So that means next quarter it will bump? [Now that I’ve figured out but not acted on selling $4 ITM calls at 2pm can give a 50% return in an hour.]Just like clock work. Powell talks, market crashes.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I was debating to see if TSLA will fill the gap up (180) or the gap down (146) first. But it has been 10 days since after ER TSLA could not manage to close above 165-166. A drop to fill the gap down is more obvious to me. If AAPL ER is good, TSLA might be able to test that 165 one more time. My -c160 this week is still okay for now and willing to roll out another week if needed.

I opened -148P at 160 yesterday after closing 150P at 164. So far so good. Some room to go down but 148 is a risk I'm willing to take. Also have -177.5 for next week. At this level I'm willing to sell calls but need some room to fix it if I turn out to be wrong. $1 for the 177.5's today - not too shabby. The first time it touches 180 will result in a rejection so I still have a lot of leeway if 158.8 was it for the pullback. I do expect to see 157 but I'm not going to bet my account on $1.8.Seems lots of bullish buying action at the bid making sub-160 less likely(?). I’m currently flat and finding it hard to muster a responsible play at these crossroads.

Are you currently in anything new given the price action or waiting?

I opened -148P at 160 yesterday after closing 150P at 164. So far so good. Some room to go down but 148 is a risk I'm willing to take. Also have -177.5 for next week. At this level I'm willing to sell calls but need some room to fix it if I turn out to be wrong. $1 for 177.5 today, not too shabby.

That’s great!

What do you make of the difficulty TSLA has mounting $165-$166 (3-4x already), will it get through before visiting $148-146 or we hanging around $160 (+/-$5) for a few weeks?

Closed 5x -c160 at break even at end of day after being very close to rolling them earlier. Also closed a -p160 near the day’s high.

Still holding 15x 160c and 20x 165c and a handful of -p162.50-165. Looking to close or roll everything tomorrow if possible because ATM with 1 DTE is too much anxiety for me.

Still holding 15x 160c and 20x 165c and a handful of -p162.50-165. Looking to close or roll everything tomorrow if possible because ATM with 1 DTE is too much anxiety for me.

Without going into the technicals too much: the most likely scenario I see here is choppy trading in a tight range (155-170) for the next month and a half. TSLA is in the middle of a tug of war between:That’s great!

What do you make of the difficulty TSLA has mounting $165-$166 (3-4x already), will it get through before visiting $148-146 or we hanging around $160 (+/-$5) for a few weeks?

a. Bad memory of the crash from 180 late 2022. Without Elon's selling, it would never have crashed from 180 in such an impulsive manner. Now some people are wondering if they're going to fall victim to a similar crash although the correction from 217 so far has been mild following a sideway pattern.

b. The impulsive bounce from 102 is a sign that maybe 102 was the deal of a lifetime and all bad news had been priced in there.

Scenario 1: double zig zag

The 2 down legs in green in this scenario are 2 zig zags. This puts the ratio between the 2nd and 1st leg close to 1. This is my default scenario atm.

Scenario 2: Flat

In this scenario, the 2nd down leg would take the form of a 5 wave impulse instead of a 3 wave zig zag. The overall structure so far is supportive of BOTH scenarios. Interestingly, 166 and 5/3/2023 would serve as the longitude and latitude for the end of wave 4 if there was indeed a wave 4.

If this is a 5 wave impulse, what is there to guarantee it's not going to morph into something as destructive as the crash from 180 late last year? However, if this is indeed a 3 wave zig zag, we're looking at the last basing in TSLA before wave 3 begins. This basing period can last a week or it can last 3 months but the bottom line is 152.3 was the bottom. Sooner or later market is going to decide one way or the other and if it agrees with me you're gonna see 166 sliced right through like butter vs knife.

The yellow DCB was very strong, as it borrowed its strength from the 102-217 impulse. This structure does not support a deep retracement feared by a lot of people. I don't think the 146 gap has to be filled.

Just because I give you what's possible doesn't mean I can't make up my mind. I think 152.3 was the low, at least until Q2 P&D / ER. It's time to place your bet.

Last edited:

The most likely scenario I see here is choppy trading in a tight range (155-170) for the next month and a half…

…It's time to place your bet.

