Ya, like a saw-toothed shape as if being prevented from going too negative after each attempt. Strange.Agreed. From my understanding, this stock is trading somewhat like one headed for a blow-off top, where the pullbacks are short and shallow. I think there are valid reasons for that based on circumstances surrounding the stock, ie. fundamental developments and short interest, but nevertheless it bears watching.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Y

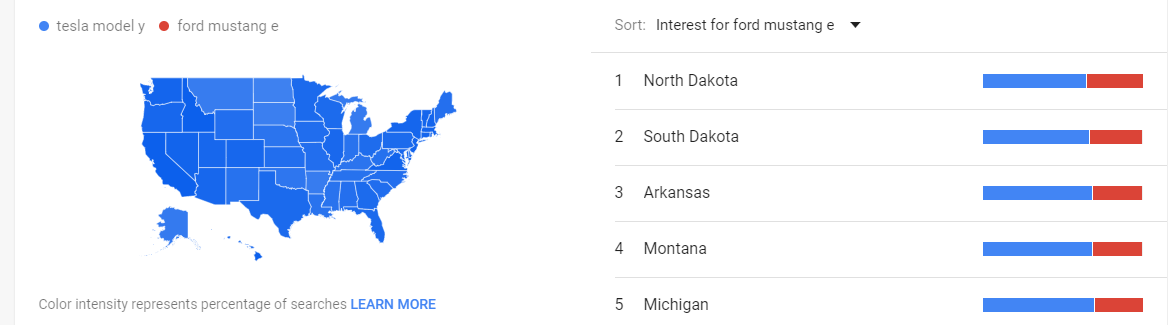

I have been unable to replicate this with Google trends. Comparing "Tesla model y" and "Ford mustang e" over periods of 7,30,90 days and 1, 5 years for web search, image search, news search and youtube search.

The closest was 90 days image search, but even that was not very close.

All searches are more favorable to Tesla, here is a typical example:

Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

View attachment 500497

I have been unable to replicate this with Google trends. Comparing "Tesla model y" and "Ford mustang e" over periods of 7,30,90 days and 1, 5 years for web search, image search, news search and youtube search.

The closest was 90 days image search, but even that was not very close.

All searches are more favorable to Tesla, here is a typical example:

Yes, "I pity the fool" that is caught in short-shorts now...

Artful Dodger

"Neko no me"

There's a word for 'STUPID' in New York City, too: TSLAQ.The Icelandic word for "stupid" is heimsk(ur), from an earlier meaning more along the lines of "ignorant". It ultimately derives from heima (at home). The notion being that you can hear about the world beyond your doorstep, you can spend your whole life reading about it, but unless you actually see it yourself, experience it, get to know it personally, you'll never really understand it. "Heima alinn".

That Fortune article, asking people to divorce themselves from actually knowing the company and to only look at cherry-picked, distorted (at times beyond recognition) info that the author wants them to, is asking them to be heimsk. Ignorant. Stupid. Don't actually look into things yourself. Just take the information that I give you at face value. Trust that you're getting an accurate picture with your blindfold on.

Honestly, it's so terrible, it should be bookmarked. It'll be hilarious a few years from now

Cheers!

Not to fear. Ford will spend a lot of money on advertising the Model Y for Tesla.You guys are forgetting Florida is on the Mach E list. My guess is older folks don't even know about Tesla Model Y.

Build it and they will come.

StealthP3D

Well-Known Member

It definitely feels to me like typical Wall St "wants" to introduce a lot more volatility in the stock with heavy swings back and forth but it seems like everyone's holding and/or buying in anticipation of that earnings report.

You have to think a lot of people bought-in for the first time above the current levels in anticipation of what's to come. And I think Q4 will be a strong positive catalyst and meet or beat their expectations.

So the bottom line is I'm not really worried. But it does suck for anyone having call options expiring between now and then.

Yes, we are spoiled!

I was thinking about this very informative post and out of curiosity ran some back of the envelope calculations to get a sense of the scale of ambition implied by Elon’s comments in interviews.

1. 1.5M vehicles in 2021 and then 3M in 2023 is approx 41% compounded growth in production in Elon’s mind.

2. Elon then says he thinks “long term” production is 20M. So then I wondered, if you simply continued 41% compounded, how long would it take to hit 20M starting from 3M in 2023? I got roughly 5.5 years, but rounded that to 6 years...then rounded 2029 to 2030 to just say it will be by the end of the decade.

3. Then I pulled an ASP out of thin air of $40K for the 20M cars in 2030 and then got a ridiculous number for revenues: 800B in revenue.

4. Then I said what if there’s 20% margin? And I got a crazy number: $160B.

5. Then I made up another number for SG&A and R&D spending of 40B annually in 2030, and got $120B.

6. Then I said ok what if there’s a 20x multiple on that? And I got $2.4T.

7. Then I said ok what if there’s 300M shares outstanding then? What’s the share price? And I got $8000 per share.

8. And then I said: oh, I forgot about Tesla Energy, the FSD revenues in each car, the revenues from Tesla’s share of the robotaxis network, Supercharger revenues, insurance, and any Services Revenue...and then my brain melted.

9. Another thing is that if ~600K cars requires 39GWh batteries, then 20M cars (33x) requires 1.3TWh of batteries. So right now I’m in a bit of disbelief about these ridiculous numbers from these back of the napkin calculations. Looking forward to Battery Investor day to see what the path is to that level of production.

Fun napkin math. One added wrinkle: 367,500 in 2019 to 3 million in 2023 is 69% annual unit growth. Elon has estimated growth at 50-100% per year.

If you feel uneasy, don't do it. That right there is a warning sign that you know, for whatever reason. Anything can happen, even low probability events.

I don't talk about my investments with much of anybody (pretty much just my wife). When I bought into $TSLA I was passionate enough about it and said something to my mother that she ended up putting a pittance into it. Which has done well, but it was her choice.

i was in Orlando last week, and it seemed like every other car was a Model 3. There are quite a few in Palm Bay Area. Tesla is quite well known in central Florida. The model Y well sell well here.You guys are forgetting Florida is on the Mach E list. My guess is older folks don't even know about Tesla Model Y.

Build it and they will come.

I'm very glad my handful of calls expire in Feb or March. My 1/7 calls didn't hit the ideal spot but I still can't complain.You have to think a lot of people bought-in for the first time above the current levels in anticipation of what's to come. And I think Q4 will be a strong positive catalyst and meet or beat their expectations.

So the bottom line is I'm not really worried. But it does suck for anyone having call options expiring between now and then.

Yes, we are spoiled!

kengchang

Active Member

Macro is heading up while TSLA is being pushed down to session low HMMM

I don't expect horrible, but it's unclear how good it's going to be. We don't have much info on deliveries in Q1. We have some info that delivery dates are pushed back and maybe China is sold out, but how many cars is that for? We will have to see what they say during Q4 earnings.

We have Franco Mossotto's shipping spreadsheet, which indicates 5 or 6 ships (the question as to the number revolves around a possible manifest error) arriving to Pier 80 by January 30th.

How does this measure up to 2019?

Pier 80 ships arriving by 30 days from quarter start, 2019Q1-2020Q1 (estimated):

Q1'19: 5 (4 EU, 1 CN)

Q2'19: 5 (2 EU, 2 CN, 1 JP)

Q3'19: 4 (2 EU, 2 CN)

Q4'19: 9 (4 EU, 3 CN, 2 KR)

Q1'20E: 5-6 (1 KR, 4-5 TBD)

Note that China accounted for an average of two ships in the first 30 days from start of quarter in 2019. Even with GF3 up and running, Tesla is likely to match or exceed Q1-Q3 2019 ship arrivals at Pier 80 through 30 days from quarter start. This picture will become much clearer over the next 3 weeks as we see February scheduled arrivals and learn the destination of currently scheduled arrivals.

In other words, I find nothing alarming in the shipping data at this time to indicate a substantial drop in deliveries, particularly given the existence of GF3 and rumors of very high demand, and the ability of Tesla to deliver substantial MIC M3s this quarter, there.

But I do agree that the picture remains unclear. The question of a US price drop continues to loom. The later into Q1 we get without such a drop, the more bullish I will become for Q1 numbers. I am also keeping a sharp eye on inventory discounts (for personal and investment reasons), but as expected those are virtually nonexistent at this time due to Q4 inventory reduction.

Last edited:

Zhelko Dimic

Careful bull

Not sure who you're arguing with, but most North Americans don't get hatchbacks, as they're not popular here and very few are being sold. I wouldn't be surprised that for most people word hatchback evokes fuzzy images of anything that has fifth door, or that it's basically poorly defined. While, in Europe, when you say hatchback, everyone knows exactly what that is, Golf like type of car...Sounds like your problem is with the words "near vertical". Sorry, but I had to find a word for hatchbacks (e.g. not liftbacks) which didn't involve using the word hatchback. Because normally just saying "hatchback" is good enough to exclude liftbacks. But since this conversation is you trying to include liftbacks as "hatchbacks", I had to pick different wording. I chose that to distinguish vs. "near horizontal" rear "hatches" (aka liftbacks).

If you don't like that wording to describe hatchbacks, forget it. Choose whatever wording you want. They're still very distinct from liftbacks, whatever wording you use.

But thanks for offering a reference to a definitive source, "marti5 on torquecars.com".

Note that Tesla Model S is a liftback. Tesla refers to it as a sedan. Not a hatchback. Indeed, it's very common for liftbacks to just be called sedans.

Ask a designer to draw a hatchback. 99 times out of 100 it'll end up looking like in the "top 10 hatchbacks" link of yours. Because that's what the word "hatchback" invokes.

Green Pete

Active Member

In all seriousness. How good does the quarterly report have to be to justify the gains at this point. Long term obviously the sentiment here is it's still a bargain. But the recent price increase seems to indicate the warning report is going to be mind blowingly good. I actually expect a dip when it comes out because as awesome as a company Tesla is the report can only indicate so much.

woodisgood

Optimustic Pessimist

In all seriousness. How good does the quarterly report have to be to justify the gains at this point. Long term obviously the sentiment here is it's still a bargain. But the recent price increase seems to indicate the warning report is going to be mind blowingly good. I actually expect a dip when it comes out because as awesome as a company Tesla is the report can only indicate so much.

The report itself is unlikely to move the SP as much as what Elon discusses on the call including guidance; he has said he will outline the next few years.

@Artful DodgerTwo points:

- The EIA forecasts that natural gas will fuel 39 percent of overall electricity generation in the PJM Interconnection region by next year, up from 31 percent in 2018 (Sep 19, 2019)

Elon should still be their hero. Jus' sayin'.

- SpaceX Raptor rocket engines use natural gas for propellant

Cheers!

a few data point, NewJersey, Pennsylvania and Maryland (ya know, PJM)(a goodly part of it)

Trillions of BTU 2010

1-Solar 0.48 <--------

2-Nuclear 1300.00

3-Hydro 39.18

4-Wind 18.14 <---------

6-Natural Gas 482.00

7-Coal 1412.00

8-Biomass 47.40

9-Petroleum 12.30

15-Wasted Energy 2240.00 (ie, electricity made and not used)

Trillions of BTU 2014

1-Solar 8.68 <------

2-Nuclear 1303.00

3-Hydro 40.56

4-Wind 37.32 <---------

6-Natural Gas 684.40

7-Coal 1030.00

8-Biomass 47.90

9-Petroleum 14.20

15-Wasted Energy 2124.00

Energy Flow Charts

Nat gas up, Coal down, Wind UP, Solar way up (from teeny tiny tho)

data is 5 years old

entire US for 2018

In all seriousness. How good does the quarterly report have to be to justify the gains at this point. Long term obviously the sentiment here is it's still a bargain. But the recent price increase seems to indicate the warning report is going to be mind blowingly good. I actually expect a dip when it comes out because as awesome as a company Tesla is the report can only indicate so much.

The report itself is unlikely to move the SP as much as what Elon discusses on the call including guidance; he has said he will outline the next few years.

Two things I'm particularly interested in for Q4 earnings report, and which I think could send the stock price higher despite the recent bull run:

- Q4 profits sufficient such that a Q1 profit of $1 dollar will make Tesla eligible for S&P inclusion.

- Guidance.

Last edited:

thx1139

Active Member

Geotagging of tweets?Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

View attachment 500497

Does that simple means if I tweeted "Ford Mach-E sucks" or "An electric Mustang? Sorry not interested in the Ford Mach-E" then that is interest?

ItsNotAboutTheMoney

Well-Known Member

Not sure who you're arguing with, but most North Americans don't get hatchbacks, as they're not popular here and very few are being sold. I wouldn't be surprised that for most people word hatchback evokes fuzzy images of anything that has fifth door, or that it's basically poorly defined. While, in Europe, when you say hatchback, everyone knows exactly what that is, Golf like type of car...

North Americans absolutely get hatchbacks.

It's just that they are willing to pay an extra $4k for them to be taller, so they get crossovers instead.

Elsewhere in the world, people are buying taller hatchback and crossovers as well.

Chickenlittle

Banned

I expect we will see announcement of 4th qtr report tomorrow. Usually 2 week warning and usually on a thurday

Well, if we don't wind up seeing a real short squeeze I guess I'll have to console myself with waiting until 2025 to hit Ark's 6k price target.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K