I have been intrigued by Loup Ventures' recent analysis concluding that returns from tech companies with strong revenue growth -- above 20% annually -- have been more than four times higher over the past five years than tech companies with slower growth.

From a basket of 39 leading tech names, Loup identified 14 companies with y/y revenue growth of 20% or more for five years including Tesla, Facebook, Amazon, Netflix and Google, and 25 tech companies with slower growth. The conclusion: "The five-year return for the growth group was 485% vs. the non-growth return of 116%, a more than 4x difference." There's Still No Such Thing as a Value Stock in Tech | Loup Ventures

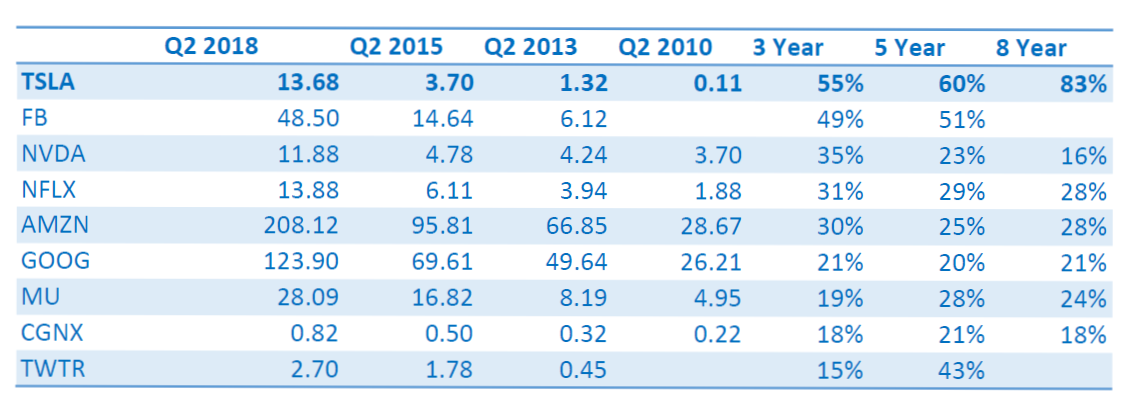

From Loup's list of 14 high-growth tech companies, the chart below shows annualized growth for the top companies over 3, 5 and 8 year periods (since Tesla went public).

Can you guess which company stands out from the rest?

(Figures are TTM for most recent quarter.)

Two highlights:

Using Elon/Tesla's estimates where available (700K Model 3/1 million Model Y/100K Semi/100K S/X), and excluding for sake of argument revenues from the Tesla Network, 2023 revenues could look something like this:

700K Model 3 @$45K $31.5B

1M Model Y @$45K $45B

300K pickup @$50K $15B

100K S/X @$100K $10B

100K Semi @$165K $16.5B

200K solar roof @$40K $8B

5K Roadster at $225K $1.1B

Storage $6B

Total: $133B

This would result in a revenue CAGR of 58%, in line with the past 3 and 5 year periods.

With Model 3 production at ~5K/week, Tesla is now in a position to be sustainably profitable beginning this quarter or in Q4. This is a potential game changer.

Once profitability is here, I believe there is a good chance savvy investors will start filtering out the noise (which is currently at record levels) and recognizing that (1) growth is where the money is in tech; (2) Tesla is a growth juggernaut, and (3) that Tesla's current price does not come close to pricing in its potential.

I am looking forward to the next couple years.

From a basket of 39 leading tech names, Loup identified 14 companies with y/y revenue growth of 20% or more for five years including Tesla, Facebook, Amazon, Netflix and Google, and 25 tech companies with slower growth. The conclusion: "The five-year return for the growth group was 485% vs. the non-growth return of 116%, a more than 4x difference." There's Still No Such Thing as a Value Stock in Tech | Loup Ventures

From Loup's list of 14 high-growth tech companies, the chart below shows annualized growth for the top companies over 3, 5 and 8 year periods (since Tesla went public).

Can you guess which company stands out from the rest?

(Figures are TTM for most recent quarter.)

Two highlights:

- Tesla consistently has been at the top of the chart over 3, 5 and 8 year periods.

- Tesla's growth has been far greater than other top tech growth companies

- Over the past 5 years Tesla's growth rate was more than double almost every other company on the list -- including leading growth names such as AMZN, NFLX, GOOG, and NVDA.

- The only exceptions are FB and TWTR, but they also grew significantly slower than TSLA.

Using Elon/Tesla's estimates where available (700K Model 3/1 million Model Y/100K Semi/100K S/X), and excluding for sake of argument revenues from the Tesla Network, 2023 revenues could look something like this:

700K Model 3 @$45K $31.5B

1M Model Y @$45K $45B

300K pickup @$50K $15B

100K S/X @$100K $10B

100K Semi @$165K $16.5B

200K solar roof @$40K $8B

5K Roadster at $225K $1.1B

Storage $6B

Total: $133B

This would result in a revenue CAGR of 58%, in line with the past 3 and 5 year periods.

With Model 3 production at ~5K/week, Tesla is now in a position to be sustainably profitable beginning this quarter or in Q4. This is a potential game changer.

Once profitability is here, I believe there is a good chance savvy investors will start filtering out the noise (which is currently at record levels) and recognizing that (1) growth is where the money is in tech; (2) Tesla is a growth juggernaut, and (3) that Tesla's current price does not come close to pricing in its potential.

I am looking forward to the next couple years.

Last edited: