Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

JRP3

Hyperactive Member

Accident

Member

Tesla's Deliveries May Disappoint, Analyst Says. He Cut His Stock-Price Target.

Piper Sandler analyst Alexander Potter cut his target for Tesla's stock price to $340 from $360.www.barrons.com

You wouldn't know that from the Barron's headline (which of course the details of the article are behind a paywall)

They also lowered the delivery estimate, but that just give us a better potential for a beat.

From the article:

"While analysts project about 358,000 deliveries, according to Bloomberg, and about 370,000, according to FactSet, he (Piper Sandler analyst Alexander Potter) cut his delivery number to 354,000 from 380,000. That number comprises 140,000 vehicles from Tesla's Fremont, Calif., factory; 189,000 built in Shanghai; and 25,000 from the company's two new plants in Texas and Germany."

"New Street Research analyst Pierre Ferragu, who also rates share Buy, also cut his delivery estimate recently, to 360,000 from 380,000. Like Potter, Ferragu cited the mix of exports and domestic shipments in China coming into quarter end."

thx1139

Active Member

I am really worried that delivery estimates will disappoint. Lots of the estimates are coming in at what appears to be max capacity for the factories for the Quarter. Production will likely be over those estimates, but not sure the cars will arrive in customers in hand by close of business tomorrow.They also lowered the delivery estimate, but that just give us a better potential for a beat.

From the article:

"While analysts project about 358,000 deliveries, according to Bloomberg, and about 370,000, according to FactSet, he (Piper Sandler analyst Alexander Potter) cut his delivery number to 354,000 from 380,000. That number comprises 140,000 vehicles from Tesla's Fremont, Calif., factory; 189,000 built in Shanghai; and 25,000 from the company's two new plants in Texas and Germany."

"New Street Research analyst Pierre Ferragu, who also rates share Buy, also cut his delivery estimate recently, to 360,000 from 380,000. Like Potter, Ferragu cited the mix of exports and domestic shipments in China coming into quarter end."

The Fed is out of control and unstoppable, but they are right to be concerned about inflation. The problem is that they are late (very) and now over-correcting.

Things will be volatile for some time and very few stocks will be spared (including TSLA) because of the beta. The good news is whatever supposed competition they have will have stronger headwinds on multiple fronts (hard to do capex in a high rate environment)… Tesla is years ahead of all of them.

Still, the Fed is tamping down consumer demand until they can see Core CPI come down significantly.

Zoom out and focus on the longer term (3-5 years at least). Next few quarters will be tough.

P&D should be strong but forward guidance will be critical.

Things will be volatile for some time and very few stocks will be spared (including TSLA) because of the beta. The good news is whatever supposed competition they have will have stronger headwinds on multiple fronts (hard to do capex in a high rate environment)… Tesla is years ahead of all of them.

Still, the Fed is tamping down consumer demand until they can see Core CPI come down significantly.

Zoom out and focus on the longer term (3-5 years at least). Next few quarters will be tough.

P&D should be strong but forward guidance will be critical.

insaneoctane

Well-Known Member

Is the powerwall rated to survive a flood? If so, damnnnnnnn that's boss!

ZeApelido

Active Member

I can't believe I live 15 min away from AI Day event and didn't get an invite.

I'm gonna stand outside of the event tomorrow night with a boombox over my head.

I'm gonna stand outside of the event tomorrow night with a boombox over my head.

insaneoctane

Well-Known Member

I don't understand this chart. It appears that I should be happy in the US? I'm not because everything costs more, my employer doesn't care because I'm already well compensated (translation = suck it up, buttercup - no raise for you), and my portfolio is in the toilet. Not feeling that strong dollar...maybe the chart is just trying to tell me that others have it worse?

Skryll

Active Member

Water cooling ?Is the powerwall rated to survive a flood? If so, damnnnnnnn that's boss!

Yes. Be economically glad you don’t live in Europe right now (Or anywhere else frankly).I don't understand this chart. It appears that I should be happy in the US? I'm not because everything costs more, my employer doesn't care because I'm already well compensated (translation = suck it up, buttercup - no raise for you), and my portfolio is in the toilet. Not feeling that strong dollar...maybe the chart is just trying to tell me that others have it worse?

MC3OZ

Active Member

Wait for a knock on the door, that could be Optimus hand delivering an invite for a FSD ride to the event.....I can't believe I live 15 min away from AI Day event and didn't get an invite.

I'm gonna stand outside of the event tomorrow night with a boombox over my head.

View attachment 858276

But more likely it will be the Mormons

Last time i checked, it still cost $268.xx to buy a share of $TSLA, regardless of how strong the US Dollar isI don't understand this chart. It appears that I should be happy in the US? I'm not because everything costs more, my employer doesn't care because I'm already well compensated (translation = suck it up, buttercup - no raise for you), and my portfolio is in the toilet. Not feeling that strong dollar...maybe the chart is just trying to tell me that others have it worse?

insaneoctane

Well-Known Member

For the price Monroe Associates charged for those cells, I'd be hella pissed if it came with pink and grey structural adhesive / epoxy all over it. Those cells aren't display worthy!

jhm

Well-Known Member

It looks like I picked a bad day to look at my portfolio.

TheTalkingMule

Distributed Energy Enthusiast

I believe I heard something about fleet deliveries at the end of the month. So whatever can't be delivered to individuals can just be transfered to Hertz or whomever.I am really worried that delivery estimates will disappoint. Lots of the estimates are coming in at what appears to be max capacity for the factories for the Quarter. Production will likely be over those estimates, but not sure the cars will arrive in customers in hand by close of business tomorrow.

Gigapress

Trying to be less wrong

Paul Graham co founded Y-Combinator, the best startup incubator of all time, and their biggest success in their portfolio is AirBnB. I am glad to see AirBnB co-founder Joe Gebbia is joining the board because Paul Graham has spoke very highly of how AirBnB has been run from the beginning and also of the founders themselves. Additionally, I think that the culture Gebbia helped instill at AirBnB meshes well with the culture of the Musk companies.

The Scientific Method for using rigorous empiricism to understand reality was described by Sir Francis Bacon four centuries ago and unfortunately it still today is not widely used by the vast majority of people the vast majority of the time. Investors can gain an advantage by overcoming their biases with science in order to gain a more accurate understanding of the world and thereby make better forecasts and consequently better investing decisions. The best way to test the truth of any hypothesis is randomized controlled trials with careful data collection and rigorous analysis of the data.

Y-Combinator is effectively a research lab that has spent more than a decade running experiments in a quest to determine what factors influence the probability of startup success. Paul Graham has spent years on the ground working with startups and their users and has also collected a lot of data from thousands of startups that have gone through Y-Combinator as well as data of the applicants whom they rejected and their subsequent performance without Y-Combinator’s help. Therefore Paul Graham's opinion on this subject is of great value if we want to predict the success likelihood of a given startup such as Tesla. Y-Combinator has batches of startups that go through the same selection process and work together helping each other out, with the same funding connections to venture capital, and they all work at the coworking space in Silicon Valley. This is the closest thing we’ll probably ever get to randomized controlled trials with large sample sizes and long follow-up periods for 21st-century technology startup entrepreneurship.

If you haven’t read any of Paul Graham’s essays, I highly recommend doing it (link) These writings factored heavily in my decision to back up the truck on TSLA with half my savings in 2018. Graham has described his observations on the distinguishing factors that separate mega-successful startups from the rest, and I saw that Tesla operated like those previous dominant startups and that Elon Musk thought and acted like the ideal founder.

Here are some of his gems with obvious parallels to Tesla as well as the surrounding FUD and general public misunderstanding:

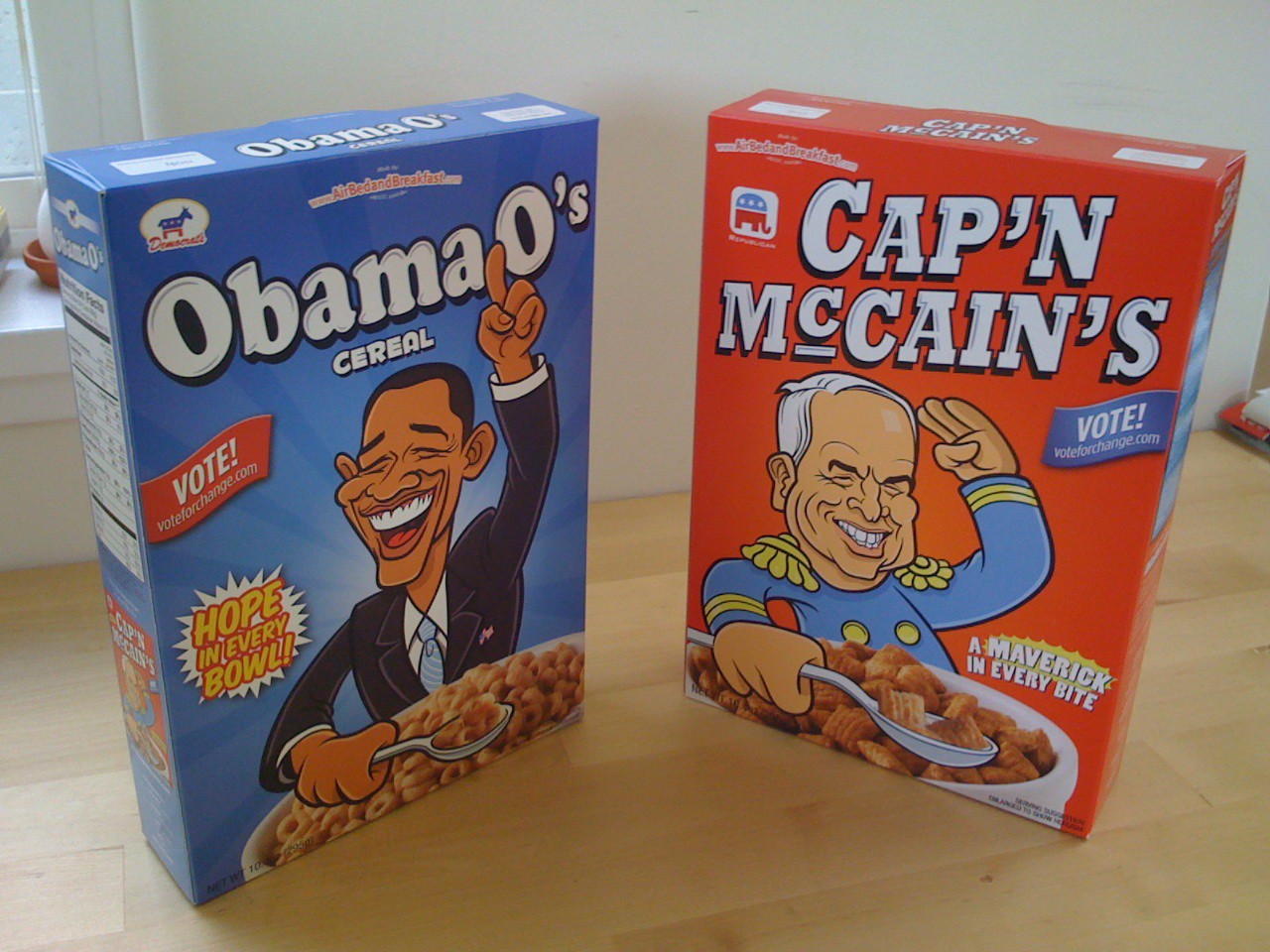

The AirBnB founders were hardcore from day one because they had just quit their jobs to start a business together and their landlord increased rent by 20%, so they came up with the idea of renting out their air mattresses and living rooms to people traveling to San Francisco for a big design conference that month. Their initial funding came from selling Obama- and McCain-themed breakfast cereal and credit card debt until Y-Combinator invested and took them under their wing. This is the same kind of move as sleeping on the couch in the small office for Zip2 and showering at the gym, isn’t it? Or sleeping at the factory and setting up the Fremont tent? Or like selling flamethrowers, surfboards, short shorts, and tequila in lightning bolt-shaped bottles? You pivot decisively into whatever it takes to win (ethically of course) and have fun without taking yourself too seriously.

