I'm pretty sure that there are a lot of folks that want to order a car but get pressured into taking one from a dealer's inventory rather than getting exactly what they want. "You can have this car today if only you'll give up this small item". Dealers really don't like order placers.Certainly that is true. However the generalization made by @StealthP3D is true for the majority of sales in high volume countries. Even so, a significant minority of buyers have ordered vehicles, often sight unseen, and waited. Just for the anecdote I reviewed my own history of >50 cars I have owned I waited for 16 of them to arrive as ordered. I waited more than a year for six of them, including two Teslas, a P3D and a Model S Plaid.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

-

- Tags

- elon is an ass

Krugerrand

Meow

The disagree - I don’t think it’s going to happen like that nor in that time frame. The only companies I trust to expand as fast as humanly possible; Tesla and a couple of their current battery suppliers. That is all and that’s not enough.Ford's experiencing the same. So is GM. The waiting list for EVs is long. That should end in 2026, it is all about batteries and by 2026 we have massive amounts of battery capacity coming online in the USA and in Europe. By 2028 there will be 30x the original GF capacity open and running and the constraints will surely morph into supply chain issues on batteries. By 2030 battery capacity is such that I would think we'll see a steep decline in costs, we'll have reached scale. Right now we are clearly seeing the impact of scarcity, by 2030 we can safely assume no scarcity and a glut. What happens between now and then ...that's where things get interesting.

Everyone else is a lot of talk; press releases, photo ops, hand waving, feet dragging and not much action.

Additionally, there’s a lot of battery/ battery management systems issues in EVs other than Tesla and a few others that need to be addressed. Nay, should have long since been addressed.

ZeApelido

Active Member

Just wanted to add this opinion giving the conversation of people not wanting to use margin (which I generally agree with).

Why Deep ITM LEAPs Call Options Could Be Better Than Margin

ITM = In The Money

LEAPS = Long-Term Equity Anticipation Securities

#1 - The safest thing to do is hold shares. However, if you have the inkling to use a little bit of leverage, it is probably better and less stressful to buy LEAPs than more shares on margin.

#2 - Using a bit of leverage should be reserved for when you think the stock has hit or near a medium- term bottom.

1. Say you have own $100k of equity in TSLA at current share price. Say you are allowed to borrow up to 40% of that equity to buy more shares to give you 1.4x leverage. This of course would be stupid because any drop in stock price would give you a margin call, and it's quite likely there will some short term dip. So you try to estimate what the biggest dip could be from here. Say you estimate it's a 20% drop in share price, to $145. So actaully you only have enough margin for 1.3x. But still, now you have to stress out everytime the stock drops say 10-15%, not enjoyable.

But maybe you are super convinced the stock cannot drop past $100, so you use margin so you won't have any issues unless the stock drops past $100. So in reality you can leverage to 1.2x.

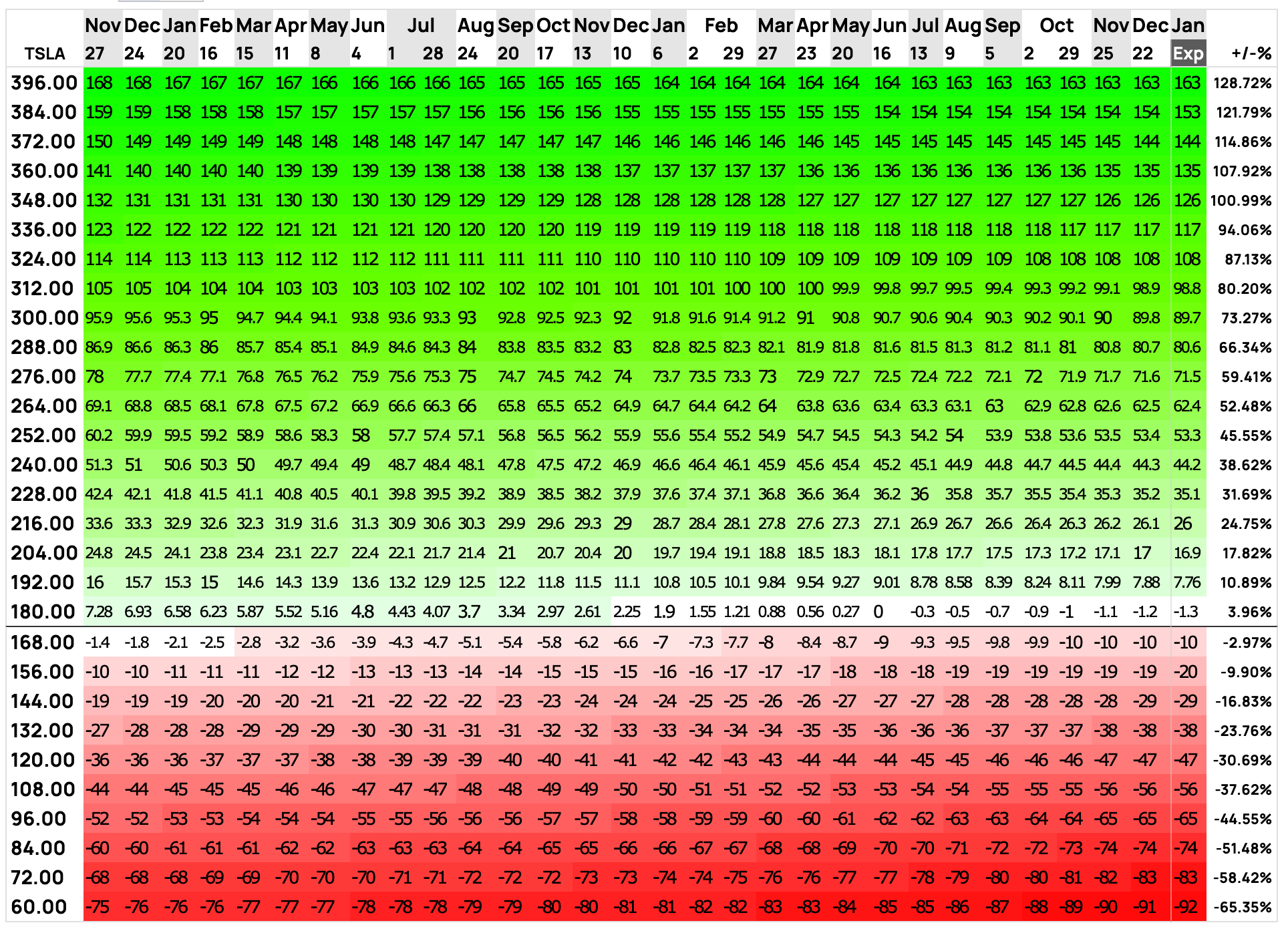

Compare that to buying Jan 2025 $50 calls with your $100k in cash. The cells indicate the call % change in value, each row being a % change in share price from current value, and each column a point in time. The calls give you about ~25%-30% (1.25x-1.3x) leverage depending on time and stock price value.

But you get that leverage without using margin.

So even if you buy these and the stock dips to $100 temporarily, you do not need to have any of the short term stress you would have to with margin.

Downsides:

If the stock goes and stays below $100 long term, you will start losing more money than you would have using margin. Share price near $50 in 2 years means you lose all your money. That is a big downside, and while may seem very unlikely, it is the reason there is upside allowed on all other share prices above it. There is no free lunch.

Also, whether you close the trade at some point before expiration or acquire the shares, this forces a tax event in your taxable accounts. Selling profitable calls after > 1 year of holding is a long term capital gain.

As you increase the strike price, you get more leverage but higher risk of losing a crapton of money to the downside. That's why I'm only bringing up the DEEP ITM example and talking about it after the stock has already been beating up bigly.

IMO it's safer and less stressful than using margin especially in current conditions. Not advice.

P.S. - if instead of buying straight $50 calls, you bought a $50 / $400 call spread, you leverage will increase to 1.8x near expiration up to $400.

opcalc.com

opcalc.com

Why Deep ITM LEAPs Call Options Could Be Better Than Margin

ITM = In The Money

LEAPS = Long-Term Equity Anticipation Securities

#1 - The safest thing to do is hold shares. However, if you have the inkling to use a little bit of leverage, it is probably better and less stressful to buy LEAPs than more shares on margin.

#2 - Using a bit of leverage should be reserved for when you think the stock has hit or near a medium- term bottom.

