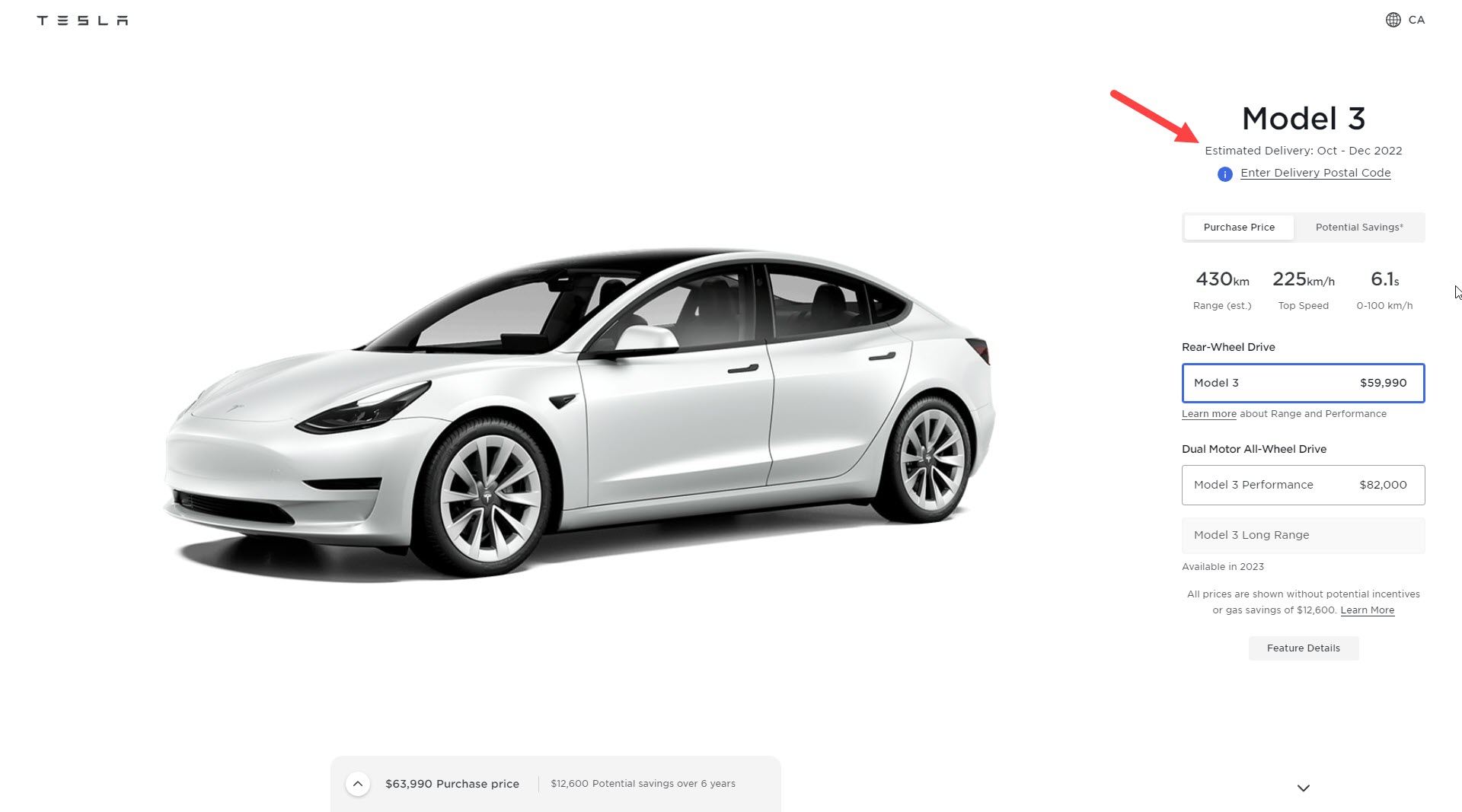

I think they'll end up limiting the SUV/Truck/Van category to vehicles that are larger and have larger battery packs than the Model Y and other similar small SUVs, this is part of what the IRS is asking for feedback on.I believe the Model Y will be in the SUV category and have a higher price ceiling

It could go the way you're suggesting but makes little sense to me, $80k is an obscene amount for an SUV the size of a Model Y and I doubt the spirit of the legislation is using taxpayer dollars to fund small SUVs with big luxury price tags.

Now using taxpayer dollars to fund vehicles with much larger battery packs and that will cost more by default because of the sheer size, that makes a bit more sense and $80k would actually do something to limit prices on a vehicle the size of something like a Rivian R1T/S.

I most definitely believe the IRS has people or will receive feedback from people who know this stuff inside and out as part of their Request for Comments, but this is pretty simple compared to the intricacies of tax law.do you think IRS really understands HW/OTA nuances?

Last edited: