Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I'm not sure any of us here expected this...

Definitely sold too early!Sold some 780CC for Friday (probably sold too early, but wanted to capture some premium and not watch it slip away like I've done too many times). Waiting for more premium to sell some 800/850 BCS.

Opened some 800/900 and 820/920 BCS. Hopefully safe for Friday....

Unexpected, but VERY welcome!I'm not sure any of us here expected this...

We really needed this.

I am always impressed to see how fast the SP rockets once I sell 800 CCs.

Selling covered calls is the fastest way to make the stock price bounce back. I have noticed a 100% correlation.

Selling covered calls is the fastest way to make the stock price bounce back. I have noticed a 100% correlation.

Knightshade

Well-Known Member

I'm not sure any of us here expected this...

I'd like to say I expected it in that I closed my ccs for the week near the lows yesterday north of 90% profit... but I did it because I was concerned we'd get good CPI numbers and a bit of a rally... instead we got BAD ones and...still a rally?

#betterluckythangood

juanmedina

Active Member

I sold 780 and 770cc I hope I don't regret it. I also sold 610/560 BPS at open.

sp and 20sma resting at 720 maxpainI sold 780 and 770cc I hope I don't regret it. I also sold 610/560 BPS at open.

Last edited:

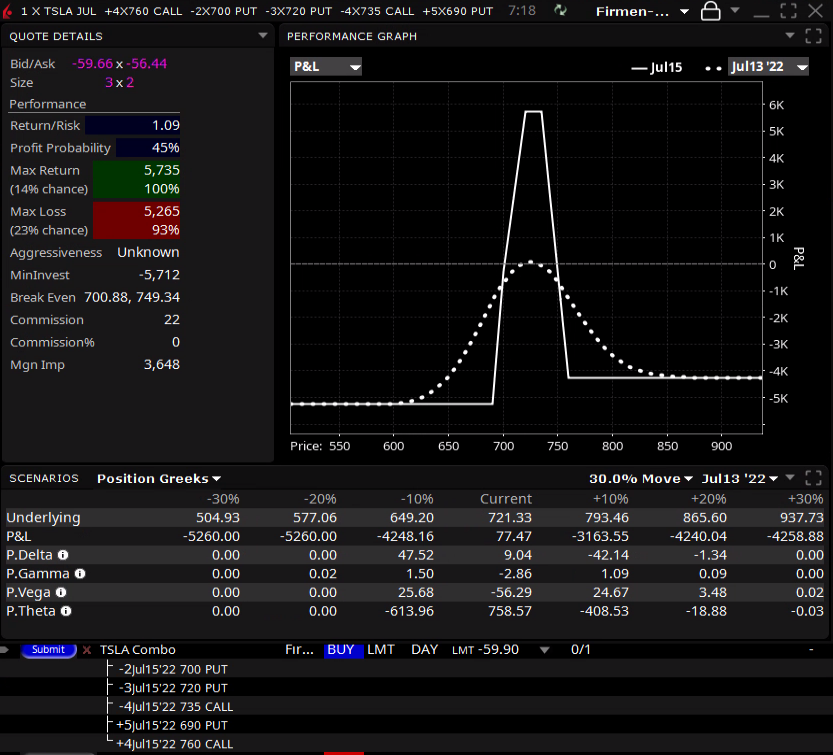

If someone wants to play the Open-Interest-Walls at 700-750, i just came up with a thing based on a suggestion from option-stratagy-lab:

Currently trading at -60, i think i enter one at -70 (~690-700 SP) to get my whole account theta-positive. That thing currently burns down $760 theta a day.

Currently trading at -60, i think i enter one at -70 (~690-700 SP) to get my whole account theta-positive. That thing currently burns down $760 theta a day.

Closed 0715-c$740 at $7.19 for a 63% profit since 7/8 and missed a $22 limit order by seconds/pennies at 11:24 ($716.57) for 0722-c$750, we'll see if it hits later. Can't seem to resist too bullish STO limit orders which often don't hit, but the $1 would cover a new set of golf clubs.

Most of the day traders lose money, but they don't notice it. Explanation is, that if they end up holding some stock at loss, they mentally move it to "long account" away from the "trading account" and thus never realize the loss.

I could see something similar happening with the Wheel, if you end up owning a stock and can't sell it with profit and refuse to sell it with loss. You end up owning a stock with a loss but never realize it? Have you taken this into account when calculating yearly ROIC?

I could see something similar happening with the Wheel, if you end up owning a stock and can't sell it with profit and refuse to sell it with loss. You end up owning a stock with a loss but never realize it? Have you taken this into account when calculating yearly ROIC?

Last edited:

Since we are relatively on the low side of the share price imo the wheel strategy isn’t such a bad idea if you are acquiring shares at 700 or below. I don’t believe the wheel strategy is good when we are near 52 week highs. I think the trick is to detach emotions to the shares and sell calls aggressively or yes you can lose big if the prices move away from the original strike.Most of the day traders lose money, but they don't notice it. Explanation is, that if they end up holding some stock at loss, they mentally move it to "long account" away from the "trading account" and thus never realize the loss.

I could see something similar happening with the wheel, if you end up owning a stock and can't sell it with profit? You end up owning a stock with a loss but never realize it? Have you taken this into account when calculating yearly ROIC?

I have been very successful doing boring 18%-20% OTM BPS the last year that I’ll be retiring from my day job under two weeks. Obviously you’ll need need enough margin or cash to make this worthwhile.

Yep. Easy to doMost of the day traders lose money, but they don't notice it. Explanation is, that if they end up holding some stock at loss, they mentally move it to "long account" away from the "trading account" and thus never realize the loss.

I could see something similar happening with the Wheel, if you end up owning a stock and can't sell it with profit and refuse to sell it with loss. You end up owning a stock with a loss but never realize it? Have you taken this into account when calculating yearly ROIC?

Closest thing to advice / suggestion I have:

- do the Options Alpha intro to options training linked in the Wiki and on page 1. Figure that's about 20 hours of videos in 3 big chunks. I think of those chunks as "basics", "getting into a trade", and "getting out of a trade".

- THEN after reading the first page of this thread, and probably reading the wiki (plan on reading the wiki a few times over as you get started and ideas that seemed reasonable in the abstract, become more real), and getting some ideas of where to get started... then get started with something small. For me that was seriously far OTM cash secured puts. Like 175 strike puts with shares at $400.

By small I mean big enough to keep your attention, and small enough that a complete loss doesn't really affect you. AND stick to 0 leverage as well; no margin, no spreads. Strictly shared backed covered calls and cash secured puts as mentioned elsewhere. These represent defined risk positions with a really, really low likelihood of a full loss (vs. a spread where a full loss is much more achievable). If you don't yet understand why / how that is, then you aren't ready to use leverage.

AND plan on a year or more of trading like that, reading the thread, and learning more as your education / experience period. Only when you are educated / experienced to you want to spend much time on ROIC calculations and OMG so good!?!

The ROIC that you've already calculated can be the carrot out in front that makes this worth pursuing.

A regular theme for my first year was "being paid to learn / gain experience". It's good to be paid to learn!

R

ReddyLeaf

Guest

Yes, we’ve heard this 100 times, but this is why this thread is the most valuable one on TMC. Thanks again for bringing us back home.Yep. Easy to do

Closest thing to advice / suggestion I have:

- do the Options Alpha intro to options training linked in the Wiki and on page 1. Figure that's about 20 hours of videos in 3 big chunks. I think of those chunks as "basics", "getting into a trade", and "getting out of a trade".

- THEN after reading the first page of this thread, and probably reading the wiki (plan on reading the wiki a few times over as you get started and ideas that seemed reasonable in the abstract, become more real), and getting some ideas of where to get started... then get started with something small. For me that was seriously far OTM cash secured puts. Like 175 strike puts with shares at $400.

By small I mean big enough to keep your attention, and small enough that a complete loss doesn't really affect you. AND stick to 0 leverage as well; no margin, no spreads. Strictly shared backed covered calls and cash secured puts as mentioned elsewhere. These represent defined risk positions with a really, really low likelihood of a full loss (vs. a spread where a full loss is much more achievable). If you don't yet understand why / how that is, then you aren't ready to use leverage.

AND plan on a year or more of trading like that, reading the thread, and learning more as your education / experience period. Only when you are educated / experienced to you want to spend much time on ROIC calculations and OMG so good!?!.

The ROIC that you've already calculated can be the carrot out in front that makes this worth pursuing.

A regular theme for my first year was "being paid to learn / gain experience". It's good to be paid to learn!

Closed 0715-c$740 at $7.19 for a 63% profit since 7/8 and missed a $22 limit order by seconds/pennies at 11:24 ($716.57) for 0722-c$750, we'll see if it hits later. Can't seem to resist too bullish STO limit orders which often don't hit, but the $1 would cover a new set of golf clubs.

Executed at 12:08!

Yoona and others have posted some great statistics on weekly Monday-Friday SP changes. So one option is to open all the positions and make iron condors at the open on Monday, 20% OTM, and be done for the week. This goes against the open into strength strategy we were doing several months ago. This week I only succeeded in opening half the BCS spreads I planned Monday morning before the SP dropped and made opening more spreads 20% above the open worthless. Today I opened more as we climbed (I kept the premiums the same but increased the strikes as the SP climbed with short legs at 780, 800, and 820), but they are no longer 20% above the Monday open. This is where I have almost gotten burned in the past. The SP drops on Tuesday or Wednesday, I open BCS for Friday 2 DTE that are now 10-15% above the weekly low, and when the stock recovers to the Monday open, and then climbs 10% above the Monday open, my call spreads are now ITM. So I'm trying to figure out what my best strategy will be going forward....

Last edited:

Knightshade

Well-Known Member

IIRC the "safe" zone on the call side is further OTM than on the put side FWIW... (doesn't prevent doing ICs, but does mean one wing would need to be further OTM than the other rather than just 20% both ways)

I have no fancy analysis to offer you, but my gut feeling is that you're trading too much...Yoona and others have posted some great statistics on weekly Monday-Friday SP changes. So one option is to open all the positions and make iron condors at the open on Monday, 20% OTM, and be done for the week. This goes against the open into strength strategy we were doing several months ago. This week I only succeeded in opening half the BCS spreads I planned Monday morning before the SP dropped and made opening more spreads 20% above the open worthless. Today I opened more as we climbed (I kept the premiums the same but increased the strikes as the SP climbed with short legs at 780, 800, and 820), but they are no longer 20% above the Monday open. This is where I have almost gotten burned in the past. The SP drops on Tuesday or Wednesday, I open BCS for Friday 2 DTE that are now 10-15% above the weekly low, and when the stock recovers to the Monday open, and then climbs 10% above the Monday open, my call spreads are now ITM. So I'm trying to figure out what my best strategy will be going forward....

Maybe back off a bit, just put a small %age of your capital at risk and play some really safe trades

In times of turmoil small wins can be very rewarding and add up over time

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K