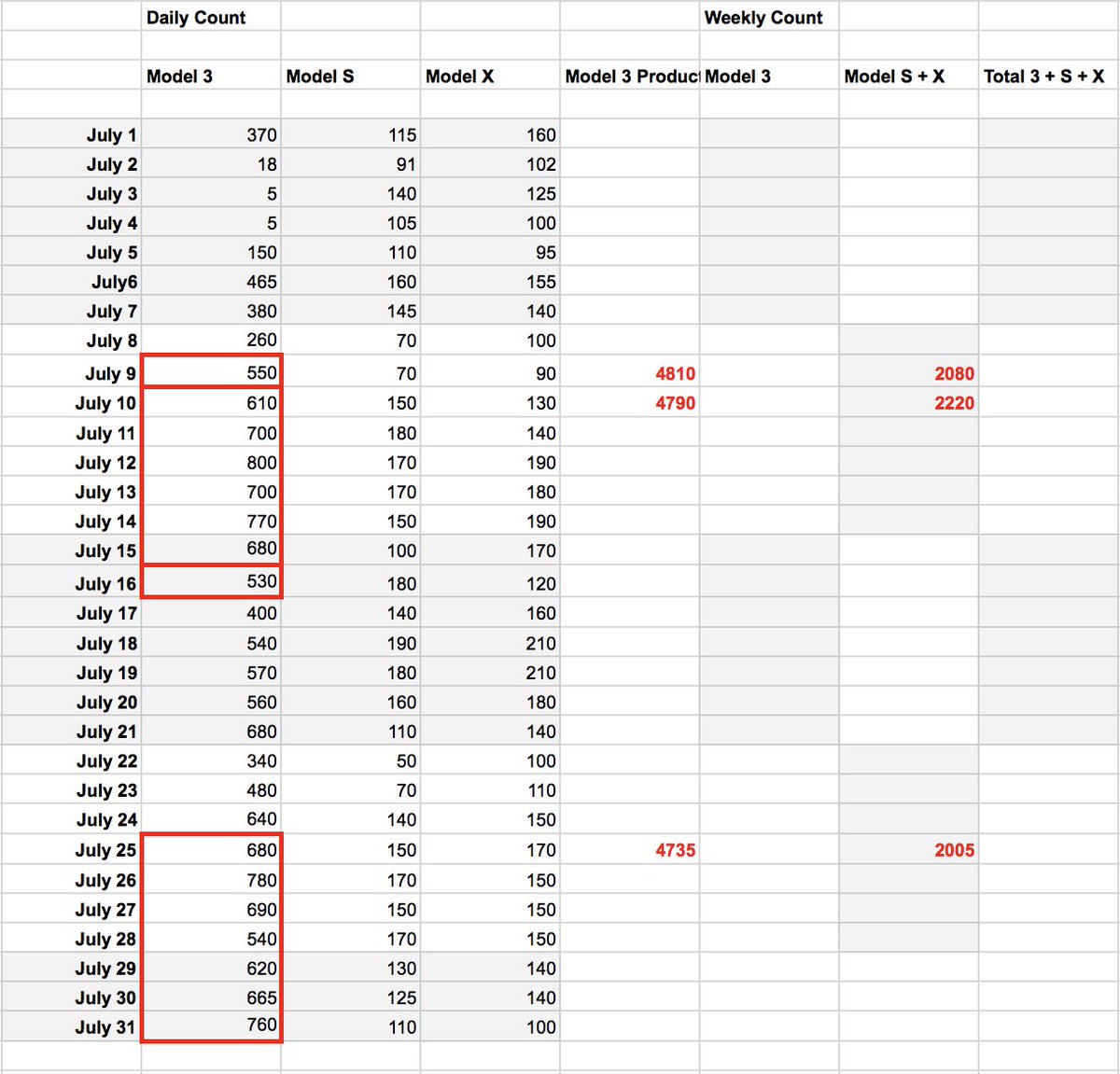

Skabooboo has a monthly averages of

Model 3 3599/wk

Model S 937/wk

Model X 1004/wk

Total 5540/wk

I'm not sure that this is far enough from the Tesla description (which is intentionally vague) to conclude the these numbers are fabrications. There were about 5 rolling 7-day sums that would round up to 5000/wk, if you round to the nearest 1000. So Tesla's language would seem to agree with this.

I'm still skeptical of this persona, but I don't think we have clear evidence of fabricated numbers yet. I think he will just stop reporting numbers soon.

That´s Skabooshka´s own take of how his numbers might fit the "hitting 5000 multiple times":

skabooshka on Twitter

Not saying it is definitely true but not unrealistic either.

Attachments

Last edited by a moderator: