hmmmmm i might copy paste thatSTO July 15th $575P's @ $33 each - if they hit then I am in for $541 each Yay!

If not, I will be selling very aggressive ATM puts until they hit and collecting premium until they convert to shares.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

juanmedina

Active Member

Sold 2x 580/530 BPS for $1.12 and have an order for a Jun 23 1000p for $44k.

chiller

Member

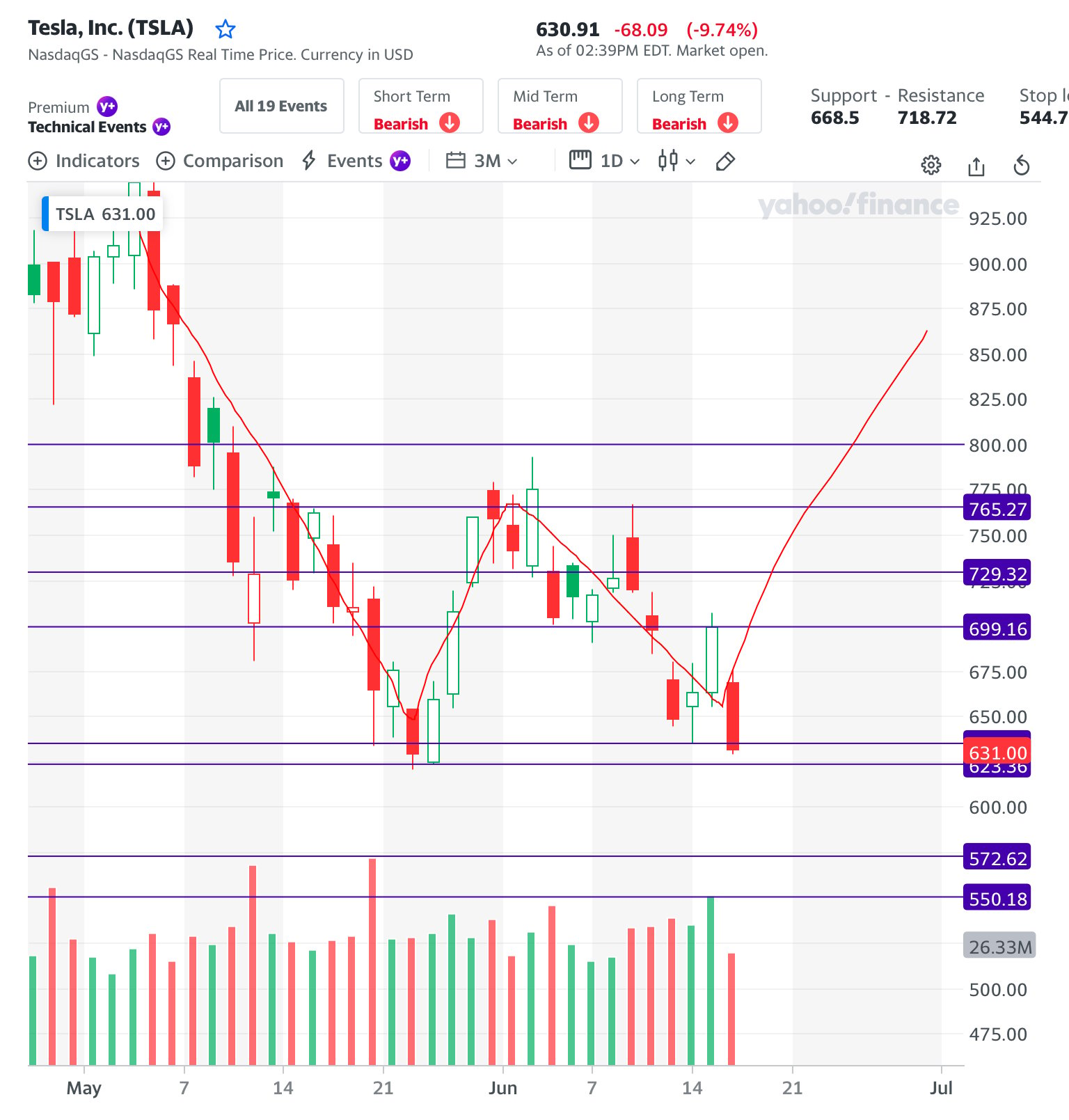

Down 10%. Uptick rule just triggered.

R

ReddyLeaf

Guest

Ok, they have done it again, dropping to -10%. Why are we not predicting this every time? Why am I not waiting for this? Ok, this time I’m jumping on this. Bought one 7/08 +c800 at $6.15 and one more share at $631.50. That’s it, only enough cash in one account to buy one more share, and I’m waiting for the last $620 low. Edit: Buy Buy Buy. thanks @chiller

Anybody else hoping for this Monday?

Anybody else hoping for this Monday?

Last edited by a moderator:

juanmedina

Active Member

Ok, they have done it again, dropping to -10%. Why are we not predicting this every time? Why am I not waiting for this? Ok, this time I’m jumping on this. Bought one 7/08 +c800 at $6.15 and one more share at $631.50. That’s it, only enough cash in one account to buy one more share, and I’m waiting for the last $620 low. Edit: Buy Buy Buy. thanks @chiller

I decided to keep you company one share and the same call.

Two shares for me at $628 is all I can muster up. Man, I wish I had saved some cash for a rainy day, cuz it's pouring!I decided to keep you company one share and the same call.

Deployed some of my dry powder in IRAs to buy a few Jun 24 500 calls. I don't need the money in 2024 but have a hunch this will work out

In my trading account, did a buy write for 400 shares this week( 691 and 671 purchase price), cost basis on these down to the low 650s. I got in and out of calls day trading to reduce the cost basis. I agree with @adiggs that this strategy is way less stressful vs using your margin/cash for writing puts/BPS.

With SSR triggered for tomorrow I expect a decent day for TSLA tomorrow. Cheers.

In my trading account, did a buy write for 400 shares this week( 691 and 671 purchase price), cost basis on these down to the low 650s. I got in and out of calls day trading to reduce the cost basis. I agree with @adiggs that this strategy is way less stressful vs using your margin/cash for writing puts/BPS.

With SSR triggered for tomorrow I expect a decent day for TSLA tomorrow. Cheers.

Calling local bottom - in for 4x 590/540 @$1.30 - $1.55

Narrator: *It wasn’t*

I have cash. Some would say a lot of it.

I am sitting on it cause I is a wuss.

OTOH, if I wasn’t a wuss, I probably would not have any cash…

If we see 400s the cash comes out in big way. We don’t see it… eh. I am a wuss after all. Guess inflation will run roughshod over me.

I am sitting on it cause I is a wuss.

OTOH, if I wasn’t a wuss, I probably would not have any cash…

If we see 400s the cash comes out in big way. We don’t see it… eh. I am a wuss after all. Guess inflation will run roughshod over me.

Knightshade

Well-Known Member

Or you could just sell 20% OTM, relatively wide, weekly BPSes Monday morning.

Based on data previously shown, in the entire history of Tesla, this would have failed to be profitable exactly 0 weeks, ever.

Profits aren't massive by stocks-gains-in-2020 standards, but they're still gonna beat the hell out of inflation rates....and since it's only week to week you're able to jump back into shares or LEAPs at whatever point you think makes sense.

Based on data previously shown, in the entire history of Tesla, this would have failed to be profitable exactly 0 weeks, ever.

Profits aren't massive by stocks-gains-in-2020 standards, but they're still gonna beat the hell out of inflation rates....and since it's only week to week you're able to jump back into shares or LEAPs at whatever point you think makes sense.

Ok, they have done it again, dropping to -10%. Why are we not predicting this every time? Why am I not waiting for this? Ok, this time I’m jumping on this. Bought one 7/08 +c800 at $6.15 and one more share at $631.50. That’s it, only enough cash in one account to buy one more share, and I’m waiting for the last $620 low. Edit: Buy Buy Buy. thanks @chiller

Anybody else hoping for this Monday?

View attachment 817380

Hope is a good thing maybe the best of things but Monday is a holiday

I have cash. Some would say a lot of it.

I am sitting on it cause I is a wuss.

OTOH, if I wasn’t a wuss, I probably would not have any cash…

If we see 400s the cash comes out in big way. We don’t see it… eh. I am a wuss after all. Guess inflation will run roughshod over me.

Wow are you expecting a drop to 400s?

We are almost at the 52 Week low. Will that provide resistance?

Do you have any 600/XXX BPS in play for this week?

Just kidding I think 600 is safe for tomorrow, don't think we go lower than 620 tomorrow. Next week it might be a different story.

corduroy

Active Member

In my IRA I sold some shares and with the cash bought back the short legs on some Mar 2023 debit spreads I had. This increased the overall delta on my TSLA position by 7% (bullish).

I am not that smart. I wasn’t expecting a drop to the 600s.Wow are you expecting a drop to 400s?

This cash I refer is only allowed to be deployed when there is no doubt. I would have no doubts in the 400s. I think

But what I want answered is when do these rate hikes stop and when does inflation go away. Granted the market will bottom before that…. Which is when exactly?

What I see now is aggressive rate hikes into the teeth of a crashing market. Have not seen this in my investing lifetime. Fed has always been a backstop, not a catalyst for market and asset destruction.

juanmedina

Active Member

At $500 it would be another 20% to go and we are already at 47% that seems insane to me but who knows.

