Tslynk67

Well-Known Member

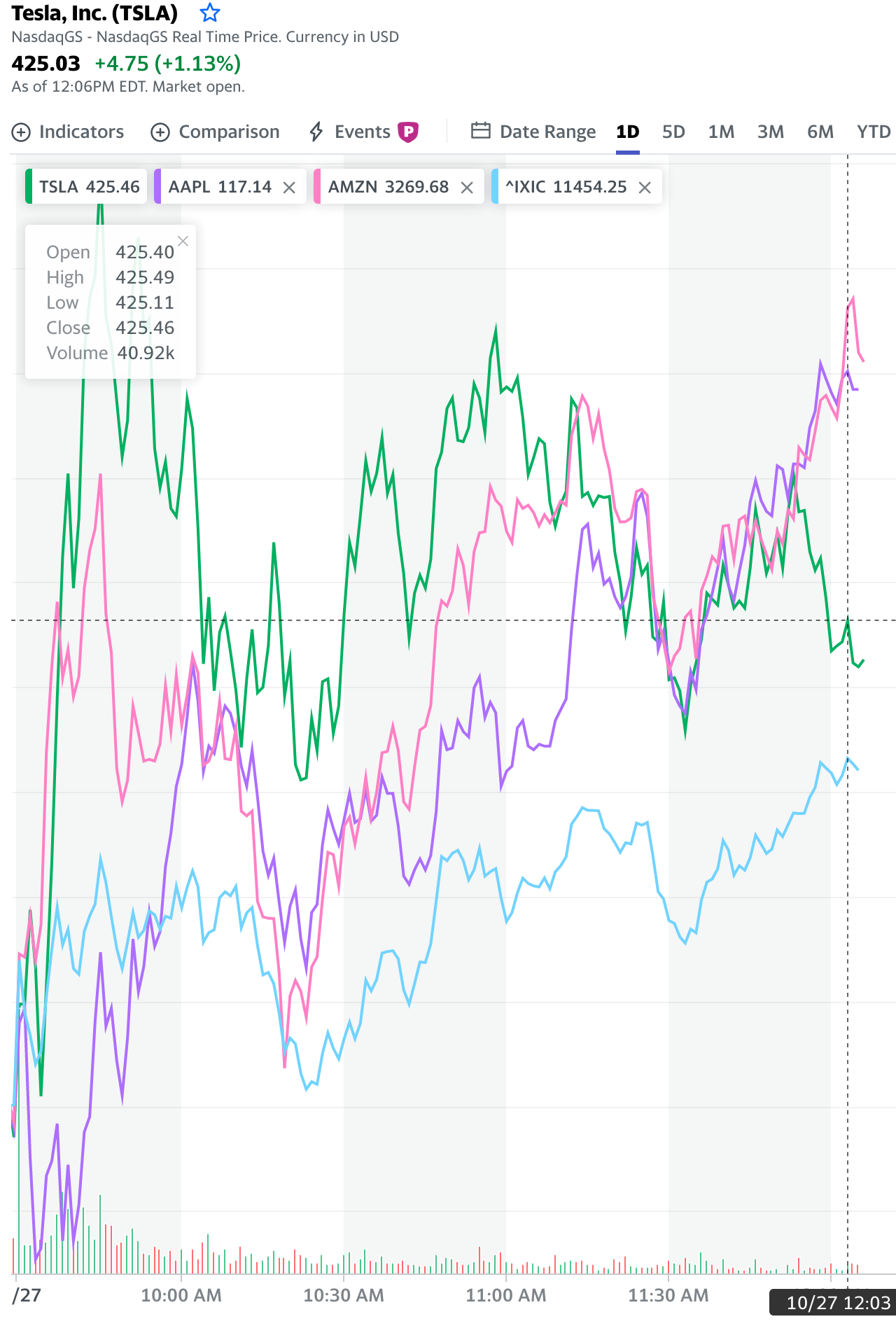

No manipulation here, move along now, let's be having you...

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Yes, but with skillful lawyering and lobbying justice is often not blind. (Think patent troll friendly courts in Texas.)

