In this Sandy Munro interview he said the octavalve in 3/Y, which brings huge efficiency and cost reduction (and is one of his favorite part of the 3/Y design) was clearly not designed by any automobile engineer. He is convinced it must have been designed by the Spacex engineering team. We know that some Spacex staff also have job titles in Tesla and we heard rumours in the past of Tesla teams visiting Spacex. Having access to Spacex resources including both expertise and equipment/material would be another clear competitive advantage that continuous to increase Tesla’s lead. (Sorry I can’t find the timestamp so you will need to watch the whole thing)SpaceX just had its 26th successful launch in 2020, with the booster returning to land for the 70th time (in total). It's been such an awesome year for SpaceX.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

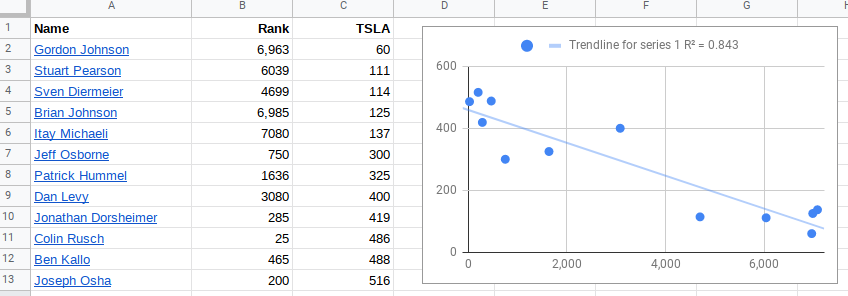

I have done some research and scientific data analysis using TipRanks: collected TSLA price targets from a dozen financial analysts and plotted it against their TipRank ranking:

Look at that correlation graph, R^2=0.843 is nothing to sneeze at, it is nothing like a random shotgun plot.

Clearly, there is a fairly strong correlation, something to ponder for geniuses, like Gordo.

Look at that correlation graph, R^2=0.843 is nothing to sneeze at, it is nothing like a random shotgun plot.

Clearly, there is a fairly strong correlation, something to ponder for geniuses, like Gordo.

Skryll

Active Member

And with paying your bills on time. What an outlandish concept.Operating a factory in Germany/France/Belgium comes with a lot of oversight, bureaucracy and resulting headaches (> California!), I suppose this was factored into the location decision.

You live in Phuket? I visited once, and not sure I'd get any sleep let alone sleep in on the inclusion event. Would love to join you. Beaches are very nice too. Maybe if I run away someday...I’m living in Phuket, Thailand now and here the US market hours go from 9:30 pm to 4:00 a.m. It is very hard to sleep knowing TSLA volatility, but I drifted off for about the fourth time just minutes before the close and woke up later in the morning to see the spectacular finish. What a jolt! Just. Wow!

But, I must confess I’m a little frustrated today because I put in a limit order at 700 to sell a little less than half my shares to fund the purchase of an amazing sea view villa here. So close! I hope I wasn’t too greedy and will get a chance for the order to execute on Monday. I’m going to be disciplined and stick with my planned share number/price point order, but damn it will be annoying if the share price recedes on Monday and I let that five dollar delta stand between me and a TSLA-funded dream home. It’s not a Kruggerand-level purchase, but it sure is a nice villa ON an island!

Here’s hoping that those predicting some inclusion buying pressure remains come Monday are right and my order executes. Even if it doesn’t and 700 does not get breached for awhile, I will try to be philosophical about it and take comfort in the fact that other buying opportunities will certainly arise.

Happy Holidays and thanks to all of you in this special community for great information arbitrage, investing wisdom, timely humor and the psychological support to weather the volatility storms that have been such a significant part of the TSLA story to date.

Cheers,

Bill

Yesterday was a pretty good market day for me (the rest of my life is a disaster that is off topic). I wanted more security for retirement, so I sold Jan 2022 covered calls about 5 minutes before the close for good money. I sold 10% of my shares AH for 682. I didn't quite get the 695 because I couldn't figure out how to do the MOC order. What I don't get is who decided on the 695 for the cross? Was that a form of insider manipulation? At what point did they know it was going to be 695?

JusRelax

Active Member

I have done some research and scientific data analysis using TipRanks: collected TSLA price targets from a dozen financial analysts and plotted it against their TipRank ranking:

View attachment 619211

Look at that correlation graph, R^2=0.843 is nothing to sneeze at, it is nothing like a random shotgun plot.

Clearly, there is a fairly strong correlation, something to ponder for geniuses, like Gordo.

While I do completely agree with you, take into account that, within the past year, pretty much ANYONE that chose TSLA would already be at a huge advantage compared to those that didn't.

Slacker.....If he'd traded the dips and perfectly timed the market then may it's possible, but agreed, probably bought some cheap calls in a dip.

$10k to $1m in three years isn't that great, IMO, I'm $3.5k to $1.3m over the last year in my trading account, and that was without playing the inclusion at all - in hindsight I could have made $2m extra there, but just wasn't prepared to take any risks with the cash I had put aside for the house purchase.

Does anyone have a good grasp of AP's role in this trade?

Could AP's have delivered TSLA shares to the ETF's without yet having secured them, and as such be naked short?

What is AP? Do you mean market makers?

Nolimits

Member

Yesterday was a pretty good market day for me (the rest of my life is a disaster that is off topic). I wanted more security for retirement, so I sold Jan 2022 covered calls about 5 minutes before the close for good money. I sold 10% of my shares AH for 682. I didn't quite get the 695 because I couldn't figure out how to do the MOC order. What I don't get is who decided on the 695 for the cross? Was that a form of insider manipulation? At what point did they know it was going to be 695?

Lots of HoDLers here but sometimes you gotta take profits.

Congratulations on making that tough decision.

And visit PattayaYou live in Phuket? I visited once, and not sure I'd get any sleep let alone sleep in on the inclusion event. Would love to join you. Beaches are very nice too. Maybe if I run away someday...

D

dm28997

Guest

The SP 500 inclusion was sure fun to observe. I believe the shares gobbled up will drastically shrink the float. The idea that the SP will drop after this event doesn't pencil out to me. But I am not following the short interest anymore and don't know the mechanics of shorting in this case. I see less than 8 million shares available to short so it could be the shorts are close to maxing out(all conjecture on my part) but this very historical day has some crazy things going on. Think I'll watch Queens Gambit for the 3rd time. Perhaps I'll keep staring at the ceiling until I get a clue

JusRelax

Active Member

Makes sense that yesterday closed below $700 with 46,860 x $700 calls expiring worthless. Darn 10% rule.

View attachment 619214

@truth_tesla has a thread on twitter regarding how the 10% rule may have been intentionally manipulated:

https://twitter.com/truth_tesla/status/1340220191075151873

HG Wells

Martian Embassy

I just (accidentally) figured out how to make MORE money.

During the dip I bought too many 660 dec 18 calls. Don't have all the money to exercise them.

Well they exercised them any way and got a note asking me to sell something on monday.

It's an IRA so no margin.

Will sell some January 2022 calls to make me cash neutral on monday.

During the dip I bought too many 660 dec 18 calls. Don't have all the money to exercise them.

Well they exercised them any way and got a note asking me to sell something on monday.

It's an IRA so no margin.

Will sell some January 2022 calls to make me cash neutral on monday.

Banks and brokers do this every day to their customers. Nothing special about Tesla here.And with paying your bills on time. What an outlandish concept.

I think it is not a bill but a deposit as a guarantee. Tesla has taken it upon itself to start building without a complete permit (so it saves time), but if the final permit doesn’t come off, the construction has to be undone and the site restored. That is costly and to avoid being a bag holder, the money must be deposited. If the permit is cleared Tesla will get the money back or perhaps a retainer is kept for once the factory is closed in the far future. I don’t know how that works in Germany. In any case, socializing the cost and privatizing the profits is frowned a bit upon in Europe. Helps to make paying tax more acceptable.And with paying your bills on time. What an outlandish concept.

I have done some research and scientific data analysis using TipRanks: collected TSLA price targets from a dozen financial analysts and plotted it against their TipRank ranking:

View attachment 619211

Look at that correlation graph, R^2=0.843 is nothing to sneeze at, it is nothing like a random shotgun plot.

Clearly, there is a fairly strong correlation, something to ponder for geniuses, like Gordo.

Do you know what their ranking was last year? This could just be having the wrong call and going short on one company that x10 caused their ranking to tank. Inversely having the right call shot up their ranking.

If that's the case then the data doesn't really mean much besides the obvious.

1. Tesla has an extension so work hasn't stopped.I think it is not a bill but a deposit as a guarantee. Tesla has taken it upon itself to start building without a complete permit (so it saves time), but if the final permit doesn’t come off, the construction has to be undone and the site restored. That is costly and to avoid being a bag holder, the money must be deposited. If the permit is cleared Tesla will get the money back or perhaps a retainer is kept for once the factory is closed in the far future. I don’t know how that works in Germany. In any case, socializing the cost and privatizing the profits is frowned a bit upon in Europe. Helps to make paying tax more acceptable.

2. The question is whether this particular bill is something new that Germany just added (in addition to the original security deposit) or is it part of the original? If it's a new addition, perhaps Tesla intends to protest as unfair treatment or some such.

3. Interest on $1M is not trivial--even these days.

@truth_tesla has a thread on twitter regarding how the 10% rule may have been intentionally manipulated:

https://twitter.com/truth_tesla/status/1340220191075151873

Is the theory that the share price was forced down low at 12:45 so that it could only rise 10% from that low point?

Because it looks to me like 695 is right around 10% higher than the share price was at that time.

Implying that if it was allowed to rise 10% from where it was in the 670s just prior to that, we could have seen a 10% increase to the mid 700s.

Plus, the extension moves the payment into Q1...1. Tesla has an extension so work hasn't stopped.

2. The question is whether this particular bill is something new that Germany just added (in addition to the original security deposit) or is it part of the original? If it's a new addition, perhaps Tesla intends to protest as unfair treatment or some such.

3. Interest on $1M is not trivial--even these days.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K