I think a lot of money was made in the market (particularly the NASDAQ) last year, and a bunch of individual investors suddenly realized they have to write cheques to the IRS. Big ones. I'm reminded of mid-April 2001, which I believe started the bursting of the Internet bubble. This time, I don't see an actual bubble, so I hope for recovery. Keep plenty of dry powder.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla Investor's General Macroeconomic / Market Discussion

- Thread starter FluxCap

- Start date

You may not take it seriously, but I have a guess for this selloff in stocks with high multiplies. I am blaming Mark Zuckerberg and Facebook acquisition of Whatsapp. After this move I have started to see many people talking about bubbles creating snow ball effect. At least in my opinion it started with this, because he paid this ridicules price not with free cash neither with loans but thanks to high valuation.

Mario Kadastik

Active Member

What I'm worried about is that this may turn really into a bear market independent of any economic downturns. The market is just overextended, the margin usage is huge etc. So a correction to truer valuations is in order, but it's not even started really on s&p. So this may well continue months with little impact from real economic news that turn it. Anyone with stocks can just go away and ignore the noise, but anyone with any options really needs to think out a strategy and to be fair I don't have a good one yet. I expected to wait it out as most of what I have are LEAPs, but those LEAPs are going further and further OTM meaning that as this slump continues and if it does for say half a year, then most of those will become worthless. So should I exit all options and move the money to stock instead (to not miss out if things rally again) or hold out or ... I know that this kind of panic often means the end of the slump is near, but right now what worries me is that it's the nasdaq that's been falling, but not even that hard. It's down less than 10% from the high and the S&P is within 1-2% of its high so in reality the market hasn't really corrected much. Even the January correction was bigger, but there Tesla held its ground so I felt it less. Now the solars and Tesla have slumped at high beta and that hurts like hell and if it goes down further 10+% for the whole market I think the high fliers drop 30+% more from here ...

Good discussion, guys.

After yesterday's total carnage, today is looking more frenetic and indecisive. The market is once again testing up and down, with the fear index oscillating against the nasdaq. I'm paying attention to biotechs and small caps (IBB and IWM are ETF's that track these) in particular today, as well as the usual gold and treasuries.

On the economic news items front:

After yesterday's total carnage, today is looking more frenetic and indecisive. The market is once again testing up and down, with the fear index oscillating against the nasdaq. I'm paying attention to biotechs and small caps (IBB and IWM are ETF's that track these) in particular today, as well as the usual gold and treasuries.

On the economic news items front:

"Just released, the preliminary reading of the Michigan Consumer Sentiment survey for April rose to 82.6 from the reading of 80.0 that was reported in March. The Briefing.com consensus expected the index to improve to 81.0"

"The PPI (Producer Price Index) for total final demand dipped 0.1 percent in February after rising 0.2 percent in January. Market expectations were for 0.2 percent. Total final demand excluding food & energy declined 0.2 percent after increasing 0.2 percent the month before. The consensus called for 0.1 percent. Total final demand excluding food, energy, and trade services edged up 0.1 percent in February, matching the pace in January."

After a weekend of disappointing news from the Ukraine region and a test-firing of an ICBM by an uncooperative and increasingly hostile Russia, this morning we got a spate of relatively good news on the economic calendars:

