And potential penalties for filing a false tax returnWhat will happen if you do - the IRS gave you a free loan that you have to repay?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax Questions (specifically TurboTax)

- Thread starter KaptKamp

- Start date

BikerPeaBody

Member

What will happen if you do - the IRS gave you a free loan that you have to repay?

most likely yes

if you don't mind the hassle by them, then put it down

Ah; now we're encouraging tax fraud!most likely yes

if you don't mind the hassle by them, then put it down

Blucenturion

Member

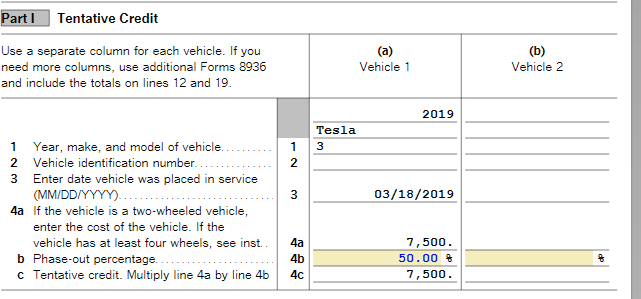

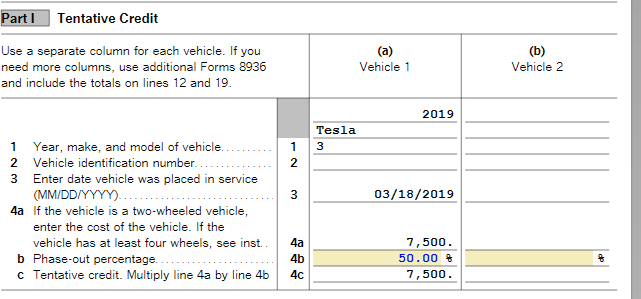

I filed with TurboTax on the 12th. The very day of the 8936 was made available. It gave me a $7500 credit, I expected it would correct it to the amount actually due, and so it did. When I checked the completed form a couple of boxes below, 50% was notated. My return was accepted and thus far I have not received any messages to the contrary.

Wait, a gray Ford just pulled out front. (kidding)

Wait, a gray Ford just pulled out front. (kidding)

most likely yes

if you don't mind the hassle by them, then put it down

+ penalty depending on how they assign blame. Software vs fraud.

Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit is not calculating correctly

The Qualified Plug-in Electric Drive Motor Vehicle Credit or Form 8936 is not calculating correctly. The tentative credit is showing as too high.

This issue is projected to be fix by 02/21/2020.

The Qualified Plug-in Electric Drive Motor Vehicle Credit or Form 8936 is not calculating correctly. The tentative credit is showing as too high.

This issue is projected to be fix by 02/21/2020.

This issue is projected to be fix by 02/21/2020.

on just TT or is it a IRS issue?

Ah; now we're encouraging tax fraud!

No one is encouraging tax fraud my question was for educational purposes in case others are in my case; I expected TurboTax to file correctly with their great marketing that their stuff is 100% accurate guaranteed blah blah blah - bottom line I filed 7500 with no intent to fraud and that's on the Turbo. Now I am waiting for the amount I owe back and when that might come to me, maybe in the next decade when the IRS is equipped with an analytics platform.

Incorrect it's your responsibility to review your tax return for accuracy before filing. It's highly likely the IRS will flag your return for an audit since this is a high fraud area (which is easy to verify based on VIN#'s). You probably have a reasonable legal case to go after TurboTax for the interest and penalties you'll owe.No one is encouraging tax fraud my question was for educational purposes in case others are in my case; I expected TurboTax to file correctly with their great marketing that their stuff is 100% accurate guaranteed blah blah blah - bottom line I filed 7500 with no intent to fraud and that's on the Turbo. Now I am waiting for the amount I owe back and when that might come to me, maybe in the next decade when the IRS is equipped with an analytics platform.

All tax prep software and online versions allow you to see the completed forms before submitting to IRS. Find the option in your software and review for your own sake.

Using Hrblock I also put the reduced amount when asked and noticed it was incorrect on the filled forms so went back and put $7500. Use trial and error and examine the forms that get produced before submitting.

Using Hrblock I also put the reduced amount when asked and noticed it was incorrect on the filled forms so went back and put $7500. Use trial and error and examine the forms that get produced before submitting.

No one is encouraging tax fraud my question was for educational purposes in case others are in my case; I expected TurboTax to file correctly with their great marketing that their stuff is 100% accurate guaranteed blah blah blah - bottom line I filed 7500 with no intent to fraud and that's on the Turbo.

- The post of mine you quoted was in response to someone else who WAS saying that committing tax fraud was okay

- By nature of this post which I am now quoting, you are acknowledging that you have knowingly committed tax fraud - you knew your tax returns were incorrect when you filed them.

- As @Spice mentioned, you probably would have a case to go after Intuit (the publishers of TurboTax) for any penalties and interest. But that is after you have gone though a long protracted battle with the IRS and then you have to go through an even longer protracted battle with Intuit.

TheNeck

Member

Personally, I won't be surprised if it never makes it that far. I assume you will eventually get a notification that your returns were rejected. I got my notification a full week after submitting them (even though I had manually corrected to my correct $1,875 credit).

- The post of mine you quoted was in response to someone else who WAS saying that committing tax fraud was okay

- By nature of this post which I am now quoting, you are acknowledging that you have knowingly committed tax fraud - you knew your tax returns were incorrect when you filed them.

- As @Spice mentioned, you probably would have a case to go after Intuit (the publishers of TurboTax) for any penalties and interest. But that is after you have gone though a long protracted battle with the IRS and then you have to go through an even longer protracted battle with Intuit.

Strange that your returns were rejected. even though manually corrected to the correct $1,875 credit?

I suspect that TT halted it knowing that the calculations were incorrect. IMO, it's still little wonky, but I was able to resubmit.Strange that your returns were rejected. even though manually corrected to the correct $1,875 credit?

Thanks to @TheNeck for stating that it was working!

So... enter 7500 and it'll calculate the correct amount?TT fixed the form, now it calculates the correct amount.

Yeah, that's what I had to do. When I had $1,875 as the amount, it then said I had a $469 credit (1/4 of $1,875)So... enter 7500 and it'll calculate the correct amount?

Trying to understand why I am only getting $469 vs $1875??Yeah, that's what I had to do. When I had $1,875 as the amount, it then said I had a $469 credit (1/4 of $1,875)

Similar threads

- Replies

- 10

- Views

- 8K

- Replies

- 20

- Views

- 2K

- Replies

- 12

- Views

- 5K