I ended up not opening any trades today, nothing felt right. It's OK to sit out a week. I'm very feeling bearish about next week. I think it's very likely we visit the low 600s. Even without Elon's email we probably would have seen a 5-7% drop today as all of growth/tech is getting hammered. The bear market rally may be over and we start back down. I sure hope I am wrong though

Happy Friday!

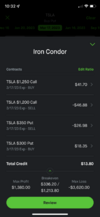

I'm bearish, but couldn't resist the $27 premium on 10x -p700's for next week:

- might not go down there

- if the SP does drop, we're already low, won't go that much lower

- weekly put rolls are very generous as of late

- the SP will come back up to $700 before not to long, probably

- I'm OK to buy shares at net $673, but my price-target to load-up is $500, so don't really want this to happen, but it would neither be a disaster

What's with all the sudden posts from this Wifey person? Do they have legit credentials or just the latest person to make one correct prediction and capitalize on social media followers?

On recommendation I started to follow this account and it's gobbledegook, all the Tweets are written oddly and I don't have the time or inclination to decode them

Seems this person made some predictions that came to pass, but of course, there are 1000's of Twitter commentators predicting every possible permutation at any given time, most of them will be right at some point (except GLJ and toilet-boy, of course)

This Wifey person called the bear-rally (I did too, but that's beside the point) and said it was going to run up like crazy, hey-presto, it got killed yesterday and now he/she is saying the markets are fcuked - so not all that prophetic, IMO

Where he/she is correct is that is that cash is the safest asset right now - which I agree with, of course there's folks that will cleat about inflation, but there are really, really, really low risk trades you can make with cash that easily out-pace inflation