Starting a new thread on this.

Yes, they need to sell the cars too, not just produce them. But, there is no evidence that they can't sell the cars they are producing. All evidence is they can't make enough cars - esp. in Q1. Inventory build up is mainly from Model 3 that they couldn't deliver in EU/China + just 2 weeks worth of sales in US (other manufacturers are happy to have an inventory of no more than 8 weeks). Infact Tesla needs to build up the inventory even more in order to quickly deliver the cars to customers - like 2 or 3 days after they order which would be ideal. There is a slight excess inventory of older 3 & X, which they will finally have to discount and sell. Just normal industry model change over practice.

They aren't making enough 3s because they don't have enough cells. How do we know this, for sure ? Because, if they had excess cells they would be making a lot of power walls and sell. There is a huge backlog of powerwall orders, as you may know.

Yes, repairs etc are taken into account. Infact most of the items are. I posted these in other threads, but repeating here.

BTW, profit is not a very useful metric. What they really need to focus on is positive cash flow. They can easily achieve that with small increase in sales over Q1.

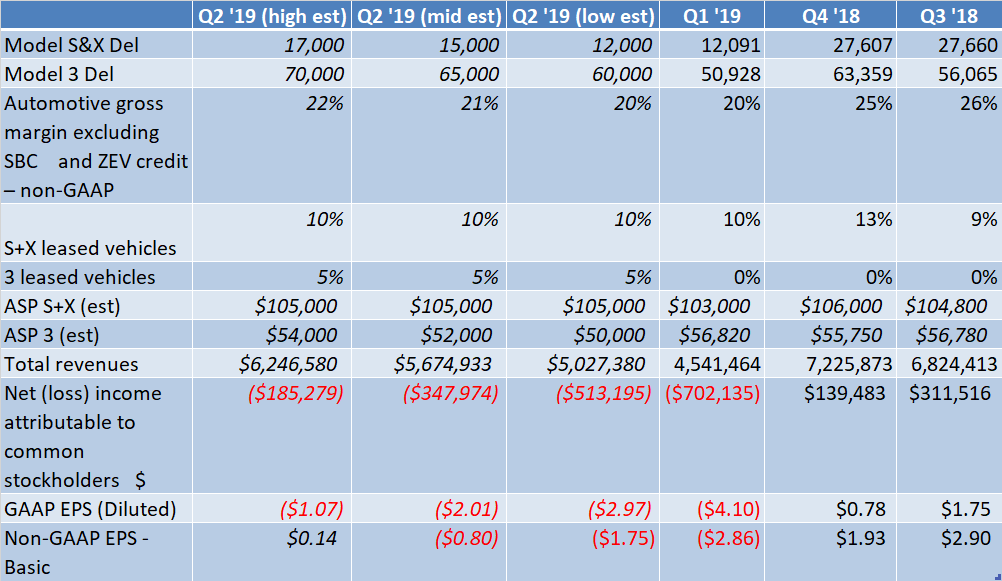

Anyway, here is my Q2 estimate.

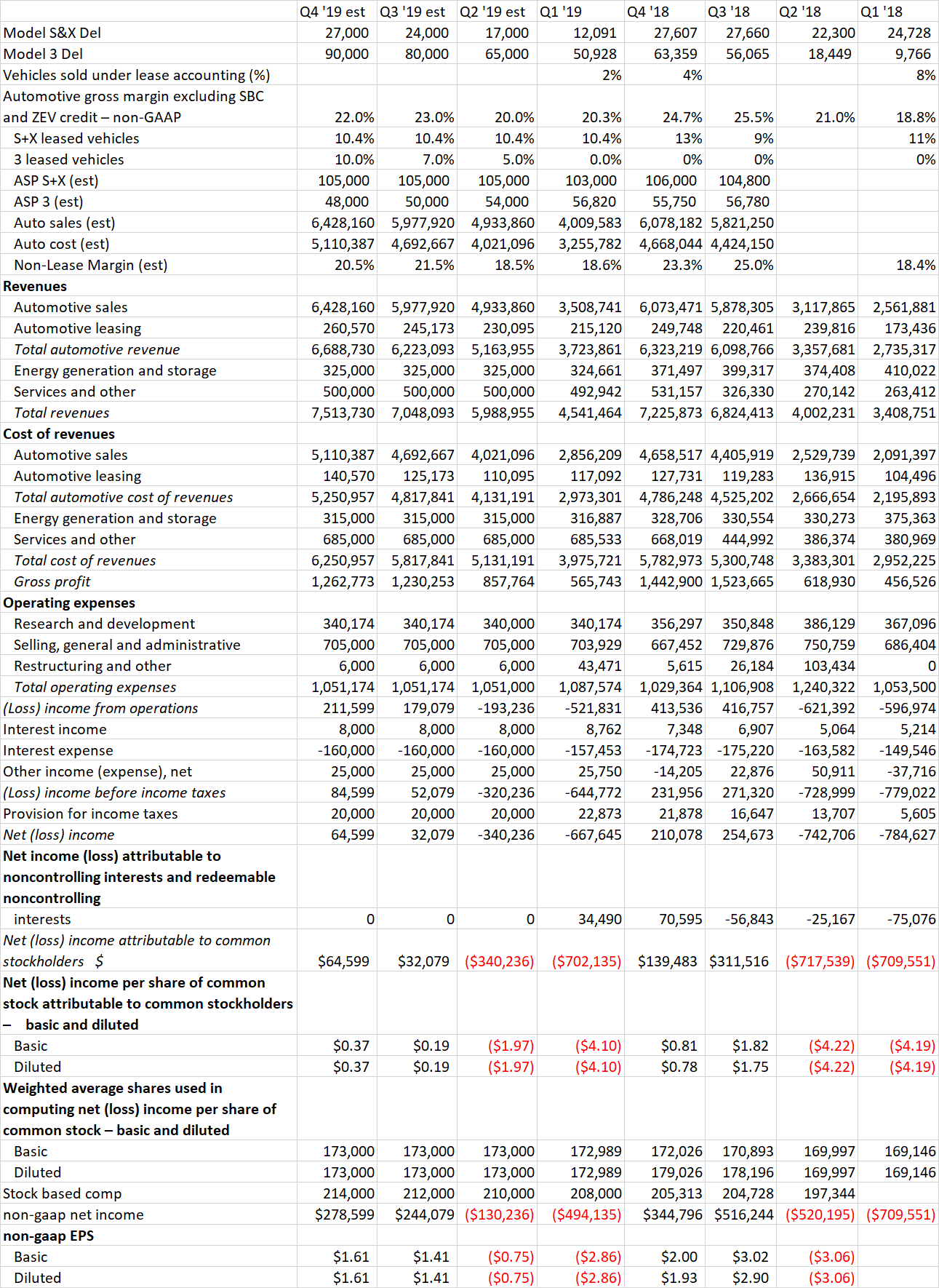

Here is my rough p&l model.

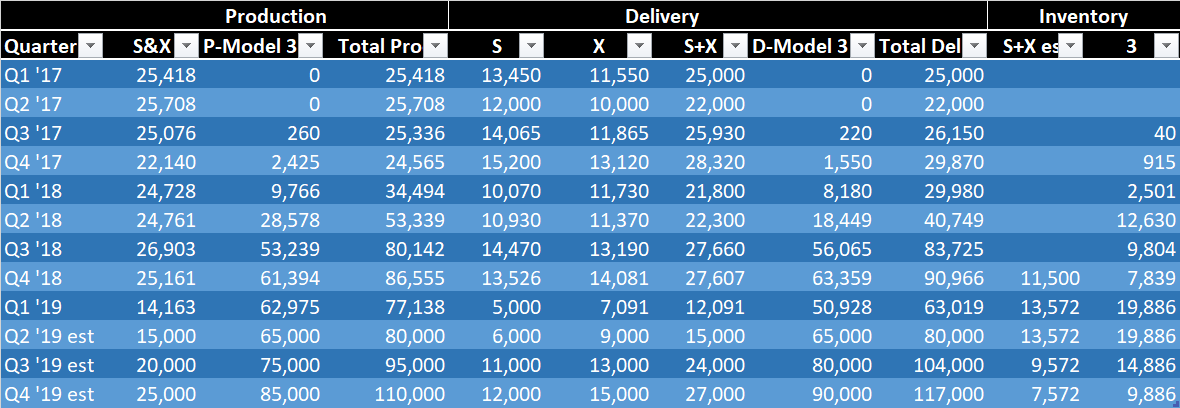

Here are my production, delivery estimates.

Musk is a drama queen. Don't go purely by what he says. Just as he can be very optimistic and exaggerate (robotaxi next year !), he can swing the other way too. He is basically saying just because they got some money doesn't mean they don't need to cut costs.I am quoting the logical gap you seem to be having.

Producing the cars does not make money. In order to make money not only you need to make the cars, you must sell them (at a profit, hopefully) first!

You don't need to be a finance person to understand this simple thing. If the cars are not selling, ASPs do not matter (I don't even know if you include all the frequent repairs in your calculations, that's a second order stuff that's not important if the cars are not selling first).

The problem that could be trivially observed with Tesla is inventory buildup. That means they sell less cars than they make. Therefore it makes no sense to make more cars. Therefore they are not making any more cars than they do and instead it even makes sense to make fewer cars!. In fact... it appears that's exactly what they are doing (esp. on the S/X front where they supposedly have the best margins).

Of course since Tesla is paying their suppliers in arrears, this all creates another problem, where the increasing sales cashflow lets them pay off older amounts due easily, as the sales go down - so does the cashflow and suddenly they need to pay way more to suppliers than they are making on sales. This is just basic personal financing with some minimal differences.

The whole "we must really conserve cash" email from Elon the other day is just another sign they are really show on cash, why do you think that is? Because they are really flush with cash?

Anyway, don't want to attract any moderator ire for posting this stuff in the wrong place.

Yes, they need to sell the cars too, not just produce them. But, there is no evidence that they can't sell the cars they are producing. All evidence is they can't make enough cars - esp. in Q1. Inventory build up is mainly from Model 3 that they couldn't deliver in EU/China + just 2 weeks worth of sales in US (other manufacturers are happy to have an inventory of no more than 8 weeks). Infact Tesla needs to build up the inventory even more in order to quickly deliver the cars to customers - like 2 or 3 days after they order which would be ideal. There is a slight excess inventory of older 3 & X, which they will finally have to discount and sell. Just normal industry model change over practice.

They aren't making enough 3s because they don't have enough cells. How do we know this, for sure ? Because, if they had excess cells they would be making a lot of power walls and sell. There is a huge backlog of powerwall orders, as you may know.

Yes, repairs etc are taken into account. Infact most of the items are. I posted these in other threads, but repeating here.

BTW, profit is not a very useful metric. What they really need to focus on is positive cash flow. They can easily achieve that with small increase in sales over Q1.

Anyway, here is my Q2 estimate.

Here is my rough p&l model.

Here are my production, delivery estimates.

Last edited: