Ah c'mon, I need more personal validation than that.Your analysis made sense, so there didn't seem to be anything to add nor correct.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Emerging Market Contagion Threatens Oil Market | OilPrice.com

Missed this a week ago, but it looks like something to watch out for. Weakening currencies in emerging markets could limit oil demand growth.

By contrast, renewable energy financed by PPAs denominated in the domestic currency can enable such a country to ride out a currency crisis like this. Of course, it can be costly to import RE hardware at such a time, but all the installation cost is in the domestic currency. It's still a better deal than being on the hook to import fuel for single use. Perhaps this is the sort of scenario that motivates India to favor domestic supply for solar panels.

Missed this a week ago, but it looks like something to watch out for. Weakening currencies in emerging markets could limit oil demand growth.

By contrast, renewable energy financed by PPAs denominated in the domestic currency can enable such a country to ride out a currency crisis like this. Of course, it can be costly to import RE hardware at such a time, but all the installation cost is in the domestic currency. It's still a better deal than being on the hook to import fuel for single use. Perhaps this is the sort of scenario that motivates India to favor domestic supply for solar panels.

mspohr

Well-Known Member

We love you ♥♥♥Ah c'mon, I need more personal validation than that.

RobStark

Well-Known Member

I thought this was a great podcast and wanted to share. John Berger saw the light on how the energy transition would change and created three different successful companies.

Watt It Takes: How Sunnova’s John Berger Convinced Oil & Gas Investors to Believe in Solar

I was looking into his latest, Sunnova, to see what their residential solar marketing was like and found this!

Watt It Takes: How Sunnova’s John Berger Convinced Oil & Gas Investors to Believe in Solar

I was looking into his latest, Sunnova, to see what their residential solar marketing was like and found this!

Meghan Nutting

Executive Vice President, Policy and Communications

Prior to Sunnova, Meghan served as the Director of Policy and Electricity Markets at SolarCity.

Xcel Resource Planning Executive: We Can Buy New Renewables Cheaper Than Existing Fossil Fuels

We're hitting the critical tipping point where new renewables are cheaper than continuing to use existing fossil plants.

We're hitting the critical tipping point where new renewables are cheaper than continuing to use existing fossil plants.

dc_h

Active Member

Interesting growth trend. With only 35% annual solar growth you see proction more than doubling every 3 years, but also see growth in the 4th year about equal to the baseline year. Meaning if 2017 is 420TWh 2021 growth will be about 420TWh. At this rate by 2030 solar should be over 1/3 of global electricity.Planetary, it's a bit of a different story, coal still gaining, however, Wind and PV Solar are "cranking" and gaining due to cost drops

View attachment 330348

with, Planetary, Wind and Solar PV 1,565+ Terawatt Hours Total, 6% from _zero_ percent in only 20 years (well 22 years)

manufactured free energy vs extracted energy

(the data is free for the download)(if you really really want I can email the spreadsheets OR

download from

Downloads | Statistical Review of World Energy | Energy economics | BP

View attachment 330351

SebastianR

Active Member

Hi all,

was away for a while but look what I found here: FFI, Clean Edge, and Alpha Vee Solutions Release Energy Transition Long-Short Strategy - this is getting us closer back to the thread origin: Fossil Free Indexes is releasing a strategy to be long renewable energy and short the worst offenders of the carbon underground 200. They claim it is a great way to make money and at least their back-tracking seems to confirm it (though I'm always sceptical to this kind of voodoo as I know too much about how you do back tracking for marketing materials )

)

Anyways - any thoughts?

was away for a while but look what I found here: FFI, Clean Edge, and Alpha Vee Solutions Release Energy Transition Long-Short Strategy - this is getting us closer back to the thread origin: Fossil Free Indexes is releasing a strategy to be long renewable energy and short the worst offenders of the carbon underground 200. They claim it is a great way to make money and at least their back-tracking seems to confirm it (though I'm always sceptical to this kind of voodoo as I know too much about how you do back tracking for marketing materials

Anyways - any thoughts?

