Yeah I can't see how that very recent event is Germaine.You're joking, right?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla Investor's General Macroeconomic / Market Discussion

- Thread starter FluxCap

- Start date

You're joking, right?

No, I was responding to the point that the market will come back when the Republicans are no longer in power. They no longer run the House.

That's a very partisan and very incorrect statement.

The Dems won the House but the market continues to decline. China trade negotiations are making progress but the market continues to decline. GDP and unemployment are not getting worse yet the market continues to decline. Mueller has all but ensured that Trump will not win in 2020 or be out sooner but the market continues to decline.

The bear market we are seeing has to do with the credit bubble that has been inflated over the last 10 years deflating. The cause was (and always is) rising interest rates. Going from 0% to 2.75% is huge for big traders who use leverage.

But the media will highlight all the other factors to make sure the Fed is kept out of the spotlight and gets no blame.

What other choice did the Fed have than to raise rates? Seems irresponsible to keep them at 0% forever. Are you saying that the rate increases came too quickly?

What other choice did the Fed have than to raise rates? Seems irresponsible to keep them at 0% forever. Are you saying that the rate increases came too quickly?

Not at all. In fact, I think they should have raised them long ago and never started QE3. No one knows why they waited until Trump was elected to begin the rate increase cycle and let them stay at zero for Obama's entire presidency. Completely unprecedented.

Rates went down too far and for too long and created a bubble in all assets including stocks, real estate, and even fine art.

Now rates are going back up and have reached a point where the process is reversing.

Higher interest rates affect everything from DCF valuations, real estate CAP rates, stock buybacks, and the amount of leverage big traders can maintain.

Not at all. In fact, I think they should have raised them long ago and never started QE3. No one knows why they waited until Trump was elected to begin the rate increase cycle and let them stay at zero for Obama's entire presidency. Completely unprecedented.

Rates went down too far and for too long and created a bubble in all assets including stocks, real estate, and even fine art.

Now rates are going back up and have reached a point where the process is reversing.

Higher interest rates affect everything from DCF valuations, real estate CAP rates, stock buybacks, and the amount of leverage big traders can maintain.

Ah, I misunderstood your position. I agree completely.

JRP3

Hyperactive Member

1. The economy doesn't turn on a dime. Trump inherited a good economy from Obama, it took a little while for him to screw it up.No, I was responding to the point that the market will come back when the Republicans are no longer in power. They no longer run the House.

2. The new Dem's have not yet taken their seats in the House so their "takeover" has had no effect.

1. The economy doesn't turn on a dime. Trump inherited a good economy from Obama, it took a little while for him to screw it up.

2. The new Dem's have not yet taken their seats in the House so their "takeover" has had no effect.

What if the economy was not "good"? What if the economy was built on a house of cards of low interest rates that masked what was really happening? If you follow just the stock market, it looked like we were in boom times But we weren't. This is why Main Street was looking for a change. Sanders and Trump were the ones pulling in the biggest crowds. Not the ones who wanted to maintain the status-quo like Hillary or Jeb.

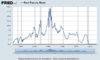

Labor participation rates have been low and remain low since 2008. Real wages are still not rising and haven't since 2008. While prices for housing, energy, and food kept rising. Consumer credit kept rising to make up the difference. That is the definition of a credit bubble. It's just not in housing like it was in 2007. Rising rates is reversing this and the stock market has caught on first. Where I live, real estate has also turned based on rising mortgage rates.

This is what happens when your print $4T and try to reverse the process of paying it back.

Last edited:

neroden

Model S Owner and Frustrated Tesla Fan

I should probably clarify.

Most traders in the markets like *predictability* and *certainty*. For good or for bad. To exaggerate only a little, predictable fascism or predictable communism are both arguably positive for values in the market. Uncertainty leads people to the sidelines, to cash.

Trump has been creating *unpredictability* and *uncertainty*, pretty much non-stop. His administration also seems flagrantly incompetent in many, many ways. Basically, he's a source of risk. The Republicans in Congress seem to have merely added to that unpredictability and uncertainty. By ignoring precedent in favor of desired-results-based judging, the Republicans on the Supreme Court have *also* added to that unpredictability and uncertainty.

Everything controlled by Republicans in the Federal Government right now is the sort of "no rule of law", "no predictable business environment", "arbitrary expropriation" stuff which causes *emerging markets* in *third world countries* to drop. The US is not immune. For example, everyone fears that Trump will suddenly add a tarriff to their business sector with no warning, because he's done that repeatedly.