Fascinating! Thanks for taking the time to write all that out. I’m learning a lot along the way.

Since bottom line TSLA will likely be trading in a tight range ($155-$170) for the next 6 weeks or so, some bets for this type of market may be:

1) At dips (150-160) STO $140 CSP’s, perhaps out to 6/9/23. BTC at highs around $165-$170, rinse repeat. (RISK: Quite risky in case macro dumps the markets).

2) At peaks (165-170) STO aggressive number of $180 CC’s for 2-weeks out at a time (or LEAPS if core share CB is high, so premiums are meaningful). BTC on dips to lows, rinse repeat. (RISK: Markets rally and trap the CCs; sudden bullish TSLA news such as Tesla financing cars itself if perceived bullish; another Hertz; etc.

I’m not experienced enough to come up with more (or know if the two above make much sense). Y’all have much more hard-earned experience than me.

What are your thoughts on these bets and what bets are you taking yourself?

Thanks again!

I wish I have something that stationary of a plan. My plan is simple, but it evolves every day depending on the chart. Right now I have -177.5C and -148P. That's it.Fascinating! Thanks for taking the time to write all that out. I’m learning a lot along the way.

Since bottom line TSLA will likely be trading in a tight range ($155-$170) for the next 6 weeks or so, some bets for this type of market may be:

1) At dips (150-160) STO $140 CSP’s, perhaps out to 6/9/23. BTC at highs around $165-$170, rinse repeat. (RISK: Quite risky in case macro dumps the markets).

2) At peaks (165-170) STO aggressive number of $180 CC’s for 2-weeks out at a time (or LEAPS if core share CB is high, so premiums are meaningful). BTC on dips to lows, rinse repeat. (RISK: Markets rally and trap the CCs; sudden bullish TSLA news such as Tesla financing cars itself if perceived bullish; another Hertz; etc.

I’m not experienced enough to come up with more (or know if the two above make much sense). Y’all have much more hard-earned experience than me.

What are your thoughts on these bets and what bets are you taking yourself?

Thanks again!

Last edited:

intelligator

Active Member

See anything familiar?

yeah, if I read it right, good probability of a climb... looks like I'll need to motor out of the near the money BCS before things get hot

SebastienBonny

Member

Still holding 175CC for next week (opened last Friday).

Didn't get any chance to close it early for 60%+, because we are trading rather sideways these days.

Might consider rolling it one week further today or tomorrow to add some more premium.

Didn't get any chance to close it early for 60%+, because we are trading rather sideways these days.

Might consider rolling it one week further today or tomorrow to add some more premium.

intelligator

Active Member

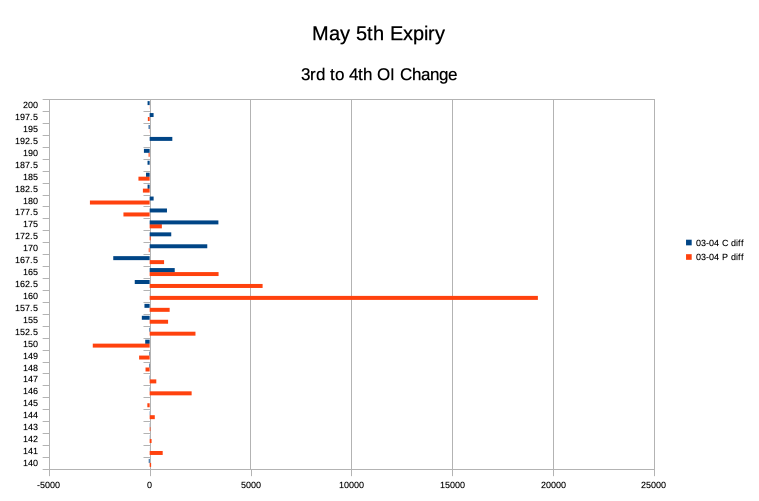

Yesterday's action, OI stacked at p160 by +19k, call side didn't change much.

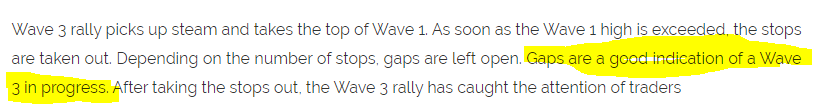

Watch this opening gap very carefully. TSLA has refused to fill it even as SPY was dropping precipitously. Only $0.5 and the gap is filled but large orders are there, absorbing all the sell volume. I don't mean to scare you ATM call sellers, but this is one of the little things that tell a much bigger story. If this gap remains unfilled at EOD, I'll brace for an imminent breakout.

