pz1975

Active Member

U.S. Financial markets are closed today in observance of Memorial day.

It was a joke (not very funny I guess).

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

U.S. Financial markets are closed today in observance of Memorial day.

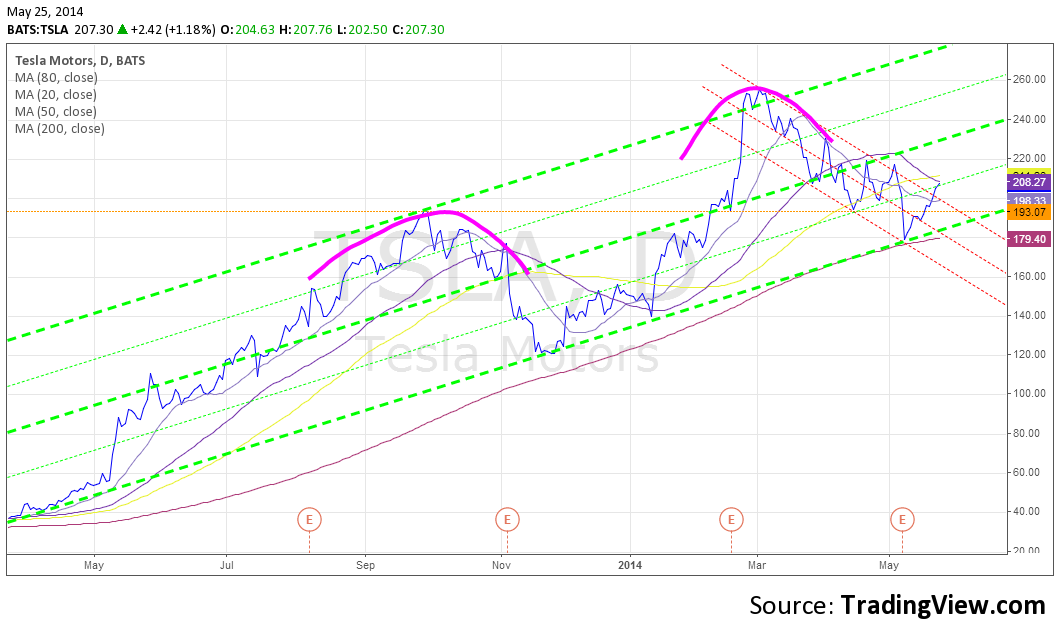

Just wanted to get a chart up with a few comments. As always, take it or leave it.

Looks like this coming week will be interesting as it will either confirm or reject our breakout from the red channel, the one we've been in since the ATH. The 50dma and 80dma might provide some downwards resistance as well. I have no idea which way it will go, but I am leaning towards a confirmation of the breakout and more upwards or horizontal movement. For the record, I am by no means acting on that prediction and Im not suggesting others do either. In fact, now that I've publically called it, its probably advisable to do the opposite.

Here is something I never do, a cold hard unashamed prediction: See those purple arcs? Be on the lookout for everyone and their mother to start calling a "Head and Shoulders" formation as soon as we start approaching ATHs again.

And yes, TA and Charting is all worthless witchcraft or magical unicorn fairy tales... I get it.

I believe Tesla has to announce the final site selection for the first Gigafactory site ahead of ground breaking. Which means it is likely at least 1 week before ground breaking, which I assume means we get news of the site selection hopefully before June 20th. The question is then, what will TSLA trade at given that news? I'm thinking somewhere in the 220's.

This steady but slow climb is allowing shorts to get out in an orderly fashion, but that doesn't mean that they actually do exit gracefully.

I thought they were going to break ground on two locations at the same time, just so they don't have to do final site selection before groundbreaking?

S&P has just given Tesla's credit an unsolicited rating of B- or "highly speculative," below investment grade:

Tesla Gets Unsolicited SP Junk Rating on ‘Niche’ Position - Bloomberg

The analysts' comments cast some doubt on Tesla's long-term prospects and categorize the company as a "niche" automaker. This is obviously not positive news. Any ideas on how the market might react to the rating tomorrow?

I thought bond ratings were paid for by companies issuing the bonds. Doesn't s and p make their money this way? Isn't it fair to find out who paid for the rating?S&P has just given Tesla's credit an unsolicited rating of B- or "highly speculative," below investment grade:

Tesla Gets Unsolicited SP Junk Rating on ‘Niche’ Position - Bloomberg

The analysts' comments cast some doubt on Tesla's long-term prospects and categorize the company as a "niche" automaker. This is obviously not positive news. Any ideas on how the market might react to the rating tomorrow?

The S&P announcement truly is astonishing on many fronts. The snippet "unable to adapt to technological changes" so spectacularly and appropriately applies to all those who are not Tesla that one wonders why on earth S&P ever would consider making this close-to-unprecedented unsolicited assessment. So much so, that the disinterested observer can very understandably be forgiven for thinking "Conspiracy?".

Overall, I believe today's release will redound far more significantly - and negatively - to Standard & Poors than it will to Tesla Motors Corp.

but after market pricing looks unaffected ?!

but after market pricing looks unaffected ?!

There were only 19,000 shares traded after hours today. The price action is meaningless.

S&P has just given Tesla's credit an unsolicited rating of B- or "highly speculative," below investment grade:

Tesla Gets Unsolicited SP Junk Rating on ‘Niche’ Position - Bloomberg