THAT was the phrase! I was hoping someone would remember.I think the technical term is "a more elegant pull-away"!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Fact Checking

Well-Known Member

Isn´t what you describe the point of any trade? I would think that the difference here is that it is not an individual profiting personally from insider info but the company itself profiting.

It would only be insider trading if a company's management, stupidly and potentially illegally, based on material non-public information, decided to sell a derivatives position before its value crashed.

In the Q4 scenario I outlined the opposite happened: TSLA closed the year at $418 and was trading above those levels afterwards. Tesla did not benefit from any non-public information and if they sold the hedge the underwriters benefited from that, because the hedge is even more valuable today.

Also, when there's the danger of MNI there are ways to counter it: for example to give the decision about whether to sell the hedges to an external party who doesn't have insider information. That way it's not management that decides to sell.

Companies are buying their own derivatives all the time, Microsoft being a famous example. I'm sure there are ways to make all of this 100% above board - the only question in my mind is whether Tesla would have sold a hedge for about 50% of its maximum potential value.

I think they'll wait until TSLA is consistently above $607 - in that case the hedge won't appreciate in value anymore and can be converted to cash.

Last edited:

ReflexFunds

Active Member

A Path to S&P Inclusion ....NOW:

@Fact Checking - your comment above was related to the potential that Tesla's Call options gains could bring sufficient GAAP profits in Q4 to ensure S&P inclusion with the Q4 filing. In a separate post I commented that the gains would not likely be counted as income.

However:

There is an obscure item on Tesla's Balance Sheet that could bring huge upside to Q4....enough to achieve full year 2019 GAAP Profits and inclusion into the S&P. I have hesitated to bring this up in the past because it could easily be a big Nothing Burger and also because it is a very technical tax accounting issue. But since this is the weekend and your post touched on early S&P inclusion, I thought I would share it.

TL;DR: Tesla has deferred the recognition of $1.8B in tax benefits on the P&L because they could not conclude it was likely that they would have income in the future to take advantage of these benefits. Once profitability is likely (and supported by the auditors), this $1.8B (or a portion thereof) gets recognized immediately to GAAP profits. If Tesla concludes now that profitability is likely in 2020 and thereafter, $1.8B (or a portion) gets included in Q4 profits.

The Long Version

When a company incurs a loss, they record a tax benefit because they can reduce taxes in the future by offsetting future tax income with these tax losses. It's called a "Net Operating Loss Carryforward" (a Tax Asset).

So you would typically see a P&L as such:

$(100,000) - Pretax Income (Loss)

$ 30,000 - Tax Benefit (Expense)

$ (70,000) - Net Income (Loss)

However, the accounting rules state that you can only record this benefit if "it is more likely than not" that you will be able to use this benefit (tax asset) in the future.

Tesla has not recognized any of these benefits over the past 15 years because they could not confidently conclude and support to the auditors that profitably in the future was "more likely than not".

Here is Tesla's wording from the 2018 10K:

As of December 31, 2018, we recorded a valuation allowance of $1.81 billion for the portion of the deferred tax asset that we do not expect to be realized.....Management believes that based on the available information, it is more likely than not that the U.S. deferred tax assets will not be realized, such that a full valuation allowance is required against all U.S. deferred tax assets.

You can see this deferred benefit (valuation allowance) on their deferred tax asset schedule from the 2018 10K below:

View attachment 501942

Tesla's position on this tax accounting is correct.

Here is the important point: As soon as Tesla can support to the auditors, that "it is more likely than not", that profitability will be achieved in 2020 and beyond, this tax benefit comes back to earnings immediately. If not all of the $1.8B a substantial amount would.

Points Against Recognition in Q4

Points For Recognition in Q4

- Since Tesla has never had a full year profit in its history, they and their auditors may take a conservative approach and deem future profits unlikely.

- Despite 2 profitable Qtrs in 2018, Telsa still concluded (as seen in the 2018 10K) that it was "more likely than not" they would not be able to recognize the tax benefits with future profits.

I'm not sure which way this will go. If the huge benefit is not taken in Q4 2019, it's certain we'll see it in 2020.

- Tesla has been profitable in 4 of the last 6 Qtrs

- With Model 3 fully ramped, GF3 producing vehicles and Model Y entry assured for 2020, profitability is "more likely than not".

- Elon will likely state during the Q4 earnings call that Tesla expects a full year profit in 2020. Telsa can't state this publicly while simultaneously stating in the 2019 10K that future profits cannot be assured for taking the tax benefits.

- Generally Accepted Accounting Principles (GAAP) needs to be applied consistently. You can't take the position: "profits are more likely than not but let's not take the earnings benefit just to be conservative". Profits are either "more likely than not" or they're "more unlikely than not". If it is the former, you take the benefit to earnings.

My brain tells me that they will take the huge benefit in Q4 2019 but my gut says they won't.

TeslaQ has been all over the Balance Sheet pushing questions on Warranty Reserves, Accounts Receivables, etc.......but they're not talking about this one.

Let's see how this plays out.

Thanks for this, I'd missed this possibility at Tesla. But if Tesla is going to get anywhere close to my 2020 underlying earnings expectations, I think they would likely recognise a substantial % of this $1.8bn valuation allowance as profit in the coming quarters.

I'm trying to rectify how this analysis means this forum really messed up a year ago. How could Elon say they were going to be profitable every quarter going forward, if they weren't confident in realizing these tax benefits? We didn't see that.

The future profit forecasts used to set the valuation allowance need sign off from auditors who are encouraged to be conservative.

Significant profit in 2020 looks far more comfortable than it ever did for 2019 though, so I'd me more concerned this year if Tesla does not book a significant gain from this tax revaluation in Q4. However it doesn't hurt to be conservative so I don't think we can read so much into it even this year.

How Do Auditors Learn to Forecast? Evidence from the Predictive Power of the Deferred Tax Asset Valuation Allowance by Zhuoli Axelton, Jeffrey Gramlich, M. Harris :: SSRNASC 740-10-30-5 requires that companies record an appropriate amount of VA (a contraasset account) if “it is more likely than not (a likelihood of more than 50 percent) that some portion or all of the deferred tax assets will not be realized.” At each balance sheet date, the VA is determined by applying this judgment rule. When a firm does not expect to realize part or all of the DTA for which a VA did not previously exist, an increase in the VA is required, and this adjustment increases current tax expense. Alternatively, when a firm expects to realize any portion of a DTA for which a VA had previously been established, it reduces the VA, and this action increases the net DTA and decreases tax expense.

Guidance from professional auditing standards, the PCAOB, and the Securities and Exchange Commission (SEC) reinforce the critical role that auditors fill in evaluating estimates such as the VA. Under AS 2501.04, auditors evaluate the reasonableness of management’s accounting estimates in the context of overall financial statements. The rule encourages “professional skepticism” and requires the auditor to judge both subjective and objective factors, as well as the potential for bias in the subjective factors. Importantly, however, no specific tests are required to validate the data used to develop accounting estimates.

In June 2017, after a three-year comment period concerning its initial discussion draft (PCAOB 2014), the PCAOB signaled dissatisfaction with the strength and specificity of AS 2501.04 by issuing a proposed replacement (PCAOB 2017). The guideline proposes a new standard for auditors’ evaluations of management estimates, including the VA.10 The estimate focused proposal would 1) require additional audit procedures, 2) emphasize auditor attention to potential management bias and encourage professional skepticism, 3) extend the current procedures used in the evaluation of fair values to all significant accounting estimates, and 4) integrate risk-assessment standards in the evaluation of accounting estimates.

A Path to S&P Inclusion ....NOW:

@Fact Checking - your comment above was related to the potential that Tesla's Call options gains could bring sufficient GAAP profits in Q4 to ensure S&P inclusion with the Q4 filing. In a separate post I commented that the gains would not likely be counted as income.

However:

There is an obscure item on Tesla's Balance Sheet that could bring huge upside to Q4....enough to achieve full year 2019 GAAP Profits and inclusion into the S&P. I have hesitated to bring this up in the past because it could easily be a big Nothing Burger and also because it is a very technical tax accounting issue. But since this is the weekend and your post touched on early S&P inclusion, I thought I would share it.

TL;DR: Tesla has deferred the recognition of $1.8B in tax benefits on the P&L because they could not conclude it was likely that they would have income in the future to take advantage of these benefits. Once profitability is likely (and supported by the auditors), this $1.8B (or a portion thereof) gets recognized immediately to GAAP profits. If Tesla concludes now that profitability is likely in 2020 and thereafter, $1.8B (or a portion) gets included in Q4 profits.

The Long Version

When a company incurs a loss, they record a tax benefit because they can reduce taxes in the future by offsetting future tax income with these tax losses. It's called a "Net Operating Loss Carryforward" (a Tax Asset).

So you would typically see a P&L as such:

$(100,000) - Pretax Income (Loss)

$ 30,000 - Tax Benefit (Expense)

$ (70,000) - Net Income (Loss)

However, the accounting rules state that you can only record this benefit if "it is more likely than not" that you will be able to use this benefit (tax asset) in the future.

Tesla has not recognized any of these benefits over the past 15 years because they could not confidently conclude and support to the auditors that profitably in the future was "more likely than not".

Here is Tesla's wording from the 2018 10K:

As of December 31, 2018, we recorded a valuation allowance of $1.81 billion for the portion of the deferred tax asset that we do not expect to be realized.....Management believes that based on the available information, it is more likely than not that the U.S. deferred tax assets will not be realized, such that a full valuation allowance is required against all U.S. deferred tax assets.

You can see this deferred benefit (valuation allowance) on their deferred tax asset schedule from the 2018 10K below:

View attachment 501942

Tesla's position on this tax accounting is correct.

Here is the important point: As soon as Tesla can support to the auditors, that "it is more likely than not", that profitability will be achieved in 2020 and beyond, this tax benefit comes back to earnings immediately. If not all of the $1.8B a substantial amount would.

Points Against Recognition in Q4

Points For Recognition in Q4

- Since Tesla has never had a full year profit in its history, they and their auditors may take a conservative approach and deem future profits unlikely.

- Despite 2 profitable Qtrs in 2018, Telsa still concluded (as seen in the 2018 10K) that it was "more likely than not" they would not be able to recognize the tax benefits with future profits.

I'm not sure which way this will go. If the huge benefit is not taken in Q4 2019, it's certain we'll see it in 2020.

- Tesla has been profitable in 4 of the last 6 Qtrs

- With Model 3 fully ramped, GF3 producing vehicles and Model Y entry assured for 2020, profitability is "more likely than not".

- Elon will likely state during the Q4 earnings call that Tesla expects a full year profit in 2020. Telsa can't state this publicly while simultaneously stating in the 2019 10K that future profits cannot be assured for taking the tax benefits.

- Generally Accepted Accounting Principles (GAAP) needs to be applied consistently. You can't take the position: "profits are more likely than not but let's not take the earnings benefit just to be conservative". Profits are either "more likely than not" or they're "more unlikely than not". If it is the former, you take the benefit to earnings.

My brain tells me that they will take the huge benefit in Q4 2019 but my gut says they won't.

TeslaQ has been all over the Balance Sheet pushing questions on Warranty Reserves, Accounts Receivables, etc.......but they're not talking about this one.

Let's see how this plays out.

We should be paying you. Good job!

ReflexFunds

Active Member

Could Tesla, in principle, re-classify some of the hedges as Derivatives, recognize the purchase costs of the hedge as expenses and count them against any income from selling them, generating net GAAP income on the P&L sheet?

In particular the $309-$607 5-year bull spread purchased in May of 2019 when the stock price was around $240 was a ridiculously profitable trade, even with all costs included.

(@KarenRei, who is using leveraged bull spreads, might be able to chime in on this.)

Selling them would generate very real income, so it's not "accounting games" but clever financing and hedging that earned them some real cash. (Assuming they can be sold, which they might not be. Tesla might have agreed to non-transferability in exchange of lower hedging costs. Maybe @ReflexFunds has an idea about how financing rounds via convertibles are usually structured? Maybe the convertibles SEC filings contain some clues? We don't even know the counterparties ...)

I agree with @The Accountant that under Tesla's current accounting treatment, changes in the hedge value shouldn't impact the P&L, however I don't fully understand the accounting treatment Tesla is using, and it certainly seems possible that if they close this hedge they would reclassify the accounting treatment which could possibly lead to the gain being treated as a derivative within the P&L.

I wouldn't give this a high probability at this stage though, and I don't know how easy it would be for all the derivative and hedging transactions to be unwound and closed early.

One of the strangest things with the convert accounting was that Tesla recorded $188m operating cash outflow related to repaying the 2019 converts in Q1, even though this was a non cash item and a non operating item. I think for some reason this must have flowed through the interest line and they recorded it on cash flow even though it was just a non cash adjustment of balance sheet items.

Fact Checking

Well-Known Member

Nice article by @ZachShahan about short sellers who don't even own a Tesla filing nuisance SUA complaints to the NHTSA to manipulate the stock price:

Also, here's a post from last year from @wk057, who is investigating Tesla SUA claims:

Just curious: are you still 17 for 17 for SUA claims log pulls, usually done for insurance companies?

Also, here's a post from last year from @wk057, who is investigating Tesla SUA claims:

Seriously, this thread is still a thing? Every claim here should just be met with an auto-response: "No, you're wrong. You, your wife, your husband, or whoever was in the driver seat at the time hit the wrong pedal. Accept responsibility. Get over it." *Closed*

Here's what I'll do. If you want to prove SUA, bring your car to my shop along with $10,000 cash. I'll have $10,000 cash as well. I'll pull the logs, verify they weren't tampered with, and decode them right in front of you. If you're technically minded, I'll even go over how exactly the speed and pedal position data is deciphered in Tesla logs.

If they show what I know they'll show (driver pressing the accelerator), I keep your $10,000 cash and mine and also make a public post detailing the findings.

If it shows that the brake was pressed instead, yet the car still accelerated, you take my $10,000 cash and yours. I'll additionally make an affidavit testimony of what I've uncovered and offer my services as an expert witness in any related litigation, free of charge. At your discretion, I'll post my findings publicly.

Still want to say you're right? Put your money where your mouth is and prove it.

If not, just get over it and move on.

Edit: Disclaimer - You can't win this bet. I'm 17 for 17 so far on log pulls related to Tesla SUA claims (most for insurance company contacts).

Just curious: are you still 17 for 17 for SUA claims log pulls, usually done for insurance companies?

Garnam

Member

I have been having almost identical thoughts about robotaxis.

Realisticaly, I dont even like my wife driving my model S, and I consider her to be a very good driver. I just cant see the idea of private owners adding their vehicle to some robo taxi fleet. But another ownership model, and a properly developed robo-taxi membership structure does seem more viable. I dont see it as being quite as open to all comers as the Uber model though.

A Path to S&P Inclusion ....NOW:

@Fact Checking - your comment above was related to the potential that Tesla's Call options gains could bring sufficient GAAP profits in Q4 to ensure S&P inclusion with the Q4 filing. In a separate post I commented that the gains would not likely be counted as income.

However:

There is an obscure item on Tesla's Balance Sheet that could bring huge upside to Q4....enough to achieve full year 2019 GAAP Profits and inclusion into the S&P. I have hesitated to bring this up in the past because it could easily be a big Nothing Burger and also because it is a very technical tax accounting issue. But since this is the weekend and your post touched on early S&P inclusion, I thought I would share it.

TL;DR: Tesla has deferred the recognition of $1.8B in tax benefits on the P&L because they could not conclude it was likely that they would have income in the future to take advantage of these benefits. Once profitability is likely (and supported by the auditors), this $1.8B (or a portion thereof) gets recognized immediately to GAAP profits. If Tesla concludes now that profitability is likely in 2020 and thereafter, $1.8B (or a portion) gets included in Q4 profits.

The Long Version

When a company incurs a loss, they record a tax benefit because they can reduce taxes in the future by offsetting future tax income with these tax losses. It's called a "Net Operating Loss Carryforward" (a Tax Asset).

So you would typically see a P&L as such:

$(100,000) - Pretax Income (Loss)

$ 30,000 - Tax Benefit (Expense)

$ (70,000) - Net Income (Loss)

However, the accounting rules state that you can only record this benefit if "it is more likely than not" that you will be able to use this benefit (tax asset) in the future.

Tesla has not recognized any of these benefits over the past 15 years because they could not confidently conclude and support to the auditors that profitably in the future was "more likely than not".

Here is Tesla's wording from the 2018 10K:

As of December 31, 2018, we recorded a valuation allowance of $1.81 billion for the portion of the deferred tax asset that we do not expect to be realized.....Management believes that based on the available information, it is more likely than not that the U.S. deferred tax assets will not be realized, such that a full valuation allowance is required against all U.S. deferred tax assets.