1. Say you have own $100k of equity in TSLA at current share price. Say you are allowed to borrow up to 40% of that equity to buy more shares to give you 1.4x leverage. This of course would be stupid because any drop in stock price would give you a margin call, and it's quite likely there will some short term dip. So you try to estimate what the biggest dip could be from here. Say you estimate it's a 20% drop in share price, to $145. So actaully you only have enough margin for 1.3x. But still, now you have to stress out everytime the stock drops say 10-15%, not enjoyable.

But maybe you are super convinced the stock cannot drop past $100, so you use margin so you won't have any issues unless the stock drops past $100. So in reality you can leverage to 1.2x.

Compare that to buying Jan 2025 $50 calls with your $100k in cash. The cells indicate the call % change in value, each row being a % change in share price from current value, and each column a point in time. The calls give you about ~25%-30% (1.25x-1.3x) leverage depending on time and stock price value.

But you get that leverage without using margin.

So even if you buy these and the stock dips to $100 temporarily, you do not need to have any of the short term stress you would have to with margin.

Downsides:

If the stock goes and stays below $100 long term, you will start losing more money than you would have using margin. Share price near $50 in 2 years means you lose all your money. That is a big downside, and while may seem very unlikely, it is the reason there is upside allowed on all other share prices above it. There is no free lunch.

Also, whether you close the trade at some point before expiration or acquire the shares, this forces a tax event in your taxable accounts. Selling profitable calls after > 1 year of holding is a long term capital gain.

As you increase the strike price, you get more leverage but higher risk of losing a crapton of money to the downside. That's why I'm only bringing up the DEEP ITM example and talking about it after the stock has already been beating up bigly.

IMO it's safer and less stressful than using margin especially in current conditions. Not advice.

P.S. - if instead of buying straight $50 calls, you bought a $50 / $400 call spread, you leverage will increase to 1.8x near expiration up to $400.

TSLA Long Call (bullish) calculator

Call option profit calculator. Visualise the projected P&L of a call option at possible stock prices over time until expiry.

Krugerrand

Meow

You lost me at ‘the safest’ - then my eyes crossed. The further I read, the more I thought this sounds like making beef wellington and a cheese soufflé - you just don’t do it unless you’re Gordon Ramsey and certainly not while he’s yelling obscenities at you, the latter being equivalent to what WallStreet is doing right now.Just wanted to add this opinion giving the conversation of people not wanting to use margin (which I generally agree with).

Why Deep ITM LEAPs Call Options Could Be Better Than Margin

ITM = In The Money

LEAPS = Long-Term Equity Anticipation Securities

#1 - The safest thing to do is hold shares. However, if you have the inkling to use a little bit of leverage, it is probably better and less stressful to buy LEAPs than more shares on margin.

#2 - Using a bit of leverage should be reserved for when you think the stock has hit or near a medium- term bottom.

1. Say you have own $100k of equity in TSLA at current share price. Say you are allowed to borrow up to 40% of that equity to buy more shares to give you 1.4x leverage. This of course would be stupid because any drop in stock price would give you a margin call, and it's quite likely there will some short term dip. So you try to estimate what the biggest dip could be from here. Say you estimate it's a 20% drop in share price, to $145. So actaully you only have enough margin for 1.3x. But still, now you have to stress out everytime the stock drops say 10-15%, not enjoyable.

But maybe you are super convinced the stock cannot drop past $100, so you use margin so you won't have any issues unless the stock drops past $100. So in reality you can leverage to 1.2x.

Compare that to buying Jan 2025 $50 calls with your $100k in cash. The cells indicate the call % change in value, each row being a % change in share price from current value, and each column a point in time. The calls give you about ~25%-30% (1.25x-1.3x) leverage depending on time and stock price value.

But you get that leverage without using margin.

So even if you buy these and the stock dips to $100 temporarily, you do not need to have any of the short term stress you would have to with margin.

Downsides:

If the stock goes and stays below $100 long term, you will start losing more money than you would have using margin. Share price near $50 in 2 years means you lose all your money. That is a big downside, and while may seem very unlikely, it is the reason there is upside allowed on all other share prices above it. There is no free lunch.

Also, whether you close the trade at some point before expiration or acquire the shares, this forces a tax event in your taxable accounts. Selling profitable calls after > 1 year of holding is a long term capital gain.

As you increase the strike price, you get more leverage but higher risk of losing a crapton of money to the downside. That's why I'm only bringing up the DEEP ITM example and talking about it after the stock has already been beating up bigly.

