Anyone familiar with Cryptocurrency ASIC miners? Basically it's hardware that prints money, especially when new (best) to the market.

The recent ,FSD related comments by Elon, reminded me of that.

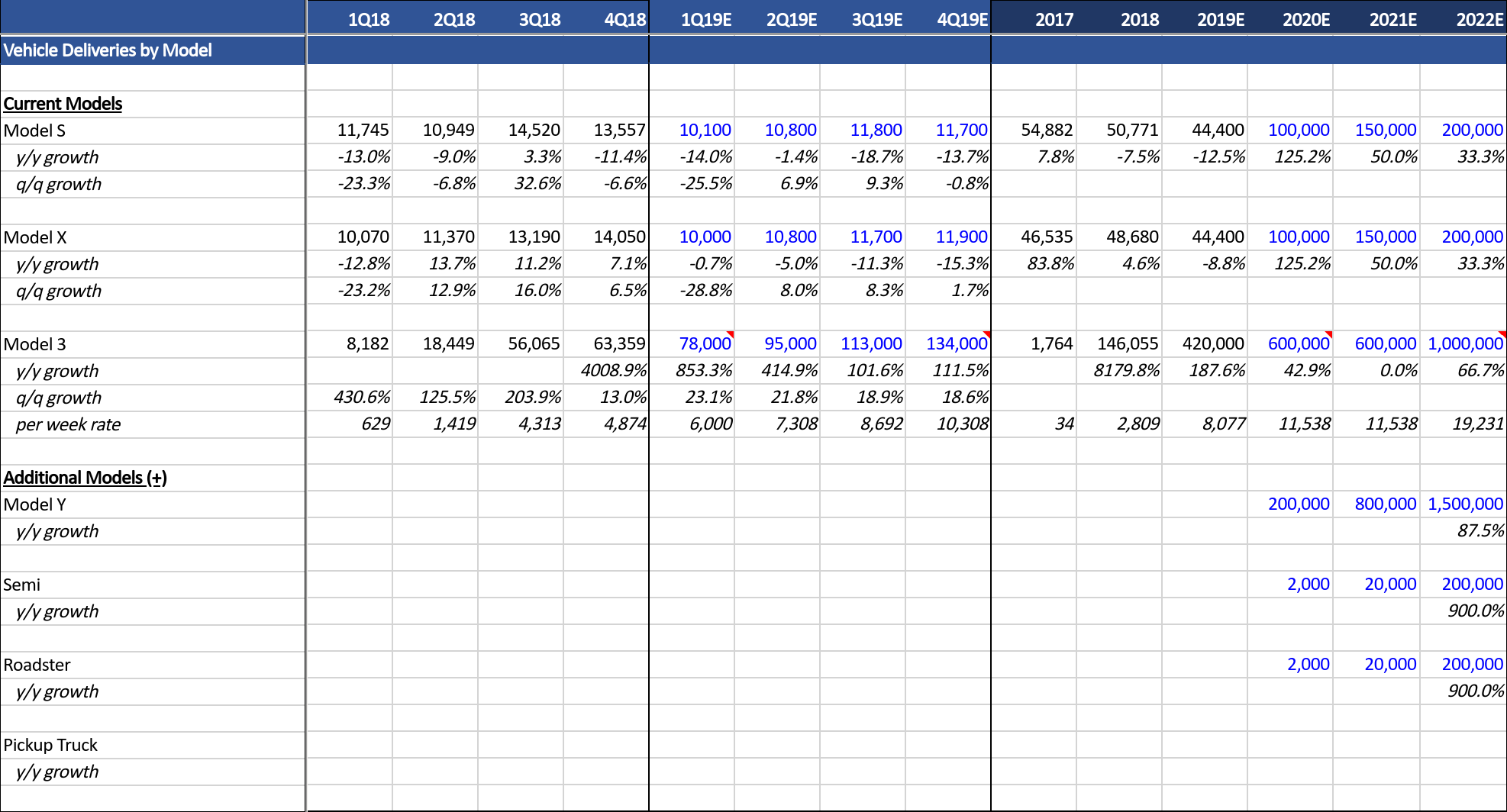

Until now, the SEXY line was considered a product for "consuming". You manufacture it, sell it with good margin and you move on to the next unit. I think Elon is surprising many of us (even the so called "Super bulls") and transforms the SEXY line into money printing machine sooner than expected.

That's quite a genius move. Customers become investors by simply owning the product. The presentation will be probably mostly aimed at current/potential SEXY owners. It will be enough to give a well presented Tesla Network scheme with believable, near term time frame stating date. It will push a lot of buyers to finally decide and buy the FSD software (and the car attached to it).

It shifts once again the "Auto market" and leaves the Legacy automakers even further from the new reality.

Then we have the Semi. What if Elon decides to go in the same direction as with the cars? What if the recent purchase of the transportation company has a deeper meaning? Car customers are needed in order to help training TSLA's NN, but Truck customers are suddenly not a necessity. Are we witnessing TSLA transforming from Energy/Auto company into Energy/Auto/Transportation company (both people and cargo)? After all, Elon is already heading in this direction with the Boring company.

It must really suck to be a TSLA competitor. Elon doesn't simply play the game better- he makes up new game on the way and makes all the good cards in your hands redundant. Many of them will realize the sooner you partner with TSLA the better.

TLDR: Size your plays and remember: I skate to where the puck is going to be, not where it has been. Wayne Gretzky.