Jim Cramer just now on CNBC - TSLA is one of his 10 ‘Up stocks’ to buy now, These are stocks that (he says) will go up substantially to finish out the year.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TheTalkingMule

Distributed Energy Enthusiast

Can we circle back to this Mary Barra selling stock thing? How does a chair/CEO sell more than half their stock and it closes up? How is this not a massive story?

I didn’t mean to come across snarky or disbelieving. Just asking if that’s about the level of suppression we're considering here.No, I think the naked shorts suppressed the SP to $85 in March 2020, and to $37 in May 2019.

Do you think the guy on your lawn yelling 'fire' while standing next to your 'For Sale' sign is holding back any potential offers on your House? Or reducing the selling price?

Fitting that they got burnt.

UnknownSoldier

Unknown Member

Index inclusion is a technical event, not a fundamentals one. So the short answer is no one except people who are trying to speculate on short term movements during the event.This relates to one of my concerns, especially as I have bought some short turn calls.

Why would those funds that "have to buy" want a squeeze? It could only hurt them. They buy, then a few days later when the stock sinks back down to some level, they are already in a losing proposition. The S and P committee and everyone else must realize this.

If anyone has been paying attention, the market seems controlled by powers other than 'us'. Why would they want to see TSLA shoot up, unless they feel it will stay up and not hurt them in the long run.

I am looking for others 'smarter' than me to possibly chime in. I have neve directly linked @Papafox but now will as really want to know his thoughts on this.

As a TMC'er said yesterday, who gets left holding the bag?

Funds that "have to buy" could not care less about the day to day movements of the price, their job is simply to make sure they hold the same number of shares in the same proportion to the index they are tracking. What happens with the daily price movements is literally just animals crawling around on the Earth eating dirt while they soar in the heavens. They'll buy TSLA whether it's $10 a share or $1000 a share, it's just an index component to them.

The hedge funds are more than happy to try and run the price up on index inclusion, it's free money for them if they buy on the way up and sell at the top. The MM's are more than happy to fight to keep the price suppressed so calls expire worthless, it's free money for them if they succeed and it's meaningless to them if they don't since they literally make the market by holding the shares people buy and sell.

StealthP3D

Well-Known Member

I’m not a TA guy but this is the literal definition of a wedge, the past 3 months were building up towards a breakout and Mission SP-500 was the catalyst for the breakout upwards.

My brother called me last Thursday night and sheepishly asked if I thought this would be a good time to be TSLA or if it was "too late". He's been resisting all this time even though I've let him know what I think and had given him a lengthy test drive of my Performance Model 3.

I told him it wasn't too late to take a long-term position. I said the share price oscillations have been steadily declining over the previous few months as it settles in around $408 and that is a good price. I added that we are very close to one of two things; a breakout to the upside or a sharp drop. I put it at 80% to the upside but added that no one knows. I started to say he might consider breaking his buy into two for cost averaging purposes but then I remembered that S&P could happen at any time so I did a 180 and said I would just buy it all at once. He thanked me and told me that's what he wanted to know.

After the S&P announcement I called him to see if he had pulled the trigger and he said he had, around $408. He didn't seem to understand the significance of the S&P 500 but was happy with his entry after it zoomed up on Tues.

The point is, Based on the share price action over the last several months, I was expecting a break-out (with a 20% chance of a drop) with or without an S&P announcement.

Hock1

Member

Passive investors should be pissed at S&P. S&P made an ideological decision years ago that excluded Tesla from the index, even though Tesla was by far the largest and highest cap company not in the index. Passive investors have lost out on some $50B in gains.

When one ponders how a stock price can be manipulated, it is necessary to understand that there are several ways to control a stock price, given enough money. It is difficult to discern how much "legal" shorting vis-a-vis "naked shorting" contribute to a major downward move of an SP. But, the one thing that most people here are missing in this endeavor, is that short selling, whether it be legit or naked can now (since 2007) be done on DOWNticks. You have to actually spend some time thinking about the power of this ability to really understand how it is done. Think about it: if you are a legitimate long, do you want to pay a higher price than the market is showing?---no. Conversely, why would a legitimate short want to sell at a LOWER price? Pretty simple, really.Given where SP was pre-split-announcement (Aug 11, ~$280) and where it finally settled to (~$420), do you really think the naked shorting depressed the SP by $140?

If you're wondering why NKLA has risen so much the last days, look no further:

Nikola soars as clueless investors mistake month-old GM website for new

(It was too funny not to link)

--------------------------------------------

California has just imposed a Covid curfew, however Tesla should not be effected. But then, they were also not effected by the first lockdown, until Alameda and Bay area decided to expand the regulations.

"Workers critical to the manufacturing, distribution, sales, rental, leasing, repair, and maintenance of vehicles and other transportation equipment (including electric vehicle charging stations) and the supply chains that enable these operations, subject to adhering public health guidance issued by CDPH."

https://covid19.ca.gov/essential-workforce/

Edit: Alameda county also allows manufacturing during the curfew!

