Congrats! My ETA for the M3SR+ in Montreal just went from November to March ( !!!) so I might keep an eye on local inventory instead.Just pulled the pin and upgraded my order from SR+ to a DEMO LR. It has 2900km on it, and they gave me $2870 dollar price adjustment for it.

Got my VIN right away, and I go and pick it up this Sunday

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SR/SR+ (Model 3 RWD) Waiting Room

- Thread starter HelixSpiral

- Start date

Congrats! My ETA for my SR+ order in Montreal just went from November to March ( !!!) so I might keep an eye on local inventory instead.Just pulled the pin and upgraded my order from SR+ to a DEMO LR. It has 2900km on it, and they gave me $2870 dollar price adjustment for it.

Got my VIN right away, and I go and pick it up this Sunday

Trekker_

Member

If you add up the options they are cheaper. For the M3P that are listed right now, looks to be about 2500 offYeah, I've seen those cars before on the inventory page, but none have reflected a discount. I guess it shows up later on the paperwork as you mentioned?

ElectricMagma

Member

I saw a ton of inventory (nothing for SR+ unfotunatly) in Montreal. q3 is ending, so i think they are selling off all the demosCongrats! My ETA for the M3SR+ in Montreal just went from November to March ( !!!) so I might keep an eye on local inventory instead.

ElectricMagma

Member

THats correct. You can also build one right on the page new, and see the difference to gauge the disountIf you add up the options they are cheaper. For the M3P that are listed right now, looks to be about 2500 off

ElectricMagma

Member

SaintMickey®

Closed

Ordered July 24th. Date went of course from Sep 1 to October 15 then to Nov 15th.