Most traders in the markets like *predictability* and *certainty*. For good or for bad. To exaggerate only a little, predictable fascism or predictable communism are both arguably positive for values in the market. Uncertainty leads people to the sidelines, to cash.

Trump has been creating *unpredictability* and *uncertainty*, pretty much non-stop. His administration also seems flagrantly incompetent in many, many ways. Basically, he's a source of risk. The Republicans in Congress seem to have merely added to that unpredictability and uncertainty. By ignoring precedent in favor of desired-results-based judging, the Republicans on the Supreme Court have *also* added to that unpredictability and uncertainty.

Everything controlled by Republicans in the Federal Government right now is the sort of "no rule of law", "no predictable business environment", "arbitrary expropriation" stuff which causes *emerging markets* in *third world countries* to drop. The US is not immune. For example, everyone fears that Trump will suddenly add a tarriff to their business sector with no warning, because he's done that repeatedly.

I should probably clarify.

Most traders in the markets like *predictability* and *certainty*. For good or for bad. To exaggerate only a little, predictable fascism or predictable communism are both arguably positive for values in the market. Uncertainty leads people to the sidelines, to cash.

Trump has been creating *unpredictability* and *uncertainty*, pretty much non-stop. His administration also seems flagrantly incompetent in many, many ways. Basically, he's a source of risk. The Republicans in Congress seem to have merely added to that unpredictability and uncertainty. By ignoring precedent in favor of desired-results-based judging, the Republicans on the Supreme Court have *also* added to that unpredictability and uncertainty.

Everything controlled by Republicans in the Federal Government right now is the sort of "no rule of law", "no predictable business environment", "arbitrary expropriation" stuff which causes *emerging markets* in *third world countries* to drop. The US is not immune. For example, everyone fears that Trump will suddenly add a tarriff to their business sector with no warning, because he's done that repeatedly.

He has been unpredictable since he took office. That was two years ago. The market went straight up for two years and the market decides to correct now?

I think the Fed raising rates 9 times in two years has more to do with it.

If you were correct, the Mueller indictments would help the market.

Take off your political blinders and you'll see the obvious.

Edit: Traders like low interest rates more than predictability.

Last edited:

neroden

Model S Owner and Frustrated Tesla Fan

Fed rate raises can damage a rally, but again, they've been going on for two years, so that doesn't explain it. They certainly didn't help, but if it was just them, it would have dropped much earlier. Also, I looked into it and the level of leverage overall wasn't high enough to create a self-reinforcing deleveraging cycle, unlike 2008. If you remove your assumptions, you'll see that.

A lot of people didn't think Trump was really going to make the amount of mess he made. Of course there was the corporate-tax-cut rally, so market traders were pretty happy with Trump until the start of 2018.

But then he became "Tariff Man". Most market traders *really* hate tariffs, and I think it's not coincidental that the multiple rounds of tariffs come very shortly before the market drop. Most traders *really* hate tariffs, and the scariest sort are arbitrary and capricious tariffs. There's a visible market drop right after Trump writes the words "Tariff Man", even.

The indictments will only help the market if the tariffs get stopped. Congress overriding the tariffs would probably help.

TLDR: it's the tariffs.

A lot of people didn't think Trump was really going to make the amount of mess he made. Of course there was the corporate-tax-cut rally, so market traders were pretty happy with Trump until the start of 2018.

But then he became "Tariff Man". Most market traders *really* hate tariffs, and I think it's not coincidental that the multiple rounds of tariffs come very shortly before the market drop. Most traders *really* hate tariffs, and the scariest sort are arbitrary and capricious tariffs. There's a visible market drop right after Trump writes the words "Tariff Man", even.

The indictments will only help the market if the tariffs get stopped. Congress overriding the tariffs would probably help.

TLDR: it's the tariffs.

Fed rate raises can damage a rally, but again, they've been going on for two years, so that doesn't explain it. The level of leverage overall wasn't high enough to create a self-reinforcing deleveraging cycle, unlike 2008. If you remove your assumptions, you'll see it.

A lot of people didn't think Trump was really going to make the amount of mess he made. Of course there was the corporate-tax-cut rally, so market traders were pretty happy with Trump until the start of 2018.

But then he became "Tariff Man". Most market traders *really* hate tariffs, and I think it's not coincidental that the multiple rounds of tariffs come very shortly before the market drop. Most traders *really* don't like tariffs, and the scariest sort are arbitrary and capricious tariffs. There's a visible market drop right after Trump writes the words "Tariff Man", even.

TLDR: it's the tariffs.

Rate hikes do not kill a bubble immediately. It took two years of rate hikes to kill the housing bubble. In addition, the Fed is taking $50B monthly out of the credit markets with QT. A recession always happens after the peak of the Fed raising cycle.

That is much bigger than tarrifs.

Attachments

neroden

Model S Owner and Frustrated Tesla Fan

Sooooo, traders don't take money out of the market just because interest rates go up. They only take it out if one of two things happens:

(1) Their expected return on equities drops below the T-bill rate of return as T-bill rates go up. This has not happened.

(2) They get margin-called (or the corporate equivalent) due to increased interest payments.

Are you alleging that #2 has happened? I'd like to see further evidence.

By contrast, tariffs affect the expected profits of companies.

(1) Their expected return on equities drops below the T-bill rate of return as T-bill rates go up. This has not happened.

(2) They get margin-called (or the corporate equivalent) due to increased interest payments.

Are you alleging that #2 has happened? I'd like to see further evidence.

By contrast, tariffs affect the expected profits of companies.

He has been unpredictable since he took office. That was two years ago. The market went straight up for two years and the market decides to correct now?

I think the Fed raising rates 9 times in two years has more to do with it.

If you were correct, the Mueller indictments would help the market.

Take off your political blinders and you'll see the obvious.

Edit: Traders like low interest rates more than predictability.

The tax break, which fueled massive buybacks, was a band-aid that helped cover the wound. Furthermore, to your point on the Special Counsel, I would argue that indictments, until brought to their resolution, result in more uncertainty.

Sooooo, traders don't take money out of the market just because interest rates go up. They only take it out if one of two things happens:

(1) Their expected return on equities drops below the T-bill rate of return as T-bill rates go up. This has not happened.

(2) They get margin-called (or the corporate equivalent) due to increased interest payments.

Are you alleging that #2 has happened? I'd like to see further evidence.

By contrast, tariffs affect the expected profits of companies.

Rising rates change the following:

- Amount of leverage traders can keep

- DCF valuations

- Stock buybacks

- Real estate CAP rates

Why do you think everyone is so focused on the Fed meeting?

Previous market crashes always happened after they raised rates. There were no tariffs in 2001 or 2008.

The tax break, which fueled massive buybacks, was a band-aid that helped cover the wound. Furthermore, to your point on the Special Counsel, I would argue that indictments, until brought to their resolution, result in more uncertainty.

There were more stock buybacks under Obama. With higher corporate tax rates. Most stock buybacks were done with borrowed money. Fueled by low interest rates.

Attachments

Last edited:

The markets do hate uncertainty. I think when Trump took office there was the hope he would be a "business friendly" president.

Now I believe the market has woke to the realization the trump has NO plans NO idea's and is at most concerned about how his hair looks.

He is incapable of understanding anything other than crowd size and chant's of "lock her up"

Now I believe the market has woke to the realization the trump has NO plans NO idea's and is at most concerned about how his hair looks.

He is incapable of understanding anything other than crowd size and chant's of "lock her up"

neroden

Model S Owner and Frustrated Tesla Fan

Rising rates change the following:

- Amount of leverage traders can keep

- Yes. This is the mechanism. Again, are you alleging that traders are getting margin-called? Convince me of this.

-

DCF valuations

- Not if analysts are remotely competent... they should be using long-term average DCFs which project interest rates far into the future

-

Stock buybacks

- No.

-

Real estate CAP rates

- What on earth does this have to do with the stock market?

There were more stock buybacks under Obama. With higher corporate tax rates. Most stock buybacks were done with borrowed money. Fueled by low interest rates.

My point wasn't to contrast the stock market's performance under Obama with its performance under Trump. Rather, I was looking to contrast the market's performance through the summer of 2018 (from Trump's inauguration) with its performance since. (You had asked, "Why now?")

Dig deeper

Member

I think your getting annoyed with this person and they clearly aren't listening. Save yourself the aggravation. You said it yourself, it is demoralizing having these kind of conversations.

- Yes. This is the mechanism. Again, are you alleging that traders are getting margin-called? Convince me of this.

- Not if analysts are remotely competent... they should be using long-term average DCFs which project interest rates far into the future

- No.

- What on earth does this have to do with the stock market?

Similar threads

- Replies

- 2

- Views

- 753

- Replies

- 6

- Views

- 11K

- Replies

- 0

- Views

- 1K

- Replies

- 98

- Views

- 26K

- Replies

- 84

- Views

- 18K