I went with the old philosophy - If you don't know what to do, do half. I bought 1,000 shares before close at around 725. We'll see what happens tomorrow and Friday....I have a buy order for 2,000 shares at 720. We'll see if we fade into the close. That would solve my CC problem by adding to my share count so I lose fewer core shares to those CCs without having to buy them back. Of course if we drop to 680 after CPI numbers come out, then I would be able to close the CC for what I paid for them if I don't spend money to buy those 2,000 shares. Decision..., decisions....

Edit: My gut feeling is that CPI numbers will be good enough that the market starts a rally and we never see these share prices again. I just don't want to lose too much money if I'm wrong....

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Mon/Tue - the AH and pre-market Highs are approximately dictating what is the day's HighIn the last 2 days, the AH and pre-market highs are approximately dictating what is the day's High.

View attachment 814112

Wed - the pre-market High is the Close

Last edited:

intelligator

Member

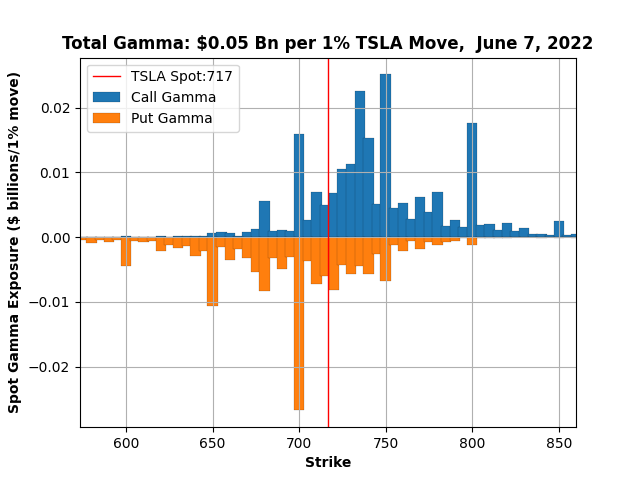

Looking at this week only, OI from 720 to 735 tightened, put and call walls at 700 and 750 strengthened, interest to 800 seems to be thinning. Barring CPI influence and other news, we had three days of slight call bias, enough sideways trading for Friday to close +/- 10 of where we sit ?

Looking at this week only, OI from 720 to 735 tightened, put and call walls at 700 and 750 strengthened, interest to 800 seems to be thinning. Barring CPI influence and other news, we had three days of slight call bias, enough sideways trading for Friday to close +/- 10 of where we sit ?

View attachment 814356 View attachment 814357 View attachment 814358

That’s the way it looks now, but I think the CPI report coming out on Friday will move the market and TSLA along with it. I don’t have a prediction on which way though.

So I will be wary of holding options over Thursday-Friday night.

jeewee3000

Active Member

Strong pre-market for now, possibly due to China numbers. What do you guys think, will this pop on open and stay flat/drop or are we setting up for a +5% day?

Need to know if I want to open extra cc's on open . Slightly hesitant because of CPI tomorrow. If the market is happy with CPI we could soar.

. Slightly hesitant because of CPI tomorrow. If the market is happy with CPI we could soar.

Need to know if I want to open extra cc's on open

corduroy

Active Member

What strikes and expirations, if you don't mind sharing?Had the short leg of all my remaining BPS assigned overnight. Will be selling some of those shares today. Glad that the BPS is resolved but with a pretty significant realized loss.

Sure, they were $890's expiring 6/10 so not a huge surprise. Had been managing and trying to roll but wasn't really getting anywhere.What strikes and expirations, if you don't mind sharing?

I check my email every morning expecting to see my 6/17 975/775 BPSs to be assigned but nothing yet. Waiting for SP 800 to close them out.Had the short leg of all my remaining BPS assigned overnight. Will be selling some of those shares today. Glad that the BPS is resolved but with a pretty significant realized loss.

jeewee3000

Active Member

Regarding assignment, I take it the biggest danger is in the final week before expiration. Happened to me and many others already, and in I believe at least 90% of cases it only happens in the last days before expiration. (And if DITM = no time value , of course).

Would be very interesting to have data on how often early assignment happens say a month before expiration.

TL;DR: if you want to manage a DITM position, do it >7 DTE.

Would be very interesting to have data on how often early assignment happens say a month before expiration.

TL;DR: if you want to manage a DITM position, do it >7 DTE.

Last edited:

jeewee3000

Active Member

Expecting similar price action today compared to the last few days: early peak of SP (now) and drifting later in the day.

Sold a $750cc @ $13 to day trade this expected move.

You can thank me when we surge.

Sold a $750cc @ $13 to day trade this expected move.

You can thank me when we surge.

bkp_duke

Well-Known Member

Expecting similar price action today compared to the last few days: early peak of SP (now) and drifting later in the day.

Sold a $750cc @ $13 to day trade this expected move.

You can thank me when we surge.

Your timing . . . like 60s after you posted this we sliced upward through 750.

jeewee3000

Active Member

At least it's not as bad as @BornToFlyYour timing . . . like 60s after you posted this we sliced upward through 750.

I'm not too worried. Will very likely be able to close these out today at a profit when TSLA's rise is capped. The other thread will complain, I will gain.

Expecting similar price action today compared to the last few days: early peak of SP (now) and drifting later in the day.

Sold a $750cc @ $13 to day trade this expected move.

You can thank me when we surge.

Wow. It's like magic!

Edit: Thank you for your sacrifice!

Knightshade

Well-Known Member

FWIW opened (again seemingly just a bit too early) -925/+1025 and -600/+500 ICs this morning for ~$2.55

Looks like one could've gotten almost $3 at the very bottom (so far) today.

FWIW closed whole thing at 0.25 net debit yesterday for just over 90% profit- between china #s incoming and CPI Friday I was fine leaving the last few pennies on the table

jeewee3000

Active Member

Note to self: wait 1 hour after open before trading.

(OTOH, often the open is the best time of the day for a quick trade, so I don't regret nothing.)

(OTOH, often the open is the best time of the day for a quick trade, so I don't regret nothing.)

I think the #1 thing we have learned over the last year is to not fly too close to the sun, and stay away from being too greedy.

jeewee3000

Active Member

Are those 100 puts?!? (amount)

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K