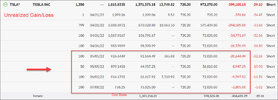

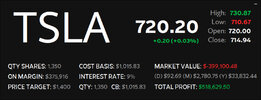

Another decent week, especially nice after being a little bit steamrolled the previous week. Last Friday, I was forced to sell some shares at ~$750 in order to roll ITM CCs to this week and farther out. Last Thursday, I had closed -c730s for about 85% profit, but then resold -c735s a few hours later for a net credit, figuring that they were “safer.” Then Friday happened. Oops. Roll for credit.

This week I was able to close out many of the CCs and buyback 2x the number of shares (at less than $700!)

Undaunted by last week’s Thursday debacle, I repeated the Thursday timing day trading CCs, but this time closed out Fri for pennies.

I still have some 7/29 -c750s, but paired with -p750s, so able to roll the straddle if earnings blows the SP. Unfortunately, in one account my 9/16 -p1000s, rolled from January, have very little time value left and not enough cash or CC sales to buyback/roll. If we don’t have a SP spike soon, it will require a phone call to do the brokerage-assisted roll. This is the big problem with DITM options, little to no strike improvement on rolling and little to no premiums for selling the other side of the straddle. Oh well, everything is cash/share secured so no margin or spread leverage, so it will all work out eventually.

This weekend’s charting exercise includes a little review of Friday’s manipulations, which are clearly obvious when looking at the volume, SP and whether the SP changed quickly or was delayed minutes. Broad buying or selling by multiple accounts usually requires several minutes of sustained direction. Large trading volumes usually occur at round numbers (700, 720, 750, etc), where there are a significant number of orders built up over days or weeks. When the line is crossed, then the dam floodgates open and the SP changes rapidly until the order imbalance is rectified. Friday had lots of anomalous behavior, large volume spikes (at non-round SP) that didn’t change the SP, small volumes push down/ups that did, etc. Obviously MMs/Hedgies on either side of the 715 MaxPain trying to protect positions.

Note especially the 420k min trading at 15:15 that didn’t impact the SP until 2-3 min later, followed by the 65k at 15:30 that did. Finally, what effect will the last 5 min run over 720 mean for next week?

The 319k trades at 12:35 didn’t impact SP and was $715.25-$715.75. Furthermore, the SP had already traded through that range just minutes earlier, so someone must have just initiated the order, otherwise the volume would have been larger earlier (both on buy and sell sides, so the order book must have been “empty”). The 345k trade at 12:45 is more “normal, with immediate increases in SP. However, again, it must have been a buy order, otherwise it would have sold 3-4 min earlier at a higher price. Interesting trading.

Finally, here’s the last few weeks range. Volatility (historical) is coming down, so selling options is getting less profitable. MaxPain is showing numbers dropping into the 60s for future weeks, and we’ve been in the 70s recently. Obviously, we should expect an IV spike Monday-Wednesday, and a drop on Thursday. However, which way will it go? Should we be on the put or call selling side? I don’t know, but I’m hoping for a stable 700-750 SP and large IV drop. I’m short too many short term CCs and not enough free cash or short term puts for balance. I do have a few unencumbered lots and might sell CCs on the Wednesday spike, but still undecided. The last few rising days (macro and AAPL) make the next few days very uncertain. Be careful out there, hedge your trades, or be ready for an explosive change.