread.Damn so Elon single handedly killed the rally? Btw check out this tweet from 2 days ago:

View attachment 812104

We've all gotten in the bad habit of posting "this is how the markets going" posts in here. This thread is for specific not advice for the drowning weekly options trader!

intelligator

Member

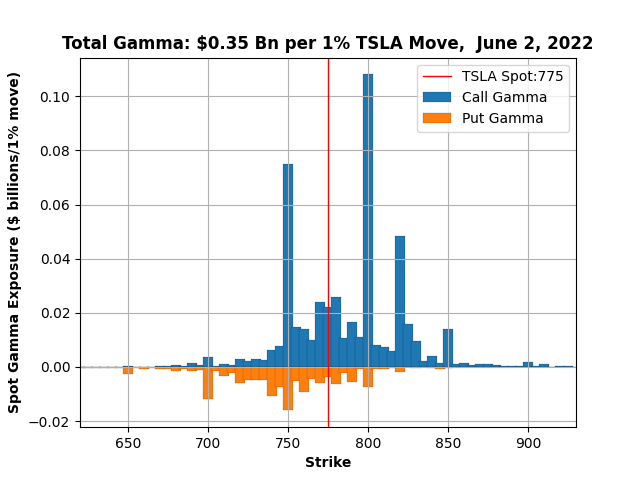

I am a ship! This chart is showing only the 6/3 expiry, based on Thursday closing OI and gamma calc. The begin of week and end of week remains mostly unchanged, suggesting it'd been relatively safe below 675 or above 835. Yesterday I thought I'd had the top and opened an -800/+850 BCS when we were at 760... not even close. So, I'll be taking this unique opportunity to play it safe by closing out this spread at market open.

EDIT: Closed spread at 90% !

EDIT: Closed spread at 90% !

Last edited:

I think this is related.Again, can we not clutter this already cluttered options thread with Twitter posts? These kinds of posts are barely on topic in the main thread.

We've all gotten in the bad habit of posting "this is how the markets going" posts in here. This thread is for specific not advice for the drowning weekly options trader!

I mean, what do we post, I sold bps/bcs 20% away from SP and hope it works?

This tweet and today’s news it seems will have a pretty significant effect.

Of course, market is bipolar and may take a week or a month to react and meanwhile you may get some lucky guesses as far as weekly price action, but to me it seems clear that the drowning weekly option seller (myself included) needs to hedge longer term.

This drop isn't about inflation, jobs reports, interest rates, cutting jobs at Tesla, etc.. It's all because I wrote a bunch of +590/-680 BPS yesterday and the MMs want to be sure I'm punished and never do it again....

scubastevo80

Member

Looking at BPS 12% OTM from yesterday's close, so likely a -685/+600 or so. I'd like to take advantage of the IV spike and don't believe we'll close down more than 12% today, although I'll be ready to roll it if we breach $700.

Edit: sold at $1.40, will close early if we get any brief jump or flatline here.

Edit: sold at $1.40, will close early if we get any brief jump or flatline here.

jeewee3000

Active Member

Those 680's are fine. I'd only start to think of managing this position if we go sub $700.This drop isn't about inflation, jobs reports, interest rates, cutting jobs at Tesla, etc.. It's all because I wrote a bunch of +590/-680 BPS yesterday and the MMs want to be sure I'm punished and never do it again....

samppa

Active Member

Oh, this is awesome for my 06/10 -c750s

Sold 06/10 BPS -p730/+p530 for $27.

Edit: should wait on red days before selling into strength.

Sold 06/10 BPS -p730/+p530 for $27.

Edit: should wait on red days before selling into strength.

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K