Ken suggest to no buy the dip yet. He is hilarious, NWS:

Edit: his target to start buying is $420.. wow.

Ken suggest to no buy the dip yet. He is hilarious, NWS:

Edit: his target to start buying is $420.. wow.

Last edited:

I am not that smart. I wasn’t expecting a drop to the 600s.

This cash I refer is only allowed to be deployed when there is no doubt. I would have no doubts in the 400s. I think

But what I want answered is when do these rate hikes stop and when does inflation go away. Granted the market will bottom before that…. Which is when exactly?

What I see now is aggressive rate hikes into the teeth of a crashing market. Have not seen this in my investing lifetime. Fed has always been a backstop, not a catalyst for market and asset destruction.

Just my opinion but I think the next inflation report will be better. Multiple commodities have fallen a lot and even oil has rolled over recently. Core inflation already peaked a couple of months ago.

I was surprised that the fed chairman didn’t make any of these observations and only gave very strong language that inflation is strong, persistent, and growing. I got the impression that the fed wanted to show that they are taking inflation very seriously and not looking at the world through rose-colored glasses - hence the 75 bps move. This may have been a reaction to being taken to task for letting inflation get out of control in the first place.

I think it is very likely that the next raise will be 50 bps. I believe that the data will support this and the fed made their point.

This should all be a net positive for TSLA. At least less negative than today!

Yes!Just my opinion but I think the next inflation report will be better. Multiple commodities have fallen a lot and even oil has rolled over recently. Core inflation already peaked a couple of months ago.

I was surprised that the fed chairman didn’t make any of these observations and only gave very strong language that inflation is strong, persistent, and growing. I got the impression that the fed wanted to show that they are taking inflation very seriously and not looking at the world through rose-colored glasses - hence the 75 bps move. This may have been a reaction to being taken to task for letting inflation get out of control in the first place.

I think it is very likely that the next raise will be 50 bps. I believe that the data will support this and the fed made their point.

This should all be a net positive for TSLA. At least less negative than today!

I completely agree. The economy is obviously rolling over! Core inflation is in downtrend!

But Powell didn’t say any of this. He made it clear he is on a hunt and destroy for speculation and overvalued assets to stop inflation. AND they changed their path from just a week ago, even though anything they do won’t show up for four to six months.

Which leads to not Really believe anything they are saying.

Maybe they are playing 4D chess and letting the market do the work so they can turn dovish in a couple of months. Ask Elon about it. He plays 4D chess all the time, or so they tell me.

I am not that smart. I wasn’t expecting a drop to the 600s.

This cash I refer is only allowed to be deployed when there is no doubt. I would have no doubts in the 400s. I think

But what I want answered is when do these rate hikes stop and when does inflation go away. Granted the market will bottom before that…. Which is when exactly?

What I see now is aggressive rate hikes into the teeth of a crashing market. Have not seen this in my investing lifetime. Fed has always been a backstop, not a catalyst for market and asset destruction.

Everything about this situation is unprecedented including the slow train wreck of a bear market. Fed will continue the hikes until they see inflation dropping. The smart ones tell me most of the interest rate hikes are already priced in. The QT might be the part that is having a bigger impact than people anticipated. Remember the fed stepped in during Covid and basically said infinite QE saving the hedge funds and wall street crooks.

Now with money supply getting tightened I think we will likely see some of these hedge funds getting liquidated. It might actually be good for the market. But unfortunately this means more pain in the short term for everyone. The action today sure feels like capitulation but then again we have said that multiple times this year. VIX is still in reasonable range(33). For comparison sakes VIX peaked at 85 during the COVID crash.

I think as investors we just have to ride this out, nobody really knows when we will bottom. It might be a prudent idea to buy stock mostly and avoid buying options. I sometimes even think about converting my IRA leaps into shares just because you don't know how long this will continue. I'm just not confident about LEAP returns in the next couple of years if this slow bleed continues. Tesla as a company will continue to grow but not sure if that means the stock price will grow at the same clip.

You can hope all you like but the stock will move exactly zero on Monday, on account of the markets being closed!Ok, they have done it again, dropping to -10%. Why are we not predicting this every time? Why am I not waiting for this? Ok, this time I’m jumping on this. Bought one 7/08 +c800 at $6.15 and one more share at $631.50. That’s it, only enough cash in one account to buy one more share, and I’m waiting for the last $620 low. Edit: Buy Buy Buy. thanks @chiller

Anybody else hoping for this Monday?

View attachment 817380

Ergo, a short week next week, up, down, sideways, all of the above? Answers on a postcard, please, to the usual address...

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K