Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StealthP3D

Well-Known Member

When faced with a choice between being a laughing stock for being wrong and admitting mistakes and correcting them, the underperforming analysts will continue to support their invalid assertions citing other FUD and using financial models that don’t fit true market realities.

Will they ever stop? Not any time soon. Tesla hate has become a familiar habit and underperforming analysts will continue to go there when feeling threatened (which is often).

This is good news for me. Because I have to sell all my TSLA stock when all the analysts have a "buy" rating!

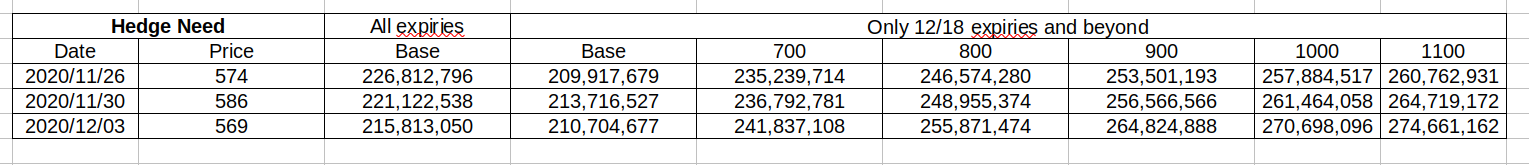

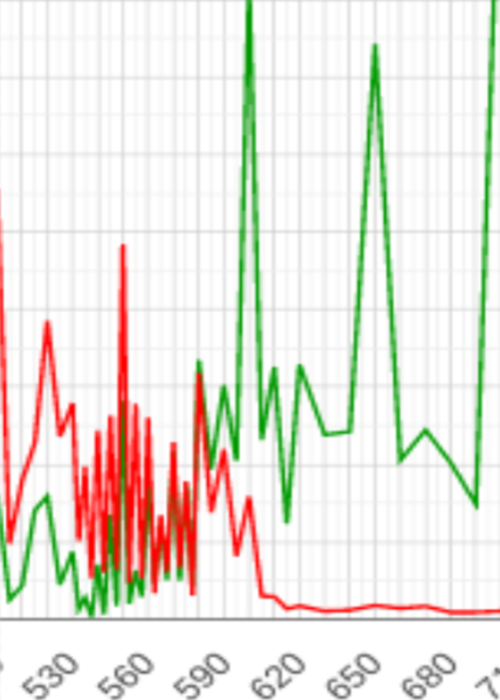

I posted this elsewhere, and wanted to bring it back to the thread. Options continue to be bought in good numbers for a post inclusion move. Looking to update this twice a week may be, but here's the view:

With both Morgan Stanley and Goldman Sachs recently moving into the Tesla BUY camp ahead of S&P 500 inclusion, this may be a setup for a huge follow-on share offering at a nice price. Those firms would likely be lead underwriters.

This is good news for me. Because I have to sell all my TSLA stock when all the analysts have a "buy" rating!

Especially if GJ says to buy. If that happens and I survive the heart attack, I will immediately sell - otherwise I will continue to HODL unless I am dead, in which case I will just hold on.

StealthP3D

Well-Known Member

"The ability to subdue the enemy without battle is a reflection of the ultimate supreme strategy. The supreme is to attack enemies' strategies and plans, by thwarting them. Next is to attack the enemies' strategic alliances with other nations." (Chapter 3, Sun Tzu Art of War)

I have been thinking about the sudden GS upgrade to $780, after their previous downgrade. Perhaps it is more of a defensive move to counter their bigger fear. Their upgrade is more a move to discourage overshooting $780 during the inclusion period than it is a genuine recognition of the TSLA fundamentals we HODL'ers are aware of.

Ponder this.

I don't think that's it. Why would GS think that one brokerage analysts price target is going to discourage overshooting that price target (when Tesla regularly blows through analyst price targets from other brokerages). Did you mean this gives GS the ability to lower their price target as TSLA approaches it? That doesn't seem like it would work much better.

A better explanation is simply that GS and friends are now positioned to benefit from a rising TSLA share price.

ZeApelido

Active Member

As we sit just under pre-split $3,000 per share, I'd just like to remind you that in June, 80% of you didn't think we'd even see $2,000 per share until later 2021.

When will TSLA first reach $2000 / ... - Poll Results - StrawPoll

When will TSLA first reach $2000 / ... - Poll Results - StrawPoll

Yeah. I conservatively figured 1k by end of 2020. Whoops. Even this $600 point is surprising in that I don't think it's overvalued at all, or if it is that's a very short term situation and I'd be afraid to miss the next jump up.As we sit just under pre-split $3,000 per share, I'd just like to remind you that in June, 80% of you didn't think we'd even see $2,000 per share until later 2021.

When will TSLA first reach $2000 / ... - Poll Results - StrawPoll

Sudre

Active Member

Looks like yesterday the option world, while busy, didn't change much in actual max pain. THEY are still looking for just under $600. $560 seems to be the best low stopping point. THEY are probably selling some 590 Puts today.

Just my gut, I don't have hard data to back this up, but I would bet Tesla is trying to get the Roadrunner pilot line's kinks ironed out. If 4680 cells with DBE (Dry Battery Electrode) are to a point where they are sure of them, then the water requirements in Berlin are at least an order of magnitude less than current 2170 tech. That would make a big difference in their permit request, and probably could be the hold up.

Just my 0.02. Take it for what it is worth (nothing).

Just watched yesterday´s Rob Maurer Tesla daily and he featured this article: Exclusive: LG Chem to double China battery capacity to meet Tesla demand - sources

The firm, a supplier for Tesla’s Shanghai-built Model 3, will also ship its increased output from China as well as Korea to Tesla’s factories in Germany and the United States, said two people with knowledge of the matter, signalling an increased role in the supply chain of the world’s leading EV manufacturer.

It would fit the puzzle if LG would do 4680s. Fremont is fine for the very beginning of Berlin and/or Austin GFs, but I think they will need an intermediate solution before either have there own cell production. When that is online, LG can supply the 4680s to Shanghai which will transition at some point. Just my speculation though.

FSD 6 is still struggling with one of the most complicated maneuvers (unprotected left turns) in Automated driving. Would be super interesting to see how long before FSD can handle these situations

ByeByeJohnny

Active Member

We are so jaded. Seven minutes went by and no one even mentioned an all time high close.

Glad Curt finally stepped up.

Glad Curt finally stepped up.

As we sit just under pre-split $3,000 per share, I'd just like to remind you that in June, 80% of you didn't think we'd even see $2,000 per share until later 2021.

When will TSLA first reach $2000 / ... - Poll Results - StrawPoll

Oh - I thought the poll was for post split price

j6Lpi429@3j

Closed

Has anybody mentioned the insanity of luninar:

Luminar going public makes 25-year-old Austin Russell one of world's first, and youngest, self-driving billionaires

Apparently the idea of lidar is exciting and new and worth billions. Investors have done so much in depth research that it looks like most of them today bought entirely the wrong stock, with a similar name...

Yahoo is now a part of Verizon Media

A bit of googling shows luminar has been around since 2012... and still lidar can not compete with the current non-lidar tesla autopilot. Thats a looong time to be wrong... and yet people have said this company could be worth half a trillion. insane.

Luminar going public makes 25-year-old Austin Russell one of world's first, and youngest, self-driving billionaires

Apparently the idea of lidar is exciting and new and worth billions. Investors have done so much in depth research that it looks like most of them today bought entirely the wrong stock, with a similar name...

Yahoo is now a part of Verizon Media

A bit of googling shows luminar has been around since 2012... and still lidar can not compete with the current non-lidar tesla autopilot. Thats a looong time to be wrong... and yet people have said this company could be worth half a trillion. insane.

Tslynk67

Well-Known Member

Is this the inevitable push to get it down below $587 for the close? Whatever, has been very bullish on low volume today.

Well, I'm very happy to be wrong with that! Very bullish close, all things considered

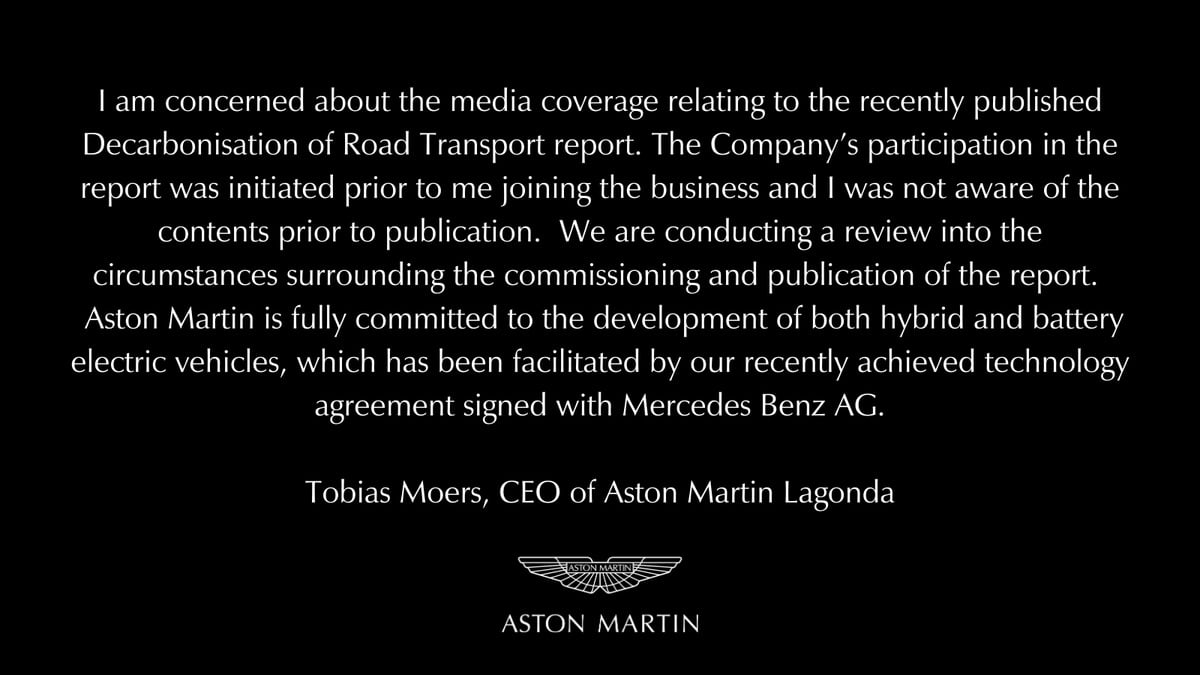

Statement from Aston Martin CEO Tobias Moers:

https://twitter.com/astonmartin/status/1334497626897571843?s=21

https://twitter.com/astonmartin/status/1334497626897571843?s=21

Tslynk67

Well-Known Member

Elon is in Poland?

Speculation:

LG Chem battery plant and VW EV plant nearby.

What is he planning?

Getting a decent bigos?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K