I anticipate that Gebbia will support Tesla’s breakneck speed of innovation and he personally knows what it’s like to have most people saying your ideas are stupid and will never work. Most people, including venture capitalists whose main job is supposed to be recognizing good founders and product-market fit, thought AirBnB was a dud concept destined to fail, and that nobody would want to pay to stay at a stranger’s home they found on the internet when they could stay at a real hotel. They did it anyway and apparently risked personal bankruptcy to do so, just like Elon did in 2008 right along with them. This mindset really fits Tesla well. Only time will tell, but I’m optimistic about this addition to Tesla’s board.

The Scientific Method for using rigorous empiricism to understand reality was described by Sir Francis Bacon four centuries ago and unfortunately it still today is not widely used by the vast majority of people the vast majority of the time. Investors can gain an advantage by overcoming their biases with science in order to gain a more accurate understanding of the world and thereby make better forecasts and consequently better investing decisions. The best way to test the truth of any hypothesis is randomized controlled trials with careful data collection and rigorous analysis of the data.

Y-Combinator is effectively a research lab that has spent more than a decade running experiments in a quest to determine what factors influence the probability of startup success. Paul Graham has spent years on the ground working with startups and their users and has also collected a lot of data from thousands of startups that have gone through Y-Combinator as well as data of the applicants whom they rejected and their subsequent performance without Y-Combinator’s help. Therefore Paul Graham's opinion on this subject is of great value if we want to predict the success likelihood of a given startup such as Tesla. Y-Combinator has batches of startups that go through the same selection process and work together helping each other out, with the same funding connections to venture capital, and they all work at the coworking space in Silicon Valley. This is the closest thing we’ll probably ever get to randomized controlled trials with large sample sizes and long follow-up periods for 21st-century technology startup entrepreneurship.

If you haven’t read any of Paul Graham’s essays, I highly recommend doing it (link) These writings factored heavily in my decision to back up the truck on TSLA with half my savings in 2018. Graham has described his observations on the distinguishing factors that separate mega-successful startups from the rest, and I saw that Tesla operated like those previous dominant startups and that Elon Musk thought and acted like the ideal founder.

Here are some of his gems with obvious parallels to Tesla as well as the surrounding FUD and general public misunderstanding:

Most really good startup ideas look like bad ideas at first, and many of those look bad specifically because some change in the world just switched them from bad to good.

Here it is: I like to find (a) simple solutions (b) to overlooked problems (c) that actually need to be solved, and (d) deliver them as informally as possible, (e) starting with a very crude version 1, then (f) iterating rapidly.

When I first laid out these principles explicitly, I noticed something striking: this is practically a recipe for generating a contemptuous initial reaction. Though simple solutions are better, they don't seem as impressive as complex ones. Overlooked problems are by definition problems that most people think don't matter. Delivering solutions in an informal way means that instead of judging something by the way it's presented, people have to actually understand it, which is more work. And starting with a crude version 1 means your initial effort is always small and incomplete.

I'd noticed, of course, that people never seemed to grasp new ideas at first. I thought it was just because most people were stupid. Now I see there's more to it than that. Like a contrarian investment fund, someone following this strategy will almost always be doing things that seem wrong to the average person.

As with contrarian investment strategies, that's exactly the point. This technique is successful (in the long term) because it gives you all the advantages other people forgo by trying to seem legit. If you work on overlooked problems, you're more likely to discover new things, because you have less competition. If you deliver solutions informally, you (a) save all the effort you would have had to expend to make them look impressive, and (b) avoid the danger of fooling yourself as well as your audience. And if you release a crude version 1 then iterate, your solution can benefit from the imagination of nature, which, as Feynman pointed out, is more powerful than your own.

The two most important things to understand about startup investing, as a business, are (1) that effectively all the returns are concentrated in a few big winners, and (2) that the best ideas look initially like bad ideas.

The first rule I knew intellectually, but didn't really grasp till it happened to us. The total value of the companies we've funded is around 10 billion, give or take a few. But just two companies, Dropbox and Airbnb, account for about three quarters of it.

In startups, the big winners are big to a degree that violates our expectations about variation. I don't know whether these expectations are innate or learned, but whatever the cause, we are just not prepared for the 1000x variation in outcomes that one finds in startup investing.

