$293k is nothing (If you are on the lookout for outliers / whales). People on WSB make those kinds of bets.At least someone is optimistic

(Disclaimer: Trade could be a hedge or STC after a few cents gain…):

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

FlamingPIG

Member

Thanks for the info guys

The calls are up around 200k, so there's a bit of tax I need to consider. So I plan to sell CC against the 50x calls, continue to sell CC when they turn into shares.

If they go ITM, I will roll them until the 5k shares turn into long term gain

The calls are up around 200k, so there's a bit of tax I need to consider. So I plan to sell CC against the 50x calls, continue to sell CC when they turn into shares.

If they go ITM, I will roll them until the 5k shares turn into long term gain

Thanks for the info guys

The calls are up around 200k, so there's a bit of tax I need to consider. So I plan to sell CC against the 50x calls, continue to sell CC when they turn into shares.

If they go ITM, I will roll them until the 5k shares turn into long term gain

One thing to remember, if you sell ITM CC's against your shares, that suspends the holding period calculation, so they'll need to be held for longer than a year to be considered long-term gains: Tax Implications of Covered Calls - Fidelity.

Also, any profits you make from selling CC's are always counted as short-term gains. So if you do well with selling CC's, you might find yourself with a bit short-term capital gains to deal with anyway.

Edit: Your broker is the one you'd want to work with about matching the CC's to either the long call options (making them spreads) or actual TSLA shares.

FlamingPIG

Member

Thanks for the tips.One thing to remember, if you sell ITM CC's against your shares, that suspends the holding period calculation, so they'll need to be held for longer than a year to be considered long-term gains: Tax Implications of Covered Calls - Fidelity.

Also, any profits you make from selling CC's are always counted as short-term gains. So if you do well with selling CC's, you might find yourself with a bit short-term capital gains to deal with anyway.

Edit: Your broker is the one you'd want to work with about matching the CC's to either the long call options (making them spreads) or actual TSLA shares.

I believe we are in a consolidation period after the recent 70% run up.

For tax purposes, I dont want to close the calls (200k gain). I do want to make a small income on the 50x 2/17 125c by selling 50x 2/17 170cc against it.

Will let 50x calls exercise

If 170cc go ITM, will roll up and out until 1 year out; then bye bye shares. Hopefully they don't get assigned prematurely.

If they expired worthless, yay! More CC on the exercised shares.

All the work just so I can save 10% in tax

Thanks for the tips.

I believe we are in a consolidation period after the recent 70% run up.

For tax purposes, I dont want to close the calls (200k gain). I do want to make a small income on the 50x 2/17 125c by selling 50x 2/17 170cc against it.

Will let 50x calls exercise

If 170cc go ITM, will roll up and out until 1 year out; then bye bye shares. Hopefully they don't get assigned prematurely.

If they expired worthless, yay! More CC on the exercised shares.

All the work just so I can save 10% in tax

So that brings us back to the original question. Why not exercise your 125c now (instead of 2 weeks later)? This way your long-term clock starts sooner. The holding period starts on when you acquired the shares, not the expiration date of the option.

GrmMastrDoobie

Member

16% and 20% off the weekly low. Those are safe.Trying to decide if I close my 195 and 200cc for Friday with a small loss now (they were a huge loss three days ago). I can’t tell if today is a small breather in the market before recovering tomorrow and ripping end of week after Fed meeting?… I would hate for them to go ITM by Friday. I’m thinking close now, and open something new in a few days if there is a bounce. Thoughts?

I don't know that I really have a strategy per seWhat is your strategy with LEAPS now? You sell them for a profit 6 months before expiry and buy at the same strike price 1 year out? Or you adjust strike price?

More ...

I divide the world of long dated call options (LEAP calls) into speculative and share replacement.QUESTION: not having bought any LEAPS ever I am very interested in which ones you have chosen/would choose. I would choose a LEAPS that runs ITM soon (And I am a superbull @ these levels), giving me the oppertunity to sell soon at a big gain or be confident and wait for the real grow. My bias is SP $200 before august 1st and $500 in 2025.

