You got an in?

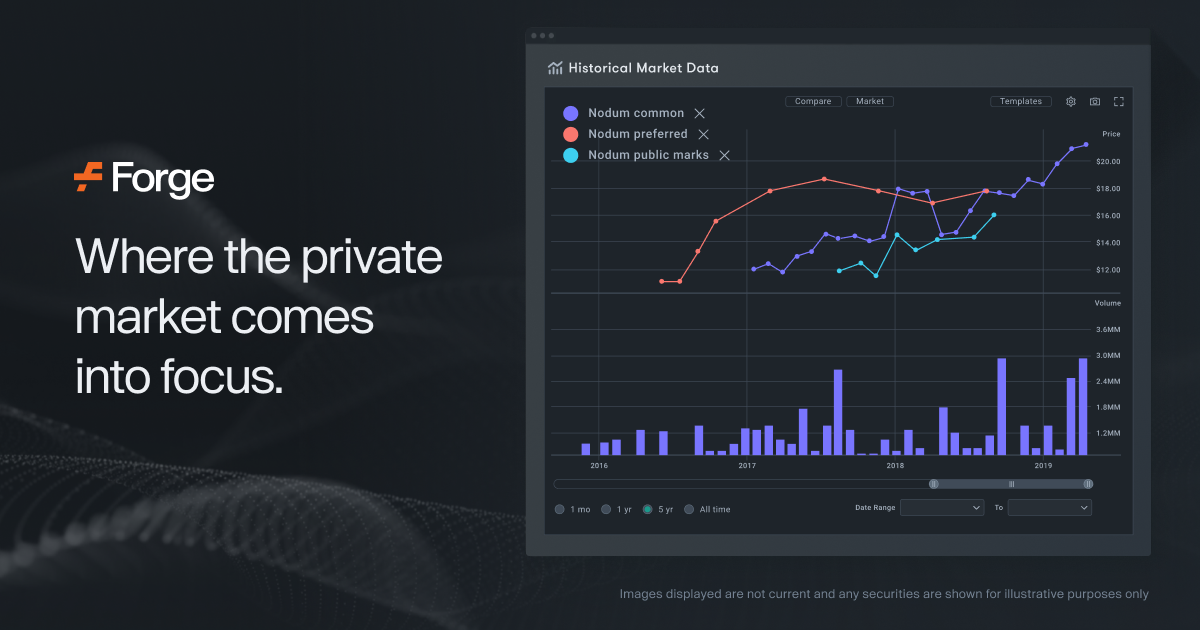

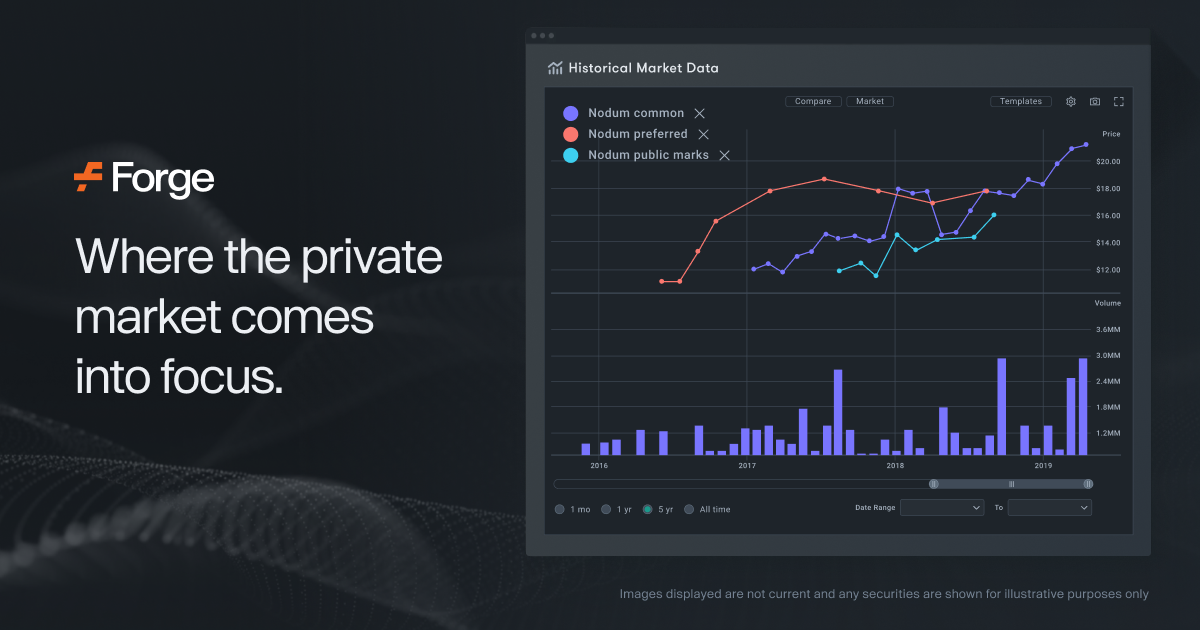

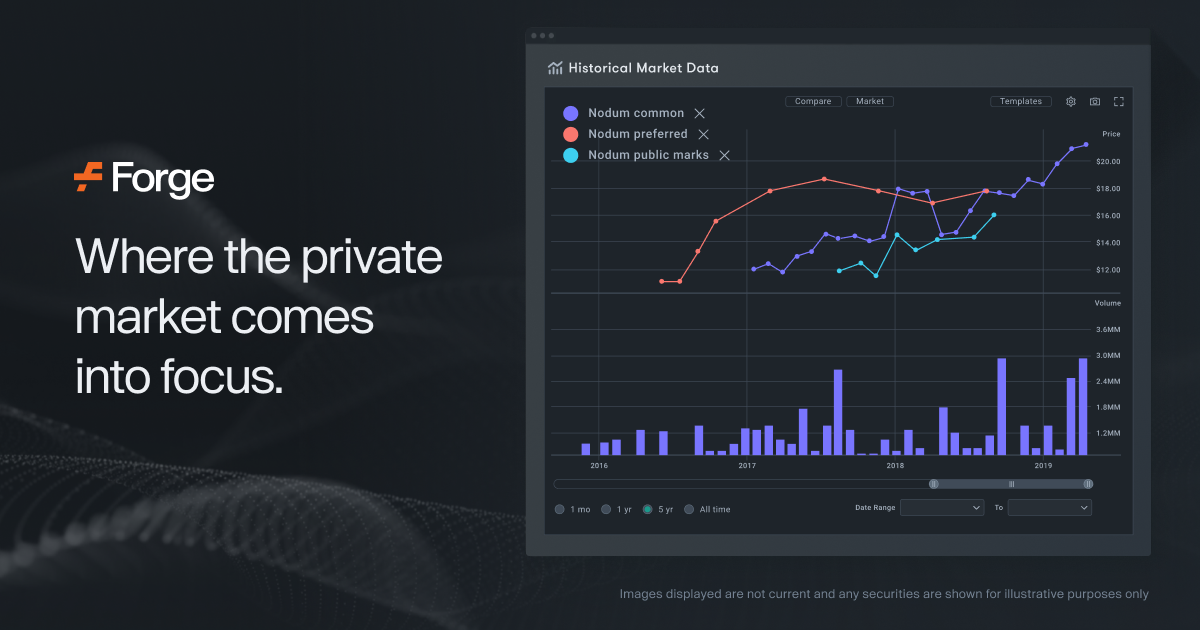

Welcome to Forge - A More Accessible Private Market

Accelerate your future with Forge's private market solutions. Get access to pre-IPO investment opportunities and liquidity for your private company shares.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

You got an in?

Can you summarize what is required by Forge Global besides being an accredited investor? All of the opportunities I investigated a while back were the equivalent of extortion schemes that allowed the facilitator to keep their hand in your pocket indefinitely.

Welcome to Forge - A More Accessible Private Market

Accelerate your future with Forge's private market solutions. Get access to pre-IPO investment opportunities and liquidity for your private company shares.forgeglobal.com

Hey, Mo, Sorry for delay was too busy crying over my Solars.Can you summarize what is required by Forge Global besides being an accredited investor? All of the opportunities I investigated a while back were the equivalent of extortion schemes that allowed the facilitator to keep their hand in your pocket indefinitely.

All I want to do is buy a large chunk of shares while paying fees and a (presumably large) premium. Does Forge Global offer that?

Thanks for the reply. You are correct that agreeing to give up a large portion of future capital gains is totally unacceptable. This is what I consider extortion, almost criminal.Hey, Mo, Sorry for delay was too busy crying over my Solars.

What you describe for a chunk of shares is the process I am familiar with.

However, I have since been told that SpaceX demand is so high that the deals being offered now included something like a 30% capital gain tax. I can understand that such an arrangement would be always unacceptable. At least it would be for me.

All I can tell you is give it a shot. And expect to pay a large premium, probably over five percent. But if they ask for a piece of future profits, it is hard to go forward.

Sorry I cannot give more clarity, but the private industry is very company specific. And in SpaceX case, even that is a moving target.

Thanks for the reply. You are correct that agreeing to give up a large portion of future capital gains is totally unacceptable. This is what I consider extortion, almost criminal.

On the other hand, I would be willing to pay much more than a 5% premium. The main thing is the facilitator must be out of my wallet after the transaction.

I don't like it either of course but consider it this way. You have 500 million dollars to invest and you put it in SpaceX. Then instead of just holding the entire amount you create a fund and take say 20% of their gains. You are greatly reducing your possible upside in return for a guaranteed %. It's not all that different than selling covered calls from a moral standpoint. They make their money by taking a cut, that's all.Thanks for the reply. You are correct that agreeing to give up a large portion of future capital gains is totally unacceptable. This is what I consider extortion, almost criminal.

On the other hand, I would be willing to pay much more than a 5% premium. The main thing is the facilitator must be out of my wallet after the transaction.

I understand the motivations of the broker but those terms just don't work for this buyer. If demand allows them to get away with this, so be it. Maybe I'm better off staying 99% TSLA and this prevents me from making a mistake.I don't like it either of course but consider it this way. You have 500 million dollars to invest and you put it in SpaceX. Then instead of just holding the entire amount you create a fund and take say 20% of their gains. You are greatly reducing your possible upside in return for a guaranteed %. It's not all that different than selling covered calls from a moral standpoint. They make their money by taking a cut, that's all.

yeah but you won't get access to the shares unless you're willing to pay. 20% of the future profits is steep but you gotta pay to play. Sharespost doesn't charge this type of fee from what I recall but typically you need to be willing to invest 200k min.I understand the motivations of the broker but those terms just don't work for this buyer. If demand allows them to get away with this, so be it. Maybe I'm better off staying 99% TSLA and this prevents me from making a mistake.

Again, I would pay a much higher fee than 5% (like 15%) to actually own the shares outright and not be under anyone's thumb.

yeah but you won't get access to the shares unless you're willing to pay. 20% of the future profits is steep but you gotta pay to play. Sharespost doesn't charge this type of fee from what I recall but typically you need to be willing to invest 200k min.

Is anyone familiar with Glassboard portal? I have some company (Principal Pre-IPO group) that claims to have access to private equity shares in companies including specifically SpaceX. They claim they are out of inventory right now but can make indication of interest on Glassboard.

I am very hesitant and start with a 90% chance the whole thing is a crock, but I believe there is a chance it is legitimate. Thoughts?

Is anyone familiar with Glassboard portal? I have some company (Principal Pre-IPO group) that claims to have access to private equity shares in companies including specifically SpaceX. They claim they are out of inventory right now but can make indication of interest on Glassboard.

I am very hesitant and start with a 90% chance the whole thing is a crock, but I believe there is a chance it is legitimate. Thoughts?

My DD on Principle Pre-IPO Group was AVOID.Is anyone familiar with Glassboard portal? I have some company (Principal Pre-IPO group) that claims to have access to private equity shares in companies including specifically SpaceX. They claim they are out of inventory right now but can make indication of interest on Glassboard.

I am very hesitant and start with a 90% chance the whole thing is a crock, but I believe there is a chance it is legitimate. Thoughts?

Since I had been in contact with SharesPost earlier I too was contacted with the same offer as others, but for me the minimum required investment was said to be $250k - could be because I'm not a US citizen?

My main question is the 20% carry interest. Why so much, when this is not an actively managed fund? Is that normal?

Did someone review the fine print yet and if so any hesitation?

Hey everyone! I also got an email from Sharespost on the opportunity. I got a couple of questions - maybe someone who did it for 5 times already would help clarifying (no need to explain that every SPV terms can be unique and it is not a substitute for legal advice):

1) What are your thoughts on how a potential Starlink IPO might play out for SPVs? Like will SPV be assigned Starlink shares and when you exit you get them?

2) What is real liquidity on those SPVs? I understand that you need to be prepared for the investment to be almost completely illiquid, but in practice - could you exit for example in 1 year after you decide to, or it is "everyone in and everyone out" at the same time (or never)?

3) Annual management fee - is it calculated on your initial investment amount or will be reassessed with new rounds and valuations?

Thanks in advance!

DM me.419.99 @ 20% carry sounds like an amazing deal, considering how old that price is. Especially compared to what I've seen elsewhere recently. For those getting sharespost emails - how did you indicate to them you'd be interesting in SpaceX? I really haven't been able to get anyone at sharespost to respond. I did call them up and talk to someone a couple weeks ago specifically about SpaceX, that still didn't put me on "the list". Nor did multiple indications of interest.