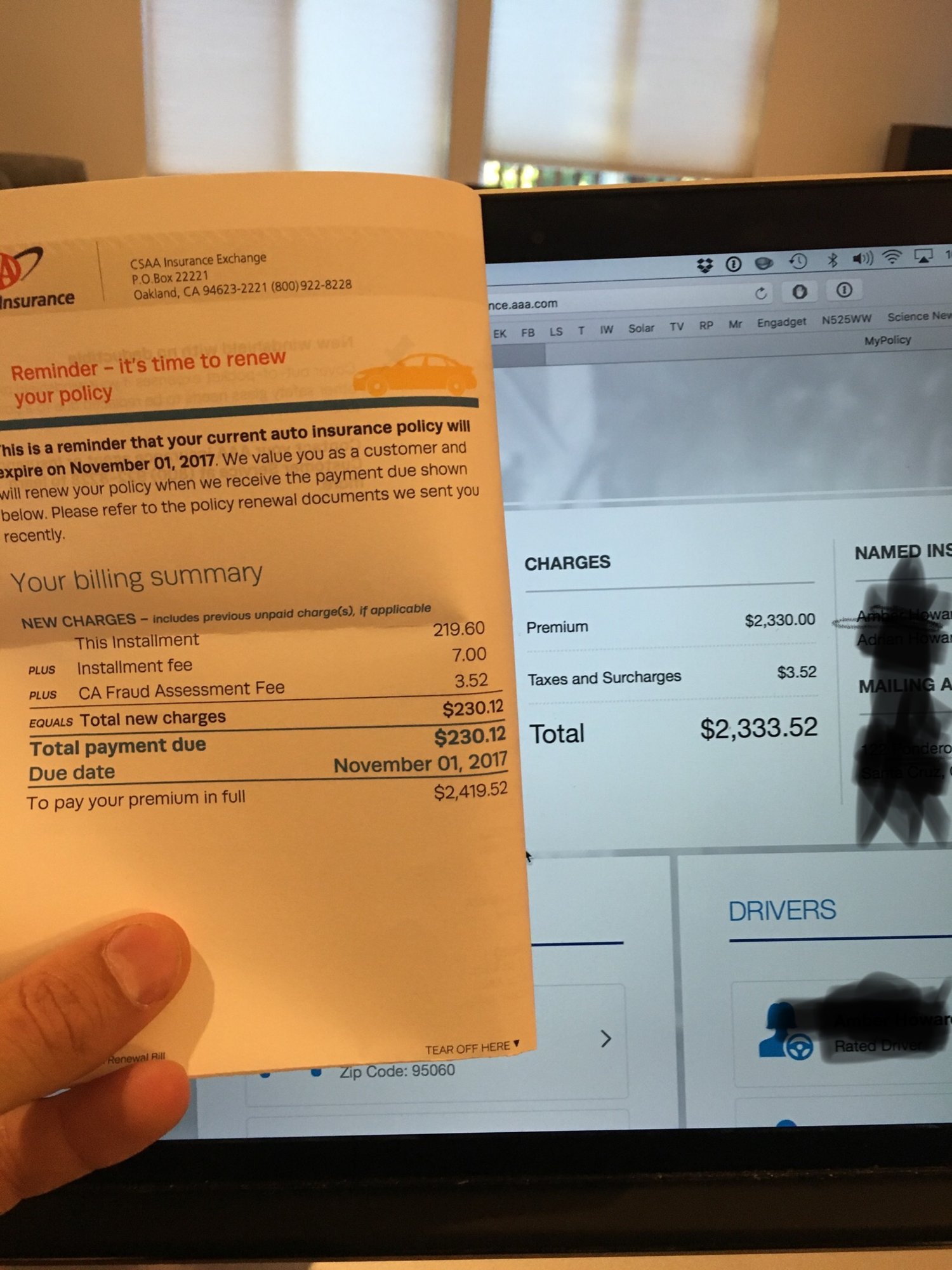

I just got my new policy from AAA. I was sort of dreading opening it. They were all over then news a while back for raising the rates on Teslas by a hundred percent or something. So the rate for the year went up a whopping 80 bucks. 2419 for this year verses 2333 for last year. Policy also covers our 2013 Volt. Two people on the policy.

I realize my car is a year older and that would normally lower the rate slightly. It seems like it normally increases yearly no matter what though. I had been planning to shop around this year, but now I'm thinking of just renewing it.

Seeing as how the increase didn't materialize I think AAA was just after a headline that had Tesla in the title.

I realize my car is a year older and that would normally lower the rate slightly. It seems like it normally increases yearly no matter what though. I had been planning to shop around this year, but now I'm thinking of just renewing it.

Seeing as how the increase didn't materialize I think AAA was just after a headline that had Tesla in the title.