Nikola soars as clueless investors mistake month-old GM website for new

(It was too funny not to link)

--------------------------------------------

California has just imposed a Covid curfew, however Tesla should not be effected. But then, they were also not effected by the first lockdown, until Alameda and Bay area decided to expand the regulations.

"Workers critical to the manufacturing, distribution, sales, rental, leasing, repair, and maintenance of vehicles and other transportation equipment (including electric vehicle charging stations) and the supply chains that enable these operations, subject to adhering public health guidance issued by CDPH."

https://covid19.ca.gov/essential-workforce/

Edit: Alameda county also allows manufacturing during the curfew!

Last edited:

She probably called Trevor Milton and asked him what he’s going to do in DecemberCan we circle back to this Mary Barra selling stock thing? How does a chair/CEO sell more than half their stock and it closes up? How is this not a massive story?

Given where SP was pre-split-announcement (Aug 11, ~$280) and where it finally settled to (~$420), do you really think the naked shorting depressed the SP by $140?

I think of it as a "help" ...like when a car is at the top of a hill and a little push will get it rolling down.

The folks that want the stock to go down "help" it by shorting. Sometimes they wait till a macro event then "help" the stock go down faster and further than it would if they didn't.

Certainly they are not responsible for every dollar drop but when they can make money of accelerating that drop they do.

@Papafox has a pretty detailed picture of this.

Plus Jake Ricard did a nice blog post as well about the shenangines that entity's do to control the price.

I was about to post that.

So their bet is that it will drop till the actual S&Pinclusion on December 21st?

TSLA reached 15% of their portfolio?

Artful Dodger

"Neko no me"

Yeah, it's cool man, no offense taken. But as Wayne Gretzky would say, "You miss 100% of the shots you don't take". That's what naked shorting accomplishes: it suppresses the number of shots taken.I didn’t mean to come across snarky or disbelieving. Just asking if that’s about the level of suppression we're considering here.

Cheers!

Last edited:

TSLA just went up 25% in three days. I'd guess they thought it was time to rebalance. I doubt it means anything about their expectations for the next month. They may be doing this several times between now and when inclusion happens.I was about to post that.

So their bet is that it will drop till the actual S&Pinclusion on December 21st?

TSLA reached 15% of their portfolio?

Knightshade

Well-Known Member

Lots of ha ha’s about this on the board today but I think it should be taken seriously. People buying cars pay attention to this stuff.

JMHO

Not enough to matter thusfar.

Now by the time Tesla needs to sell 10x or 20x or 50x as many cars, yeah the niggling little QC things will matter.... but GOOD NEWS!

From what we've seen MiC cars are a lot better on this stuff... possibly thanks to building a new factory from scratch, and doing so with all the lessons learned from retrofitting Freemont and from the mistakes made during the 3/Y ramps there.

Even better news- GigaBerlin and Texas will not only be entirely new factories- but likely ALSO build on not just the lessons learned from Freemont, but China too- and offer even better QC than Shanghai.

Ideally as many of these improvements as possible make their way back to Freemont eventually since that's still the only place the S and X (2 of the cars CR is dinging for quality issues) are built right now.

Probably a good reason why Tesla doesn't participate in consumer reports surveys.

I think you have them mixed up with JD Power.

No car company "participates" in consumer reports surveys. They don't survey car companies, they survey car owners.

More specifically- CR surveys their own members/subscribers who report back on whatever kind of cars they happen to own- for 2020 they got 329,000 responses to their survey for example.

It's JD Power that attempts to contact owners using info from the car makers... everyone but Tesla gives them permission to access their customer lists. They don't need permission in 35 states, so recently began offering Tesla scores on that incomplete data- but lack the data from the other 15 states.

The other difference worth noting is CR doesn't take any money from car companies for any of this.

JD Power is happy to sell their own research as a product to car companies... and also to charge a licensing fee to those car companies to use the results and the JD Power logo/awards given out in advertising.... this is in fact their main sources of revenue.

So CR works for actual car owners rather than JD Power which works for automotive companies essentially.

Not that CR isn't a bit GET OFF MY LAWN about stuff, but they're really a different set of data and a different type of company.

Last edited:

adiggs

Well-Known Member

View attachment 610053

Source: Tesla Model S Owner Walks Away From 100 MPH Crash

Tesla Inc (NASDAQ: TSLA) vehicles are some of the safest on the market — and this week brought an extreme example.

Driver fled the scene - later found, taken to hospital for minor injuries.

The rest of the details will follow them. But heck - they lost control at 100mph and get to deal with legal consequences!

Just a guess, but I would say that a generation that can do google and youtube search is not using CR for anything.Lots of ha ha’s about this on the board today but I think it should be taken seriously. People buying cars pay attention to this stuff.

JMHO

Whoah! Solstice, conjunction and inclusion on the same date.When the giant planets Jupiter & Saturn will appear their closest together in the sky since 1623, at about one-fifth the angular width of a Full Moon. Hmmm, wonder if Elon's spacefaring Tesla will squeeze between them.

View attachment 610050

adiggs

Well-Known Member

Can we circle back to this Mary Barra selling stock thing? How does a chair/CEO sell more than half their stock and it closes up? How is this not a massive story?

Because it's pretty standard for ~every CEO and other senior executive to have some sort of diversification plan in place that regularly reduces their holding in the company they work for, so they don't become overly concentrated.

It makes sense from a personal financial planning perspective - I think it's weak in the CEO, and contributes to a quarterly focus on the part of the C-suite more generally. As a result, I mostly don't trust CEOs to actually have my (long term) interests at heart. I trust them to have their own interests at heart, under the hypothesis that our interested are in alignment, when in reality they're interested in 'short term' and I'm not.

It's just one of many reasons why I trust GM to fumble the EV transition badly.

Artful Dodger

"Neko no me"

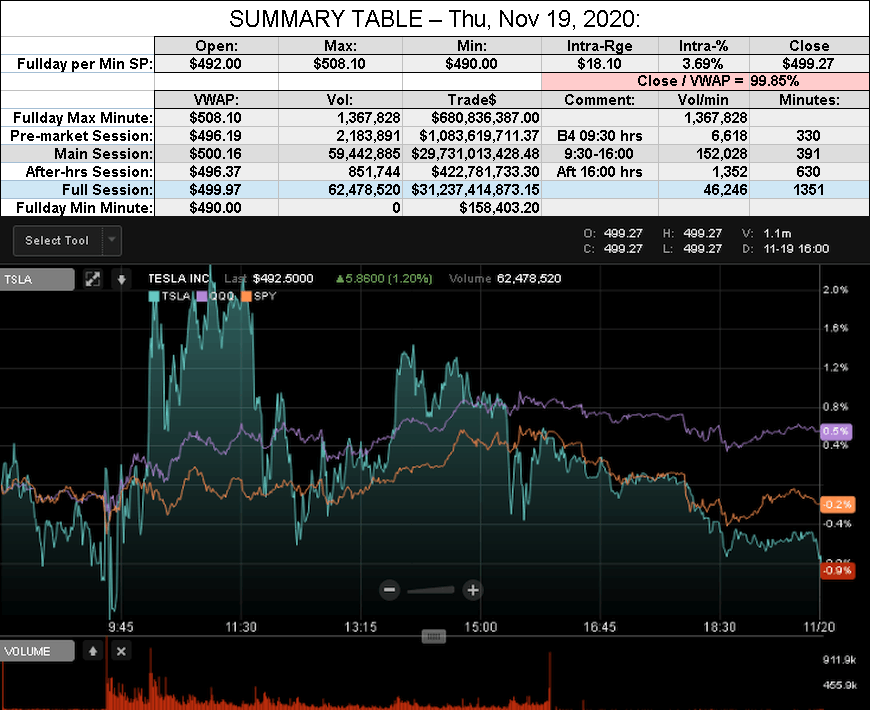

After-action Report: Thu, Nov 19, 2020: (Full-Day's Trading)

Headline: "TSLA Hits Multiple ATHs"

'Short' Report:

Comment: "Back to the Future"

QOTD: @DragonWatch "Tesla has been gainingsteam voltage since 2010 ~ shocking"

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Hits Multiple ATHs"

Traded: $31,237,414,873.15 ($31.24B)

Volume: 62,478,520

VWAP: $499.97

Close: $499.27 / VWAP: 99.85%

TSLA closed BELOW today's Avg SP

TSLA MaxPain: $425

Mkt Cap: TSLA / TM $473.259B / $195.249B = 242.39%

Note: Yahoo Finance updated TSLA Mkt Cap for shares issued Sep 9th (per 10-Q)

CEO Comp. Status:Volume: 62,478,520

VWAP: $499.97

Close: $499.27 / VWAP: 99.85%

TSLA closed BELOW today's Avg SP

TSLA MaxPain: $425

Mkt Cap: TSLA / TM $473.259B / $195.249B = 242.39%

Note: Yahoo Finance updated TSLA Mkt Cap for shares issued Sep 9th (per 10-Q)

TSLA 30-day Moving Avg Market Cap: $402.30

TSLA 6-mth Moving Avg Market Cap: $316.63

Nota Bene: Mkt Cap for 5th tranche ($300B) likely achieved Nov 09, 2020

TSLA 6-mth Moving Avg Market Cap: $316.63

Nota Bene: Mkt Cap for 5th tranche ($300B) likely achieved Nov 09, 2020

'Short' Report:

FINRA Volume / Total NASDAQ Vol = 55.8% (56th Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 57.8% (55th Percentile rank Shorting)

FINRA Short Exempt Volume ratio was 0.98% of Short Volume (49th Percentile Rank)

FINRA Short / Total Volume = 57.8% (55th Percentile rank Shorting)

FINRA Short Exempt Volume ratio was 0.98% of Short Volume (49th Percentile Rank)

Comment: "Back to the Future"

QOTD: @DragonWatch "Tesla has been gaining

View all Lodger's After-Action Reports

Cheers!

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K