So a call june 2025 $200, currently priced about $54, seems reasonable. That will be cheaper in the next dip, if it comes, and can grow easily into +700% much before expiration, especially if after the dip the run-up is steep after march 1 (and especially Q2 I Guess)

The share replacement calls are primarily what I've bought, and the idea is to go fairly DITM on the purchase. One might find the strike that costs you 1/2 as much as the share price -- somewhere around 60% of the share price. And longest date available. Not even 1 expiration earlier. So shares at 170 right now - probably looking at a 90 or 100 strike call.

I would tend to round the strike to something common / high volume.

Strategy:

The intention is that these LEAPs are really shares (to me), but with some leverage. The big problem is that unlike shares, these are on a clock. So I'm looking for some sort of peak to sell some or all of them off. Or good cc sales points, and plan to actively close an ITM cc and one of these (a Poor Man's Covered Call - you can DuckDuckGo it).

I.e. - use them like shares. Since these are options, I would be rolling these out with 3-6 months to go, anything that hasn't previously been closed / reopened. Probably costs me 1/2 of the time value to get down to that 3-6 months, and the other 1/2 in the final 3-6 months. Therefore - roll back out at the 1y to 1.5y mark.

I have previously rolled really, really DITM calls closer to the money. By coming in closer to the money I could roll to a later expiration and take some money out. I view these as partial sales, and I like to do these at a relative low point in the share price (so my new calls are as cheap as possible). Heh - those really, really DITM calls are now 200 strike Jun '25s, purchased when the shares were more like $300. Thus also illustrating the importance of max DTE - I still have 18 months to go to get back to 200 strike.

Yeah, but 22x -c130's was too many - perhaps a better strategy, and one I rarely take, TBH, would be to roll half of the positionHopium got the best of you - again! I’m positioning exactly the opposite. Trying to roll the 135s weekly until they magically expire worthless or close to that and I can roll up for a credit.

The +ve is that I halved my exposure from 22x covered calls to 11x cc and 11x csp - selling -p250's here, isn't the same as selling -p250's at SP270, if they were to early assign, I just sell the shares and resell a similar position, yes there's risk, but not so great IMO

Last edited:

jeewee3000

Active Member

Haven't been following the thread closely, can someone fill me in? What happened?

It's all my fault - I was trying to go against just posting Twitter pictures and I think @Yoona took it the wrong way - can't direct message them or I would have....Haven't been following the thread closely, can someone fill me in? What happened?

My bad all - just wanted the old school data driven posts instead of twitter stuff.

Hopefully they will come back

I didn't think what was said was enough to cause someone to leave, but I think she might have had some -c130's like me, and is perhaps fully occupied dealing with those - I could be 100% wrong on both counts thoughIt's all my fault - I was trying to go against just posting Twitter pictures and I think @Yoona took it the wrong way - can't direct message them or I would have....

My bad all - just wanted the old school data driven posts instead of twitter stuff.

Hopefully they will come back

Had the feeling she was running out of steam with this board.It's all my fault - I was trying to go against just posting Twitter pictures and I think @Yoona took it the wrong way - can't direct message them or I would have....

My bad all - just wanted the old school data driven posts instead of twitter stuff.

Hopefully they will come back

I believe that overall she was much appreciated here. I hope she returns.

Had the feeling she was running out of steam with this board.

I believe that overall she was much appreciated here. I hope she returns.

I echo the appreciation for @Yoona’s contribution here. It feels like family after all these recent months of difficult times with TSLA and I’m missing Yoona’s voice and positive presence

Yoona, if you’re reading this, I hope all is well and that you give us another chance.

intelligator

Member

About @Yoona, a good part may have had to do with TSLA , the sudden and quick erosion, that trading SPY was a bit more predictable and lucrative. One of her posts mentioned this.

dc_h

Active Member

I'm counting on this retracement, so that may mean it won't happen. I did sell some 7/21 140 calls that I plan to buy back with a move back to ~140 to 145. I have CC's at 155 and 165 and 180 all due this week. Could be rolling those if we stay on the current track.Did you by any chance hear about my 180 resistance?

While it is true that TSLA can climb a lot more as it did in the past, it needs to do one thing first: retrace at least 50% of the initial spike up. If you go back, it happened every single time. I invite you to go over this post.

The reason for this is deeply rooted in human psychology. It's not manipulation or random occurrences. Wave 1 up from the bottom can be impulsive because it is fear driven:

a. Short sellers fear getting blown up

b. Bottom catchers fear missing out

Smart investors do not want to buy any stock that has just run up 80% in 4 weeks, regardless how low the starting point was. Why? Is it because they don't think TSLA is worth $180? No. They don't buy it here because they don't want to compete against short sellers and bottom catchers in chasing it at this price point. If anything, they want these people to buy every share they're forced to buy before taking their own profit on the stock. When the stock or the economy has some piece of bad news, as bad news tends to happen in a shaky global economy, reality is going to set in and people is going to flip "Tesla is still the same company as it was before the ER and a lot of the initial runup was just short covering", it will retrace deeply as 80% profit in a month is no joke. The stock should retrace at least 50% before deep pocket buyers say ok the price is attractive again. That's wave 2. The retracement is simply a test of strength of the rally.

Wave 3 happens only after the stock has been tested at the bottom of wave 2 and that's when the real fun begins. That's the irrational spike you're probably thinking of. Those were wave 3, not wave 1. We are currently in wave 1. Actually we could already be in wave 2. The question is not if, but when it will retrace deeply.

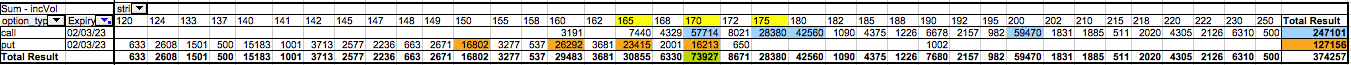

Quite a high amount of calls at 200 this Friday, so someone’s betting for a spectacular rise.View attachment 901692

They're Chairman Powell's calls.

intelligator

Member

Options volume (where contracts > 500) as of a 11:55a , call to put ratio about 2:1

Like a few of us here, I'm undecided what to do with 2/3 -c165 and -c170 , they can be rolled up 10 for a small debit to next week or out further. I typically like to stay < 5DTE , this time things can move quick up or down. Any thoughts beyond 2/10 ?

Like a few of us here, I'm undecided what to do with 2/3 -c165 and -c170 , they can be rolled up 10 for a small debit to next week or out further. I typically like to stay < 5DTE , this time things can move quick up or down. Any thoughts beyond 2/10 ?

myt-e-s-l-a

Member

Technicals

Indicators Table| Beta (5 Year) | On Balance Volume | RSI (14-Day) |

|---|---|---|

| 2.09 | -- | 63.78 |

| 10-Day Average Volume | 201,814,444 |

|---|---|

| 90-Day Average Volume | 119,808,704 |

| 20-Day Moving Average | $131.69 |

| 50-Day Moving Average | $150.71 |

| 200-Day Moving Average | $232.16 |

| Historical Volatility (10 Day) | 67.91% |

Trend Analysis

TSLA appears to be rallying within a longer-term bearish trend, driving its MACD above the signal line. However, shares remain below a declining 200-day moving average, signifying that the dominant trend remains lower. Comparative Relative Strength analysis shows that this issue is outperforming the S&P 500.

As of 12:25 PM ET Tuesday, 01/31/2023Momentum

Momentum for TSLA is strongly bullish. The 14-period Slow Stochastic oscillator is above 80, the level which many analysts call overbought. This means that investors have been actively purchasing shares and driving the price higher.

As of 12:25 PM ET Tuesday, 01/31/2023Volume

The last 10-days have seen significant volume in TSLA, with average daily volume above the average for the last year. Today's volume is no exception; with 119,539,023 shares having been traded already. The On Balance Volume indicator (OBV) is bullish. The slope of the indicator is positive and suggests that buyers are presently more active than sellers.

As of 12:25 PM ET Tuesday, 01/31/2023Volatility

Bollinger Bands® use standard deviation of the closing price around a moving average to measure volatility. The Bollinger Bands® are presently wider than usual, as a result of greater than normal volatility that accompanied the recent price move. Events such as this may precede a pause or reversal in the near term trend.

As of 12:25 PM ET Tuesday, 01/31/2023

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K