No. The options are not like exchange options, they can't be moved. He has to do any exercise first.Would creating a charitable investment trust when exercising the stock option offer any advantage to Elon for avoiding a tax hit while applying the shares toward supporting some qualifying program that he favors?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

If I had a nickel for everytime I thought TSLA would shoot up, I'd have my own Nickel Reserve by now.

snellenr

Member

What would be the effect if the Board withdrew those option grants (or reached an agreement with Elon that he would never exercise them), and then issued new options of roughly equivalent value that vested in late 2022?For the record, it's the date his options were granted (not vested) in CA. So everything prior to the move to TX will be CA taxed, even if he cashes it out years later.

The move to TX, and staying out of CA as much as possible is a move to prevent future share allotments from being taxed at the state level.

Not a CPA, but that's what my friend in TSLA management said (and he also moved to TX for similar reasons).

Other than California spending the next several years in fruitless litigation, of course…

bkp_duke

Well-Known Member

What would be the effect if the Board withdrew those option grants (or reached an agreement with Elon that he would never exercise them), and then issued new options of roughly equivalent value that vested in late 2022?

Other than California spending the next several years in fruitless litigation, of course…

It would probably be an invitation for a tax evasion lawsuit from CA since it would be pretty obviously for saving Elon taxes (it doesn't affect TSLA itself). I just can't see that ever happening, highly unlikely the board would even entertain such a notion.

Just got an Email from Tesla which is obviously aimed at business/property owners that would like to host a supercharger location - bodes well with regard to the supercharger network expansion, it links to this page (make sure you don´t use the localization for Germany in you browser...):

navguy12

Active Member

Perhaps there is no “challenge“ with the Y program compared to challenges implicit in the other programs you mentioned…Not saying Elon hates the Y. He can see the numbers and knows how well the thing is selling. The Y as the initial product at Berlin and Austin is obvious.

But I've been watching Elon Musk, his twitter feed, and reading TMC since 2007. And I just can't help but notice he's less invested in the Y than in other Tesla cars. Elon Musk likes the Y, he just doesn't love it like he loved the S, X, or 3, or loves the Cybertruck. It's like the other programs were personally run by Elon Musk while the Y was done by the Tesla team mostly on its own.

That bolded part resonates with me.No, I definitely did not *expect* it go bankrupt, which is why i was (and am) heavily invested in the stock, and why my kids are going to start life with their educations, first car, and first house already paid for, and why I can retire any time i want.

But all my life practically every day things happen that i didn't expect. Approaching the world in terms of probabilities rather than binary decision-making has worked well for me (i think all people do this to some degree anyway, but i find formalizing that approach is useful). At the time, I (and Elon as well apparently) would have put Tesla's chances of failure somewhat above "near zero", where "failure" is defined not necessarily as the shares going to $0, but perhaps being greatly reduced before being bought out.

correct, i did not expect the stock to go to zero even in the extreme failure case -- i expected it to succeed, mainly because it seemed like Elon had endless access to capital through various means (in addition to all of Tesla's other assets and advantages) but if it did fail, i agree, it'd have been sold off for some value.

Many years ago, a friend lived in an apartment on one of the most intensely trafficked streets in Stockholm, a four-lane thoroughfare ring route with very high speeds in practice. He had the car parked across the street and so had to cross the street often. One day, he said, it dawned upon him that rather than just jaywalking to his door as usual, he really should take the small detour and instead use the controlled crossing. Because, he explained, while the risk of each particular crossing killing him was very low, the fact he did it many times daily radically increased the accumulated risk to his life.

A calculated reduction of a small risk with a large expected value outcome -- painful death. Or at least inconvenient.

That idea stuck in my mind for all these years.

I’m sure you’re aware of the tax-sharing scheme (?) the Tri-States have. I used to work in NY, live in CT, and travel overseas quite a bit. There was a complicated formula based on days actually worked in NY, but I believe that applies just to salary and bonus, not sure about ISO, etc.I vested in some sizeable options prior to retirement. I was working in NJ and living in CT. When I exercised them later in retirement, tax was deducted for NJ.

Since CT tax is less than NJ, I argued that I no longer worked in NJ and I should have had taxes deducted for CT not NJ.

My prior employer stated that the Options were earned in NJ where they were granted and vested and not earned when exercised. It was a 0.5% difference so I didn't want to investigate it any further.

Last edited:

I don‘t believe the risks of individual unrelated and repeated events are cumulative statistically, but maybe someone with more recent stats work understands it better than I.That bolded part resonates with me.

Many years ago, a friend lived in an apartment on one of the most intensely trafficked streets in Stockholm, a four-lane thoroughfare ring route with very high speeds in practice. He had the car parked across the street and so had to cross the street often. One day, he said, it dawned upon him that rather than just jaywalking to his door as usual, he really should take the small detour and instead use the controlled crossing. Because, he explained, while the risk of each particular crossing killing him was very low, the fact he did it many times daily radically increased the accumulated risk to his life.

A calculated reduction of a small risk with a large expected value outcome -- painful death. Or at least inconvenient.

That idea stuck in my mind for all these years.

StealthP3D

Well-Known Member

What you quote above applies to RSUs, but that's not what Elon has. He has options.

When you exercise these options with a strike price of $X, and the current price of $Y, you have to pay the company $X, and you have made an instant income of ($Y-$X), and you owe tax on that amount immediately. As Elon pointed out, the number is so large that he's instantly in the top tax bracket which is >50% given the CA state tax. There are three ways to go:

1. Have enough cash/margin/borrowing available to cover both the company and the tax bill, and hold all the shares.

2. "sell" enough of the options to cover the costs associated with exercising all of them, and hold the shares that are left. This is called "sell to cover".

3. "sell" all of the options and keep the leftover cash.

I write "sell" in quotes because actually it's a three step process. First the broker lends you enough money to exercise the options and remit the tax, secondly the broker sells some or all of the resulting shares, and thirdly pays themselves back; it all happens in an eyeblink.

The equivalent to the 83(b) election is to exercise the options early, while their value is still relatively low, then hold the resulting stock. I have friends who were badly burned in the dot.bomb because the tax they incurred was actually more than the value of the stock after the bubble collapsed. Common wisdom is that if you believe in the company, delay exercise as long as is reasonable/allowable.

Aside: exercising the options is actually good for the company. It was carrying a liability on the books, and it gets to exchange the liability for $X in cash!

Thanks for that!

Investors shouldn't be concerned about how any possible sales from Elon will impact the share price, it's really not fundamental to the company. It looks to me like people are over-emphasizing how the supply and demand of shares affects the share price because they are focusing on the short-term and forgetting that as the shares rise towards being "over-valued" the high valuation reduces demand. Conversely, when shares fall towards the low side, the lower price increases demand.

The driver of all of this is the underlying value of the company, not whether Elon is selling shares to pay taxes In the end, TSLA shares are worth whatever the company is worth divided by the number of shares. Long-term investors focus on the value of the company, not the share price which will naturally fluctuate quite a bit for various reasons. In the end, because the supply and demand is self-regulating, any fluctuations attributable to them get lost in the noise in time. They are basically meaningless on a longer timescale and don't impact the rate at which the company can grow.

To phrase it in simple terms: You only live once. YOLO. Also die, unless your name is Bond.I don‘t believe the risks of individual unrelated and repeated events are cumulative statistically, but maybe someone with more recent stats work understands it better than I.

By Elon's own admission, Tesla was incredibly close to bankruptcy several times between that point and now (particularly during the early Model 3 ramp, iirc). Obviously, the decision to go all-in with your pension on Tesla worked out phenomenally well for you, and that is awesome, but that was still an incredibly risky move. The danger in taking advice only from successful people is that it filters out anyone who's ever been unlucky, or failed for any reason. That's called Survivorship Bias.

A mortgage would be an example of low-cost debt. If you have a pile of cash and a mortgage, should you use the cash to pay off your mortgage, or invest it? I think we all know the answer to that.

Another clueless person criticizing Elon Musk for his space endeavours while forgetting that he started the EV revolution and opened up prize money for the most effective carbon capture technology.

Prince William: Saving Earth should come before space tourism - BBC News

Prince William: Saving Earth should come before space tourism - BBC News

Last edited:

Why frustration from the price action today? Because TSLA does not go up big? IMO the last 2 months it has been my favorite TSLA price action, steadily trickling up a few points almost every single day. Less nightmare and sleep apneaWhenever I get frustrated with the price action - as I am today -

Drumheller

Active Member

I agree that the mission is moving forward and Tesla is selling everything they make. However, I think the membership here, on average, underestimates how much damage the FUD has done. Many people here are retired and out of touch with the working class. I regularly encounter people online and in person that think Elon is a terrible person and Tesla is overhyped.The occasional case where someone is forbidden from buying a Tesla due to media FUD does not impact the sales of products that are supply constrained.

In other words, I fail to see that the media FUD is working, especially not to the degree of "mission accomplished". That rings as hollow as when it was plastered on the deck of the aircraft carrier in 2003. Tesla has shown us that it's going to take more than Media FUD to defeat them.

As for the Model Y, it is the most boring of Teslas. I think that may be why Elon doesn't seem as excited about it. I own a Model Y, it is a great vehicle, but I do miss my old Model S. It will sell like crazy because it is so practical.

After my conversation with a source familiar with the exciting details of the Giga Berlin press, I'm more confident than ever that the manufacturer's true competitive advantage is yet to come

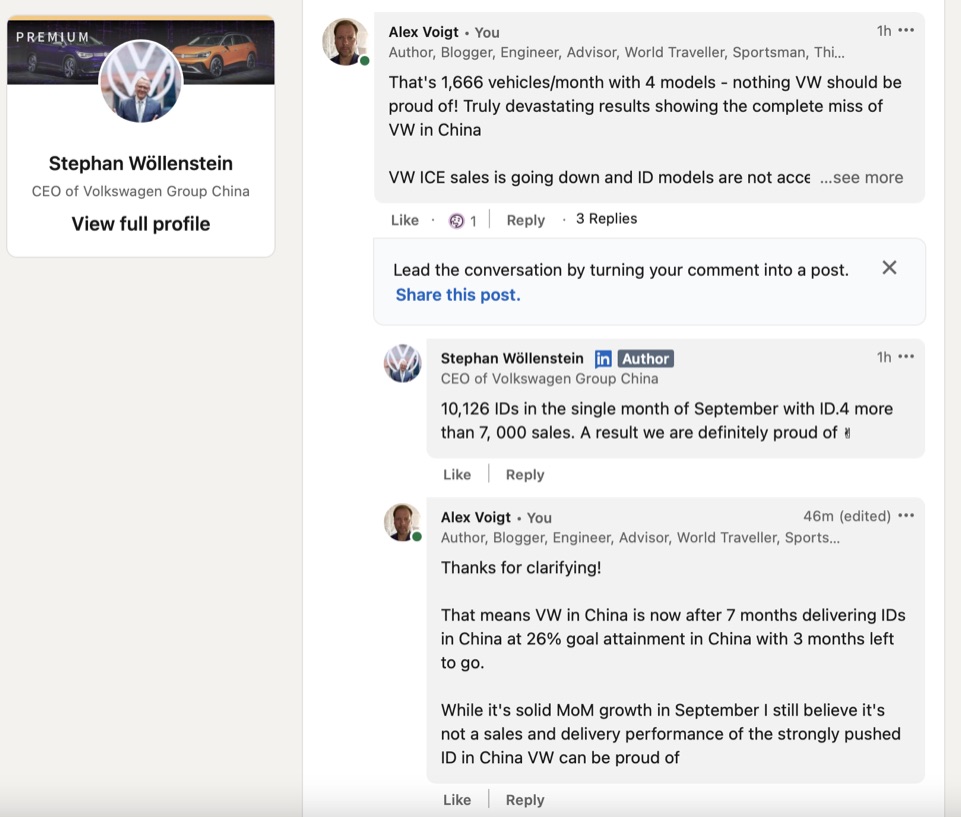

The VW board is in a panic, rushing from one crisis meeting and wake-up call to the next, and the first top maneuverer may be to fired, Wöllenstein CEO VW China who received a clear warning. If he doesn't hit the low end of 80-100k IDs in China in 2021, he will likely be fired.

According to my source, Tesla is in talks to take a next step with a 12,000 ton Giga Casting Machine for a full body casting. The 8,000 ton casting machine for CT is already a done deal.

If you want to hear more, listen to my video

The VW board is in a panic, rushing from one crisis meeting and wake-up call to the next, and the first top maneuverer may be to fired, Wöllenstein CEO VW China who received a clear warning. If he doesn't hit the low end of 80-100k IDs in China in 2021, he will likely be fired.

According to my source, Tesla is in talks to take a next step with a 12,000 ton Giga Casting Machine for a full body casting. The 8,000 ton casting machine for CT is already a done deal.

If you want to hear more, listen to my video

Your neighbor must be living in one of the western countries. Parents nowadays have no choice but to abide by their children's command/demandI just found out from my wife that one of our neighbors is forbidden from buying a Tesla by their daughter, because she hates Elon for some reason....

Even if it didn't happen...im sure someone will file a lawsuit for this, even though 'he' has nothing to do with itIt would probably be an invitation for a tax evasion lawsuit from CA since it would be pretty obviously for saving Elon taxes (it doesn't affect TSLA itself). I just can't see that ever happening, highly unlikely the board would even entertain such a notion.

If it were my kid, next time she came she would find two Tesla’s in the drive and she would be told that would be her inheritance. I’m sure my brother would find something more creative as he makes me look like a softy.Your neighbor must be living in one of the western countries. Parents nowadays have no choice but to abide by their children's command/demand

Nolimits

Member

Don’t know why people are so upset about the price action today. 820 is great! Still have tons of room to grow after earnings. I think these slow climbs are the ones that really stick. Won’t see sub 800s in near future I bet. (Hope I didn’t jinx it)

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K