That's pretty cool. It's a variation om pairs trading. The upshot here is that many of the common factors impacting energy markets get neutralized. For example, suppose there is overinvestment in energy, and all forms of energy suffer in market performance. This impact both the long and short portions of the portfolio. So net there is little impact on the portfolio. But factors which benefit renewables more than fossils will be a net gain to the portfolio.Hi all,

was away for a while but look what I found here: FFI, Clean Edge, and Alpha Vee Solutions Release Energy Transition Long-Short Strategy - this is getting us closer back to the thread origin: Fossil Free Indexes is releasing a strategy to be long renewable energy and short the worst offenders of the carbon underground 200. They claim it is a great way to make money and at least their back-tracking seems to confirm it (though I'm always sceptical to this kind of voodoo as I know too much about how you do back tracking for marketing materials)

Anyways - any thoughts?

adiggs

Well-Known Member

Hi all,

was away for a while but look what I found here: FFI, Clean Edge, and Alpha Vee Solutions Release Energy Transition Long-Short Strategy - this is getting us closer back to the thread origin: Fossil Free Indexes is releasing a strategy to be long renewable energy and short the worst offenders of the carbon underground 200. They claim it is a great way to make money and at least their back-tracking seems to confirm it (though I'm always sceptical to this kind of voodoo as I know too much about how you do back tracking for marketing materials)

Anyways - any thoughts?

That looks pretty cool to me. I was disappointed to read that it's a strategy that somebody can use, but it isn't a an ETF / mutual fund / ... that I can go buy.

Is anyone planning to read "Saudi America: The Truth about Fracking and How It's Changing the World" by Bethany McLean? The book only came out a few days ago. The description reminds me of an article I read on CleanTechnica (The Great American Fracking Bubble). The book and the article are about fracking being a financial bubble that will blow up finally.

hmm....interesting...will put it on my list.Is anyone planning to read "Saudi America: The Truth about Fracking and How It's Changing the World" by Bethany McLean? The book only came out a few days ago. The description reminds me of an article I read on CleanTechnica (The Great American Fracking Bubble). The book and the article are about fracking being a financial bubble that will blow up finally.

This might be of interest: https://www.amazon.com/Oil-Power-War-Dark-History/dp/1603587438

I read the original version (French) a few years ago, and the author is a member of the Shift Project - an organization that flights climate change and try to stop the economic relying on fossil fuels .

I read the original version (French) a few years ago, and the author is a member of the Shift Project - an organization that flights climate change and try to stop the economic relying on fossil fuels .

China's diesel demand has peaked, gasoline to peak 2025: CNPC research | Reuters

In China, the research arm of CNPC is projecting that diesel demand has already peaked. Moreover, they project that gasoline demand will peak by 2025 and crude demand by 2030. The government is pressing to replace 20% of the heavy-duty diesel fleet with lower emissions vehicles. Natural gas figures into this; however, electric buses and electric trucks are coming on fast.

This is a stunning projection. We've discussed here the idea that diesel would peak globally as many as five years sooner than gasoline. It was actually the slow demand growth of diesel in China that first tipped me off to this possibility. The ISO low sulfur rule shipping continues to cloud the timing of the global diesel peak, which is why I still see that peak happening as late as 2021. But this development in China is very promising of an earlier peak. It is curious to ask, if diesel demand is not growing in China, where is the growth to come from. Europe has its own problem around diesel demand too. So ISO demand from shipping may be the last solid demand driver in the next few years.

