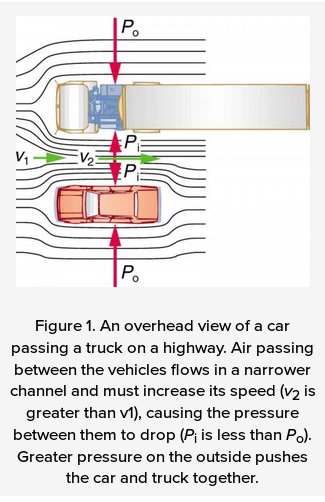

Yeah, exactly, but note how tunnels are different. On a highway as you are passing a truck the following happens:

The shape of the two vehicles forces about twice the amount of air between them as on the other side of the car, which creates a low pressure counter-flow between them which pushes the car towards the semi.

In a symmetric tunnel scenario I believe the effect reverses: if the car moves a bit towards the wall then on that side

less air is forced through and pressure increases - pushing the car back towards the center.

(I'll try to search whether there's existing research about this: this would something that should be within the engineering experience of underground train systems.)