Still holding my 177.5C, but rolled my short puts up from 148 to 152.

EDIT: and it's filled. No harm no foul.

Still holding my 177.5C, but rolled my short puts up from 148 to 152.

EDIT: and it's filled. No harm no foul.

Last edited:

Watch this opening gap very carefully. TSLA has refused to fill it even as SPY was dropping precipitously. Only $0.5 and the gap is filled but large orders are there, absorbing all the sell volume. I don't mean to scare you ATM call sellers, but this is one of the little things that tell a much bigger story. If this gap remains unfilled at EOD, I'll brace for an imminent breakout.

Still holding my 177.5C, but rolled my short puts up from 148 to 152.

View attachment 934485

View attachment 934486

Thank you for the live update!

I have -C 5/12 $180 and $182.50 opened this morning at $162.95 high. If the breakout does happen, are these still safe given the cadence expected?

Gap filledWatch this opening gap very carefully. TSLA has refused to fill it even as SPY was dropping precipitously. Only $0.5 and the gap is filled but large orders are there, absorbing all the sell volume. I don't mean to scare you ATM call sellers, but this is one of the little things that tell a much bigger story. If this gap remains unfilled at EOD, I'll brace for an imminent breakout.

Still holding my 177.5C, but rolled my short puts up from 148 to 152.

View attachment 934485

View attachment 934486

They should be fine. The hard resistance remains at 180.Thank you for the live update!

I have -C 5/12 $180 and $182.50 opened this morning at $162.95 high. If the breakout does happen, are these still safe given the cadence expected?

intelligator

Active Member

Open positions for this week:

-c165/+c170 ... 60%

-c167.5/+c172.5 ... 85%

Will be watching pre , during , post speaker's rationale, let dust settle before a knee jerk move.

Closed the above at the mentioned gains. May just sit out this expiry, instead spot a 6DTE position.

Just opened a $165 Straddle for next week (05/12) expiration - for $10.50 each

Plenty of room to adjust if needed and don't mind buying at $154.75 or selling at $175.50 next week for more leaps.

Thought this was fair since max pain is $165 next week and it looks like this weeks $162.50 is close unless macro gets really bad - I think AAPL tonight tells us the direction.

Plenty of room to adjust if needed and don't mind buying at $154.75 or selling at $175.50 next week for more leaps.

Thought this was fair since max pain is $165 next week and it looks like this weeks $162.50 is close unless macro gets really bad - I think AAPL tonight tells us the direction.

Just want to expand on this a little. A while ago, I was at a stage in my trading career where I thought I should have a foolproof plan to deal with every scenario the market threw at me. However, we have to accept that we can't be right 100% of the time and the market is unpredictable. So try to be less wrong and make sure we can survive when we're horribly wrong. We have to live in the moment and do the work everyday as the situation unfolds. Risk off during good times so that you have spare ammos to carry you through bad times. Diversify and I'm not talking about buying other stocks. Use your trading profits to buy real estates or businesses that fit your lifestyle.Fascinating! Thanks for taking the time to write all that out. I’m learning a lot along the way.

Since bottom line TSLA will likely be trading in a tight range ($155-$170) for the next 6 weeks or so, some bets for this type of market may be:

1) At dips (150-160) STO $140 CSP’s, perhaps out to 6/9/23. BTC at highs around $165-$170, rinse repeat. (RISK: Quite risky in case macro dumps the markets).

2) At peaks (165-170) STO aggressive number of $180 CC’s for 2-weeks out at a time (or LEAPS if core share CB is high, so premiums are meaningful). BTC on dips to lows, rinse repeat. (RISK: Markets rally and trap the CCs; sudden bullish TSLA news such as Tesla financing cars itself if perceived bullish; another Hertz; etc.

I’m not experienced enough to come up with more (or know if the two above make much sense). Y’all have much more hard-earned experience than me.

What are your thoughts on these bets and what bets are you taking yourself?

Thanks again!

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K