corduroy

Active Member

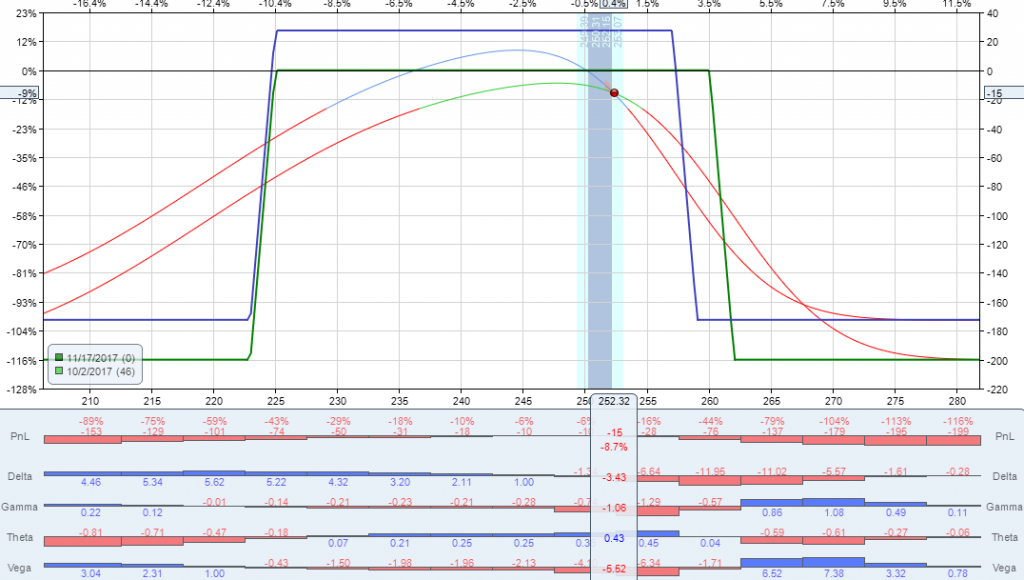

I think it's as simple as adding the delta of the 4 positions. For example, I have an IC right now with these deltasThat is really interesting. How would we figure out the net delta of the IC without his software?

Edit: Does subtracting the Delta of the short call from the long call and multiplying by the number of contracts work?

-2.4

14.5

-11.8

1.2

Net delta: 1.5

Timely advice, I just started trading high probability ICs on SPY this week. Thanks!how to fix an IC using net delta strategy (to buy more time; i've tried this before and it reduces the stress caused by "fix this problem asap")

5 Iron Condor Adjustments that will help you manage your trade

Iron Condor Adjustments are just as important as entry and exit. There are a number of ways a trader can defend this trade when the underlying makes a move.mrtoptick.com

"4. Delta Hedge. Another Iron Condor adjustment is to use NET delta to hedge this position. This is one of my favorite adjustments because by removing some of the directional exposure, this buys me time to wait and see how I need to adjust this position further. To hedge an Iron Condor using Delta I can use stock or options of the underlying instrument. Let’s say my NET delta of an Iron Conor is -20. I can buy 20 shares of the underlying to cut my NET delta to 0 OR I can buy two 10 delta calls that will add a total of 20 positive delta and will neutralize my directional exposure. If the underlying continues to move against my position, I will then remove my hedge and roll up or down the troubled spread farther away from where the underlying is trading. By using a hedge for this adjustment, it helps to make up some of the losses accumulated by either short spreads of an Iron Condor."