I am also encouraged by a forecasted 2025 peak for gasoline. I do find it hard to believe that if diesel is well into decline as gasoline peaks in 2025 that crude demand could continue to rise for another five years. Petrochem/LPG, kerosene jet fuel and tar is not a compelling growth mix. I suspect the modelers are simply rounding the nearest five year number. So they may actually be saying that crude demand will fall just after gasoline peaks. Moreover, as the effort to electrify heavy vehicles takes off, I think we'll see adoption speed up and forecasts will shorten. So my impression here is that I would not be surprised if gasoline and crude both peak within the span of 2023 and 2025. This hunch is based on the potential for EV tech and adoption to advance more quickly than government based plans. Also note that the government operates on the basis of five-year plan. The current one end 2020, then 2025 and 2030. So the forecasted peaks may simply be coordinated with this planning cycle.

I will be interesting to see how oil market react to the prospect of declining Chinese demand for diesel. It becomes much harder to pin hopes on Ching being a robust demand engine for oil going forward.

In China, the research arm of CNPC is projecting that diesel demand has already peaked. Moreover, they project that gasoline demand will peak by 2025 and crude demand by 2030. The government is pressing to replace 20% of the heavy-duty diesel fleet with lower emissions vehicles. Natural gas figures into this; however, electric buses and electric trucks are coming on fast.

This is a stunning projection. We've discussed here the idea that diesel would peak globally as many as five years sooner than gasoline. It was actually the slow demand growth of diesel in China that first tipped me off to this possibility. The ISO low sulfur rule shipping continues to cloud the timing of the global diesel peak, which is why I still see that peak happening as late as 2021. But this development in China is very promising of an earlier peak. It is curious to ask, if diesel demand is not growing in China, where is the growth to come from. Europe has its own problem around diesel demand too. So ISO demand from shipping may be the last solid demand driver in the next few years.

I am also encouraged by a forecasted 2025 peak for gasoline. I do find it hard to believe that if diesel is well into decline as gasoline peaks in 2025 that crude demand could continue to rise for another five years. Petrochem/LPG, kerosene jet fuel and tar is not a compelling growth mix. I suspect the modelers are simply rounding the nearest five year number. So they may actually be saying that crude demand will fall just after gasoline peaks. Moreover, as the effort to electrify heavy vehicles takes off, I think we'll see adoption speed up and forecasts will shorten. So my impression here is that I would not be surprised if gasoline and crude both peak within the span of 2023 and 2025. This hunch is based on the potential for EV tech and adoption to advance more quickly than government based plans. Also note that the government operates on the basis of five-year plan. The current one end 2020, then 2025 and 2030. So the forecasted peaks may simply be coordinated with this planning cycle.

I will be interesting to see how oil market react to the prospect of declining Chinese demand for diesel. It becomes much harder to pin hopes on Ching being a robust demand engine for oil going forward.

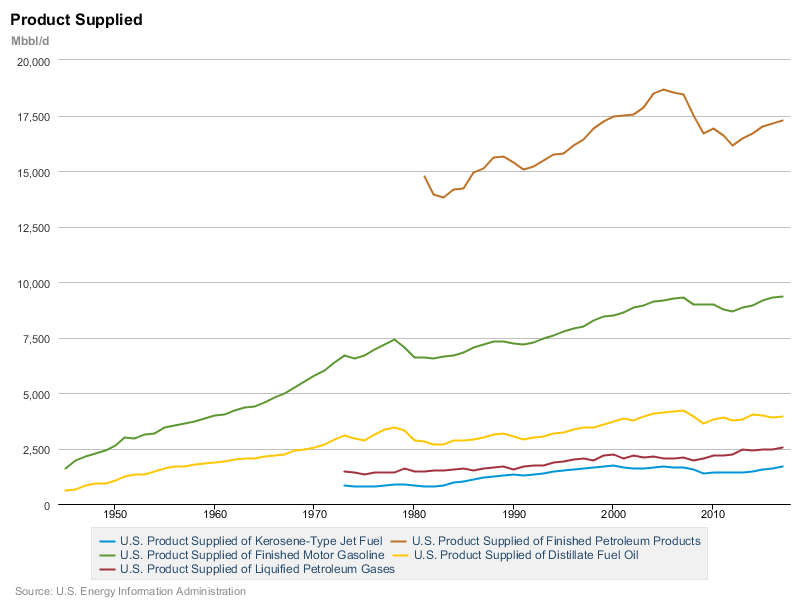

U.S. Product Supplied for Crude Oil and Petroleum Products

The EIA annual products supplied (consumption) numbers came out Aug 31. So let's see how strong petroleum product demand is in the US.