You can see this deferred benefit (valuation allowance) on their deferred tax asset schedule from the 2018 10K below:

View attachment 501942

Tesla's position on this tax accounting is correct.

Here is the important point: As soon as Tesla can support to the auditors, that "it is more likely than not", that profitability will be achieved in 2020 and beyond, this tax benefit comes back to earnings immediately. If not all of the $1.8B a substantial amount would.

Points Against Recognition in Q4

Points For Recognition in Q4

- Since Tesla has never had a full year profit in its history, they and their auditors may take a conservative approach and deem future profits unlikely.

- Despite 2 profitable Qtrs in 2018, Telsa still concluded (as seen in the 2018 10K) that it was "more likely than not" they would not be able to recognize the tax benefits with future profits.

I'm not sure which way this will go. If the huge benefit is not taken in Q4 2019, it's certain we'll see it in 2020.

- Tesla has been profitable in 4 of the last 6 Qtrs

- With Model 3 fully ramped, GF3 producing vehicles and Model Y entry assured for 2020, profitability is "more likely than not".

- Elon will likely state during the Q4 earnings call that Tesla expects a full year profit in 2020. Telsa can't state this publicly while simultaneously stating in the 2019 10K that future profits cannot be assured for taking the tax benefits.

- Generally Accepted Accounting Principles (GAAP) needs to be applied consistently. You can't take the position: "profits are more likely than not but let's not take the earnings benefit just to be conservative". Profits are either "more likely than not" or they're "more unlikely than not". If it is the former, you take the benefit to earnings.

My brain tells me that they will take the huge benefit in Q4 2019 but my gut says they won't.

TeslaQ has been all over the Balance Sheet pushing questions on Warranty Reserves, Accounts Receivables, etc.......but they're not talking about this one.

Let's see how this plays out.

I've looked into Amazon as a case study of how a reduction in valuation allowance can play out.

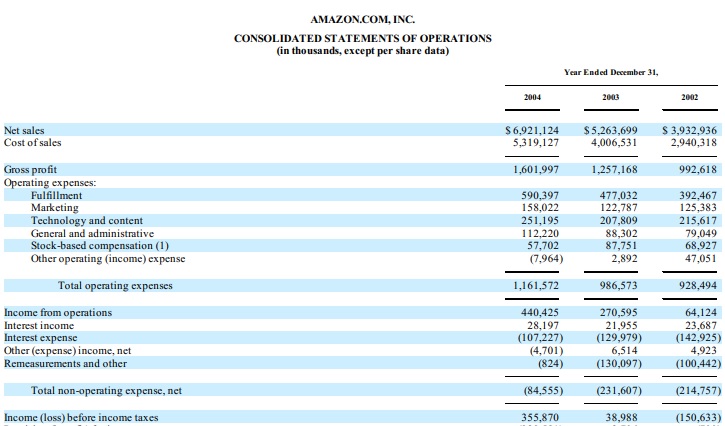

Amazon's EBT in 2004, 2003, and 2002, was as follows:

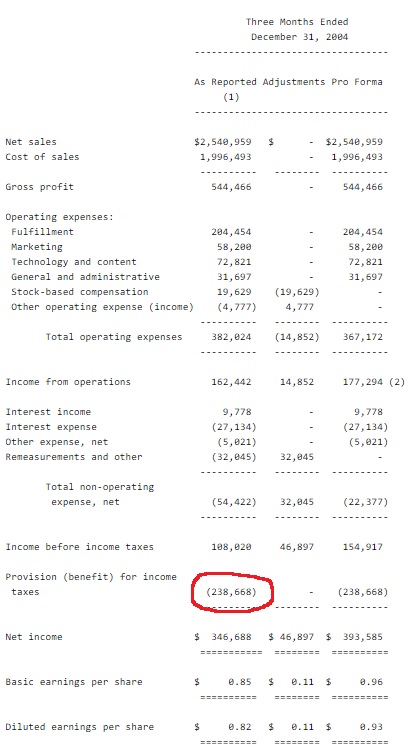

In Q4'04 Amazon's income statement looked like this:

They posted these additional comments in the Q4'04 quarterly report:

Provision (Benefit) for Income Taxes and Deferred Tax Asset

- We have recorded a tax benefit for current and deferred U.S. federal, state, and foreign income taxes, classified as "Provision (benefit) for income taxes" on the consolidated statements of operations.

- We periodically evaluate the likelihood of future realization of deferred tax assets, and reduce the carrying amount of these deferred tax assets by a valuation allowance to derive a net deferred tax asset we believe is more likely than not to be realized. We consider many factors when assessing the likelihood of future realization of our deferred tax assets, including our recent cumulative earnings experience by taxing jurisdiction, expectations of future taxable income, the carry forward periods available to us for tax reporting purposes, and other relevant factors.

- In the fourth quarter we determined that $363 million of our deferred tax asset is realizable through future operations, and recorded a current tax benefit of $244 million to "Provision (benefit) for income taxes" in our results of operations, and a $106 million credit to "Stockholders' Equity" on our consolidated balance sheet as of December 31, 2004.

- Our net deferred tax assets are $363 million at December 31, 2004, comprised of approximately $270 million related to our net operating loss carryforwards (NOLs) and the remainder related to temporary timing differences between tax and financial reporting.

- Classification of deferred tax assets between current and long-term asset categories is based on the expected timing of realization, and the valuation allowance is allocated ratably.

- At December 31, 2004, our gross deferred tax assets related to our NOLs were approximately $800 million (associated with approximately $2.6 billion of NOLs, the majority of which expire between 2017 and 2024), offset by a valuation allowance on approximately $530 million due to uncertainty about their future realization. Substantially all of the remaining $530 million, if realized, would be credited to "Stockholders' equity" rather than results of operations for financial reporting purposes since they primarily relate to tax-deductible stock-based compensation in excess of amounts recognized for financial reporting purposes.

- Significant judgment is required in making the assessment of deferred tax asset realization, and it is very difficult to predict when, if ever, our assessment may conclude that the remaining portion of our deferred tax assets is realizable.

- We expect net income for 2005 to decline because we expect a tax provision in 2005, rather than the large tax benefit we received in 2004.

- We expect our cash taxes paid in 2005 to be approximately $25 million, compared with $4 million in 2004.

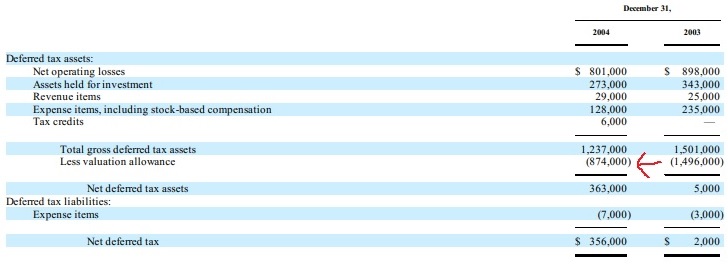

As a result, this is how Amazon's valuation allowance changed in 2004:

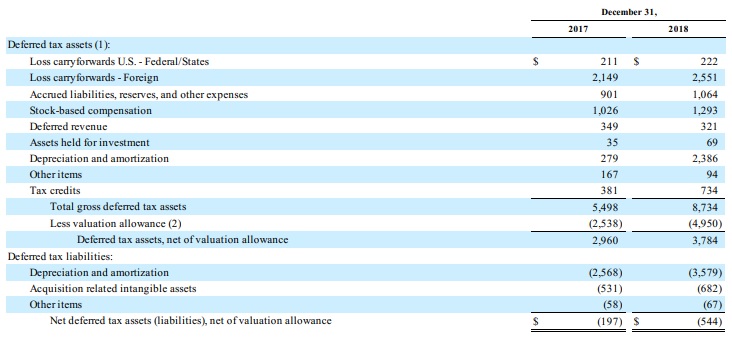

In recent years, it seems like Amazon's valuation allowance has once again gone up significantly:

Judging from reading their 10-K, it sounds like the increase in recent years is due tax assets in different jurisdictions in which they're not sure yet they will be able to recognize them.

Four observations from all of this:

- The valuation allowance decreased by a $622M from 2003 to 2004, but only $350M was recognized. I have been unable to find out where the other $272M went.

- In the case of Amazon, a very large part of their valuation allowance was due to "tax-deductible stock-based compensation", that did NOT show up on the P&L.

- Jurisdictions play a role in being able to reduce valuation allowance. Being overall profitable, doesn't mean no more valuation allowance.

- If one considers Amazon's 2003 income break-even, Amazon started to reduce valuation allowance after it's first full year of GAAP Profits.

- The fact that nowhere near all of Amazon's $1.5B valuation allowance was recognized on the P&L, does not bode well for Tesla's chances of recognizing enough for S&P 500 inclusion.

- It seems likely that the same thing would happen in Tesla's situation. Maybe @The Accountant knows more about how these "tax-deductible stock-based compensations tax assets" are recognized, but it seems like it would not be on the P&L.

- I don't know enough to comment on how jurisdictions will hurt or help Tesla in recognizing their valuation allowance. Does anybody else have any input here?

- I've never invested in or followed Amazon, but if there are any early 2000's Amazon investors reading this, it'd help to know what Amazon's prospects looked like at the end of 2003 and 2004.

Amazon 2004 10-K

Amazon Q4'04 Quarterly Report

Amazon 2018 10-K

Realisticaly, I dont even like my wife driving my model S, and I consider her to be a very good driver. I just cant see the idea of private owners adding their vehicle to some robo taxi fleet. But another ownership model, and a properly developed robo-taxi membership structure does seem more viable. I dont see it as being quite as open to all comers as the Uber model though.

Model 3 owners may be a bit more inclined to do so.

so our superbulls weekend off topic hype gives us additional 2.7B$ of profit for Q4!?! 1.8 tax and 0.9 of sold calls.

we just need one of both to become true...

why did these topics came up just now and why are they on noones radar since months?

we just need one of both to become true...

why did these topics came up just now and why are they on noones radar since months?

A Path to S&P Inclusion ....NOW:

@Fact Checking - your comment above was related to the potential that Tesla's Call options gains could bring sufficient GAAP profits in Q4 to ensure S&P inclusion with the Q4 filing. In a separate post I commented that the gains would not likely be counted as income.

However:

There is an obscure item on Tesla's Balance Sheet that could bring huge upside to Q4....enough to achieve full year 2019 GAAP Profits and inclusion into the S&P. I have hesitated to bring this up in the past because it could easily be a big Nothing Burger and also because it is a very technical tax accounting issue. But since this is the weekend and your post touched on early S&P inclusion, I thought I would share it.

TL;DR: Tesla has deferred the recognition of $1.8B in tax benefits on the P&L because they could not conclude it was likely that they would have income in the future to take advantage of these benefits. Once profitability is likely (and supported by the auditors), this $1.8B (or a portion thereof) gets recognized immediately to GAAP profits. If Tesla concludes now that profitability is likely in 2020 and thereafter, $1.8B (or a portion) gets included in Q4 profits.

The Long Version

When a company incurs a loss, they record a tax benefit because they can reduce taxes in the future by offsetting future tax income with these tax losses. It's called a "Net Operating Loss Carryforward" (a Tax Asset).

