The psychology of channels. Let's study the current bullish channel.

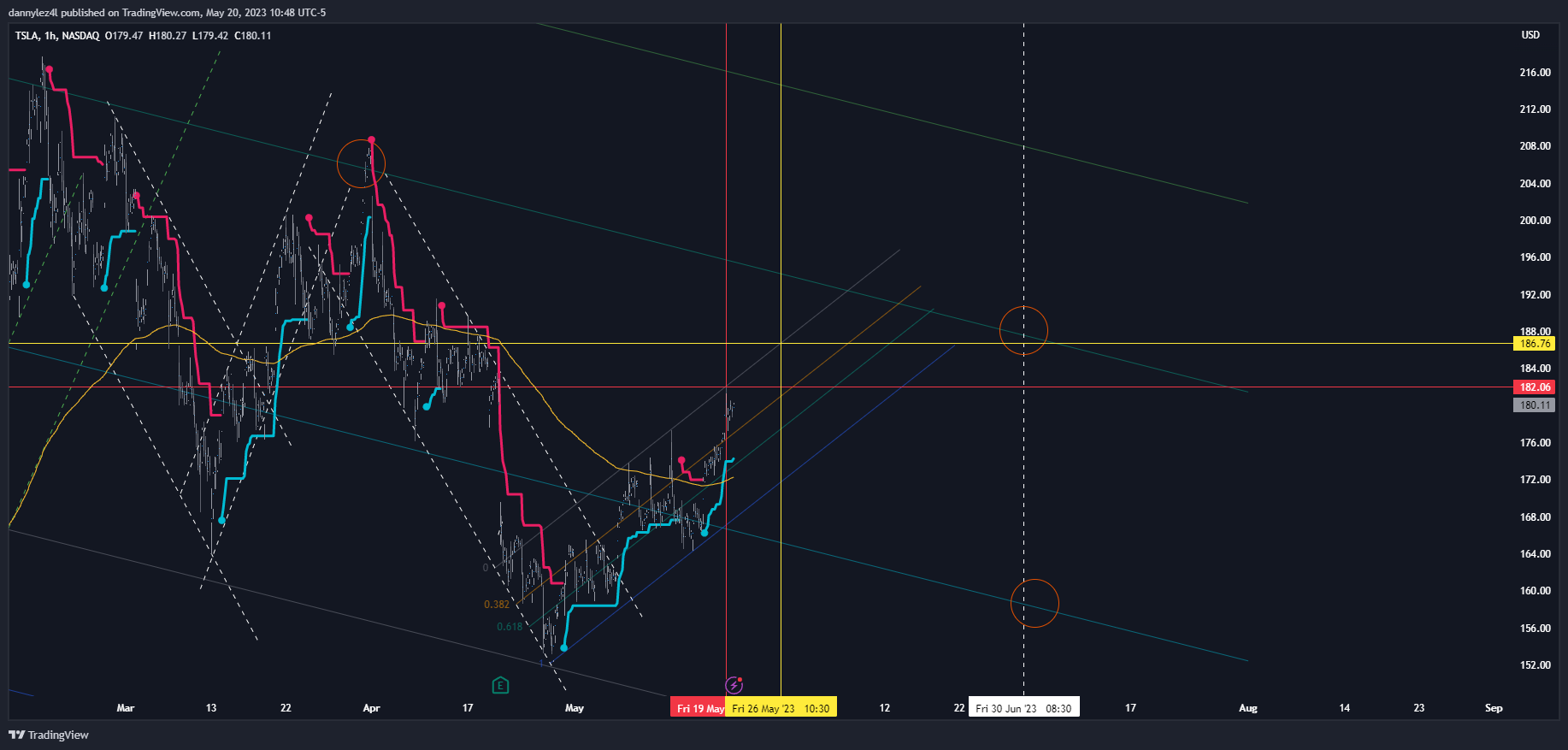

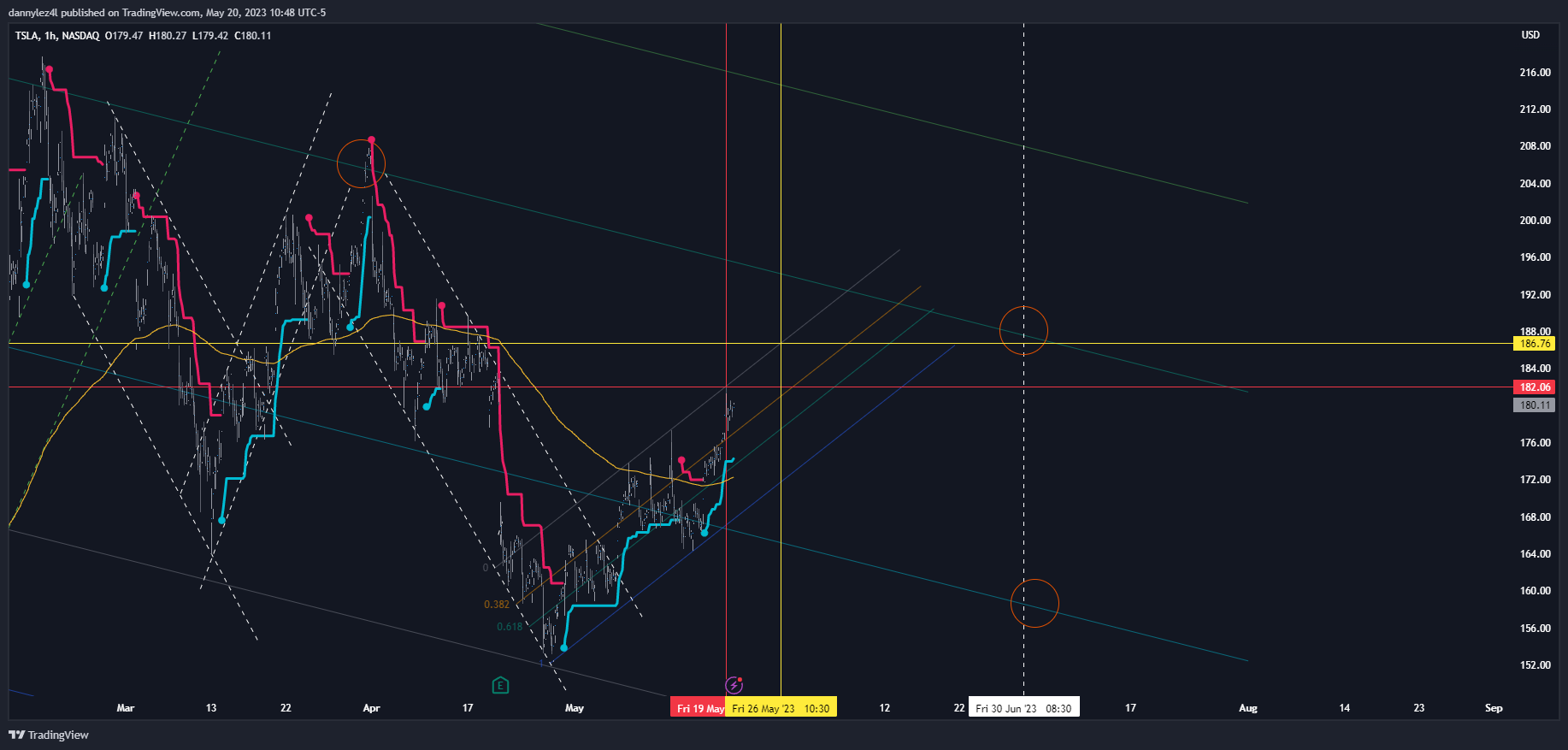

Look at where the stock touched the top trendline resistance in the past 2 weeks.

The first time it touched it was a non-event. All channels need a point of origination.

The 2nd time was also a nothingburger except for the fact that it made that new high only after an unexpected news (new TWTR CEO) and after such a steep pullback.

The 3rd time was when SPY hit 6 month high on Friday.

The question is: what did it take for the stock to spike violently twice in 2 weeks? Nothing short of spectacular. These events can happen again and again but just like drugs, euphoria tends to numb the market once it's has worn off and each subsequent dose has to drastically outdo the last in order to produce new highs.

Bullish channels are a luxury. Take this one for example: every week it goes up by about $5. If TSLA simply follows this channel for the next 3 years and gains a measly $5 every week, it would end up at $930 by June 2026. Let's forget about the for/against valuation arguments for a second. What about macro hiccups? Company bad news?

Bullish channels, therefore, have a limited shelf life and the stock tends to gravitate toward the bottom of the channel over time before eventually falling out of it and it takes a tremendous amount of energy to touch the top. Every time it touches the top, ask yourself what happened? Did something fundamentally change, like a massive ER beat, or is it something else? If TSLA rallies to the top all by itself then pls, for the love of God, don't stand in front of it. On the other hand, if it is simply responding to unexpected developments that don't really have a long term impact to the fundamentals, then it's more of a flash than a freight train. This is when one should expect a semi-immediate reversal to the mean.

