Actually they are producing it for quite a while now. Look up e-up!. Not saying that it's a good car or smth but it's a small electric car.https://twitter.com/DeItaone/status/1332362983780081675?s=20

VOLKSWAGEN WILL NOT PRODUCE A SMALL ELECTRIC CAR FOR AT LEAST ANOTHER THREE YEARS - FT

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Among several others, Rob discussed it in one of his videos and Gary Black addressed it in Twitter.

Thanks! I feel bad when someone mentions Rob, Dave Lee or any of the other various outlets that follow TSLA as closely as those in this thread, like I showed up to class today without reading the assigned Chapters last night (which I normally do), lol.

@EnzoXYZ You should be able to change it after the fact. Depending on your broker, you might have to wait until later Monday or Tuesday to change it online. If you can't figure it out, call your broker (or online chat).No. Mostly its FIFO - First In First Out.

Thought about liquidating calls just for the weekend to save on theta decay, but outweighed by rising IVs and likelihood of >600 in premarket.

Discussion must now move to the likely effect of S&P announcement: will it cause a drop in IV even if goes as expected? A market starved for news will make news out of anything.

Discussion must now move to the likely effect of S&P announcement: will it cause a drop in IV even if goes as expected? A market starved for news will make news out of anything.

Tslynk67

Well-Known Member

$DJI +0.1%

COMP +0.9%

SPX +0.2%

NKLA -7.6%

GM -0.9%

F +0.1%

FCAU +0.3%

TSLA +2.0%

A fourth consecutive day of TSLA all-time intraday and closing highs

ATH open too

Today's reported trading volume is very weird. The total is 36.8m. But if you look at the hourly, they are these:

hour 1: 10.8

hour 2: 6.0

hour 3: 4.2

hour 4 (only half an hour): 2.5

Total: 23.5

Any insights?

hour 1: 10.8

hour 2: 6.0

hour 3: 4.2

hour 4 (only half an hour): 2.5

Total: 23.5

Any insights?

NKLA -7.6% - Should really be -37.6%...can't really understand how a company with 0 products and 0 in-house development is still worth this much.$DJI +0.1%

COMP +0.9%

SPX +0.2%

NKLA -7.6%

GM -0.9%

F +0.1%

FCAU +0.3%

TSLA +2.0%

A fourth consecutive day of TSLA all-time intraday and closing highs

StealthP3D

Well-Known Member

The baseline is going "all-in" at $373 ($74.60 post-split) on March 19.

I plunged heavy into 210115C650s last week which have tripled. My IRA is up 60% since Friday's close.

"Once in a lifetime".

I've always heard "10-bagger" used to refer to a single trade or, alternatively, an average cost basis.

But I still don't see how you figure an ~8 bagger plus a 3 bagger = a 10 bagger.

Thought about liquidating calls just for the weekend to save on theta decay, but outweighed by rising IVs and likelihood of >600 in premarket.

Discussion must now move to the likely effect of S&P announcement: will it cause a drop in IV even if goes as expected? A market starved for news will make news out of anything.

I was thinking an announcement of two tranches could cause even more buying pressure next week as speculators rush to get in before indexers are forced to buy.

adiggs

Well-Known Member

Right before the bottom of the hour, CNBC felt the need to mention the minor Tesla recall. For any other company, such a recall would be a non-event. I get that Tesla is high profile, but does seem odd to mention, especially when the timing of the mention by CNBC is taken into account. TSLA saw about a $6 decline right after the CNBC mention.

Odd timing, yes.

Or business as usual in the TSLA investing universe.

Today's reported trading volume is very weird. The total is 36.8m. But if you look at the hourly, they are these:

hour 1: 10.8

hour 2: 6.0

hour 3: 4.2

hour 4 (only half an hour): 2.5

Total: 23.5

Any insights?

Actually yesterday's reporting was even worse:

H1: 9.3

H2: 6.0

H3: 3.9

H4: 3.6

H5: 3.4

H6: 3.0

H7: 2.4

Total: 31.6

Reported Total: 48.9

BTW, this was the FSD example that immediately caused me to want my shares back today. Now looking for a Model Y.I found the reason TSLA´s up again today:

Unbelievable. Just wow.

Thanks!

I have majority at Schwab. Anyone use them for options?@EnzoXYZ You should be able to change it after the fact. Depending on your broker, you might have to wait until later Monday or Tuesday to change it online. If you can't figure it out, call your broker (or online chat).

The VW e-up!/Skoda Citigo IV/Seat Mii trio is EOL. Their production was supposed to end earlier this year, but VW was lacking EU ZEV Credits so they opened the order books for a limited time again this fall. Over here they offered a quote of ~200 and it was sold out in 4 days. They will produce these pre-orders thru 2021, but at some point next year it is done and they are not taking any more orders either.Actually they are producing it for quite a while now. Look up e-up!. Not saying that it's a good car or smth but it's a small electric car.

The ID.1 is supposed to be replacing it, but it is not due for 2-3 more years.

StealthP3D

Well-Known Member

I have majority at Schwab. Anyone use them for options?

Yes, they've always let me change my lots in the window between the trade and settlement.

Mo City

Active Member

I meant it in terms of the total value of my IRA.I've always heard "10-bagger" used to refer to a single trade or, alternatively, an average cost basis.

But I still don't see how you figure an ~8 bagger plus a 3 bagger = a 10 bagger.

After last Friday's close, I was at 6.18x. Since then, 1.52x more (only the big 15Jan call purchase last week tripled in value). Finished up at 9.42x after the late slide. The mid-morning peak was sweet while it lasted.

agastya

Member

FIFO can be adjusted to other sale arrangements. I’ve changed mine with my broker to LIFO (Last In First Out) for minimizing tax ramifications on trading shares.

HiCost is even better if you trade regularly -

samppa

Active Member

It's been a great week! Looking forward to next 3 weeks

Time to celebrate a bit

Time to celebrate a bit

agastya

Member

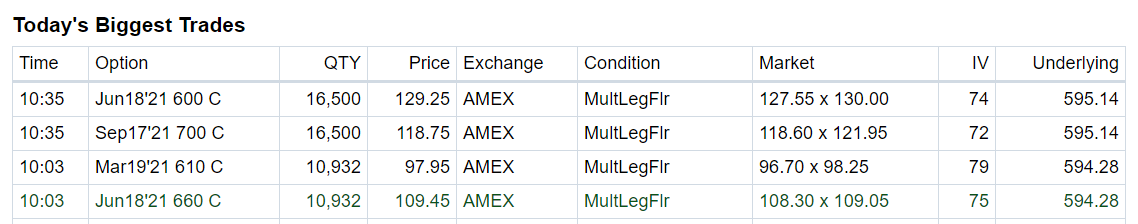

Some very high volume OTM spreads in the options market today. Should be the MMs given the volume - does anyone know how one can find out which leg was long v/s short?

Gary Black suggests that FAANG is out and FAATAM is in:

https://twitter.com/garyblack00/status/1332331310547779584

Would sound even better with an ORGANA addition.

https://twitter.com/garyblack00/status/1332331310547779584

Would sound even better with an ORGANA addition.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K