So you would typically see a P&L as such:

$(100,000) - Pretax Income (Loss)

$ 30,000 - Tax Benefit (Expense)

$ (70,000) - Net Income (Loss)

However, the accounting rules state that you can only record this benefit if "it is more likely than not" that you will be able to use this benefit (tax asset) in the future.

Tesla has not recognized any of these benefits over the past 15 years because they could not confidently conclude and support to the auditors that profitably in the future was "more likely than not".

Here is Tesla's wording from the 2018 10K:

As of December 31, 2018, we recorded a valuation allowance of $1.81 billion for the portion of the deferred tax asset that we do not expect to be realized.....Management believes that based on the available information, it is more likely than not that the U.S. deferred tax assets will not be realized, such that a full valuation allowance is required against all U.S. deferred tax assets.

You can see this deferred benefit (valuation allowance) on their deferred tax asset schedule from the 2018 10K below:

View attachment 501942

Tesla's position on this tax accounting is correct.

Here is the important point: As soon as Tesla can support to the auditors, that "it is more likely than not", that profitability will be achieved in 2020 and beyond, this tax benefit comes back to earnings immediately. If not all of the $1.8B a substantial amount would.

Points Against Recognition in Q4

Points For Recognition in Q4

- Since Tesla has never had a full year profit in its history, they and their auditors may take a conservative approach and deem future profits unlikely.

- Despite 2 profitable Qtrs in 2018, Telsa still concluded (as seen in the 2018 10K) that it was "more likely than not" they would not be able to recognize the tax benefits with future profits.

I'm not sure which way this will go. If the huge benefit is not taken in Q4 2019, it's certain we'll see it in 2020.

- Tesla has been profitable in 4 of the last 6 Qtrs

- With Model 3 fully ramped, GF3 producing vehicles and Model Y entry assured for 2020, profitability is "more likely than not".

- Elon will likely state during the Q4 earnings call that Tesla expects a full year profit in 2020. Telsa can't state this publicly while simultaneously stating in the 2019 10K that future profits cannot be assured for taking the tax benefits.

- Generally Accepted Accounting Principles (GAAP) needs to be applied consistently. You can't take the position: "profits are more likely than not but let's not take the earnings benefit just to be conservative". Profits are either "more likely than not" or they're "more unlikely than not". If it is the former, you take the benefit to earnings.

My brain tells me that they will take the huge benefit in Q4 2019 but my gut says they won't.

TeslaQ has been all over the Balance Sheet pushing questions on Warranty Reserves, Accounts Receivables, etc.......but they're not talking about this one.

Let's see how this plays out.

I've looked into Amazon as a case study of how a reduction in valuation allowance can play out.

Amazon's EBT in 2004, 2003, and 2002, was as follows:

View attachment 502055

In Q4'04 Amazon's income statement looked like this:

View attachment 502056

They posted these additional comments in the Q4'04 quarterly report:

As a result, this is how Amazon's valuation allowance changed in 2004:

View attachment 502059

In recent years, it seems like Amazon's valuation allowance has once again gone up significantly:

View attachment 502060

Judging from reading their 10-K, it sounds like the increase in recent years is due tax assets in different jurisdictions in which they're not sure yet they will be able to recognize them.

Four observations from all of this:

How these relate to Tesla and S&P 500 inclusion:

- The valuation allowance decreased by a $622M from 2003 to 2004, but only $350M was recognized. I have been unable to find out where the other $272M went.

- In the case of Amazon, a very large part of their valuation allowance was due to "tax-deductible stock-based compensation", that did NOT show up on the P&L.

- Jurisdictions play a role in being able to reduce valuation allowance. Being overall profitable, doesn't mean no more valuation allowance.

- If one considers Amazon's 2003 income break-even, Amazon started to reduce valuation allowance after it's first full year of GAAP Profits.

- The fact that nowhere near all of Amazon's $1.5B valuation allowance was recognized on the P&L, does not bode well for Tesla's chances of recognizing enough for S&P 500 inclusion.

- It seems likely that the same thing would happen in Tesla's situation. Maybe @The Accountant knows more about how these "tax-deductible stock-based compensations tax assets" are recognized, but it seems like it would not be on the P&L.

- I don't know enough to comment on how jurisdictions will hurt or help Tesla in recognizing their valuation allowance. Does anybody else have any input here?

- I've never invested in or followed Amazon, but if there are any early 2000's Amazon investors reading this, it'd help to know what Amazon's prospects looked like at the end of 2003 and 2004.

Amazon 2004 10-K

Amazon Q4'04 Quarterly Report

Amazon 2018 10-K

I was loath to post last night (not an accountant), but @FrankSG's post matches my understanding/ research.

Unfortunately, the scenario painted by @The Accountant is not how it seems to work.

The valuation line tracks the difference between income as reported to shareholders vs income reported to the IRS. This difference is due to things like warranty reserves and such which are hedged against in terms of shareholder value, but are not realized until expensed.

This line also includes Net Operating Loss (NOL) from previous quarters.

The purpose of the item is to track unclaimed income reductions for tax purposes in the future. When the company becomes profitable, they can use this amount to offset their positive net income before taxes to reduce their tax. Apparently, they can claim up to 80% of pre tax income each year.

It will be a benefit in terms of better earnings after taxes, but it does not flow down directly into P&L, nor does it at a 1:1 rate. (No idea how they track a tax credit vs NOL though)

Links on the topic:

Understanding Deferred Tax Assets | The Motley Fool

Loss Carryforward

What Is a Loss Carryforward?

Loss carryforward refers to an accounting technique that applies the current year's net operating loss (NOL) to future years' net income to reduce tax liability. For example, if a company experiences negative net operating income (NOI) in year one, but positive NOI in subsequent years, it can reduce the amount of future profits it reports using the NOL carryforward to record some or all of the loss from the first year in the subsequent years. This results in lower taxable income in positive NOI years, and reduces the amount the company owes the government in taxes. Loss carryforward can also refer to a capital loss carryforward.

Last edited:

In order for 80% of Tesla owners to put their car on a Robotaxinot network (which I see in your chart for 2030), there would have to be an almost unfathomable change in attitude toward vehicles. If you ask any 100 people "how would you feel about strangers riding in your car" (you know, hot sex in the back seat, hopping a Robotaxi at last call and vomiting in the car, just being an angry kid and slashing the seats, even just swimming in a muddy creek and then hopping a Robotaxi, let your imagination run wild) -- I can't see 80% of people agreeing. That is, until what you have to offer to pay them gets way out of control. And there's going to be a limit to what riders will pay (here in the Philly suburbs today, Uber is uneconomical for daily commute and errands -- so there's an upper limit right there).

I am with you there - my TMX will not be a robotaxi. But then I also know people who rent their cars on car share networks like Nabobil.no - Private car rental in your neighbourhood including Tesla owners - so some people are OK with this.

More important are people who really can't afford a car suddenly realizing they can afford a Tesla if they share it as a robotaxi. And their friends will hear about their genious way of financing a really nice new car.

And then I would change my mind about my TMX being on the robotaxi network if I could use the profits to buy a Roadster that only I would drive.

The Accountant

Active Member

Accounting rules often seem odd to me (as a non-accountant). What would happen to a company in the following scenario:

The quarter in which a company determines the Operating Loss Carryforward will be more likely than not to be used (in future quarters) happens to be the last quarter of a long string of quarterly losses and it was a break-even quarter? The company is hanging on by a shoestring, heavy with debt, but the future looks bright. After the long string of losses they have a HUGE Operating Loss Carryforward to recognize in that quarter. This gives them a HUGE GAAP profit but no money with which to pay the taxes. It doesn't seem to make a lot of sense.

I know this is confusing...even to accountants who have been doing this for 30 years.

There are book financials and tax financials. Book financials are the 10Ks...Tax financials are what is used for tax returns.

They can be slightly different (tax depreciation rates, etc).

In this scenario, when it came time to complete their tax return for the profitable year, they would not pay any taxes as they would deduct the prior losses against the current year gains. So no need to come up with money.

So for the Tax financials going forward, there is no tax due until they exhaust the losses.

However for the Book financials (10K), if Tesla recognized the benefit now, they have to record tax expense going forward even though there is no tax payment due.

debit - tax expense

credit - deferred asset (without the tax asset, a company would credit Cash)

I told you it was complicated

I’m not understanding what you are saying here. Specifically to quote the link you provided.I was loath to post last night (not an accountant), but @FrankSG's post matches my understanding/ research.

Unfortunately, the scenario painted by @The Accountant is not how it seems to work.

The valuation line tracks the difference between income as reported to shareholders vs income reported to the IRS. This difference is due to things like warranty reserves and such which are hedged against in terms of shareholder value, but are not realized until expensed.

This line also includes Net Operating Loss (NOL) from previous quarters.

The purpose of the item is to track unclaimed income reductions for tax purposes in the future. When the company becomes profitable, they can use this amount to offset their positive net income before taxes to reduce their tax. Apparently, they can claim up to 80% of pre tax income each year.

It will be a benefit in terms of better earnings after taxes, but it does not flow down directly into P&L, nor does it at a 1:1 rate. (No idea how they track a tax credit vs NOL though)

Links on the topic:

Understanding Deferred Tax Assets | The Motley Fool

Loss Carryforward

So your link seems to support the idea that deferred tax assets can be added to GAAP income when it is decided they are likely to be used. But you are saying that is not correct somehow?Keep a watchful eye on valuation allowances. Because they're based on very subjective estimates, they're an easy way for management to manipulate earnings. For example, if a company has a $100 million valuation allowance to offset $100 million in DTAs, and management realizes it's going to miss earnings by $2 million, it can make slightly more aggressive assumptions to release $2 million in its valuation allowance, which flows to net income and allows the company to meet earnings.

edit: to be clear I meant deferred tax assets kept in the valuation reserve. Anything outside the reserve has already been recognized as income.

The Accountant

Active Member

Thanks for the great comment.

When you show the following increase in the Tax Benefit. It's calculated based on the losses made in the period.

Wouldn't the reverse be true when Tesla starts making money, that Tesla could only recognise the Tax Benefit to the value of any tax payable in that quarter?

Or is there an accounting rule that which ignores profits in the period and they can just decide profitability is more likely than not from now on, take the whole amount to P&L, and just pay tax on future profits?

Your last sentence is the correct ruling - you need to look to future earnings to recognize this benefit.

The Accountant

Active Member

Could Tesla, in principle, re-classify some of the hedges as Derivatives, recognize the purchase costs of the hedge as expenses and count them against any income from selling them, generating net GAAP income on the P&L sheet?

In particular the $309-$607 5-year bull spread purchased in May of 2019 when the stock price was around $240 was a ridiculously profitable trade, even with all costs included.

(@KarenRei, who is using leveraged bull spreads, might be able to chime in on this.)

Selling them would generate very real income, so it's not "accounting games" but clever financing and hedging that earned them some real cash. (Assuming they can be sold, which they might not be. Tesla might have agreed to non-transferability in exchange of lower hedging costs. Maybe @ReflexFunds has an idea about how financing rounds via convertibles are usually structured? Maybe the convertibles SEC filings contain some clues? We don't even know the counterparties ...)

Regarding your question (which I bolded), it may be possible. Again - I'm not an expert in this area but perhaps if you sell the hedge while still holding onto the Convertible Note, you have decoupled the instruments and then hedge may be considered a derivative with gains going to P&L. A good thought but I'm not sure.

Buckminster

Well-Known Member

Also, why didn't the paid professional analysts find this - oh, yeah, right...so our superbulls weekend off topic hype gives us additional 2.7B$ of profit for Q4!?! 1.8 tax and 0.9 of sold calls.

we just need one of both to become true...

why did these topics came up just now and why are they on noones radar since months?

The other way forward is a little of both.

25% of the tax = 0.45Bn

50% of the calls = 0.45Bn

=$0.9Bn

The Accountant

Active Member

I've looked into Amazon as a case study of how a reduction in valuation allowance can play out.

Amazon's EBT in 2004, 2003, and 2002, was as follows:

View attachment 502055

In Q4'04 Amazon's income statement looked like this:

View attachment 502056

They posted these additional comments in the Q4'04 quarterly report:

As a result, this is how Amazon's valuation allowance changed in 2004:

View attachment 502059

In recent years, it seems like Amazon's valuation allowance has once again gone up significantly:

View attachment 502060

Judging from reading their 10-K, it sounds like the increase in recent years is due tax assets in different jurisdictions in which they're not sure yet they will be able to recognize them.

Four observations from all of this:

How these relate to Tesla and S&P 500 inclusion:

- The valuation allowance decreased by a $622M from 2003 to 2004, but only $350M was recognized. I have been unable to find out where the other $272M went.

- In the case of Amazon, a very large part of their valuation allowance was due to "tax-deductible stock-based compensation", that did NOT show up on the P&L.

- Jurisdictions play a role in being able to reduce valuation allowance. Being overall profitable, doesn't mean no more valuation allowance.

- If one considers Amazon's 2003 income break-even, Amazon started to reduce valuation allowance after it's first full year of GAAP Profits.

- The fact that nowhere near all of Amazon's $1.5B valuation allowance was recognized on the P&L, does not bode well for Tesla's chances of recognizing enough for S&P 500 inclusion.

- It seems likely that the same thing would happen in Tesla's situation. Maybe @The Accountant knows more about how these "tax-deductible stock-based compensations tax assets" are recognized, but it seems like it would not be on the P&L.

- I don't know enough to comment on how jurisdictions will hurt or help Tesla in recognizing their valuation allowance. Does anybody else have any input here?

- I've never invested in or followed Amazon, but if there are any early 2000's Amazon investors reading this, it'd help to know what Amazon's prospects looked like at the end of 2003 and 2004.

Amazon 2004 10-K

Amazon Q4'04 Quarterly Report

Amazon 2018 10-K

Awesome - nice digging effort into the Amazon financials.

I agree with others in this board regarding the robotaxi fleet. Once it works every fund with a few million will buy all the cars Tesla is willing to sell. They will pay more than individual consumers.Realisticaly, I dont even like my wife driving my model S, and I consider her to be a very good driver. I just cant see the idea of private owners adding their vehicle to some robo taxi fleet. But another ownership model, and a properly developed robo-taxi membership structure does seem more viable. I dont see it as being quite as open to all comers as the Uber model though.

Owning an autonomous taxi fleet is perfect for these sorts of investors. Long term income, relatively low opex (compared to current taxi fleets) and the ability to gear up the capital structure against a known asset.

Stock based compensation was not an expense in 2004. It was only in 2006 it became an expense. I don’t know how that comes into play exactly but that part may be different. I think the biggest thing to get from this is the timing. I think we need more than 2 quarters of profits before we’ll see it.I've looked into Amazon as a case study of how a reduction in valuation allowance can play out.

Amazon's EBT in 2004, 2003, and 2002, was as follows:

View attachment 502055

In Q4'04 Amazon's income statement looked like this:

View attachment 502056

They posted these additional comments in the Q4'04 quarterly report:

As a result, this is how Amazon's valuation allowance changed in 2004:

View attachment 502059

In recent years, it seems like Amazon's valuation allowance has once again gone up significantly:

View attachment 502060

Judging from reading their 10-K, it sounds like the increase in recent years is due tax assets in different jurisdictions in which they're not sure yet they will be able to recognize them.

Four observations from all of this:

How these relate to Tesla and S&P 500 inclusion:

- The valuation allowance decreased by a $622M from 2003 to 2004, but only $350M was recognized. I have been unable to find out where the other $272M went.

- In the case of Amazon, a very large part of their valuation allowance was due to "tax-deductible stock-based compensation", that did NOT show up on the P&L.

- Jurisdictions play a role in being able to reduce valuation allowance. Being overall profitable, doesn't mean no more valuation allowance.

- If one considers Amazon's 2003 income break-even, Amazon started to reduce valuation allowance after it's first full year of GAAP Profits.

- The fact that nowhere near all of Amazon's $1.5B valuation allowance was recognized on the P&L, does not bode well for Tesla's chances of recognizing enough for S&P 500 inclusion.

- It seems likely that the same thing would happen in Tesla's situation. Maybe @The Accountant knows more about how these "tax-deductible stock-based compensations tax assets" are recognized, but it seems like it would not be on the P&L.

- I don't know enough to comment on how jurisdictions will hurt or help Tesla in recognizing their valuation allowance. Does anybody else have any input here?

- I've never invested in or followed Amazon, but if there are any early 2000's Amazon investors reading this, it'd help to know what Amazon's prospects looked like at the end of 2003 and 2004.

Amazon 2004 10-K

Amazon Q4'04 Quarterly Report

Amazon 2018 10-K

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K