The AirBnB founders were hardcore from day one because they had just quit their jobs to start a business together and their landlord increased rent by 20%, so they came up with the idea of renting out their air mattresses and living rooms to people traveling to San Francisco for a big design conference that month. Their initial funding came from selling Obama- and McCain-themed breakfast cereal and credit card debt until Y-Combinator invested and took them under their wing. This is the same kind of move as sleeping on the couch in the small office for Zip2 and showering at the gym, isn’t it? Or sleeping at the factory and setting up the Fremont tent? Or like selling flamethrowers, surfboards, short shorts, and tequila in lightning bolt-shaped bottles? You pivot decisively into whatever it takes to win (ethically of course) and have fun without taking yourself too seriously.

I anticipate that Gebbia will support Tesla’s breakneck speed of innovation and he personally knows what it’s like to have most people saying your ideas are stupid and will never work. Most people, including venture capitalists whose main job is supposed to be recognizing good founders and product-market fit, thought AirBnB was a dud concept destined to fail, and that nobody would want to pay to stay at a stranger’s home they found on the internet when they could stay at a real hotel. They did it anyway and apparently risked personal bankruptcy to do so, just like Elon did in 2008 right along with them. This mindset really fits Tesla well. Only time will tell, but I’m optimistic about this addition to Tesla’s board.

Last edited:

The Accountant

Active Member

I believe I heard something about fleet deliveries at the end of the month. So whatever can't be delivered to individuals can just be transfered to Hertz or whomever.

I do see some evidence that Shanghai may have up to 10k cars in transit to Europe and Australia at quarter end which won't count as sales.

I have a 373k estimate but won't be surprised to see 363k. I will likely be adding 10k to my Q4 delivery number.

It appears that Tesla may be focused on achieving the Year rather than the Qtr. By putting 10k cars on ships now it ensures all exports for Q4 get delivered early allowing Tesla to focus on local deliveries for the final 5-7 weeks of the year. The exports also provide a higher margin for Q4 in my estimate.

B

betstarship

Guest

Paul Graham co founded Y-Combinator, the best startup incubator of all time, and their biggest success in their portfolio is AirBnB. I am glad to see AirBnB co-founder Joe Gebbia is joining the board because Paul Graham has spoke very highly of how AirBnB has been run from the beginning and also of the founders themselves. Additionally, I think that the culture Gebbia helped instill at AirBnB meshes well with the culture of the Musk companies.

The Scientific Method for using rigorous empiricism to understand reality was described by Sir Francis Bacon four centuries ago and unfortunately it still today is not widely used by the vast majority of people the vast majority of the time. Investors can gain an advantage by overcoming their biases with science in order to gain a more accurate understanding of the world and thereby make better forecasts and consequently better investing decisions. The best way to test the truth of any hypothesis is randomized controlled trials with careful data collection and rigorous analysis of the data.

Y-Combinator is effectively a research lab that has spent more than a decade running experiments in a quest to determine what factors influence the probability of startup success. Paul Graham has spent years on the ground working with startups and their users and has also collected a lot of data from thousands of startups that have gone through Y-Combinator as well as data of the applicants whom they rejected and their subsequent performance without Y-Combinator’s help. Therefore Paul Graham's opinion on this subject is of great value if we want to predict the success likelihood of a given startup such as Tesla. Y-Combinator has batches of startups that go through the same selection process and work together helping each other out, with the same funding connections to venture capital, and they all work at the coworking space in Silicon Valley. This is the closest thing we’ll probably ever get to randomized controlled trials with large sample sizes and long follow-up periods for 21st-century technology startup entrepreneurship.

If you haven’t read any of Paul Graham’s essays, I highly recommend doing it (link) These writings factored heavily in my decision to back up the truck on TSLA with half my savings in 2018. Graham has described his observations on the distinguishing factors that separate mega-successful startups from the rest, and I saw that Tesla operated like those previous dominant startups and that Elon Musk thought and acted like the ideal founder.

Here are some of his gems with obvious parallels to Tesla as well as the surrounding FUD and general public misunderstanding:

The AirBnB founders were hardcore from day one because they had just quit their jobs to start a business together and their landlord increased rent by 20%, so they came up with the idea of renting out their air mattresses and living rooms to people traveling to San Francisco for a big design conference that month. Their initial funding came from selling Obama- and McCain-themed breakfast cereal and credit card debt until Y-Combinator invested and took them under their wing. This is the same kind of move as sleeping on the couch in the small office for Zip2 and showering at the gym, isn’t it? Or sleeping at the factory and setting up the Fremont tent? Or like selling flamethrowers, surfboards, short shorts, and tequila in lightning bolt-shaped bottles? You pivot decisively into whatever it takes to win (ethically of course) and have fun without taking yourself too seriously.

View attachment 858265

I anticipate that Gebbia will support Tesla’s breakneck speed of innovation and he personally knows what it’s like to have most people saying your ideas are stupid and will never work. Most people, including venture capitalists whose main job is supposed to be recognizing good founders and product-market fit, thought AirBnB was a dud concept destined to fail, and that nobody would want to pay to stay at a stranger’s home they found on the internet when they could stay at a real hotel. They did it anyway and apparently risked personal bankruptcy to do so, just like Elon did in 2008 right along with them. This mindset really fits Tesla well. Only time will tell, but I’m optimistic about this addition to Tesla’s board.

They're not the only ones that do this sort of work. All of the VC accelerators do, but they follow a niche nowadays as the ecosystem has grown. An entire ecosystem has been and continues to be built to grow out human progress applying new technologies found, mostly first, in the private markets.

There's probably going to come a day when even the private markets will have trading activity too. CartaX is an example.

Ramblings of an idiot a day before AI Day and a few days before Q3 P&D numbers are announced:

Hype and expectations for AI Day are starting to get a bit out of hand (pardon the pun). The likes of Dave Lee, Dr. Know It All, the usual Twitter suspects, are all voicing their excitement and posting their expectations of what they want/expect to see tomorrow evening. Even with Elon coming out and saying this will be a highly technical presentation meant for AI recruiting, it still feels to me like folks are expecting a lot. Potential setup for disappointment if this is a highly technical presentation and it goes over the head of most of us, including WS analysts.

Ross Gerber just posted on Twitter that the consensus analyst delivery estimate is now 364K. I'm not sure where he gets that number, but it's higher than I would expect the consensus to be. I thought it was down to 360K, and that is before the likes of Potter and Ferragu lowered their number this week. I hope I'm wrong, but this also feels like a setup for disappointment. Rob Maurer is at 360K, Troy Teslike will be publishing his final estimate tomorrow, but I bet it comes in under 360K. With the Shanghai production/delivery model a bit out of synch this quarter, I could see a miss here.

The above, combined with the horrible macro environment, make me concerned about the SP near term. Hope I'm wrong; I will be nervously watching over the weekend and Monday.

Having said that, I am the absolute worst at short term predictions and stock price movements. I would be much more successful if I traded the exact opposite of what I expect.

So bullish!?

Hype and expectations for AI Day are starting to get a bit out of hand (pardon the pun). The likes of Dave Lee, Dr. Know It All, the usual Twitter suspects, are all voicing their excitement and posting their expectations of what they want/expect to see tomorrow evening. Even with Elon coming out and saying this will be a highly technical presentation meant for AI recruiting, it still feels to me like folks are expecting a lot. Potential setup for disappointment if this is a highly technical presentation and it goes over the head of most of us, including WS analysts.

Ross Gerber just posted on Twitter that the consensus analyst delivery estimate is now 364K. I'm not sure where he gets that number, but it's higher than I would expect the consensus to be. I thought it was down to 360K, and that is before the likes of Potter and Ferragu lowered their number this week. I hope I'm wrong, but this also feels like a setup for disappointment. Rob Maurer is at 360K, Troy Teslike will be publishing his final estimate tomorrow, but I bet it comes in under 360K. With the Shanghai production/delivery model a bit out of synch this quarter, I could see a miss here.

The above, combined with the horrible macro environment, make me concerned about the SP near term. Hope I'm wrong; I will be nervously watching over the weekend and Monday.

Having said that, I am the absolute worst at short term predictions and stock price movements. I would be much more successful if I traded the exact opposite of what I expect.

So bullish!?

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K