IMO it's safer and less stressful than using margin especially in current conditions. Not advice.

P.S. - if instead of buying straight $50 calls, you bought a $50 / $400 call spread, you leverage will increase to 1.8x near expiration up to $400.

View attachment 878435

TSLA Long Call (bullish) calculator

Call option profit calculator. Visualise the projected P&L of a call option at possible stock prices over time until expiry.opcalc.com

bkp_duke

Well-Known Member

Some background on the frank discussions between the US and Europe regarding the IRA. I don’t think this will impact Tesla’s investment decisions much beyond shifts of a quarter or two. But if Europe creates its own subsidy program, that could impact Tesla’s margins.

Glad that Tesla had the foresight to site a plant in Germany and to keep investing irrespective of subsidies.

Biden keeps ignoring Europe. It’s time EU leaders got the message

The US president has sparked new outrage in Europe over plans to subsidize industry.www.politico.eu

Positively affect Tesla's margins, I would expect, with Berlin having on-site battery production coming online soon, and in-EU auto production.

China imports would not be eligible but I could see Berlin expansion fast-tracked.

When do folks see this happening? Q4 or Q1?I would expect, with Berlin having on-site battery production coming online soon

B

betstarship

Guest

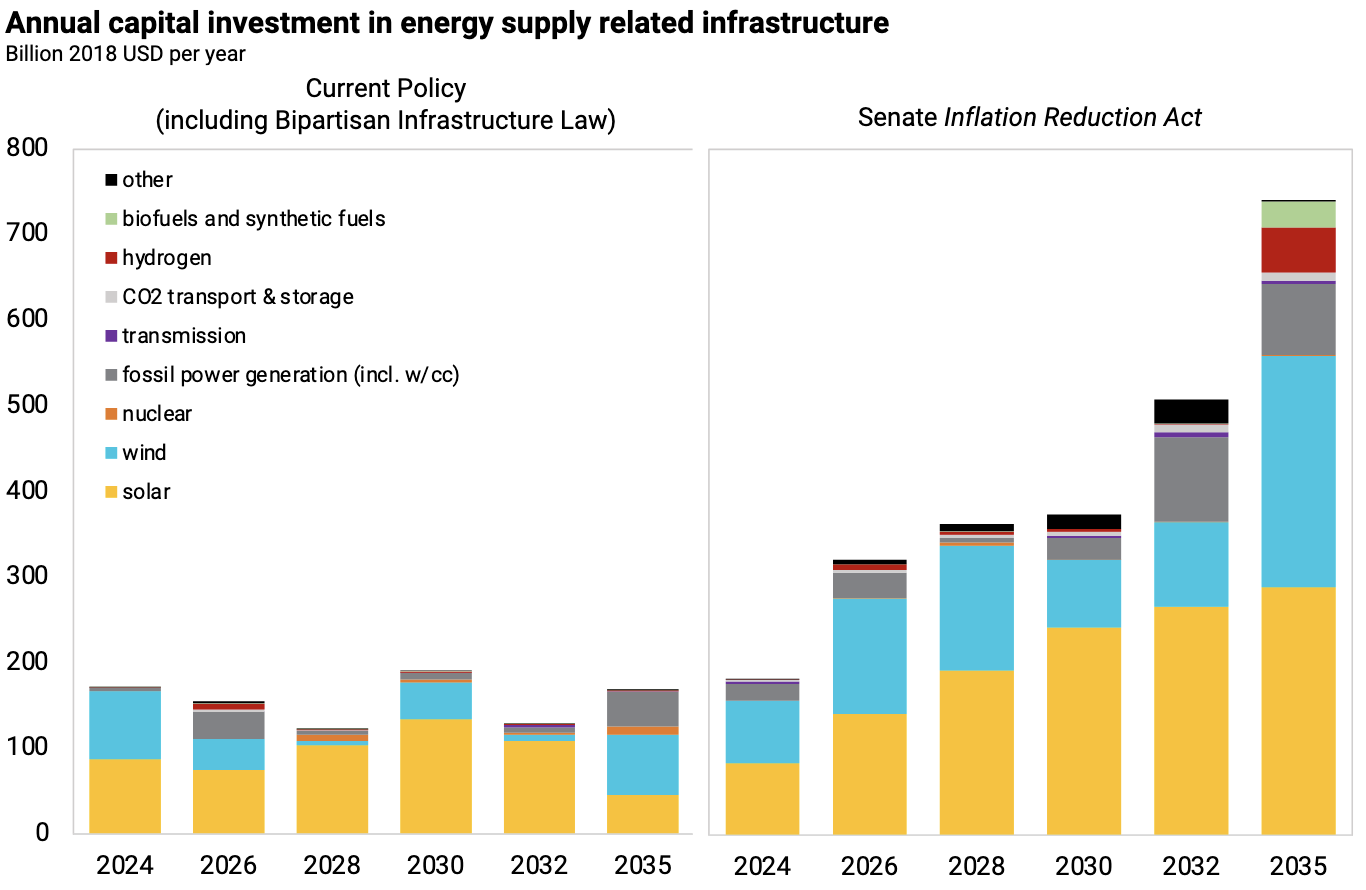

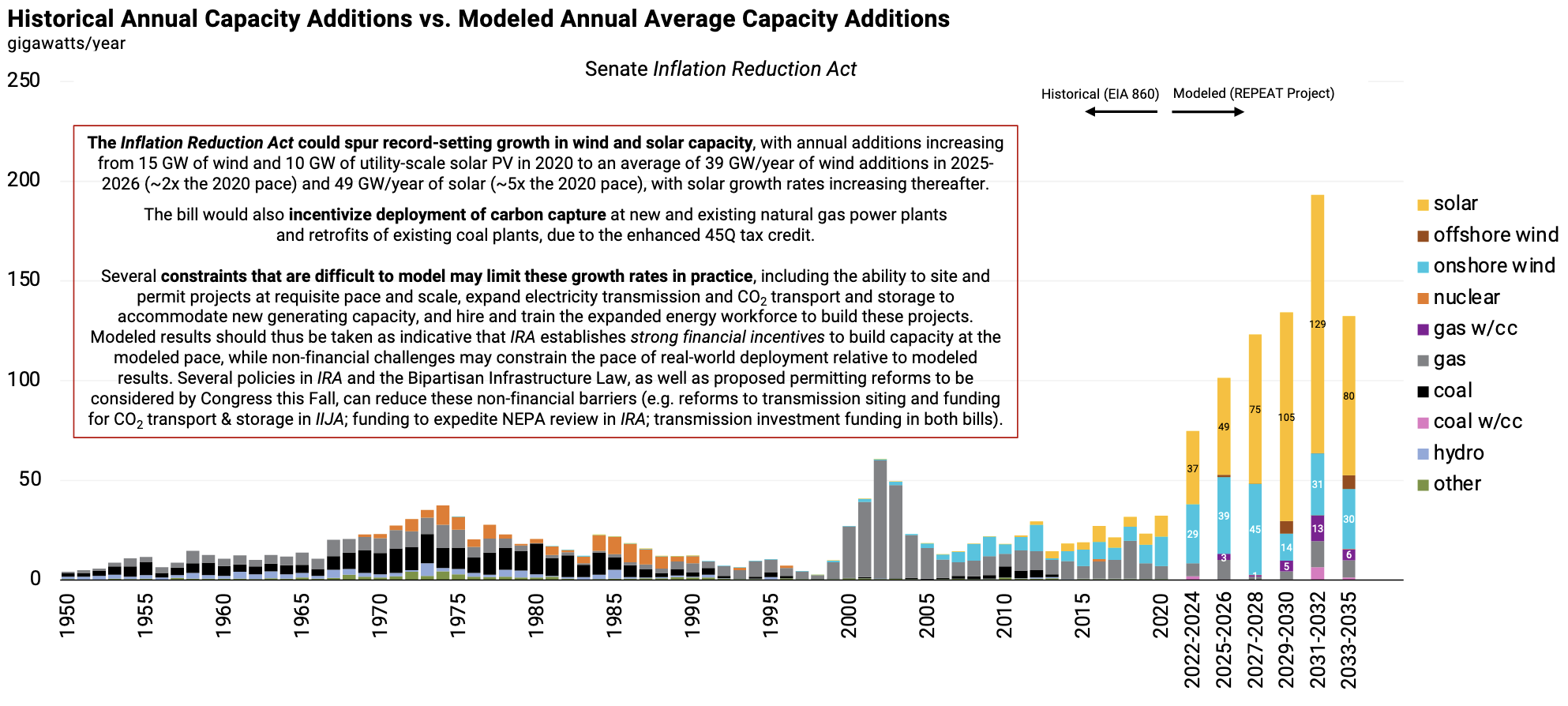

Cool findings about the Inflation Reduction Act's impact on energy utilization creation:

Some charts:

Some charts:

bkp_duke

Well-Known Member

When do folks see this happening? Q4 or Q1?