Finished Petroleum Products is exclusive of LPG, but it does represent the bulk of demand for oil. This clearly peaked at 18,650 kbpd in 2005. In the last year 2017, it climbed to 17,279 kbpd, up just 132 kbpd from the prior year. It looks unlikely that this will rise to a new peak before EVs and efficiency can permanently arrest growth.

Gasoline is at a new peak at 9327 kbpd in 2017, but this is up a mere 10 kbpd from prior year. This is such weak growth that a mere 300k EV private autos would suffice to arrest further gasoline demand growth. Tesla Model 3 alone is coming close to forcing a peak. Also ICE auto sales have been slowing. It is plausible that 2018 could be the peak year for US gasoline consumption. If not, the peak may be within just a few years.

Distillates (diesel) peaked in 2007 at 4196 kbpd. In 2017 this is at 3932, up 55 kbpd from prior year. This is modestly strong demand growth, but even here we may be just a few years from peak. Just 60k to 80k electric buses and trucks in a given year could arrest this growth. An economic down turn could also halt demand growth temporarily, but this may be enough for EVs to catch up and lock in declining demand. Likewise, diesel used in islands and other remote areas for power generation can be replaced by renewables and batteries.

LPGs are still growing, up 70 kbpd from last year, and is at a new high of 2540 kbpd. This includes contributions for natural gas liquids (NGLs). Actually that is the bulk of it. So while this is solid growth, it is really hard for me to see growth in LPGs driving crude growth.

Finally kerosene jet fuel also peaked in 2000 at 1725 kbpd. In 2017, this is 1682 kbpd, up 68 kbpd. This is the strongest growth of petroleum products from crude. We will likely see new peaks, but growth in jet fuel will hardly make up for declines in both gasoline and diesel.

In sum, I think we are about a year away from peak gasoline and 3 years from peak diesel. So I could see oil peaking by 2022 in the US. I would point out that this is sooner than much of my earlier views that were based almost exclusively at displacement from EVs. The reality is that efficiency is steadily eroding demand growth. This soften up the challenge and makes it easier for the contributions of EVs to push the situation solidly into decline. tracking year by year like this can show how demand is eroding. It won't be long.

The EIA annual products supplied (consumption) numbers came out Aug 31. So let's see how strong petroleum product demand is in the US.

Finished Petroleum Products is exclusive of LPG, but it does represent the bulk of demand for oil. This clearly peaked at 18,650 kbpd in 2005. In the last year 2017, it climbed to 17,279 kbpd, up just 132 kbpd from the prior year. It looks unlikely that this will rise to a new peak before EVs and efficiency can permanently arrest growth.

Gasoline is at a new peak at 9327 kbpd in 2017, but this is up a mere 10 kbpd from prior year. This is such weak growth that a mere 300k EV private autos would suffice to arrest further gasoline demand growth. Tesla Model 3 alone is coming close to forcing a peak. Also ICE auto sales have been slowing. It is plausible that 2018 could be the peak year for US gasoline consumption. If not, the peak may be within just a few years.

Distillates (diesel) peaked in 2007 at 4196 kbpd. In 2017 this is at 3932, up 55 kbpd from prior year. This is modestly strong demand growth, but even here we may be just a few years from peak. Just 60k to 80k electric buses and trucks in a given year could arrest this growth. An economic down turn could also halt demand growth temporarily, but this may be enough for EVs to catch up and lock in declining demand. Likewise, diesel used in islands and other remote areas for power generation can be replaced by renewables and batteries.

LPGs are still growing, up 70 kbpd from last year, and is at a new high of 2540 kbpd. This includes contributions for natural gas liquids (NGLs). Actually that is the bulk of it. So while this is solid growth, it is really hard for me to see growth in LPGs driving crude growth.

Finally kerosene jet fuel also peaked in 2000 at 1725 kbpd. In 2017, this is 1682 kbpd, up 68 kbpd. This is the strongest growth of petroleum products from crude. We will likely see new peaks, but growth in jet fuel will hardly make up for declines in both gasoline and diesel.

In sum, I think we are about a year away from peak gasoline and 3 years from peak diesel. So I could see oil peaking by 2022 in the US. I would point out that this is sooner than much of my earlier views that were based almost exclusively at displacement from EVs. The reality is that efficiency is steadily eroding demand growth. This soften up the challenge and makes it easier for the contributions of EVs to push the situation solidly into decline. tracking year by year like this can show how demand is eroding. It won't be long.

Incumbents fail – so are we wasting our time on sustainability?

To all those non-sustainable businesses out there, just make your money and die a natural death. More adaptive businesses will take your place.

To all those non-sustainable businesses out there, just make your money and die a natural death. More adaptive businesses will take your place.

Aramco To Spend $133B On Drilling Over The Next Decade | OilPrice.com

Saudi Arabia intends to spend at least $133B over the next ten years drilling for oil. Their current production in July is 10.63 mbpd with another 1.7 mbpd of spare capacity. Production in certain fields will be increased by 1 mbpd by 2023, but this appears simply to offset decline in other fields. So it does not appear that this ambitious plan does little to increase total production. But let's suppose they get to 12 mbpd. Over a 10 year period this 4.38 B bbl of mostly replacement. This works out to a drilling replacement cost of about $30 per barrel. There may be other field infrastructure spending not accounted for here.

A $30/b drilling cost is shockingly high for a country that had been claiming total production costs in range of $5 per barrel. Saudi well have been known for having very long production lives. So it is possible that these very low costs were based on decades old investments, not the current cost of replacement. If my envelop math is on the right track, the Kingdom really does not have much of a cost advantage left. If oil prices fall below $40/b over the next decade this could be critical. It could cut off any meaningful upside potential for maintaining the Saudi oil supply. This also explains why the Saudis have not be so eager to increase oil production for quite awhile. The marginal cost of increased capacity is just not that attractive.

It will be interesting to see how things play out the next time oil prices plummet.

Saudi Arabia intends to spend at least $133B over the next ten years drilling for oil. Their current production in July is 10.63 mbpd with another 1.7 mbpd of spare capacity. Production in certain fields will be increased by 1 mbpd by 2023, but this appears simply to offset decline in other fields. So it does not appear that this ambitious plan does little to increase total production. But let's suppose they get to 12 mbpd. Over a 10 year period this 4.38 B bbl of mostly replacement. This works out to a drilling replacement cost of about $30 per barrel. There may be other field infrastructure spending not accounted for here.

A $30/b drilling cost is shockingly high for a country that had been claiming total production costs in range of $5 per barrel. Saudi well have been known for having very long production lives. So it is possible that these very low costs were based on decades old investments, not the current cost of replacement. If my envelop math is on the right track, the Kingdom really does not have much of a cost advantage left. If oil prices fall below $40/b over the next decade this could be critical. It could cut off any meaningful upside potential for maintaining the Saudi oil supply. This also explains why the Saudis have not be so eager to increase oil production for quite awhile. The marginal cost of increased capacity is just not that attractive.