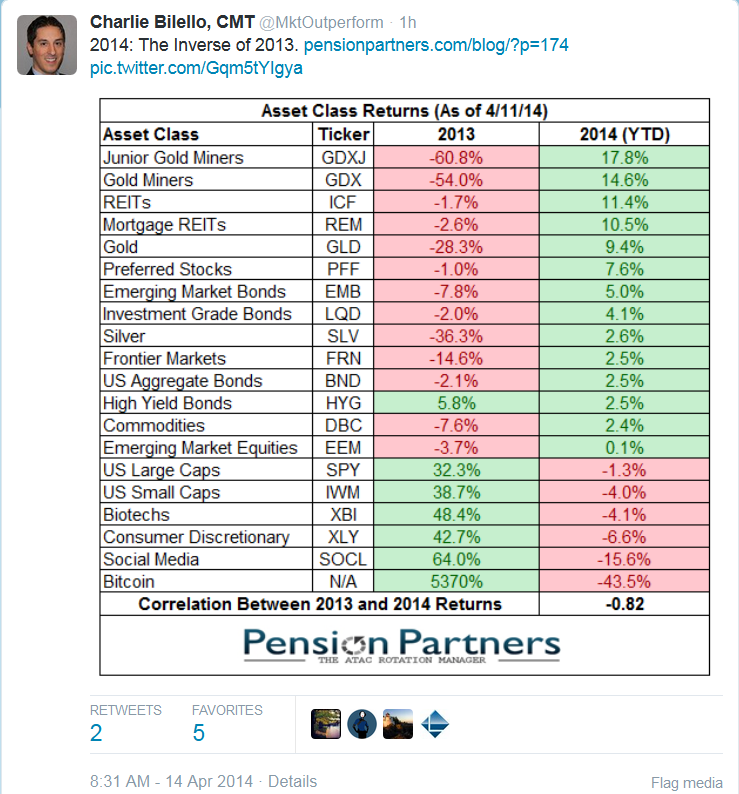

Also of interest is the performance of different asset classes so far in 2014. Here is a particularly interesting chart I thought I'd share that illustrates the tough 2014 we've had already fairly well:

It remains to be seen whether last week's sell-off continues, and VIX / VXX fear index should be watched closely to track market sentiment.

I'm personally heartened by the resistance TSLA showed at $200.

Here's hoping for a good week.

March Retail Sales report (+1.1% versus Briefing.com consensus 1.0%). As expected from the motor vehicle sales data, auto sales contributed significantly to overall sales growth. Sales at motor vehicle and parts dealers increased 3.1% in March after increasing 2.5% in February. Excluding autos, retail sales still increased a solid 0.7% in March, up from a 0.3% gain in February. The consensus expected these sales to increase 0.5%.

February business inventories rose 0.4%, which was below the 0.6% increase expected by the Briefing.com consensus. This follows the prior month's unrevised increase of 0.4%.

Also of interest is the performance of different asset classes so far in 2014. Here is a particularly interesting chart I thought I'd share that illustrates the tough 2014 we've had already fairly well:

It remains to be seen whether last week's sell-off continues, and VIX / VXX fear index should be watched closely to track market sentiment.

I'm personally heartened by the resistance TSLA showed at $200.

Here's hoping for a good week.

I don't quite know how to look at TSLA vs. QQQ in the light of Friday and today. Friday it seemed to be bucking the trend with considerable support at 200 and closing strong against QQQ weakness. Today just the opposite - the Nasdaq and the tech components that I have been watching had a pretty strong day for at least the first half, but TSLA very weak. I really really hope the tax issue is a plausible excuse for this, but if that were the case, you would think that the downward pressure would be letting up some by now, no? Some ideas about this, anyone?

marvinat0rz

Member

Anyone with stocks can just go away and ignore the noise, but anyone with any options really needs to think out a strategy and to be fair I don't have a good one yet

My options strategy was to close my single open option position, which was firmly in the red. This might be a poor decision, but that the moment I think the risk/reward curve looks unhealthy.

As many others have pointed out, we have already had a solid correction in high-multiple stocks. This could just be a temporary correction.