I have heard no details, aside from watching construction videos of Berlin and the assembly of the plant out there.

If I were totally guessing, Q2 2023. Why? I see no rear megacastings for Berlin and I haven't seen the level of battery production equipment delivered to Berlin as we have seen for TX (and TX is behind ramping on battery, by reasonable accounts).

How would you propose that it be fast-tracked? I don't think it's a matter of money, but rather sequencing the movement of scarce engineering talent.Positively affect Tesla's margins, I would expect, with Berlin having on-site battery production coming online soon, and in-EU auto production.

China imports would not be eligible but I could see Berlin expansion fast-tracked.

bkp_duke

Well-Known Member

How would you propose that it be fast-tracked? I don't think it's a matter of money, but rather sequencing the movement of scarce engineering talent.

I don't think it is scarce engineering talent. We have Kato Rd up, and doing effectively some production + iterative versioning of the 4680 cells (chemistry is still relatively simple compared to things we see in the 2170s). Then in Austin we have things being deployed and in production.

We had the rumor a few months ago that Tesla had in-housed the production of the 4680 production equipment, because a vendor wasn't meeting specs. I would assume that it is this transition that is the bottleneck right now for ramping 4680 faster - Tesla is "reinventing a better wheel" than their supplier could make.

My 0.02 - pure speculation with only a limit bit of data I am extrapolating from.

I understood that Berlin 4680s were delayed a bit due to a pretty small German engineering team going to Austin rather than Berlin. I don't know if that was cover for something else going on. Or I guess the "German engineering team" could have been the Tesla Grohmann automation folks coming stateside to consult on replacing the failed supplier.I don't think it is scarce engineering talent. We have Kato Rd up, and doing effectively some production + iterative versioning of the 4680 cells (chemistry is still relatively simple compared to things we see in the 2170s). Then in Austin we have things being deployed and in production.

We had the rumor a few months ago that Tesla had in-housed the production of the 4680 production equipment, because a vendor wasn't meeting specs. I would assume that it is this transition that is the bottleneck right now for ramping 4680 faster - Tesla is "reinventing a better wheel" than their supplier could make.

My 0.02 - pure speculation with only a limit bit of data I am extrapolating from.

Gigapress

Trying to be less wrong

It could be more than a bit of extra demand if we look a few decades out, especially if the future winning solution is multistage flash distillation instead of reverse osmosis as the article proposes. This is in line with my general expectation that electricity consumption will explode as solar energy begins to set unprecedented electricity prices in the coming years.For Tesla, RO Desalination just adds a bit extra to the overall demand for batteries to regulate supply in predominatly renewable energy grids (such as we are rapidly transitioning to).

Dr Handmer calculated 12 TW of potential power required for 8 billion humans to use American per-capita water consumption generated exclusively from reverse osmosis desalination. For comparison, humanity currently consumes about 500 TW of power from all energy sources, not just for electricity but for everything.

From what I’m seeing, flash distillation is simpler and cheaper to build than reverse osmosis, but it uses 10x more energy per m^3 of water because it basically involves repeatedly heating water to steam and condensing it until reaching the desired purity, whereas RO just involves pressing water through a fancy filtration membrane.

My understanding is that energy is the single biggest cost element in desalination in general, so using an order of magnitude more energy than RO makes distillation sound like a non-starter, until we factor in that solar energy costs have been predictably declining by an order of magnitude every 15 years or so, in accordance with Wright’s Law. In places with the worst drought, like the American Southwest, Africa and the Middle East, solar energy prices are rapidly approaching $10/MWh. Another 10x drop puts it at $1/MWh by the late 2030s. Flash distillation might make sense at these prices because the energy cost would be around $30/acre-foot. It might be possible to use less energy for application where lower purity is tolerable. If we can cut the number of stages in half, then the energy cost will roughly fall by a half too. Now $15/acre-foot. Lower purity is likely acceptable for agriculture (which is what uses the majority of all water humans consume) and even refilling rivers and lakes stricken by overconsumption and drought.

