Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

yesterday (Tue) morning 9:26, MACD "predicted" a green open and it did happen; i've been using it more and more for my daytradingMacros down in pre-market. My memory is that on down Macro days, TSLA eventually gets pulled red even if green at the open. So hopefully macro turns around like it did yesterday.

Wow, I'm on a roll..., for being the best contra-indicator. Yesterday I sold Jan 2024 CC near the open fearing a drop that would put me in margin trouble, and instead we ended green. My plan for today was to buy shares at the bottom of the MMD (for some of those CC), and so far we have done nothing but go straight up. Incredible.

jeewee3000

Active Member

jeewee3000

Active Member

This baby wants to run apparently, on limited volume and rising macro's. I'm staying clear of selling more cc's before I see a local top. (to prevent what happened to me last week)

intelligator

Active Member

I have a 6/10 690CC as part of a buy write that I keep rolling +$10 week to week. Thinking of waiting out until Friday to see what the CPI impact is, maybe this would be the last roll, reset to a more practical near the money CC? I'm hesitant to roll out more than 5DTE.

i still predict 730 for friday .. also explains the capping̀-attempts we had at 730 and the push above is macro-related.

i doubt we hit >750 this friday - as many are predicting a "hammer down" on the friday CPI/inflation/whatever(?) numbers

I think that MM want to keep the SP AS LOW AS POSSIBLE until quad-witching day (6/17).

Why?

every dollar lower saves someone millions in calls.

Since it is quad-witching there are also many options running >2 years coming up.

I don't know if they have already hedged it. I don't even care. I just have the suspicion that this acts as a lid on the pressure cooker.

ALSO this coincides with the "end" of the inverted SHS and the "breakout" according to Elliot-Wave-Theory.

So .. for me that are 3 astrological signs aligning...

Am I right? What do i know.. we will see in 2 weeks if i was

i doubt we hit >750 this friday - as many are predicting a "hammer down" on the friday CPI/inflation/whatever(?) numbers

I think that MM want to keep the SP AS LOW AS POSSIBLE until quad-witching day (6/17).

Why?

every dollar lower saves someone millions in calls.

Since it is quad-witching there are also many options running >2 years coming up.

I don't know if they have already hedged it. I don't even care. I just have the suspicion that this acts as a lid on the pressure cooker.

ALSO this coincides with the "end" of the inverted SHS and the "breakout" according to Elliot-Wave-Theory.

So .. for me that are 3 astrological signs aligning...

Am I right? What do i know.. we will see in 2 weeks if i was

jeewee3000

Active Member

Opened some more 6/10 cc's after the drop from ~750 to 746 and closed my 6/10 puts at 75% profit.

Expecting a stagnating of SP around $750 (or drop).

If we do rise: my puts had little value left ($4) so I'd rather close them in case the market reacts badly to CPI report or Shanghai numbers. Risk-reward kind of decision.

Expecting a stagnating of SP around $750 (or drop).

If we do rise: my puts had little value left ($4) so I'd rather close them in case the market reacts badly to CPI report or Shanghai numbers. Risk-reward kind of decision.

jeewee3000

Active Member

i still predict 730 for friday .. also explains the capping̀-attempts we had at 730 and the push above is macro-related.

i doubt we hit >750 this friday - as many are predicting a "hammer down" on the friday CPI/inflation/whatever(?) numbers

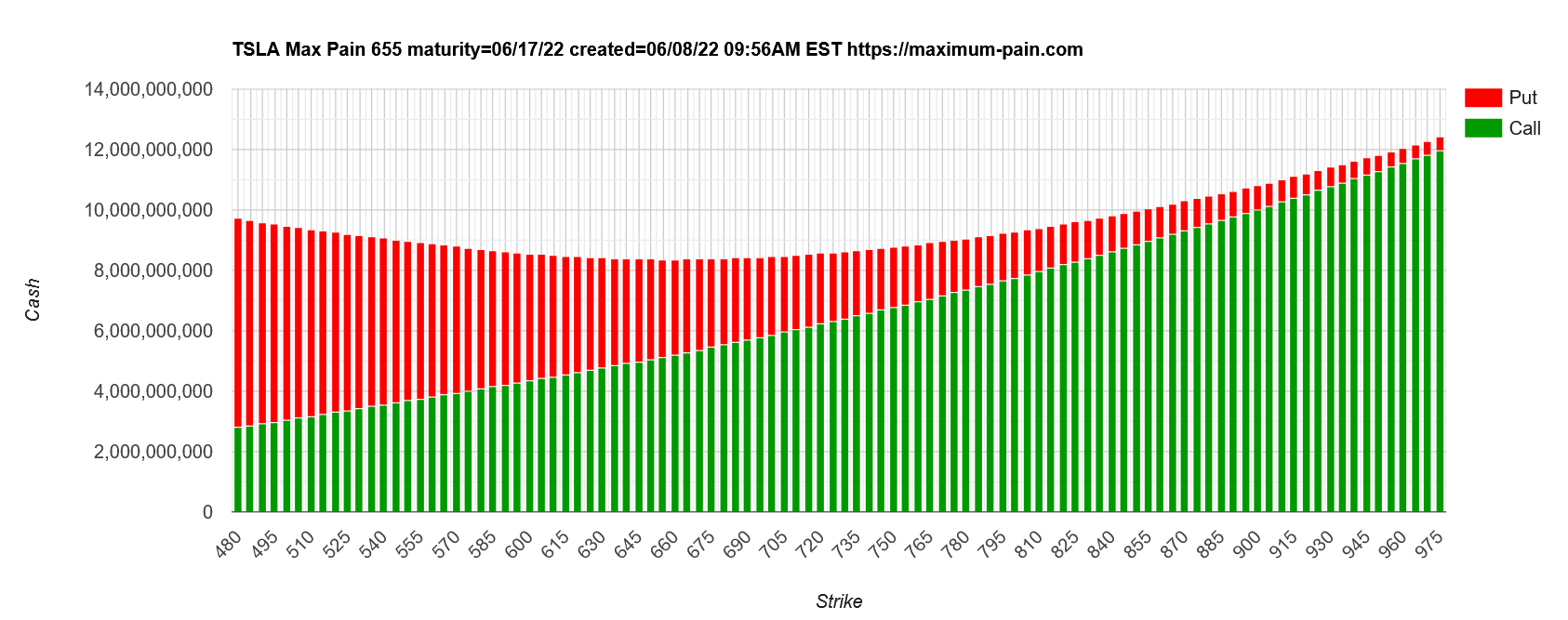

I think that MM want to keep the SP AS LOW AS POSSIBLE until quad-witching day (6/17).

Why?

View attachment 814123

every dollar lower saves someone millions in calls.

Since it is quad-witching there are also many options running >2 years coming up.

I don't know if they have already hedged it. I don't even care. I just have the suspicion that this acts as a lid on the pressure cooker.

ALSO this coincides with the "end" of the inverted SHS and the "breakout" according to Elliot-Wave-Theory.

So .. for me that are 3 astrological signs aligning...

Am I right? What do i know.. we will see in 2 weeks if i was

The zoomed out version is hilarious.

155k put contracts open at a strike price of $1. Just checked the volume and even today 20 of those were traded according to my broker. This must be bots since I can't imagine anyone trading this manually.

The call walls aren't that high though. Mainly $1100 is a big one. Within range the $950, $900 and $850 are noticable but all of these have a low open interest.

Therefore I don't think the max pain will keep a lid on the SP. It all will depend on macro's and Shanghai numbers IMO.

Thats why i specifically ignore max pain & said "every dollar lower" would be good for someone(tm)View attachment 814133

The zoomed out version is hilarious.

155k put contracts open at a strike price of $1. Just checked the volume and even today 20 of those were traded according to my broker. This must be bots since I can't imagine anyone trading this manually.

The call walls aren't that high though. Mainly $1100 is a big one. Within range the $950, $900 and $850 are noticable but all of these have a low open interest.

Therefore I don't think the max pain will keep a lid on the SP. It all will depend on macro's and Shanghai numbers IMO.

Imo it is not about a target-price, but "damage control" until those huge number of contracts are out of the way.

Also why i talk about a "lid" on the SP .. that get lifted after 6/17 where we then have one enemy less wanting to put pressure on

Triple/Quad witching week OI charts always look out of place a couple of weeks out due to the long period of time those options have been in play. We've discussed this and observed similar things on previous quad witching's. What has tended to happen on previous occasions is that the Put and Call walls gradually move to look closer to adjacent weeks as the actual quarterly expiry week dawns (although O/I quantities are much higher). Max pain can still be a bit off but my recollection is that the week trades similar to normal weeks except that the extra volume on the expiry day can cause more movement. Some of this can be due to wider macro movements, not just related to TSLA.

juanmedina

Active Member

I sold 830's CC for $1.2-0.7. I may have to adjust my strategy because opening trades on Monday would have been more profitable vs waiting. The last few weeks have playout that way.

750 proves to be a strong resistance. Or is it? I don't know. Maybe we just decided to respect the purple trend line's identical twin this time. Didn't I say this is a magnificent chart? My bet is we go back to test the breakout point at 720 sometime late this week and early next week. If CPI and FOMC permits, a monster rally to 915 is in store. Call IVs show a lot of bullishness today.

I have a 6/10 690CC as part of a buy write that I keep rolling +$10 week to week. Thinking of waiting out until Friday to see what the CPI impact is, maybe this would be the last roll, reset to a more practical near the money CC? I'm hesitant to roll out more than 5DTE.

Doing same with 6/10 $740 and $765 CC — after seeing your idea several weeks ago of rolling only $10 and 1 week. This seems a really solid approach, to roll and continue to receive income, biding time for a downturn, especially for ITM buy-writes that you can let go if SP surges too far ahead. I’m hoping SP finishes the week below $740 so these can expire and I can take a couple of weeks off. Would like to be on the sidelines for awhile in case we have an SP spurt in the next month.

Still want to believe!750 proves to be a strong resistance. Or is it? I don't know. Maybe we just decided to respect the purple trend line's identical twin this time. Didn't I say this is a magnificent chart? My bet is we go back to test the breakout point at 720 sometime late this week and early next week. If CPI and FOMC permits, a monster rally to 915 is in store. Call IVs show a lot of bullishness today.

View attachment 814162

Would today's drop down to $724 meet your 'test the breakout point'? Or should we be looking at closing price?

I say we will see 720. This 5 wave down is screaming for 720. By the look of it so far, 900 is not guaranteed. There's a lot of work that needs to be done down here even if we bounce off 720.Still want to believe!

Would today's drop down to $724 meet your 'test the breakout point'? Or should we be looking at closing price?

I have a buy order for 2,000 shares at 720. We'll see if we fade into the close. That would solve my CC problem by adding to my share count so I lose fewer core shares to those CCs without having to buy them back. Of course if we drop to 680 after CPI numbers come out, then I would be able to close the CC for what I paid for them if I don't spend money to buy those 2,000 shares. Decision..., decisions....

Edit: My gut feeling is that CPI numbers will be good enough that the market starts a rally and we never see these share prices again. I just don't want to lose too much money if I'm wrong....

Edit: My gut feeling is that CPI numbers will be good enough that the market starts a rally and we never see these share prices again. I just don't want to lose too much money if I'm wrong....

R

ReddyLeaf

Guest

Coincidentally, this AM maxpain showed the OI dividing line at $720-$725, though fairly small numbers (2000-2500 contracts).Still want to believe!

Would today's drop down to $724 meet your 'test the breakout point'? Or should we be looking at closing price?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K