Question for the pros here, I notice some ppl sell TSLA CC's for, say, $1,150 strike far into 2023/2024, which gets hefty premium today.

If I’m planning to STO when TSLA is ~$920 and only hold a few days (or hours) as TSLA swings down to $870 (as the past couple days) and BTC cheaper then, do those longer-term expiry dates (2023/2024) net better profit than a closer DTE at the same strike but, say a DTE of 12/16/22?

Asked differently, for a short term volatility flip for profit, is it more profitable to have a nearer or very far out CC DTE for a better STO and BTC spread (more profit) when TSLA drops $40-50 bucks during the day?

(Is there other risk when doing this?)

Thanks in advance!

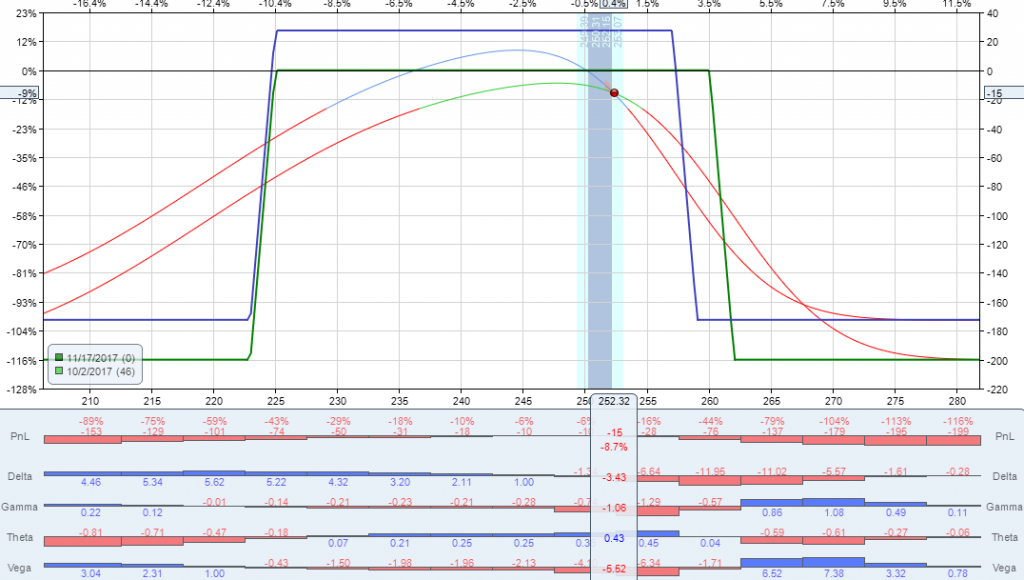

Your question has been answered already (TL;DR: the further the expiration date is, the less the option pricing is impacted by short term 'small' SP fluctuations).

Here is some definite advice though:

- don't sell LEAP cc's if you can avoid it, unless you really know what you are doing (for example it's part of a LEAP straddle or another fancy option strategy, or we're breaking ATH's and you want to derisk your stock holdings);

- IF you would sell LEAP cc's, preferably do it when SP and IV is high.

- don't forget ITM options have risk of early expiration. Odds are low with LEAPS - due to high remaining time value - but for example deep ITM options have some risk of early exercise.

If you want to play short term flips, there are much more suitable strategies around. Which one is "best"? None. It depends on your trading style, portfolio/position size, experience level.

Personal favourite "easy strategy" for (very) short term flip: when the stock shoots up in the first 15 minutes after open and you expect not much further rise, abuse the inflated IV by selling a short term (weekly, max 2 weeks out) cc at a strike that you wouldn't mind selling at short term. Wait out the day, watch SP being walked down and IV dropping and buy back the cc before the close at a profit. Risks: you lose your shares at the chosen strike price.

Good luck. Don't be afraid of asking more specific questions about strategies you'd like to try. We have many posters here that are very helpful and a lot more options-savy than I am.

Oh, and start small when 'testing', best advice around here I think.

, eh?

, eh?