So let’s say with flash distillation we use 10x more power per volume of freshwater and we also use perhaps 5x more water thanks to having a stronger, more reliable supply and wanting to meet the even bigger environmental needs to keep the biosphere intact. Now the 12TW estimate goes to 600 TW. That’s just a wild guess but it indicates a possible doubling of humankind’s energy consumption solely for freshwater generation and transportation. That would certainly affect Tesla Energy’s total addressable market.

Dikkie Dik

If gets hard, use hammer

Not an official Tesla account but proven to be accurate in the past. Early October they had some news leaked from a works council at Giga Berlin:

So according to this Berlin 4680 production should be going live in Q1.

There were some rumours about delays, hopefully proven to be incorrect:

www.tesmanian.com

www.tesmanian.com

So according to this Berlin 4680 production should be going live in Q1.

There were some rumours about delays, hopefully proven to be incorrect:

Tesla Giga Berlin Battery Factory Is Moving Forward Despite Misleading Reports

Tesla's battery factory in Giga Berlin is making excellent progress and is well on its way to starting production. The German team is full ahead, despite misleading local news reports based on unnamed sources.

bkp_duke

Well-Known Member

I understood that Berlin 4680s were delayed a bit due to a pretty small German engineering team going to Austin rather than Berlin. I don't know if that was cover for something else going on. Or I guess the "German engineering team" could have been the Tesla Grohmann automation folks coming stateside to consult on replacing the failed supplier.

I thought that rumor of the German team going to Austin was dispelled as false.

growler23

Member

This is what I was talking about when I said getting off fossil fuels would be like "ripping our own guts out". Granted, covid is unrelated but most of the other major chaos has direct lines to Big Fossil. Expect more for a good while.If nothing else, the past 3 years has demonstrated that the world is perfectly capable of being screwed up in new and creative ways on a rotating basis about once every 6 months. Violence in the capitol, epidemics, wars, economic mayhem, more shutdowns due to epidemic, energy crisis, increasing interest rates, etc etc etc.

Seems like chaos is the new norm.

Hold steady, Tesla investors. Help lead us out of the mire. Costs of much will come down, air will get cleaner, manufacturing will become 90%+ closed loop and many more global benefits emerge as we approach our goal.

HODL and believe.

All technological interventions, especially the high scale and rapid ones, carry significant risks with them. And these are risks that we cannot anticipate since many natural systems are computationally irreducible. Geoengineering technologies must be some of the riskiest ones out there, and these type of "not enough water lets desalinate water to fill rivers" really make me angry especially since there are such beautiful solutions that are well aligned with said natural systems. Australia's own P.A. Yeomans' keyline design is the type of land stewardship and geoengineering that we ought to be putting our efforts towards. Obviously we as investors tend to be biased towards centrally scalable technological solutions since we want to be part of the concentration of capital that the dynamic inevitably leads to.He is an interesting cat, glad to see he started his own business. The environmental impact of disposing of this much brine is huge, it would have drastic impacts locally and would have to be dispersed across a giant region. Might actually be helpful in some areas were salinity has fallen and impacted critical breeding spawning areas. Since San Diego can’t even get a basic small plant past environmental review I view this as something to launch overseas- Australia is the most logical starting point in my mind- all the sun you need, cheap land, new govt is very pro environmental. You might enjoy reading about the Teal movement.

That's because they make more money off all the "weather package", "paint protection", and a bunch of other nonsense to the base car. You mostly end up paying for stuff you don't want. Rarely can you find a vanilla car without a few hundred or a few thousand of nonsense added on.I'm pretty sure that there are a lot of folks that want to order a car but get pressured into taking one from a dealer's inventory rather than getting exactly what they want. "You can have this car today if only you'll give up this small item". Dealers really don't like order placers.

For certain, Russia and quite a few other dictatorial regimes are propped up by oil. Some of these countries cannot exist without oil revenue.This is what I was talking about when I said getting off fossil fuels would be like "ripping our own guts out". Granted, covid is unrelated but most of the other major chaos has direct lines to Big Fossil. Expect more for a good while.

Hold steady, Tesla investors. Help lead us out of the mire. Costs of much will come down, air will get cleaner, manufacturing will become 90%+ closed loop and many more global benefits emerge as we approach our goal.

HODL and believe.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K