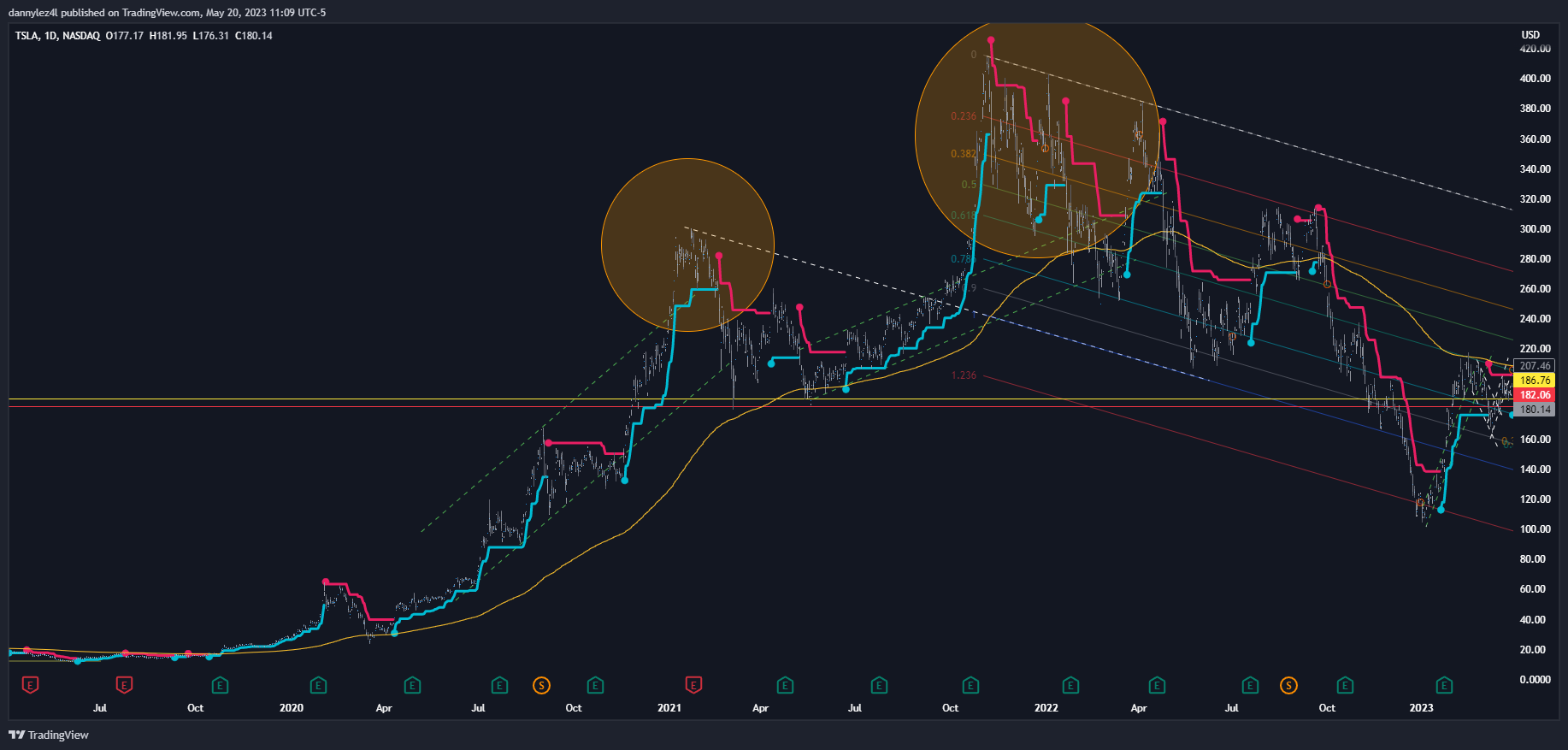

Can TSLA break out of a bullish channel? It sure can, but the market doesn't like it. Every time that happened in the past, the stock would eventually fall back to earth after a spectacular breakout.

In both of these 2 examples, TSLA underwent some sort of once-in-a-lifetime event. The first time was the SP 500 inclusion followed by a gamma squeeze into Q4 2020 ER. The 2nd time was a massive Q3 2021 ER beat followed by a massive short squeeze. But, eventually, the stock couldn't survive the high altitude and crashed back to earth weeks/months later.

So:

When TSLA is acting irrationally, especially after a fundamental change, get out of the way. If you're already caught dead with a slightly ITM call, roll it out 6 months or so.

Be careful with selling puts along these rallies. Don't assume it will go on forever. Once it reverses, it will reverse hard and you won't have time to react. Do still sell them as you should never fight the trend, but be conscious of the channel which will act as a magnet pulling the SP back down.

If you're caught with an ITM call within a bullish channel, identify its slope. Then you will have an idea of how ITM you can afford to be and still be able to play catchup.

The current channel goes up about $5 a week. Therefore, one way you can structure your rolls is to make sure you can roll them out for a $5 strike improvement every week. Right now a 5 DTE ATM call pays you about $5. Since the top of the channel reaches 187 by EOD next Friday, you then don't want to hold anything less than a -182.5C exp 5/26. If by EOD Friday it reaches and closes at 187.5, you can roll a 5/26 -182.5C to a 6/2 -187.5C for $0 or a small debit. This is how you can play catch up with a bullish channel. If you cannot roll to a 5/26 -182.5C, then maybe it's worth exploring other, longer dated options and bet on an eventual reversal to the mean, which means there has to be something on the calendar that will compel the market to take a more cautious stand: maybe a 1st quarterly GDP reading, an FOMC meeting, a monthly CPI release, the P&D report, etc... use these events as a potential temporary magnet for the SP and roll your calls to just before a target date if an ATM weekly roll is not affordable. This is what you should do if something like a November 2020 or November 2021 happens again. You have to do this early as the more ITM those calls get, the worse the rolls are going to get.

If you're already in the safe zone, there's nothing to worry about.

Look at where the stock touched the top trendline resistance in the past 2 weeks.

The first time it touched it was a non-event. All channels need a point of origination.

The 2nd time was also a nothingburger except for the fact that it made that new high only after an unexpected news (new TWTR CEO) and after such a steep pullback.

The 3rd time was when SPY hit 6 month high on Friday.

The question is: what did it take for the stock to spike violently twice in 2 weeks? Nothing short of spectacular. These events can happen again and again but just like drugs, euphoria tends to numb the market once it's has worn off and each subsequent dose has to drastically outdo the last in order to produce new highs.

Bullish channels are a luxury. Take this one for example: every week it goes up by about $5. If TSLA simply follows this channel for the next 3 years and gains a measly $5 every week, it would end up at $930 by June 2026. Let's forget about the for/against valuation arguments for a second. What about macro hiccups? Company bad news?

Bullish channels, therefore, have a limited shelf life and the stock tends to gravitate toward the bottom of the channel over time before eventually falling out of it and it takes a tremendous amount of energy to touch the top. Every time it touches the top, ask yourself what happened? Did something fundamentally change, like a massive ER beat, or is it something else? If TSLA rallies to the top all by itself then pls, for the love of God, don't stand in front of it. On the other hand, if it is simply responding to unexpected developments that don't really have a long term impact to the fundamentals, then it's more of a flash than a freight train. This is when one should expect a semi-immediate reversal to the mean.

Can TSLA break out of a bullish channel? It sure can, but the market doesn't like it. Every time that happened in the past, the stock would eventually fall back to earth after a spectacular breakout.

In both of these 2 examples, TSLA underwent some sort of once-in-a-lifetime event. The first time was the SP 500 inclusion followed by a gamma squeeze into Q4 2020 ER. The 2nd time was a massive Q3 2021 ER beat followed by a massive short squeeze. But, eventually, the stock couldn't survive the high altitude and crashed back to earth weeks/months later.

So:

When TSLA is acting irrationally, especially after a fundamental change, get out of the way. If you're already caught dead with a slightly ITM call, roll it out 6 months or so.

Be careful with selling puts along these rallies. Don't assume it will go on forever. Once it reverses, it will reverse hard and you won't have time to react. Do still sell them as you should never fight the trend, but be conscious of the channel which will act as a magnet pulling the SP back down.

If you're caught with an ITM call within a bullish channel, identify its slope. Then you will have an idea of how ITM you can afford to be and still be able to play catchup.

The current channel goes up about $5 a week. Therefore, one way you can structure your rolls is to make sure you can roll them out for a $5 strike improvement every week. Right now a 5 DTE ATM call pays you about $5. Since the top of the channel reaches 187 by EOD next Friday, you then don't want to hold anything less than a -182.5C exp 5/26. If by EOD Friday it reaches and closes at 187.5, you can roll a 5/26 -182.5C to a 6/2 -187.5C for $0 or a small debit. This is how you can play catch up with a bullish channel. If you cannot roll to a 5/26 -182.5C, then maybe it's worth exploring other, longer dated options and bet on an eventual reversal to the mean, which means there has to be something on the calendar that will compel the market to take a more cautious stand: maybe a 1st quarterly GDP reading, an FOMC meeting, a monthly CPI release, the P&D report, etc... use these events as a potential temporary magnet for the SP and roll your calls to just before a target date if an ATM weekly roll is not affordable. This is what you should do if something like a November 2020 or November 2021 happens again. You have to do this early as the more ITM those calls get, the worse the rolls are going to get.

If you're already in the safe zone, there's nothing to worry about.

Last edited: