What's In the Inflation Reduction Act?

JUL 28, 2022

Committee for Responsible Federal Budgets

TAXES

Update (8/3/2022): This analysis has been significantly updated to reflect a newly released score of the Inflation Reduction Act of 2022 from the Congressional Budget Office.

The Congressional Budget Office (CBO) just released its

score of the Inflation Reduction Act (IRA) of 2022

, legislation which would use Fiscal Year (FY) 2022 reconciliation instructions to raise revenue; lower prescription drug costs; fund new energy, climate, and health care provisions; and reduce budget deficits.

Based on the CBO score, the legislation would

reduce deficits by $305 billion through 2031 – including over $100 billion of net scoreable savings and another $200 billion of gross revenue from

stronger tax compliance.

Because the prescription drug savings would be larger than new spending, CBO finds the legislation would modestly

reduce net spending by almost $15 billion through 2031, including by nearly $40 billion in 2031.

Once fully phased in, the plan would also slightly

cut net taxes by about $2 billion per year – with expanded energy and climate tax credits roughly matching the size of new tax increases. The legislation would generate nearly $300 billion of net revenue over a decade, mostly from improved tax compliance and the spillover effects of higher wages as a result of lower health premiums -- neither of which are

tax increases -- along with early revenue collection as corporations shift the timing of certain payments.

Overall, CBO estimates the legislation includes $790 billion of offsets to fund roughly $485 billion of new spending and tax breaks

(as negotiators account for the policies, it includes $739 billion of offsets and $433 billion of investments). Unlike prior versions of this reconciliation bill, such as the House-passed

Build Back Better Act, this legislation would

reduce deficits. Along with other elements of the bill, it is likely to

reduce inflationary pressures and thus reduce the risk of a possible recession.

Inflation Reduction Act Summary

| Policy | Cost (-)/Savings (2022-2031) |

|---|

| Energy and Climate | -$386 billion |

| Clean Electricity Tax Credits | -$161 billion |

| Air Pollution, Hazardous Materials, Transportation and Infrastructure | -$40 billion |

| Individual Clean Energy Incentives | -$37 billion |

| Clean Manufacturing Tax Credits | -$37 billion |

| Clean Fuel and Vehicle Tax Credits | -$36 billion |

| Conservation, Rural Development, Forestry | -$35 billion |

| Building Efficiency, Electrification, Transmission, Industrial, DOE Grants and Loans | -$27 billion |

| Other Energy and Climate Spending | -$14 billion |

| |

| Health Care | -$98 billion |

| Extension of Expanded ACA Subsidies (three years) | -$64 billion |

| Part D Re-Design, LIS Subsidies, Vaccine Coverage | -$34 billion |

| |

| Total, Spending and Tax Breaks | -$485 billion |

| |

| Health Savings | $322 billion |

| Repeal Trump-Era Drug Rebate Rule | $122 billion |

| Drug Price Inflation Cap | $101 billion |

| Negotiation of Certain Drug Prices | $99 billion |

| |

| Revenue | $468 billion |

| 15 Percent Corporate Minimum Tax | $313 billion |

| IRS Tax Enforcement Funding* | $124 billion |

| Closure of Carried Interest Loophole | $13 billion |

| Methane Fee, Superfund Fee, Other Revenue | $18 billion |

| |

| Total, Savings and Revenue | $790 billion |

| |

| Net Deficit Reduction | $305 billion |

| Memo: Deficit reduction with permanent ACA subsidy extension | ~$155 billion |

*IRS funding provision involves an $80 billion expenditure over ten years, which CBO estimates will yield $204 billion in additional revenue for a net savings of $124 billion.

Figures are rounded, based on available information as of 8/3/2022, and subject to change. Figures may not sum due to rounding

The package includes $386 billion of climate and energy spending and tax breaks – mainly for new or expanded tax credits to promote clean energy generation, electrification, green technology retrofits for homes and buildings, greater use of clean fuels, environmental conservation, and wider adoption of electric vehicles, among other purposes. The package would also increase health care spending by nearly $100 billion, mainly by extending the American Rescue Plan's temporarily-expanded Affordable Care Act (ACA) premium tax credits for an additional three years, through 2025. Accompanying this new spending would be various regulatory and permitting reforms to help reduce energy costs outside of the reconciliation package.

The $485 billion of new costs would be offset with $790 billion of additional revenue and savings over a decade. This includes roughly $313 billion from imposing a 15 percent minimum tax on corporate book income; $322 billion for various reforms to

reduce prescription drug costs; $124 billion ($204 billion gross) from

reducing the tax gap through stronger Internal Revenue Service (IRS) enforcement; $13 billion from closing the

carried interest loophole; and $18 billion from fees on methane emissions, Superfund cleanup sites, and a permanent extension of the higher tax rate for the Black Lung Disability Trust Fund.

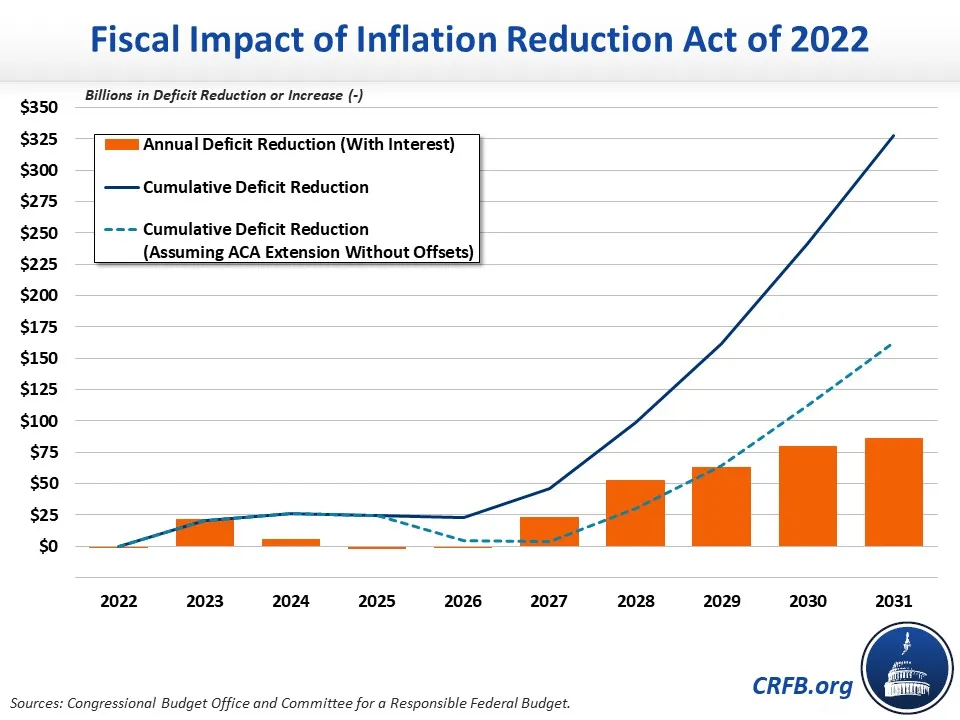

The legislation would reduce deficits by over $20 billion in the first year, and – with interest – over $85 billion in 2031. We

recently estimated it would reduce debt by nearly $2 trillion over two decades. Assuming the permanent unpaid-for extension of ACA subsidies

(which we would strongly oppose), the plan would likely save almost $50 billion per year by 2031.

Although reconciliation was designed for

deficit reduction, this would be the first time in many years it was actually used for this purpose. It would also be the largest deficit reduction bill since the Budget Control Act of 2011. With inflation at a 40-year high and debt approaching record levels, this would be a welcomed improvement from the status quo.

abc7.com