It will be interesting to see how things play out the next time oil prices plummet.

neroden

Model S Owner and Frustrated Tesla Fan

Of course, this means diesel is displacing residual fuel oil. So refineries have to figure out how to get rid of residual fuel oil, which means *all* refineries have to upgrade to recrack/upgrade/process the residual fuel oil (they can't just store it in tanks forever). This means the spread between refinery costs and end-user costs has to increase.China's diesel demand has peaked, gasoline to peak 2025: CNPC research | Reuters

In China, the research arm of CNPC is projecting that diesel demand has already peaked. Moreover, they project that gasoline demand will peak by 2025 and crude demand by 2030. The government is pressing to replace 20% of the heavy-duty diesel fleet with lower emissions vehicles. Natural gas figures into this; however, electric buses and electric trucks are coming on fast.

This is a stunning projection. We've discussed here the idea that diesel would peak globally as many as five years sooner than gasoline. It was actually the slow demand growth of diesel in China that first tipped me off to this possibility. The ISO low sulfur rule shipping continues to cloud the timing of the global diesel peak, which is why I still see that peak happening as late as 2021.

And this increase in diesel demand no good for crude oil producers, because this demand will go straight into refinery capex and opex costs to get rid of the unwanted residual fuel oil. Refineries will probably pad out their margins a bit for safety, too.But this development in China is very promising of an earlier peak. It is curious to ask, if diesel demand is not growing in China, where is the growth to come from. Europe has its own problem around diesel demand too. So ISO demand from shipping may be the last solid demand driver in the next few years.

I've been predicting for a while that we'll start to get a divergence where the "crack spread" increases; prices at the pump go up while prices at the wellhead go down. For those of us who want to see the end of the petroleum age, this is of course ideal. I can see several different phenomena which would lead to this widening. Is there any good way to track whether it's happening?

I am also encouraged by a forecasted 2025 peak for gasoline. I do find it hard to believe that if diesel is well into decline as gasoline peaks in 2025 that crude demand could continue to rise for another five years. Petrochem/LPG, kerosene jet fuel and tar is not a compelling growth mix. I suspect the modelers are simply rounding the nearest five year number. So they may actually be saying that crude demand will fall just after gasoline peaks. Moreover, as the effort to electrify heavy vehicles takes off, I think we'll see adoption speed up and forecasts will shorten. So my impression here is that I would not be surprised if gasoline and crude both peak within the span of 2023 and 2025. This hunch is based on the potential for EV tech and adoption to advance more quickly than government based plans. Also note that the government operates on the basis of five-year plan. The current one end 2020, then 2025 and 2030. So the forecasted peaks may simply be coordinated with this planning cycle.

I will be interesting to see how oil market react to the prospect of declining Chinese demand for diesel. It becomes much harder to pin hopes on Ching being a robust demand engine for oil going forward.

TheTalkingMule

Distributed Energy Enthusiast

If my envelop math is on the right track, the Kingdom really does not have much of a cost advantage left. If oil prices fall below $40/b over the next decade this could be critical. It could cut off any meaningful upside potential for maintaining the Saudi oil supply. This also explains why the Saudis have not be so eager to increase oil production for quite awhile. The marginal cost of increased capacity is just not that attractive.

Let's not forget Saudi Arabia is not some publicly traded global corporation whose increasing cost basis simply means less profit, it's a totalitarian regime whose hold on power is already stretched to the limit. If ANY of the major changes you discuss come to pass it would likely signal the beginning of the end for the royal family's control and plunge the entire region into [even more] chaos.

The clock is ticking. Does anyone in their right mind think something like this $133B plan is remotely possible? That's like expecting you can build a $10B global financial hub and the world will just show up. Insanely irrational.

As for residual fuel....I think you'll see all these massive Saudi solar auctions magically pushed off 2 years(again) as they continue to simply burn residual oil for electricity. It's a hot mess and starting to feel like the whole energy sector will crumble once we break out of this range in either direction.

Similar threads

- Replies

- 1

- Views

- 446

- Replies

- 0

- Views

- 674

- Replies

- 19

- Views

- 4K

- Replies

- 3

- Views

- 425