But on the other hand, a lot of high-multiple (or even earnings-negative) stocks have a day of reckoning coming. I am thinking of the social media stocks like Facebook, Twitter, LinkedIn and a lot of biotech firms which are valued on revenue multiples rather than other metrics. How anyone can detatch earnings from their analysis to this degree is a mystery to me. Honestly, I do computer software for a living and I think Facebook's $150 billion valuation is ludicrous. So does Facebook's management, judging from how they're treating their stock like monopoly money in their acquisition strategy. These companies almost have nowhere to go with regards to growing their earnings - at least not the 100x earnings growth implied by their current valuations. Facebook might, seeing as some of their latest acquisitions have serious strategic merit (Whatsapp, Oculus VR). But regardless, in a broader market downturn (which we already have to some extent), these stocks will get slaughtered and brought down to a more suitable risk/reward level. Bubble is such an inflationary term, but there is irrational investor behavior in this sector. Maybe fueled by low interest rates and the fantastic boom/success of hundreds of early-stage startups in the US.

The problem is, in a downturn like this, all momentum stocks will get identical treatment from fund managers and retail investors. If this scenario occurs, we could easily have Tesla back in the double digits. This would of course be a magnificent buying opportunity provided that car buyers don't stop buying cars in the meantime, but an options portfolio would get hammered regardless of Tesla's execution. Hell, I didn't think Tesla would hit $150 before 2017, so it would surprise me very little to see $150 again before the year is over. Seeing $320 would scare me, I think.

Of course I am also writing this now that we're down 25% already, and the NASDAQ is down almost 10%. The correction could be behind us. But there is plenty of downwards potential here still, even in the absence of negative news. Stock market irrationality goes both ways. (If $100 sounds like a fairy tale, imagine how things feel if the NASDAQ falls 30% from its peak - a completely precedented stock market crash even during the current decade. Note I'm talking risk management here, not prediction).

Last edited:

I don't quite know how to look at TSLA vs. QQQ in the light of Friday and today. Friday it seemed to be bucking the trend with considerable support at 200 and closing strong against QQQ weakness. Today just the opposite - the Nasdaq and the tech components that I have been watching had a pretty strong day for at least the first half, but TSLA very weak. I really really hope the tax issue is a plausible excuse for this, but if that were the case, you would think that the downward pressure would be letting up some by now, no? Some ideas about this, anyone?

I agree. Today, unlike NFLX and AMZN and a few others, we broke significantly with a more general NASDAQ-tracking trend. I suspect this was people reading FUD articles over the weekend and deciding to use TSLA holdings for their tax day cash-outs, combined with a "pouncing" by algo bots that were hunting for stop losses as Curt mentioned today in the short-term thread, followed by a slew of automatic buy orders at 195 that propelled us back up to 200 after hours. In the absence of any positive news, for one of the most shorted stocks on the NASDAQ right now, the bears can often win on days like this. Elon was busy launching SpaceX rockets (though they had to scrub the launch and wait for another day), but I'm hoping there is going to be some upwards momentum leading up to Q1 ER next month with some news from his corner.

If there was a silver lining, perhaps it was the resilience TSLA showed to bounce off 195 and trend back upwards after hours.

Last edited:

mershaw2001

I'm short the short sellers

followed by a slew of automatic buy orders at 195 that propelled us back up to 208 after hours.

If there was a silver lining, perhaps it was the resilience TSLA showed to close above 200 again.

I don't see where you got these from? I show that after hours the highest was 200.50, and it didn't close above 200 today.

I don't see where you got these from? I show that after hours the highest was 200.50, and it didn't close above 200 today.

I think...from my imagination. Apologies. I meant 198 after hours.

This morning, a modest increase in the CPI was more than offset by negative sentiment from Ukraine, general market panic, and a few other economic indicators that were decidedly negative. The Housing Market Index disappointed below consensus estimates, Janet Yellen emphasized that the economy is not out of the woods yet, and several other indicators pointed to a sluggish early spring.

Looking quite bleak in the markets today to be sure, and Tesla is taking an outsized beating. I'm seeing gleeful tweets on the short side about buying TSLA $100 puts for "a few months out" and it feels like those are the same emotions I felt betting on TSLA to go from $265 to $320 "a few months out." Honestly, I really don't see Tesla Motors with a market cap below $25billion as justifiable given the extraordinarily strong fundamentals of the business, but that doesn't keep the market from yanking us down by the throat at times like this.

Disclosure: this morning, I added to my short positions, adding some QQQ puts to my IBB puts for downside protection against my TSLA LEAPS, which I do not plan to sell.

Looking quite bleak in the markets today to be sure, and Tesla is taking an outsized beating. I'm seeing gleeful tweets on the short side about buying TSLA $100 puts for "a few months out" and it feels like those are the same emotions I felt betting on TSLA to go from $265 to $320 "a few months out." Honestly, I really don't see Tesla Motors with a market cap below $25billion as justifiable given the extraordinarily strong fundamentals of the business, but that doesn't keep the market from yanking us down by the throat at times like this.

Disclosure: this morning, I added to my short positions, adding some QQQ puts to my IBB puts for downside protection against my TSLA LEAPS, which I do not plan to sell.

blakegallagher

Member

Thanks for the updates Flux Capacitor ! Although I do not post in this thread much due to my complete lack of knowledge on the general markets it is great to get updates from someone with more knowledge on it. Keep it coming please  .

.

Thanks for the updates Flux Capacitor ! Although I do not post in this thread much due to my complete lack of knowledge on the general markets it is great to get updates from someone with more knowledge on it. Keep it coming please.

agree- thanks Flux

mershaw2001

I'm short the short sellers

Thanks fluxy. I think I speak for a lot of us saying that it's good to have someone summarizing and some discussion of the broader market because TSLA doesn't occur in isolation.

You're welcome all. I've been a bit busy last couple days but will chime in briefly here:

Today, the market digested several pieces of economic news, but the dual positives of a small but not insignificant gain in China's GDP yesterday lessened fears about Chinese economic weakness, as well as this stunner this morning:

We also got some manufacturing data from the Philly Fed:

The fear index (VIX/VXX) is also at its lowest level in several sessions, but I see that as a bit of overconfidence based on today's news alone.

Now personally, I do NOT want to be holding short-term bullish bets over the long weekend, as today is the last day of trading in the US given the long Easter weekend with markets closed tomorrow, Friday April 18th. So anything you hold now will have 3 days of non-liquidity.

Some slightly encouraging signs out of Ukraine as Kerry reports on his talks, but 3 days is a long time for Putin to get up to no good again, and I'm betting people read the paper over the weekend and come in selling on Monday if there is any small amount of negative news.

I am personally bullish on Tesla around Q1 ER, but not before that. I'm still bearish on this market overall, and actually initiated a few more market-spanning short positions today to hedge against my long TSLA options. Putin is just that unpredictable and I don't like it.

Have a great weekend everyone.

Today, the market digested several pieces of economic news, but the dual positives of a small but not insignificant gain in China's GDP yesterday lessened fears about Chinese economic weakness, as well as this stunner this morning:

Initial jobless claims for the April 5 week fell a stunning 32,000 drop to 300,000 in initial jobless claims for the April 5 week. However, Easter can play havoc with economic data in surrounding weeks and this may be the case. This was the largest drop in more than 10 years and, though the Labor Department says there are no special factors involved, this may not be true due to seasonal adjustments as Easter last year fell on March 31. But it is hard to get around improvement in this report.

We also got some manufacturing data from the Philly Fed:

Activity in the Mid-Atlantic manufacturing sector is picking up further steam this month based on the closely watched Philly Fed index which jumped 7.6 points to 16.6 to signal the strongest rate of monthly growth since September. New orders are up 9.1 points to 14.8 for the strongest reading since December.

The fear index (VIX/VXX) is also at its lowest level in several sessions, but I see that as a bit of overconfidence based on today's news alone.

Now personally, I do NOT want to be holding short-term bullish bets over the long weekend, as today is the last day of trading in the US given the long Easter weekend with markets closed tomorrow, Friday April 18th. So anything you hold now will have 3 days of non-liquidity.

