Vast Subsidies Keeping the Fossil Fuel Industry Afloat Should be Put to Better Use - Resilience

Capitalism has often been identified as the underlying cause of the

climate crisis. A leading voice on the subject is Naomi Klein, one of the climate movements most influential thinkers, whose seminal book on

climate change was subtitled

Capitalism vs. the Climate. She is one of many voices identifying capitalism as the cause of climate change.

Often central within the capitalism versus the climate framing is the idea that the heart of capitalist ideology – free market fundamentalism – has fuelled the climate crisis. But this line of argument often glosses over the fact that energy markets are not free from government intervention. In fact, the fossil fuel industry is deeply and increasingly reliant on government support to survive.

In my chapter, I show that governments the world over favour fossil fuel interests through

public financing,

financial subsidies, and

bailouts. In addition, the fossil fuel industry is helped by

corrupt governance systems. Together this forms what I call a system of fossil fuel welfare and protectionism.

To hide this reality, the fossil fuel industry has invested in

a massive public relations scheme (read: propaganda campaign) to paint itself as the defender of the free market. In the US, the fossil fuel industry has even,

quite successfully, duped Evangelicals into associating the fossil fuel industry with free markets, and free markets with God’s will. Thus, attacks on the fossil fuel industry become attacks on God’s will. But if God’s will was really aligned with the free market, then the fossil fuel industry would be doing the devil’s work.

On the other side of the Atlantic, a recent International Monetary Fund (IMF) study showed that the US, the world’s largest historic greenhouse gas emitter, gives

ten times more to fossil fuel subsidies than it does to education. Without such subsidies half of future oil production in the US

would be unprofitable.

As for coal, even the Wall Street Journal admits that US coal

simply can’t compete on a level playing field, and is losing out despite its major subsidies.

Studies reveal that without regulation to shield them from market forces, about half of the coal plants in the US would be going bankrupt.

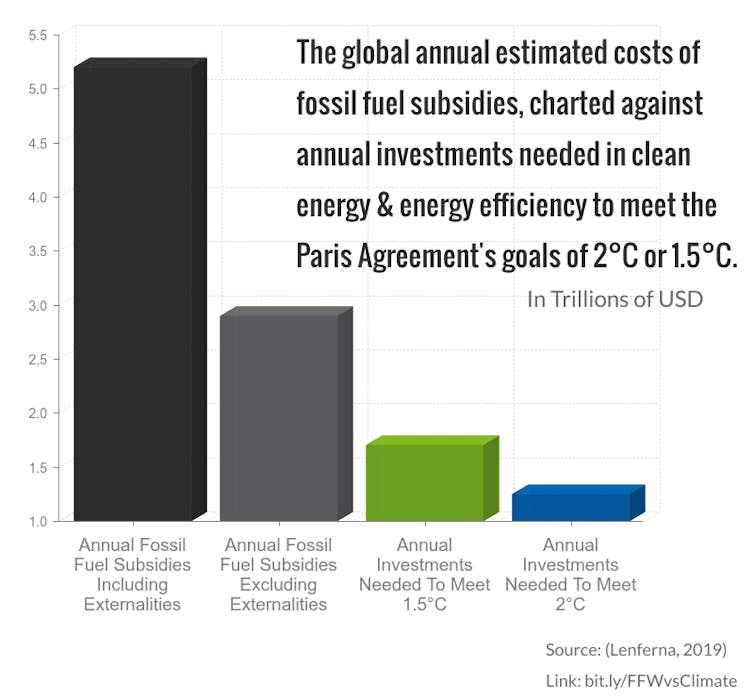

The

IMF estimates that eliminating fossil fuel subsidies could free up US$2.9 trillion in government revenue annually. That amount is more than double the annual investment of US$1.25 trillion the International Energy Agency

estimates is needed by 2035 in clean energy and energy efficiency to stop the world from warming by 2°C.

To meet the

much safer target of keeping warming to 1.5°C, would only require

an additional $460 billion per year in clean energy and energy efficiency investments.