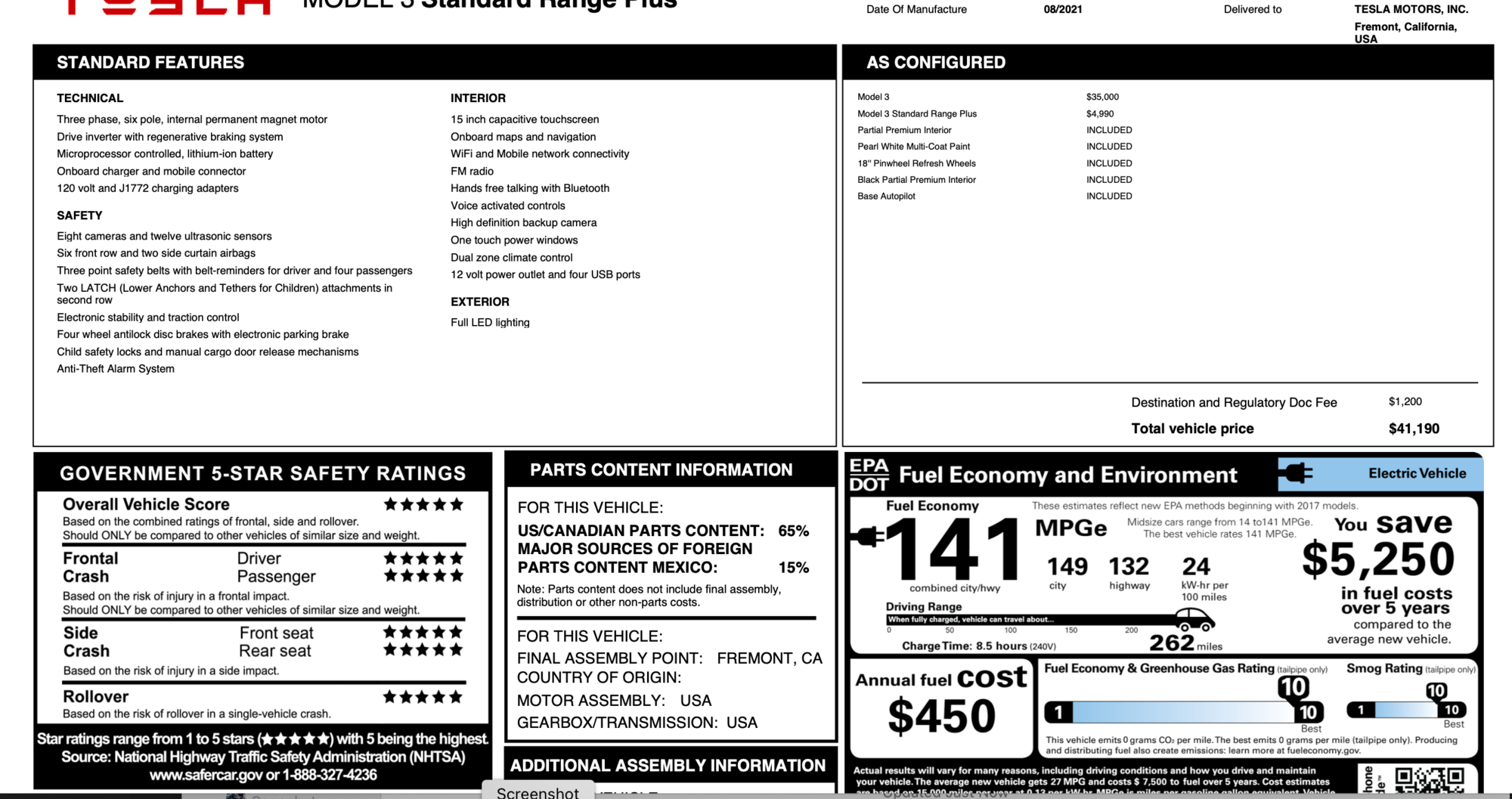

We opted for the LFP battery and took delivery on Sept 15th...looks like it was born 08.21

One thing...the date I was given in email with VIN # assigned was off by 2 weeks said Sept 1-3 but didn't get it until Sept. 15th. Those 2 weeks were longer than the previous 10 weeks! LOL

We opted for the LFP battery and took delivery on Sept 15th...looks like it was born 08.21

One thing...the date I was given in email with VIN # assigned was off by 2 weeks said Sept 1-3 but didn't get it until Sept. 15th. Those 2 weeks were longer than the previous 10 weeks! LOL

I placed my order on September 8 (White SR+, no options.) Originally, the delivery estimate was January, then December, then November. Now, they're saying October 4-24. I'm not planning on taking delivery before the beginning of November, though.

I scheduled a test drive for this morning, which was a total nightmare. I'm not going to go into details, but I drove the car around the parking garage for a couple of minutes and then parked it. I'll schedule a real test drive at a different location closer to my delivery date.

I scheduled a test drive for this morning, which was a total nightmare. I'm not going to go into details, but I drove the car around the parking garage for a couple of minutes and then parked it. I'll schedule a real test drive at a different location closer to my delivery date.

SaintMickey®

Closed

I placed my order on September 8 (White SR+, no options.) Originally, the delivery estimate was January, then December, then November. Now, they're saying October 4-24. I'm not planning on taking delivery before the beginning of November, though.

I scheduled a test drive for this morning, which was a total nightmare. I'm not going to go into details, but I drove the car around the parking garage for a couple of minutes and then parked it. I'll schedule a real test drive at a different location closer to my delivery date.

Did you opt for the LFP battery? Sounds like what mine did when I switched...

No, it didn't give me the option for the LFP battery.Did you opt for the LFP battery? Sounds like what mine did when I switched...

Love my S3xy

Member

Had an appointment for the 25, re-schedules for the 30. «Your car is arrived but it’s missing a part. We don’t know which one »

Tesla Classic

Tesla Classic

martinmac85

Member

I called my SA and said, that I only want the LFP battery. My EDD went from 12/12-01/11 to nothing now. I made the request after the dates disappeared though. We'll see what happens.Did you opt for the LFP battery? Sounds like what mine did when I switched...

hikeleader

Member

Appointment for 9/22 to get car. Hoping no hurricanes, tornadoes etc til then!I bet that can be frustrating. I emailed my pickup location and they said they have my car and is awaiting inspection and detail. Hope they don't change the date.

The early side starts tomorrow for me. I should post a countdown on here each day. Starting tomorrow with T- minus 9 days and counting. Then abort launch when it doesn’t happen. Lol. Don’t you love my pessimism? I just like to be proven wrong I guess.You guys are both SoCal like me, with EDD’s and order dates close to my original order, so I am curious how this will play out. I really don’t think you will miss your EDD’s, in fact my guess is you wind up on the early side of the EDD’s. But all the Tesla order-related stuff has been nuts lately so you can never have 100% certainty…

Tezla1

Member

I just got a VIN, anyway to see build detail or location info from VIN #?

pipp

Member

Pessimism seems like the safest approach in this case. It’s not like you’re going to feel particularly miserable if you are wrongly pessimistic and your car gets delivered early!The early side starts tomorrow for me. I should post a countdown on here each day. Starting tomorrow with T- minus 9 days and counting. Then abort launch when it doesn’t happen. Lol. Don’t you love my pessimism? I just like to be proven wrong I guess.

SaintMickey®

Closed

Pessimism seems like the safest approach in this case. It’s not like you’re going to feel particularly miserable if you are wrongly pessimistic and your car gets delivered early!

Yeah even after I had my VIN# and they could track it "on the truck" their delivery date was still 2 weeks later. But never know maybe you'll get surprised!

True it's not a great financial move but in this current market it's not that bad. Right now I have about $4,000 in extra value in my car due to high demand for used cars. If I keep it and don't get a new car that $11,000 in value will disappear eventually. By next year my Corolla might only be worth $5-7,000. Now factor in the cost of servicing that vehicle that is now 6+ years old. I'm going to have to start throwing money at it very soon. All I'm doing is losing money by keeping it. A new car would refresh that $11,000 a little and would most likely secure me from costly repairs for the next 3 years. This is based off of basic risk assessment so say I'm 25% likely to need a costly repair with a Tesla in 3 years since every part is new while with my Corolla I'm at about 75% because of all the worn parts. There's a risk in all this that's for sure but I don't think in the current market keeping an over valued vehicle is a lot better then getting a new car especially when you don't have to pay a $5,000 dealer upcharge.Buying a Tesla isn't a great financial move for any of us, generally speaking. It's responsible in other ways, but not so much for our wallets. However, "only about $137 more a month" for 72 months is not an insignificant outlay. I had a loan on a Nissan Frontier when I was younger, and the payments over 5 years for that truck were about $300 per month--you're talking about adding nearly half of that monthly payment for a mere upgrade--again, that is not insignificant. If you were to invest that $137 in an index fund each month over the next 6 years instead, you could end up with about $13,000 in savings based on the historical average return of the S&P 500. Which would turn into $128,000 in 25 years if left in the same fund--a significant boost to your retirement savings.

Most car loans will seem "doable" if you stretch out the payments over 72 months, but (in a normal market) you're putting yourself at high risk for being underwater on that loan for many years, and you'll likely tire of the car before you've got it paid off, which for many people results in rolling the balance into yet another car loan, which means they might still be paying for that LR upgrade in 15 years when they're not even driving the same car.

So your hypothetical options are: 1. invest the money and end up with a hundred grand, or 2. spend the money on a car you probably won't be driving, but might still be paying for, in 6 years.

Did that work, LOL?

Also if you're broke and $300 is a lot of a loan then yeah don't get it but that doesn't mean everyone feels like $137 is a big jump. Some people have more disposable income then others and are probably already investing in their future but they want a little fun now.

SaintMickey®

Closed

Buying a Tesla isn't a great financial move for any of us, generally speaking. It's responsible in other ways, but not so much for our wallets. However, "only about $137 more a month" for 72 months is not an insignificant outlay. I had a loan on a Nissan Frontier when I was younger, and the payments over 5 years for that truck were about $300 per month--you're talking about adding nearly half of that monthly payment for a mere upgrade--again, that is not insignificant. If you were to invest that $137 in an index fund each month over the next 6 years instead, you could end up with about $13,000 in savings based on the historical average return of the S&P 500. Which would turn into $128,000 in 25 years if left in the same fund--a significant boost to your retirement savings.

Most car loans will seem "doable" if you stretch out the payments over 72 months, but (in a normal market) you're putting yourself at high risk for being underwater on that loan for many years, and you'll likely tire of the car before you've got it paid off, which for many people results in rolling the balance into yet another car loan, which means they might still be paying for that LR upgrade in 15 years when they're not even driving the same car.

So your hypothetical options are: 1. invest the money and end up with a hundred grand, or 2. spend the money on a car you probably won't be driving, but might still be paying for, in 6 years.

Did that work, LOL?

Ours will be about the same payment as our MB but with it we paid for fuel(about $200 a month) paid to drive in the PeachPass Lane (although sparingly $100) and couldn't ride 1 person in the HOV Lane...and all that will save hundreds of hours in traffic here in Atlanta and...Time is money where I come from! OH and did I mention MB/BMW maintenance costs?! LOL

This car is the smartest financial move I've ever made on an auto.

Of course I will also pay this car off early by throwing $1000 a month at it....and in 44 months it'll be worth more than the $39,900 we paid for it by the looks of the used ones selling now!

Last edited:

You don't have to convince me, I'm buying one too.True it's not a great financial move but in this current market it's not that bad. Right now I have about $4,000 in extra value in my car due to high demand for used cars. If I keep it and don't get a new car that $11,000 in value will disappear eventually. By next year my Corolla might only be worth $5-7,000. Now factor in the cost of servicing that vehicle that is now 6+ years old. I'm going to have to start throwing money at it very soon. All I'm doing is losing money by keeping it. A new car would refresh that $11,000 a little and would most likely secure me from costly repairs for the next 3 years. This is based off of basic risk assessment so say I'm 25% likely to need a costly repair with a Tesla in 3 years since every part is new while with my Corolla I'm at about 75% because of all the worn parts. There's a risk in all this that's for sure but I don't think in the current market keeping an over valued vehicle is a lot better then getting a new car especially when you don't have to pay a $5,000 dealer upcharge.

Also if you're broke and $300 is a lot of a loan then yeah don't get it but that doesn't mean everyone feels like $137 is a big jump. Some people have more disposable income then others and are probably already investing in their future but they want a little fun now.

He asked us to talk him out of it, so I was just trying to help him out.

Similar threads

- Replies

- 6K

- Views

- 290K

- Locked

- Marketplace listing

- Replies

- 3

- Views

- 723

- Replies

- 155

- Views

- 12K

- Question

- Replies

- 30

- Views

- 1K