Some slightly encouraging signs out of Ukraine as Kerry reports on his talks, but 3 days is a long time for Putin to get up to no good again, and I'm betting people read the paper over the weekend and come in selling on Monday if there is any small amount of negative news.

I am personally bullish on Tesla around Q1 ER, but not before that. I'm still bearish on this market overall, and actually initiated a few more market-spanning short positions today to hedge against my long TSLA options. Putin is just that unpredictable and I don't like it.

Have a great weekend everyone.

Last edited:

This morning at 10am, the modestly upbeat enthusiasm from yesterday's NASDAQ rally by NFLX, TSLA and others disappeared rather fast as the market was surprised by a decidedly negative report on new home sales:

While I personally was not surprised as my wife is a realtor and we are property developers with our eyes on the ground, apparently the market has not realized that the snow that blanketed much of the most valuable real estate in the country in the first quarter was a natural suppressor to home sales, and I fully expect this number to forcefully rebound next month as the prime spring selling season for homes gets underway. Still, the market did not like this one bit and a sell-off has resumed almost across the board.

The VIX "fear index" spiked heavily this morning on this news, and has fluctuated since then. It appears traders are waiting to see if the full-on sell-off resumes or if the decline today will be tempered.

Additionally, events in Ukraine show little sign of improving significantly after an Easter weekend "truce" was pronounced by Russian media to be "over," and this has the attention of the markets once again.

In an unsettling setback for an already unsteady housing sector, new home sales fell very sharply in March, down 14.5 percent to a 384,000 annual rate that is far below the Econoday consensus for 455,000 and far below the low end estimate of 440,000. Revisions offer a marginal offset, with February and March revised upward by a combined 19,000.

Prices, arguably unsustainably high prices, are a major factor constraining sales of new homes, as they are for sales of existing homes. The median price surged 11.2 percent last month to a record high of $290,000. Year-on-year, new home prices are up 12.6 percent. This compares with a year-on-year decline in sales -- not gain in sales -- of 13.3 percent.

Low supply of homes on the market has also been constraining sales though this factor, because of the decline in sales, eased sharply in March. Supply relative to sales rose to 6.0 months, well up from 5.0 and 4.8 months in the prior two months and compared against 4.2 months in March last year.

Regional data show sweeping declines across the Midwest, West, and South. The Northeast, which is by far the smallest market for new homes, shows a gain. The Dow is moving to opening lows in immediate reaction to today's report.

While I personally was not surprised as my wife is a realtor and we are property developers with our eyes on the ground, apparently the market has not realized that the snow that blanketed much of the most valuable real estate in the country in the first quarter was a natural suppressor to home sales, and I fully expect this number to forcefully rebound next month as the prime spring selling season for homes gets underway. Still, the market did not like this one bit and a sell-off has resumed almost across the board.

The VIX "fear index" spiked heavily this morning on this news, and has fluctuated since then. It appears traders are waiting to see if the full-on sell-off resumes or if the decline today will be tempered.

Additionally, events in Ukraine show little sign of improving significantly after an Easter weekend "truce" was pronounced by Russian media to be "over," and this has the attention of the markets once again.

Last edited:

thanks for that Flux- I have some exposure to real-estate markets as well and observed similar. In addition, as prices have moved back to a more normal position and inventory of distressed has been absorbed, the appetite of investor grade buyers is off existing markets. I think this correction will resume the real-estate markets to a more normal slower but positive growth (nationwide basis- of course local markets are they're own thing), where more of the buyers and sellers transition from the investor heavy character. That could actually be very helpful to new home builders going forward (in addition to improving weather!)

Similar threads

- Replies

- 2

- Views

- 829

- Replies

- 6

- Views

- 11K

- Replies

- 0

- Views

- 1K

- Replies

- 98

- Views

- 26K

- Replies

- 84

- Views

- 18K