I agree with you conceptually, but when I do the maths, I see TSLA getting well over $10tn valuation by 2030

20M vertically integrated cars with Tesla batteries and Tesla insurance. 25% margin at ASP of $40k is $10k * 20M = $200bn margin

Agreed, it shouldn't have any place. However, lobbying changes the laws that the court enforce.Skillful lawyering is always useful but lobbying doesn't have much place in the legal system (and it shouldn't have any).

SpaceX's Starlink satellite internet service is priced at $99 per month, according to e-mail

I wonder if this would affect TSLA prices at al.

Will tesla integrate space x starlink service at a discount at all?

Which, as the FTC points out- generally requires a majority market share.

Again if you can cite any examples of a company with only 1/4 of the the share of the market having succesful anti-trust action taken against them I'd be happy to see it.

But you seem to be trying to defend an inaccurate point otherwise.

So I'm not sure why you keep insisting market share does not matter- it does. Below a certain point you don't have to worry about ant-trust issues.

If you're ABOVE that share (which Tesla is not in the examples discussed) then you MIGHT have concerns if you ALSO do other specific things that may violate the law.

What makes me think such valuations are possible (in time) is how the status quo has become so complacent and lacking when it comes to true innovation. This problem extends well beyond the auto industry into just about every industry that sells anything. Tesla is literally rewriting the book on how to run a profitable business while adhering to ESG principles. It's showing what is possible when efficiency is taken seriously. This is exactly what's needed to continue to increase standards of living worldwide while solving the biggest problem facing us today (climate crisis).

Tesla won't sell 20 million cars with a 40k ASP.

Tesla won't even sell 10 million before the 25k model is out.

Remember Elons driving goal at this point, to further the mission, is to constantly reduce the price of their products.

On your car math- that 200bn is gross margin, not net....so the 30x of that number for market cap doesn't really work either.

Q3 2020 has 2.1 billion in gross automotive profit (with a margin higher than in your example BTW), but only 331 million net profit.

Here- again- we can cite Elon focusing on the mission- having said he intends to KEEP net profit low.

If we applied that ~6.3:1 difference to your 200bn number (even accepting 40k ASP) we'd be down to just about about 31.5 billion.

Times 30 doesn't even get us to -1- trillion let alone 6.

Pretend energy is just as big as auto as you suggest is possible and you're almost at 2T total.

I clipped out the rest of your energy math because you somehow had Teslas share of energy as being worth significantly more than all energy companies in the world combined are right now- which seems weird.

I agree autonomy is an unknown wildcard- which is why a lot of folks simply leave it out of the math- there's situations it can MASSIVELY spike the value of the company- situations where it makes little difference- and situations where it significantly hurts the company. Too unknown still where that ends up.

Speaking of starlink I wonder how Elon will structure it to provide early access to retail Tesla investors.

Again, all the above is true

BUT, and its a big BUT you cannot compare the market cap of Tesla Energy with other energy companies in the same way that you cannot compare the market cap of Tesla automotive with GM or Toyota. And in the same way you cannot compare the market cap of Facebook with the New York Times.

Software changes everything. Couple that with the world's cheapest, most efficient batteries and 10,000s of the world's best engineers and it becomes difficult to replicate.

Huh? No comprendo.

I think we agree. If you don't have monopoly power, you don't have anti-trust concerns.

So - what? Well, of the two big breakups that have occurred in the last 110 years, one was within our lifetimes. ATT was broken up into eight Baby Bells in 1984. Did this breakup engender the revolution in telecommunications, or did that revolution beget the re-integration of the old ATT? An interesting, but off-topic discussion. Regardless, as of 2019 we’re back to status quo ante breakup. What is important is that a shareholder of old ATT who held on to his thus-endowed Baby Bell shares has done gloriously well and, I believe, far better than had MaBell not been broken up in 1984.

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/7336991/Screen%20Shot%202016-10-24%20at%202.21.23%20PM.png)

Agreed, it shouldn't have any place. However, lobbying changes the laws that the court enforce.